Maine Excise Tax Calculator Portland

The excise tax due will be $610.80. This is only an estimate.

A Road Map To Recreational Marijuana Taxation Tax Foundation

Year 1 0.024 year 2 0.0175 year 3 0.0135 year 4 0.010 year 5 0.0065 year 6 &

Maine excise tax calculator portland. All applicable state of maine law requirements are followed in regards to excise tax credits. City of portland excise tax credits policy Except for a few statutory exemptions, all vehicles registered in the state of maine are subject to the excise tax.

Military exemption from vehicle excise tax. Excise tax is an annual tax that must be paid prior to registering your vehicle.except for a few statutory exemptions, all vehicles (including boats) registered in the state of maine are subject to the excise tax.excise tax is defined by state statute as a tax levied annually for the privilege of operating a motor vehicle, boat or camper trailer on the public ways. Yes, you can claim a portion of the expenses.maine is one of the states where you claim personal property tax in lieu of vehicle registration fees.

Maine's general sales tax of 5.5% also applies to the purchase of beer. Please note the state of maine property tax division only provides quotes to the municipal excise tax collector and not to individuals. After 0.004 year one is the current model year (2020), year 2 is 2019, etc.

City of portland is pleased to allow exemptions for annual excise tax on vehicles owned by residents who are serving on active duty in the armed forces and who are permanently stationed at a military or naval post, station or base outside of the state of maine or who are deployed for military service for more than 180 days. This calculator will allow you to estimate the amount of excise tax you will pay on your vehicle. Excise tax for the second year of the vehicle would be $525 ($17.50 x 30).

Trailers with a declared gross weight of 9,000 pounds or less are charged a flat rate vehicle excise tax of $8.00. The assessor’s department maintains tax records on over 24,000 real estate accounts, 3,200 business personal property accounts, and 481 tax maps. The state excise tax on gas in maine is 30 cents per gallon of regular gasoline.

Since books are taxable in the state of hawaii, mary charges her customers a flat. Homepage property tax division 51 commerce drive, po box 9106 A registration fee of $35.00 and an agent fee of $6.00 for new vehicles will also be charged for a total of $641.80 due to register your new vehicle.

Property tax & records for fy22, the total value of taxable property in portland is $14.6 billion, which generates $190 million in property tax revenue to fund the operation of maine’s largest city. Every 2021 combined rates mentioned above are the results of maine state rate (5.5%). The excise tax due will be $610.80.

Maine residents that own a vehicle must pay an excise tax for every year of ownership. The maine state statutes regarding excise tax can be found in title 36, section 1482. Maine cities and/or municipalities don't have a city sales tax.

Homeowners and renters who qualify for a rebate through the maine property tax fairness credit are. Excise tax is an annual tax that must be paid prior to registering your vehicle. Except for a few statutory exemptions, all vehicles registered in the state of maine are subject to the excise tax.

To calculate excise tax, multiply the per year amount by each thousand dollar of the msrp. You will pay excise tax, registration fees (plus an extra $10 fee for a milfoil sticker if the boat will be in used in fresh water), sales tax if a private sale or bought out of state. The state excise tax on gas in maine is 30 cents per gallon of regular gasoline.

Online calculators are available, but those wanting to figure their excise tax in maine can do so easily using a manual calculator or paper and pen. To calculate the excise on your vehicle the following scale is used: 1 city hall plaza ellsworth, me 04605.

Excise tax is defined by state statute as a tax levied annually for the privilege of operating a motor vehicle or camper trailer on the public ways. The motor vehicle excise tax is based on the manufacturer's suggested retail price when the vehicle was new, as taken from the window sticker. So, you will claim the excise taxes you paid to your city or county based on your vehicle's value.

Use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state, and local taxes. Excise tax is defined by maine law as a tax levied annually for the privilege of operating a motor vehicle or camper trailer on the public ways. How 2021 sales taxes are calculated in maine.

Excise tax calculator this calculator will allow you to estimate the amount of excise tax you will pay on your vehicle. In maine, beer vendors are responsible for paying a state excise tax of $0.35 per gallon, plus federal excise taxes, for all beer sold. Excise tax is an annual tax that must be paid prior to registering your vehicle.

There is no county sale tax for maine. Meanwhile, total taxes on diesel are 31.2 cents per gallon. The state general sales tax rate of maine is 5.5%.

Property tax relief available to older portland homeowners. Maine gas tax the state excise tax on gas in maine is 30 cents per gallon of regular gasoline. Excise tax amounts are based on the vehicle's msrp (manufacturer's suggested retail price) and year of manufacture.

Like all states, maine sets its own excise tax. First year =$24.00 per thousand (or 0.0240) Overview of maine taxes maine has a progressive income tax system that features rates that range from 5.80% to 7.15%.

Excise tax is an annual tax that must be paid when you are registering a vehicle. You will need the complete information on the boat: Length, horsepower, serial number and me number if previously registered in maine.

For example, the first year excise tax for a vehicle with an msrp of $30,000 would be $720 ($24 x 30).

Welcome To The City Of Bangor Maine - Excise Tax Calculator

Want To Lower Maines Tax Burden Dont Forget To Consider Raising Incomes

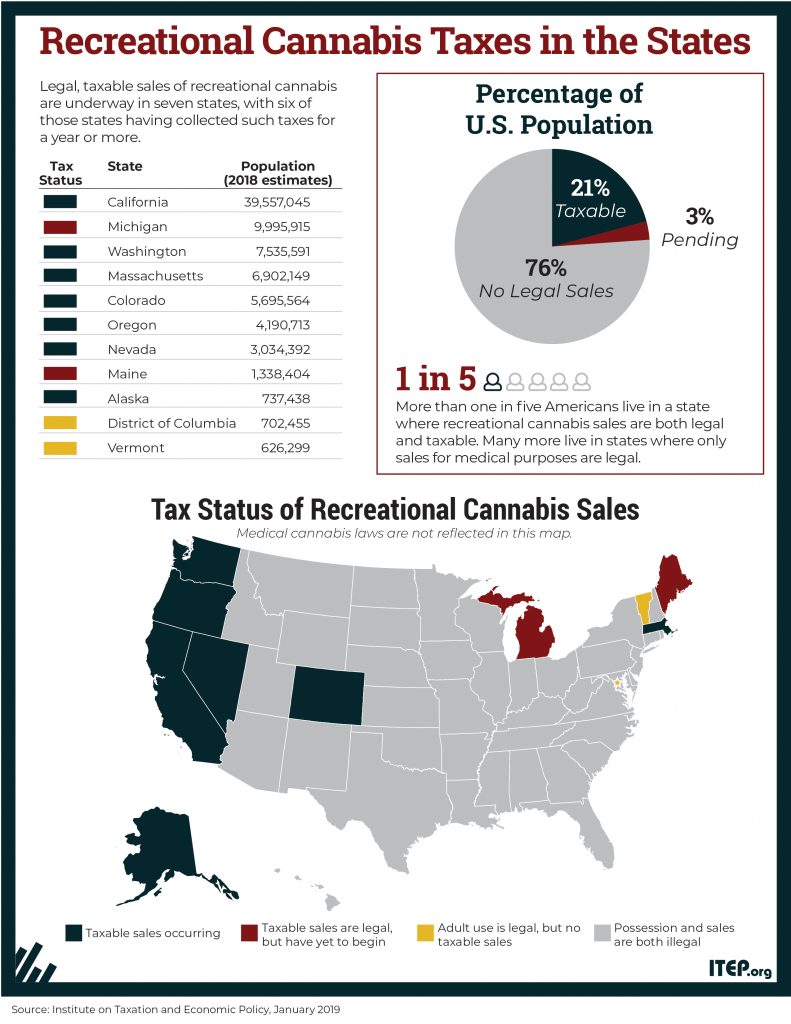

Taxing Cannabis Itep

Wireless Taxes Cell Phone Tax Rates By State Tax Foundation

Maine Income Tax Calculator - Smartasset

States With Highest And Lowest Sales Tax Rates

Maine Income Tax Calculator - Smartasset

Automobile Registration Portland Me

State Income Tax - Wikipedia

Maine Car Registration A Helpful Illustrative Guide

I-team Maine Excise Tax Among The Highest In Us How Is That Money Spent Wgme

Welcome To The City Of Bangor Maine - Excise Tax Calculator

Maine Income Tax Calculator - Smartasset

Maine Alcohol Taxes - Liquor Wine And Beer Taxes For 2021

Sales Taxes In The United States - Wikipedia

Maine Sales Tax Calculator And Local Rates 2021 - Wise

2

Maine Car Registration A Helpful Illustrative Guide

How To Calculate Cannabis Taxes At Your Dispensary