Summit County Utah Sales Tax

If you need access to a database of all utah local sales tax rates, visit the sales tax data page. The 2018 united states supreme court decision in south dakota v.

Listing Presentation Real Estate Marketing Canva Real Etsy Listing Presentation Real Estate Listing Presentation Real Estate Marketing

The latest sales tax rates for cities in utah (ut) state.

Summit county utah sales tax. 2020 rates included for use while preparing your income tax deduction. Any property unsold at the tax sale which is not in the public interest to be recertified to a subsequent. Every 2021 combined rates mentioned above are the results of utah state rate (4.85%), the county rate (1.25%).

In 2017, the state legislature passed a law allowing county governments to enact the two tax increases. Utah has state sales tax of 4.85% , and allows. Create your own online store and start selling today.

Has impacted many state nexus laws and sales tax collection requirements. The summit county sales tax is collected by the merchant on all qualifying sales made within summit county. The utah state sales tax rate is currently %.

Summit county, utah, sales tax rev bonds, series 2021. Rates include state, county and city taxes. In the unincorporated areas of summit county, the rate is 6.8%.

The tax came along with. 89 rows the other tax rates & fees chart shows additional taxes due on certain types of. The summit, utah, general sales tax rate is 4.85%.

The sales tax rate is always 6.1%. In the snyderville basin the sales tax is up to 7.1%. Summit county was one of three counties that took advantage of the opportunity to help fund road projects and public transit.

The december 2020 total local sales tax rate was also 7.150%. The treasurer is responsible for the banking, reconciliation, management, and investment of all summit county funds. The december 2020 total local sales tax rate was also 7.150%.

Sales tax rates in summit county are determined by four different tax jurisdictions, summit county, oakley, henefer and park city. There is no city sale tax for summit. Click any locality for a full breakdown of local property taxes, or visit our utah sales tax calculatorto lookup local rates by zip code.

Ledges event center 202 e. May 27, 2021 10:00 a.m. Sales tax rates for summit county (pdf) county sales tax history (pdf) mass transit sales tax history (pdf) to get more information on town sales tax, please contact:

Create your own online store and start selling today. Summit county charges sales tax and mass transit tax on the purchase of all goods, including food. The december 2020 total local sales tax rate was also 7.150%.

The summit county 2021 tax sale will be held on: Try it now & grow your business! March 4, 2021 // by kerry halligan.

The summit county treasurer is responsible for the collection, distribution, and reconciliation of property taxes levied by all of the taxing entities in summit county. The tax sale is advertised in the park record four times, once in each of the four successive weeks immediately preceding the date of the tax sale. The summit county restaurant tax committee (scrtc) is comprised of the following individuals:

This is the total of state and county sales tax rates. In 2019, summit county voters decided to prioritize the health of the community by passing a nicotine tax that effectively raised the sales tax on cigarettes to $4 per pack. The current total local sales tax rate in summit county, ut is 7.150%.

Summit county has a higher sales tax than 56.6% of utah's other cities and counties. Summit county, utah has a maximum sales tax rate of 9.05% and an approximate population of 34,507. Access utah sales and use tax rates on the utah state tax commission's website.

262 rows average sales tax (with local): Summit county, utah, sales tax rev bonds, series 2021. Summit county collects a 1.85% local sales tax, the maximum local sales tax allowed under utah law.

Utah sales & use tax rates. State sales tax and.125% of the affordable housing tax are not charged on the purchase of food. Cash management and investment duties.

The summit county sales tax rate is %. Try it now & grow your business! All entities and individuals doing business in summit county are required to pay sales tax.

791 S Nebo Circle Woodland Hills Ut - Summit Creek Utah Custom Homes Parade Of Homes Home

6691 Cody Trl Park City Ut - 55 Baths In 2021 Summer Sky Park City Utah Style

2

Park City Reminds Me A Little Of The Former Bingham Canyon Now Gone

Pin By Chayse H On Ch House Landscaping Fragrant Flowers Bloom Viburnum

Mt Olympus This Will Always Look Like Home Utah Natural Landmarks Mountains

4576 W Chenango S South Jordan Ut 84009 - Photo 8 Of 49 South Jordan House Styles Mansions

Holladay Utah Home Sales Sale House Real Estate New Homes

Utah Use Tax

2

July Sales Tax Reports From Summit County And Towns Show Signs That Post-pandemic Business Recovery Is Well Underway Summitdailycom

Caroline George On The Three-pitch Emstorm Mountain Fallsem Wi45 Big Cottonwood Canyon Just Lake George Lake Cottonwood Canyon

11714 Zephyr Way South Jordan Ut - 4 Beds3 Baths South Jordan House Styles Patio

2021 Best Places To Live In Summit County Ut - Niche

Utah Sales Tax Rates By City County 2021

Yellow Aster Butte View Of Shuksan In The North Cascades Washington North Cascades Butte Cascade

Park City Utah Ut 84060 84098 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

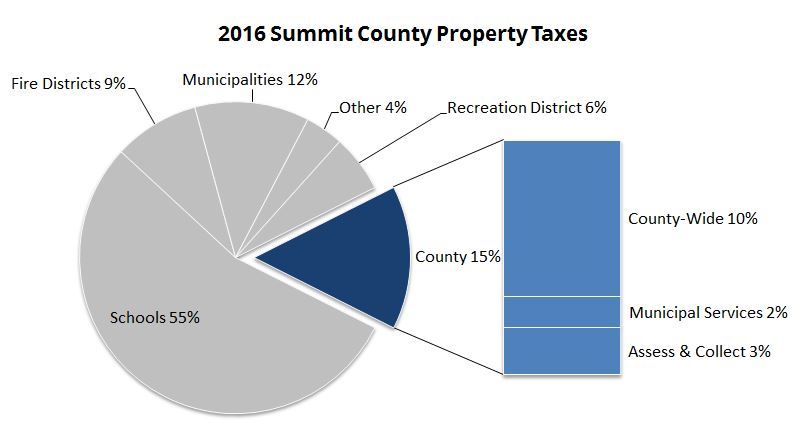

Your 2018 Summit County Utah Property Taxes Explained

Box Elder County Ut - Typical Lot L Land For Sale Acreage Residential Land