Carried Interest Tax Rate 2021

The government today released the legislation on the concessional tax treatment for carried interest in hong kong. Given the proposal to increase the corporate tax rate to 28%, many pe firms may think that operating as a corporation will necessarily lead to higher taxes.

Logic Still Universal Multipurpose Professional Invoice In 2021 Invoice Template Statement Template Templates

The biden administration has also included a provision to eliminate capital gains treatment for carried interests in its american families plan, presented to congress on may 28, 2021.

Carried interest tax rate 2021. Proceeds from that individual’s partnership interest are often taxed as capital gain rather than ordinary income. Inland revenue (amendment) (tax concessions for carried interest) bill 2021. The general partner receives its carried interest as compensation for its investment management services.

At the meeting of the executive council on 26 january 2021, the council advisedand the chief executive orderedthat the inland revenue (amendment) (tax concessions for carried interest) bill 2021 (“the bill”), at annex a, should be introduced into the. In general, equity issued in exchange for services is taxable at ordinary income rates unless that equity is a profits interest. Concessional tax treatment for carried interest includes a 0% tax rate for “qualifying carried interest” “inland revenue (amendment) (tax concessions for carried interest) bill 2021” passed its third reading in the legislative council

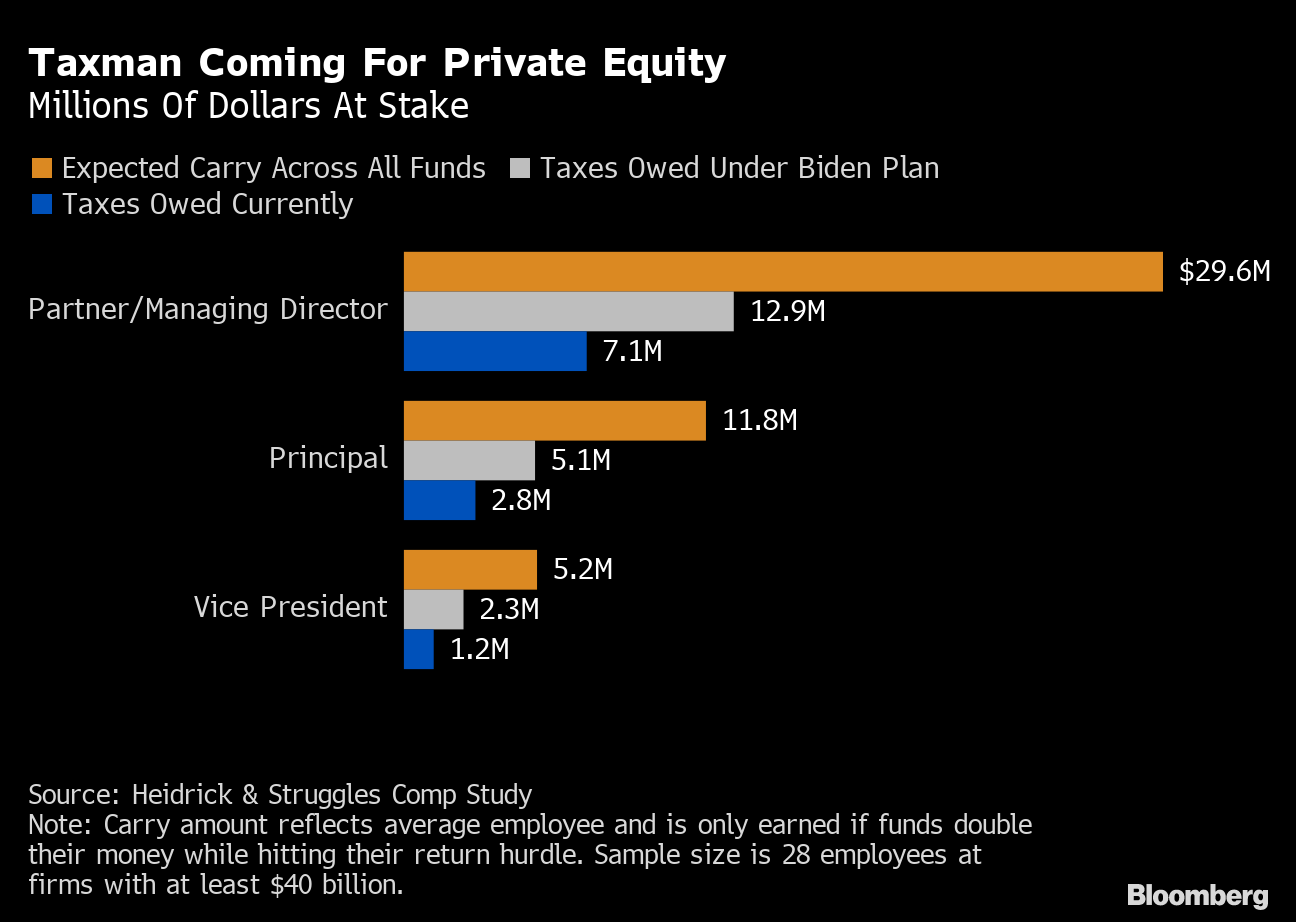

The managers pay a federal personal income tax on these gains at a rate of 23.8 percent (20 percent tax on net capital gains plus 3.8 percent net investment income tax). [16] senator ron wyden’s 2021 proposal to close the carried interest loophole is projected to raise $6.3 billion annually. 1068, “the carried interest fairness act of 2021” has been introduced in congress to eliminate capital gains tax treatment for carried interests.

Where the dimf rules apply, amounts which are in substance management fees are subject to tax as trading income regardless of the underlying nature of those amounts at the fund level (income tax at max. Carried interest offers lower tax rate than for income biden administration had proposed eliminating the tax break house democrats’. On january 4, 2021, the hong kong government announced that under its latest proposal on the carried interest tax concession, it would set the tax rate at 0% and that an amendment bill to enact the latest proposal is expected to be introduced into the legislative council in late january 2021.

The eligible carried interest distributions are to be taxed at a 0% rate for qualifying persons who are subject to profits tax, and for qualifying employees subject to salaries tax. A carried interest is a form of profits interest that gives a service provider the right to share in future partnership profits but is not taxable upon receipt because it would not share in any distributions if the partnership liquidated immediately after. The carried interest fairness act of 2021 would close the carried interest loophole and raise billions in tax revenue.

Carried interest is the portion of an investment fund's returns eligible for a capital gains tax rate of 15% or 20%, instead of the ordinary income tax rate of up to 37%. Rate of 45% and 46% in scotland and class 4 nic at a max. Lobbyists shielded carried interest from biden's tax hikes, top white house economist says published thu, sep 30 2021 12:43 pm edt updated thu, sep 30 2021 2:02 pm edt christina wilkie.

Carried interest fairness act of 2021 senators baldwin, manchin, and brown. Bdo recently polled a group of private equity fund managers about their top concerns for its fall 2021 private capital pulse survey and found that 42% of them were most concerned about the impacts of a capital gains tax increase (52%), displacing their top concern in the spring of increased taxation of digital products/services, which fell to the no. Treating carried interest earnings as ordinary compensation income could raise between $1.4 billion and $18 billion annually.

The law known as the tax cuts and jobs act, p.l.

Pin On Uvs Inc

Headphone Infographic Bluetooth Earbuds Earbuds Infographic

Dont Get Caught Paying Tax Twice On Your Backdoor Roth Ira The Motley Fool In 2021 Roth Ira Contributions Roth Ira Ira

Carried Interest Taxation Update On Final Regulations And Potential Legislative Changes Gray Reed - Jdsupra

Cost Of Goods Sold Cogs All You Need To Know In 2021 Accounting Financial Management Website Development Process

Deribits Ether Options Hit All-time-high Amidst Rising Institutional Interest Btcmanager Data Show Cryptocurrency Blockchain

Dependent Care Fsa We All Spend Time On Finding Ways To Make Money And Invest But Finding Ways To Keep Wh After School Care Way To Make Money Personal Finance

Wacc - Weighted Average Cost Of Capital Cost Of Capital Financial Management Weighted Average

Project Or Divisional Weighted Average Cost Of Capital Wacc Cost Of Capital Weighted Average Financial Strategies

2018 Section 179 Tax Deduction Write Off Tax Deductions Deduction Tax

Mandala Jasmine Universal Multipurpose Bank Visa Electr In 2021 Templates Document Templates Card Template

How Clever New Deals And An Unknown Tax Dodge Are Creating Buyout Billionaires By The Dozen Billionaire Sovereign Wealth Fund Carried Interest

Carried Interest In Private Equity Calculations Top Examples Accounting

Cost Of Goods Sold Cogs All You Need To Know In 2021 Accounting Financial Management Website Development Process

Geometric Simple Universal Multipurpose Bank Mastercard In 2021 Templates Online Activities Card Template

Carried-interest Tax Break For Private Equity Survives Another Attempt To Kill It2021

Bankingfinancial Awareness 20th December 2019 Awareness Banking Financial

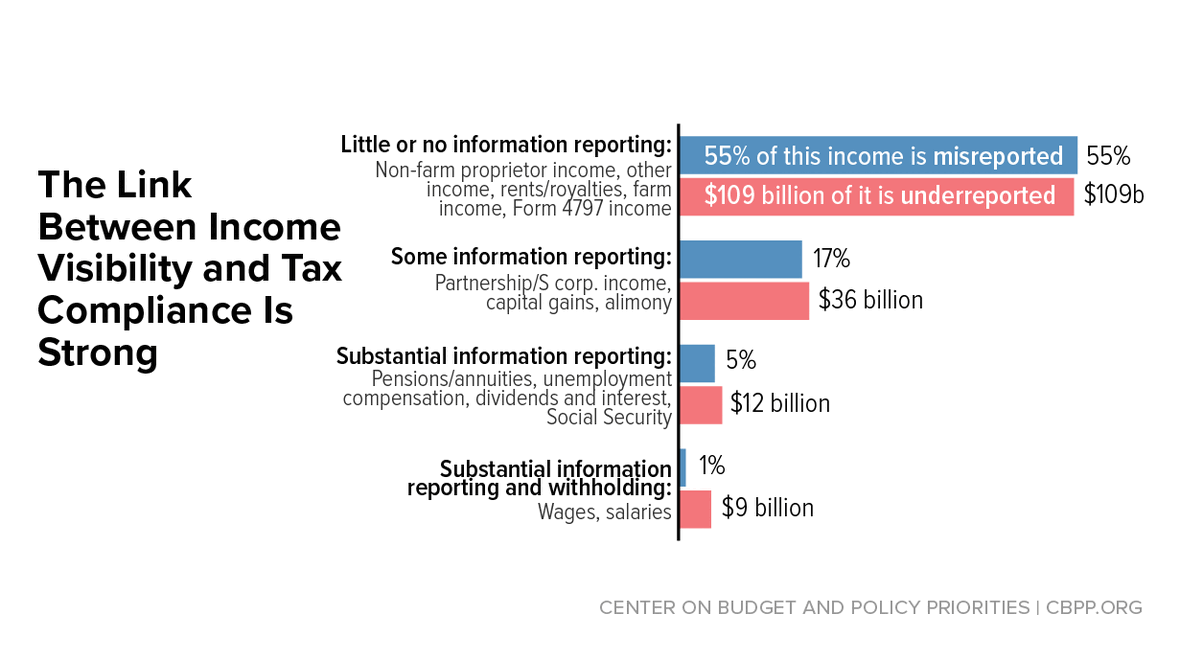

Build Back Better Requires Highest-income People And Corporations To Pay Fairer Amount Of Tax Reduces Tax Gap Center On Budget And Policy Priorities

Carried Interest Tax Private Equity Billionaires Angry Over Closing Loophole - Bloomberg