Avalara Tax Codes By State

These tax codes are taxed at the full rate. Make sure that record transactions in avatax is enabled.

Html Codes - Table Of Ascii Characters And Symbols Coding Ascii Browser Support

You will see a setting called set avalara default product tax code. you can click the link to search avalara tax codes to determine what code is best suited for your business.

Avalara tax codes by state. Taxcode — the avalara product tax code for the variant; Take advantage of our state sales tax calculator to look up a rate for a specific address. It is also possible to create, read, update, and delete items in avatax using their api.

This will send transactions from commentsold over to avalara. Base state sales tax rate 6%. Sales or sellers use tax:

Basic | reduce your risk of penalties and automate the review and approval process of tax returns. It’s important to note that there is a maximum of 100,000 items per import. Access a database of tax content, rates, and rules for.

P0000000 and u0000000 are generic codes that are used when you have items that aren't mapped to an avalara tax code. A reliable, secure, and scalable tax compliance platform. Leverage the insights and tech your business needs to stay ahead of tax compliance.

You can use this search page to find the avalara codes that determine the taxability of the goods and services you sell. Sales or sellers use tax: Setting up your avalara account this option requires you to have an account set up with avalara and some set up completed on the avalara site before productcart can correctly calculate sales tax on your store.

More avalara for excise workshop recording. Basic | report against your scheduled transaction data and make mass updates to tax returns. Let your erp do the work of managing exemption certificates enter certificate numbers into a customer record where sage sales tax keeps certificates on file in your erp and easily accessible at the point of sale.

• calculate tax on all sales in avatax • include an item code and item description on each item sold • include a street address on every transaction • have the items you sell mapped to avalara tax codes • enter exemption certificates into avatax before processing exempt transactions While we try to make these tools as. You can copy and paste a code you find here into the tax codes field in the items or what you sell areas of avatax when you are logged into the service, or into the appropriate field in your accounting or pos system.

Sage sales tax, powered by avalara, is one of the only tax compliance solutions that integrates directly with sage erp software. Virginia retail sales and use tax. Florida state sales tax rate range.

Productcart has teamed up with avalara to include the most powerful tools available for calculating and managing sales tax on your store. Automate your excise tax filing workflow. When you enter the street address, the calculator uses geolocation to pinpoint the exact tax jurisdiction.

Participating states will only cover the cost of sales tax solutions offered through a csp. This level of accuracy is important when determining sales tax rates. If you must map more than 100,000 sku codes to avalara product tax codes, you will need to perform multiple imports.

As a csp, avalara will work with you to see if you qualify for your sales tax software to be covered through the state. If you have both of the above permit types and you file both forms : *due to varying local sales tax rates, we strongly recommend using our calculator below for the most accurate rates.

There are only a limited number of service providers that meet the high standards of the sst program. For more than 15 years, avalara has provided an automated platform to offload the complexity of sales and use tax management, allowing businesses of all sizes to improve accuracy and efficiency so they can. Simply click on your state below and get the state sales tax rate you need.

Get Ready To Pay Sales Tax On Amazon Amazon Tax Amazon Sale Amazon Purchases

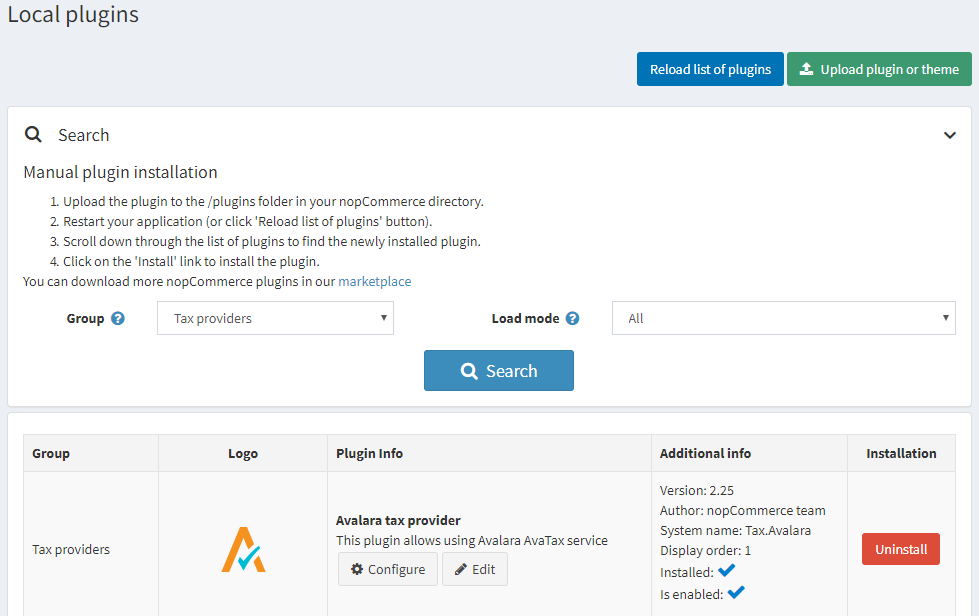

Cross-border By Avalara - Woocommerce

Understanding The Avatax For Communications Tax Engine - Avalara Help Center

Wbavatax Avalara Avatax - Tax Calcuation Integration - Whmcs Marketplace

Avalara Avatax For Enterprise

Cross-border By Avalara - Woocommerce

6 Differences Between Vat And Us Sales Tax

Avalara

Cross-border By Avalara - Woocommerce

Avalara Application By Kibo Ecommerce

Understand Sales Tax Holidays In Avatax - Avalara Help Center

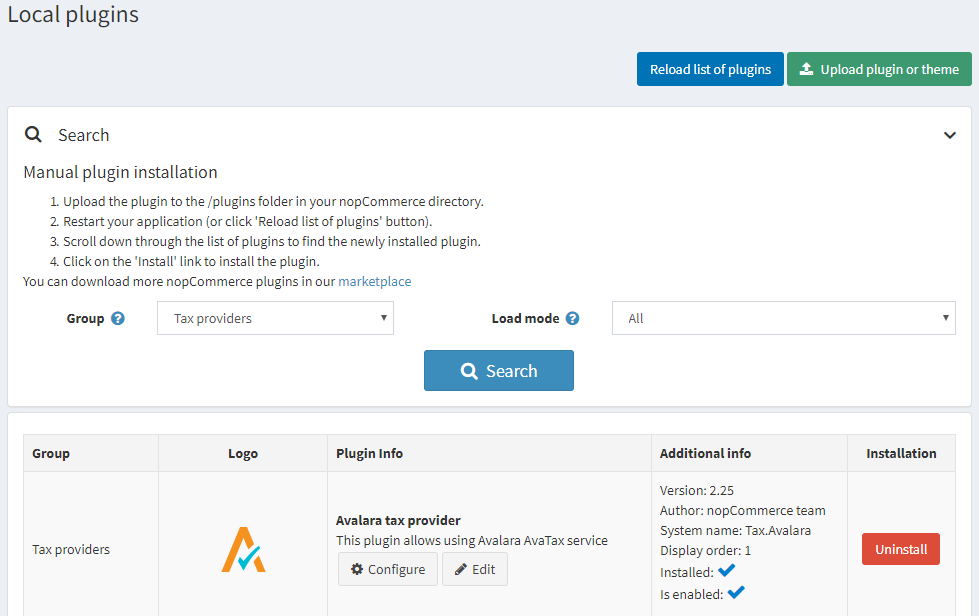

Avalara Avatax For Adobe Commerce

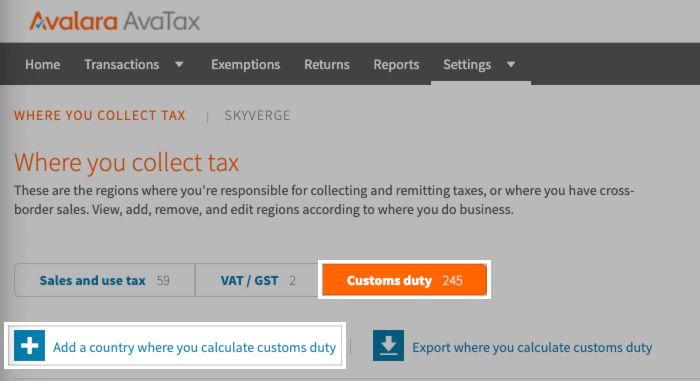

Avalara Sales Tax - Spire User Manual - 35

Learn More About Avalara Taxrates And Access Documentation Taxes Apis Api Temple

Avalara Managed Sales Tax

Enablement Steps For Advanced Taxation - Nimble Ams Help

Avalara Managed Tax Category Classification Simplifies Product Classifications And Taxability Cpa Practice Advisor

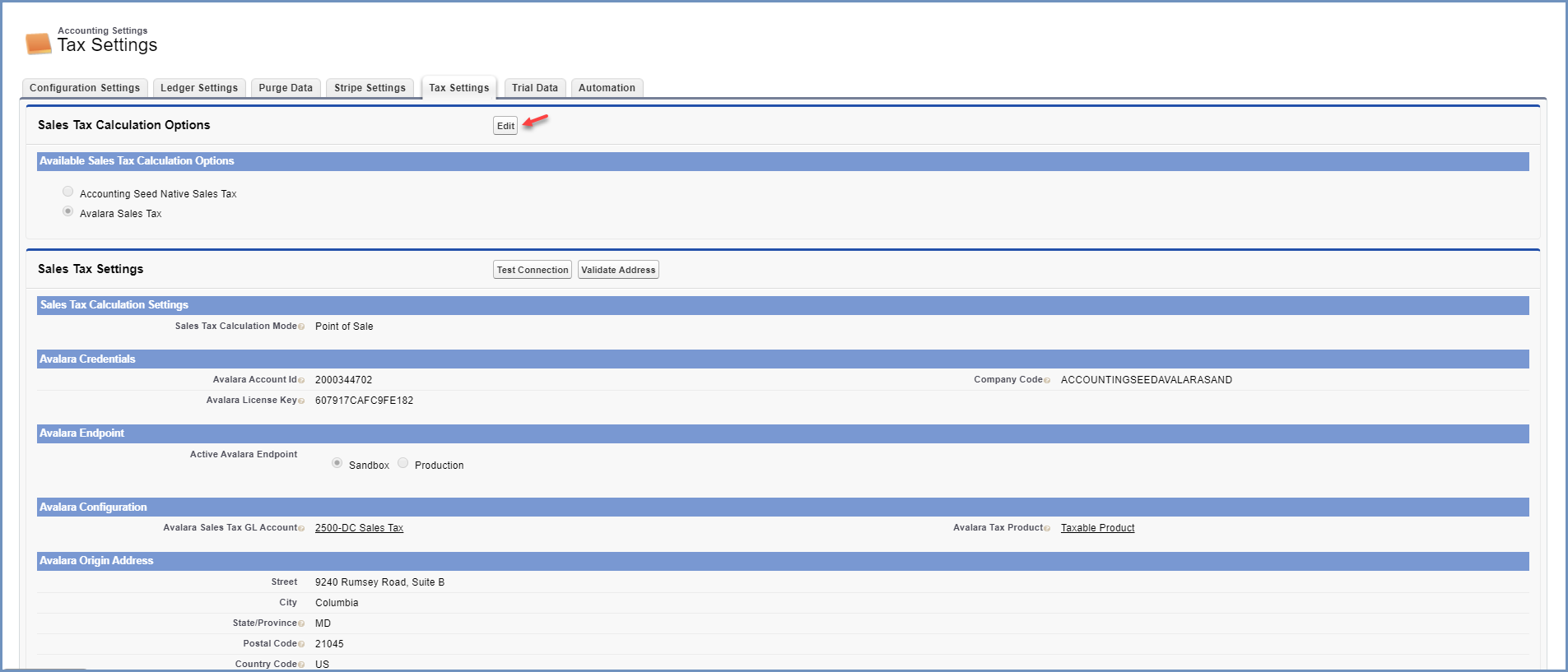

Set Up Avalara Avatax Integration Accounting Seed Knowledge Base

Software Sales Tax Use Tax - Avalara