Indiana Excise Tax On Heavy Equipment Rental

Subject heavy equipment rented from a location in indiana, but used outside indiana, is subject to the heavy equipment rental excise tax. The fee is 2.5% of the rental price.

Atlas Handlers Line Adds Mid-atlantic Dealer - Recycling Today

The new indiana excise tax will be assessed on equipment that is rented without an operator and from a location in indiana, and the tax will be 2.25% of the gross retail rent value.

Indiana excise tax on heavy equipment rental. Indiana has a heavy equipment rental excise tax imposed at a rate of 2.25% and effective january 1, 2019. Starting january 1, 2019, indiana will implement a new excise tax on the rental of heavy equipment and construction equipment. Back to indiana sales tax handbook top.

Whereas, the personal property tax on personal property was based on the. Correct/change of responsible officer information. The indiana department of revenue has clarified that the heavy equipment rental excise tax applies to the rental of all personal property by a merchant that primarily rents equipment, in a recent.

Sales of tangible media property are subject to sales tax in indiana. Rentals from a location in indiana and received in indiana. During the legislative session of the indiana general assembly for 2018, the state of indiana enacted and the governor signed into law house enrolled act no.

What is the indiana heavy equipment excise tax? Heavy equipment excise and rental tax. Effective january 1, 2019, indiana implemented an excise tax imposed upon the rental of heavy rental equipment from a retail merchant located in indiana.

Indiana has enacted a new excise tax on the rental of heavy equipment. What is the rental tax rate? Megan an example initial cost for a rental piece of equipment $76,000 after 5 years of use the engine needs replace other wise the unit is a non income (tax producer).

The rate is 1.25% of the rental price on each heavy equipment rental property rented by a consumer within the state of washington. This new law imposes a new excise tax of 2.25% of the gross retail income received by the retail merchant on heavy equipment rentals starting on january 1, 2019. If heavy equipment will be rented for less than thirty days from this location, complete this section.

New engine $7500 labor to install $1200. The heavy equipment rental property dealer will collect the tax from the consumer, and report and pay the tax to the department of revenue on the dealer’s excise tax return. 1323 creating a new excise tax on heavy equipment rentals without operators at a rate equal to 2.25% of the gross retail rental income received.

Imposes a rental excise tax on the rental of motorized heavy equipment vehicles beginning in 2014. Effective january 1, 2019, indiana approved house enrolled act no. Provides that the owner of a motorized heavy equipment vehicle shall pay a motorized heavy equipment vehicle excise tax (excise tax), instead of the property tax, on the vehicle.

In the state of indiana, any rentals for less than 30 days will be considered to be subject to any additional auto rental excise taxes. In its 2018 legislative session the indiana general assembly enacted and the governor approved house enrolled act no. 1323, which starting in 2019 imposes a new excise tax on “heavy rental equipment” while removing such equipment from taxation as.

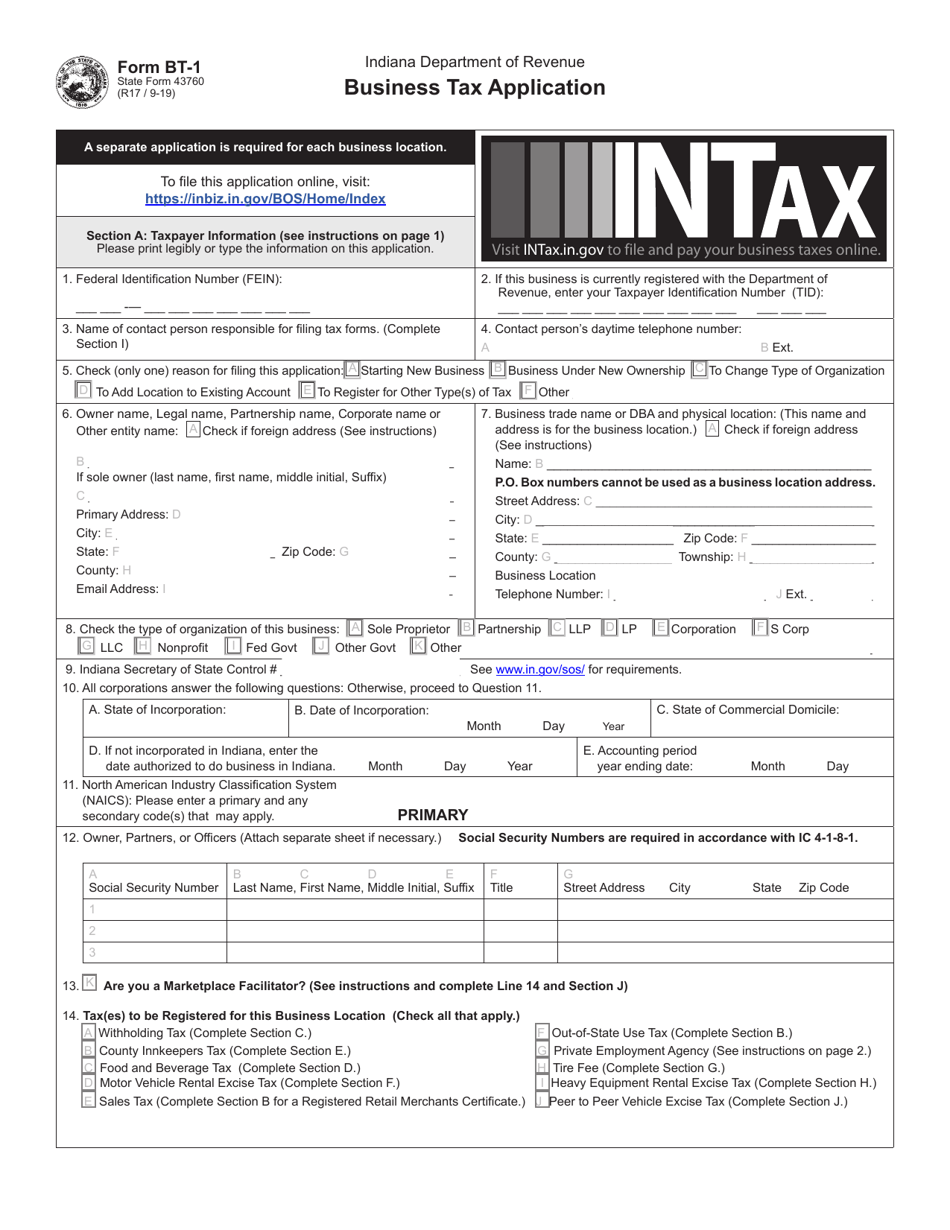

Provides a credit against the excise tax equal to the rental excise taxes paid in the preceding calendar year. Online application to register with indiana for sales tax, withholding tax, food & beverage tax, county innkeeper tax, motor vehicle rental excise tax, and prepaid sales tax on gasoline. The heavy equipment rental excise tax applies to the rental of all personal property (with some exclusions and exemptions) by a merchant that primarily rents equipment described in naics code 532412, which is u.s.

The heavy equipment rental tax is in addition to the. Industries engaged in renting or leasing heavy. This type of equipment was previously subject to personal property tax, however hea 1323 (2018) imposes this new tax type effective january 1, 2019.

The renter is liable for the tax and it will be collected by the retail merchant. Use of equipment in indiana. The heavy equipment rental excise tax is imposed upon the rental of heavy rental equipment from a retail merchant and from a location in indiana for a period of 365 days or less or for a rental contract with no specified due date.

The rental excise tax is 2.25% of the gross retail rental income. Indiana implemented a new excise tax on the rental of heavy equipment that took effect on january 1, 2019. Starting in 2019 indiana general assembly imposes heavy equipment rental excise tax in lieu of personal property tax

Heavy equipment rental excise tax registration (see instructions on page 2) (no additional fee) sales tax section b must also be completed. In 2019 heavy rental equipment will be subject to a new indiana excise tax but will avoid personal property tax. Converts the taxation of motorized heavy equipment vehicles from the property tax to an excise tax.

(a) an excise tax, known as the heavy equipment rental excise tax, is imposed upon the rental of heavy rental equipment from a retail merchant and from a location in indiana. And new tires $1200 and new battery $125.

Starting In 2019 Indiana General Assembly Imposes Heavy Equipment Rental Excise Tax In Lieu Of Personal Property Tax Tax Hatchet

2

Department Of Local Government Finance Personal Property With

Tax Alert For Contractors Doing Business In Indiana - New Excise Tax Replaces Property Tax On Heavy Rental Equipment - Sikich Llp

2

Tax Alert For Contractors Doing Business In Indiana - New Excise Tax Replaces Property Tax On Heavy Rental Equipment - Sikich Llp

Form Bt-1 State Form 43760 Download Fillable Pdf Or Fill Online Business Tax Application Indiana Templateroller

2

New Indiana Heavy Equipment Excise Tax For 2019 Blue Co Llc

Tax Alert For Contractors Doing Business In Indiana - New Excise Tax Replaces Property Tax On Heavy Rental Equipment - Sikich Llp

What Can Project Nextdor Do For You

2020 In Form Bt-1 Fill Online Printable Fillable Blank - Pdffiller

Heavy Rental Equipment Excise Tax In Indiana For 2019 - Watson Cpa

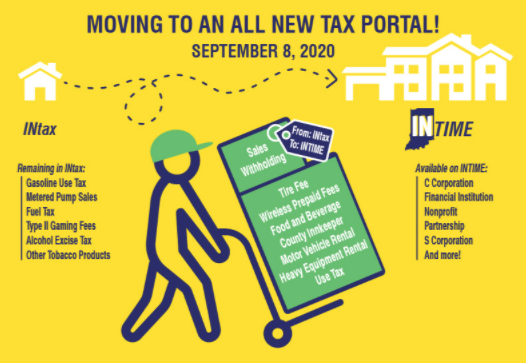

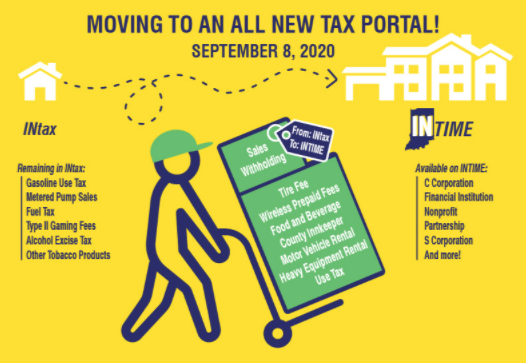

Indiana Dor Launches Second Rollout Of Business Tax System Update Business Fwbusinesscom

2

2

State Form 43760 Bt-1 Download Fillable Pdf Or Fill Online Business Tax Application Indiana Templateroller

2

Heavy Equipment Rental Excise Tax