Child Tax Credit 2021 Calculator

The child tax credit can be worth as much as $3,500 per child for tax year 2021. Under the new provisions, families are set to receive a $3,000 annual benefit per child ages 6 to 17 and $3,600 per child under 6 in the tax year 2021.

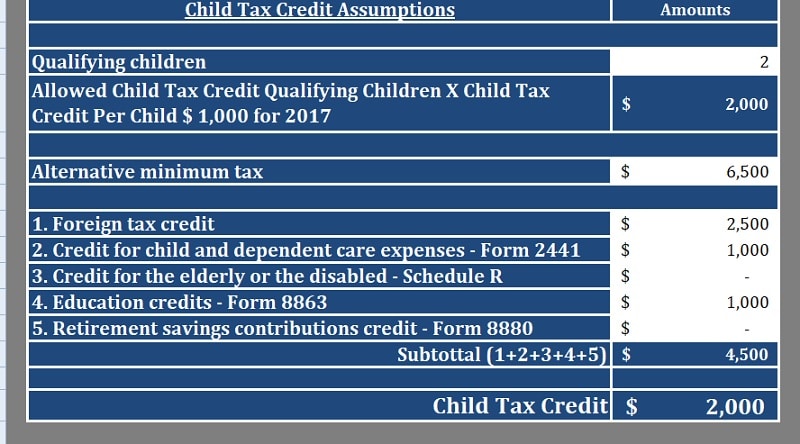

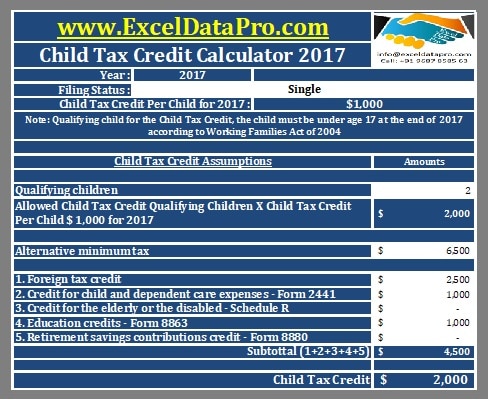

Download Child Tax Credit Calculator Excel Template - Exceldatapro

The maximum is $3,000 for a single qualifying person or $6,000 for two or more.

Child tax credit 2021 calculator. The children ages are as of december 31, 2021. $3,600 for children ages 5 and under at the end of 2021; Up to $3,600 ($300 monthly) per qualifying dependent child under 6.

You can calculate your credit here. The advance child tax credit calculator will provide you with the estimated credit amount you can expect as your child tax credit for 2021. The credit will be fully refundable.

The child tax credit provides a financial benefit to americans with qualifying kids. How does the child tax credit work? Child tax credit calculator for 2021, 2022.

Up to $3,000 ($250 monthly) per qualifying dependent child 17 or younger on dec. The child tax credit is a credit that can be claimed when filing your annual tax return. The american rescue plan updated the cdctc to try and address these realities, but only for 2021.

Advance payment of the 2021 child tax credit. However, this year (2021), child tax credit payments will be made monthly to 39 million families who qualify. You will need to provide the number of children you have in two age brackets, 5 and younger, and 6 to 17;

The child tax credit is a credit that can reduce your federal tax bill by up to $3,600 for every qualifying child. For the 2021 tax year, the program has been expanded to give bigger checks to parents, allow more of the credit to get refunded, and allow families to get an advance on their refund in the second half of this year. The changes increased the child tax credit from $2,000 to $3,000 for children over 6, and to $3,600 for children under 6.

For tax year 2021, the child tax credit is increased from $2,000 per qualifying child to: In 2021, the child tax credit offers: The payments, which could total as much as.

The child and dependent care tax credit is worth anywhere from 20% to 35% of qualifying care expenses. Find answers on this page about the child tax credit payment, the calculator, and why you may want to use the irs child tax credit portal. The child tax credit is an existing program that reduces the tax burden of families with dependent children.

Our child tax credit calculator tells you how much money you might receive in advance monthly payments in 2021 and how much of the credit you’ll claim when you file your return next year. For tax years before 2021, the irs allowed you to claim up to $2,000 per child under 17. You get to claim the lesser of 15% of your earned income above $2,500 or your unused child tax credit amount, up to $1,400 per qualifying child aged upto 16 years.

From july 15, families will receive up to $250 a month for children 6 to 17, and up to $300 a month for children under 6 through. For the 2020 tax year, the child tax credit was $2,000 per qualifying child. Vice president kamala harris spoke in pittsburgh on child tax credit awareness day on june 21, 2021, a day intended to make americans.

(cnn) eligible parents will begin receiving the first monthly installment of the new enhanced child tax credit starting on july 15. It’s combined with a dependent’s calculator, so you can also add other dependents in your. Estimate how much tax credit (including working tax credit and child tax credit) you could get every 4 weeks during this tax year, 6 april 2021 to 5 april 2022.

The child tax credit calculator will show you exactly how much you can claim this year. Your adjusted gross income (agi) determines how much you can claim back. The child and dependent care tax credit helps working families cover the high costs of child or dependent care so that parents are able to look for work and stay employed.

And $3,000 for children ages 6 through 17 at the end of 2021. Although our latest survey found that many parents are interested in receiving tax credits to. The child tax credit is intended to offset the many expenses of raising children.

There are also maximum amounts you must consider. The changes increased the child tax credit from $2,000 to $3,000 for children over 6, and to $3,600 for children under 6. Kamala harris gives remarks on child tax credit expansion.

Child Tax Credit Missing A Payment Heres How To Track It - Cnet

Download Child Tax Credit Calculator Excel Template - Exceldatapro

Child Tax Credit 2021 Find Out Eligibility How Much Could You Receive - 6abc Philadelphia

September Child Tax Credit Payment How Much Should Your Family Get - Cnet

September Child Tax Credit Payment How Much Should Your Family Get - Cnet

Child Tax Credit How To Opt Out Of Monthly Payments For One Payout

What Are Marriage Penalties And Bonuses Tax Policy Center

September Child Tax Credit Payment How Much Should Your Family Get - Cnet

Child Tax Credit Children 18 And Older Not Eligible 13newsnowcom

Child Tax Credit 2021 Payments How Much Dates And Opting Out - Cbs News

Child Tax Credit 2021 Calculator 2021 Advance Payments

Child Tax Credit Update Families Will Get Paid 7200 Per Child In 2022 By Irs - Fingerlakes1com

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

Download Child Tax Credit Calculator Excel Template - Exceldatapro

Canada Child Benefit Calculator Ativa Interactive Corp

2021 Child Tax Credit Heres Who Will Get Up To 1800 Per Child In Cash And Who Will Need To Opt Out

Download Child Tax Credit Calculator Excel Template - Exceldatapro

2021 Child Tax Credit Calculator How Much Could You Receive - Abc News