Tn Franchise And Excise Tax Manual

Book value of property $ 3,000,000. The tennessee franchise and excise tax has two levels:

Tngov

This manual provides information on sales and use tax, franchise and excise tax, business tax, and various vehicle and trailer registration provisions.

Tn franchise and excise tax manual. In a recently updated tax manual, the tennessee department of revenue has advised that if a company is treated as a foreign corporation under the internal revenue code (irc), but has income effectively connected with a united states trade or business, then its net earnings and net worth connected with its united states. All corporations, llcs, and partnerships, regardless of their tax status with the irs, are subject to the tennessee franchise tax and tennessee excise tax. The excerpts from the tennessee code are through the 2020 legislative session.

Calculate tn franchise and excise tax: Franchise and excise taxes are privilege taxes imposed on each corporation, limited partnership, limited liability company and business trust chartered/organized in tennessee or doing business in this state. The minimum amount of each quarterly payment shall be the lesser of:

The minimum franchise tax of $100 is payable if you are incorporated, domesticated, qualified, or otherwise registered through the secretary of state to do business in tennessee, regardless of whether the company is active or inactive. $0.25 per $100 based on either the fixed asset or equity of the entity, whichever is greater. The information provided in the department’s tax manuals is general in nature.

Business tax law requires that the final return must be filed no later than 15 days after the date of selling or shutting down the business. Tennessee discusses foreign corporations for corporate tax purposes. 6.5% excise tax on the net earnings of the entity, and;

The state of tennessee imposes two taxes for the privilege of doing business within its boundaries. And if you make enough income, you may also need to pay a state corporate tax rate of 6.5 percent. General partnerships and sole proprietorships are not subject to these taxes.

When calculating franchise tax, if the holding entity owns an interest in several other entities, its equity can potentially be taxed more than once. Franchise and excise tax exemptions.22 2. This manual provides information on sales and use tax, franchise and excise tax, business tax, and various vehicle and trailer registration provisions.

The goal of this manual is to provide tennessee farmers, timber harvesters, and nursery operators a central resource for tennessee state and local taxes as it applies to their respective industries. (a) 25% of the combined franchise, excise tax shown on the tax return for the preceding tax year, annualized if the preceding tax year was for less than twelve (12) months; The excise tax is based on net earnings or income for the tax year.

If you decide to close your business, you must file a final business tax return with the tennessee dept. Agricultural sales and use tax guidance. Of revenue and pay any tax that is due (minimum of $22).

Franchise, excise tax credits and prior year. If you choose to file on paper, please use due care to select the correct quarterly voucher, since payments are applied to th e. The excise tax is 6.5% of the net taxable income made in tn.

Tn posts updated f&e and business tax manual. Or (b) 25% of 80% of the combined franchise, excise tax liability for the current tax year. The excise tax is based on the net income of

The goal of this manual is to provide tennessee farmers, timber harvesters, and nursery operators a central resource for tennessee state and local taxes as it applies to their respective industries. Thankfully, the process of getting a tennessee state tax id isn’t especially difficult. Remember, tennessee charges a franchise tax, and you may be responsible for sales taxes or excise taxes, depending on what you’re selling.

Book value of property $ 3,000,000. See the answer see the answer done loading. The tax manuals are informal, do not constitute a revenue or letter ruling, and pertain to:

The state department of revenue’s new f&e and business tax manuals have been posted on the department’s website. Deduction for tn tax taken. Unlike our reports on hawaii and california, tennessee will not use economic presence criteria to impose its franchise and excise taxes.

Franchise tax is figured at.25% of the net worth of corporation or the tangible property. In the wake of the supreme court decision in south dakota v. These taxes are the excise tax and the franchise tax and they are imposed on corporations and most limited liability companies.

Mef internet filing is available for corporate, employment, estates & trusts, exempt organization, excise, individual and partnerships tax returns. Calculate tn franchise and excise tax: Deduction for tn tax taken.

Tngov

Tngov

Tngov

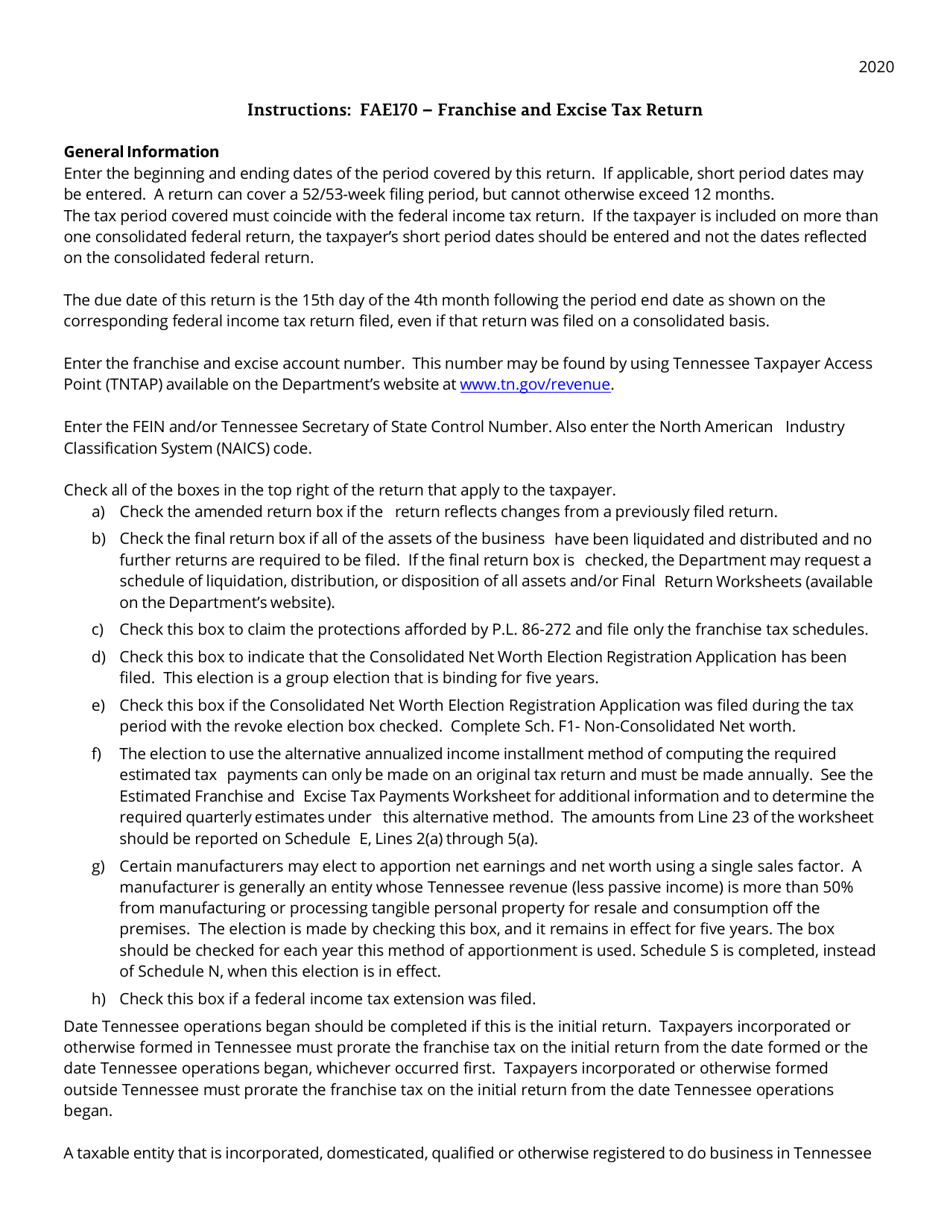

Download Instructions For Form Fae170 Rv-r0011001 Franchise And Excise Tax Return Pdf 2020 Templateroller

Tngov

Tennessee Franchise And Excise Tax Guide - Tngov Franchise And Excise Tax Guide Is Intended As An Franchise And Excise Tax Statutes Or Rules Also Offers A Toll-free Franchise -

2017-2021 Form Tn Dor Fae 173 Fill Online Printable Fillable Blank - Pdffiller

Tngov

Form Fae170 Rv-r0011001 Download Printable Pdf Or Fill Online Franchise And Excise Tax Return Tennessee Templateroller

Free Form Fae 170 Franchise And Excise Tax Return Kit - Free Legal Forms - Lawscom

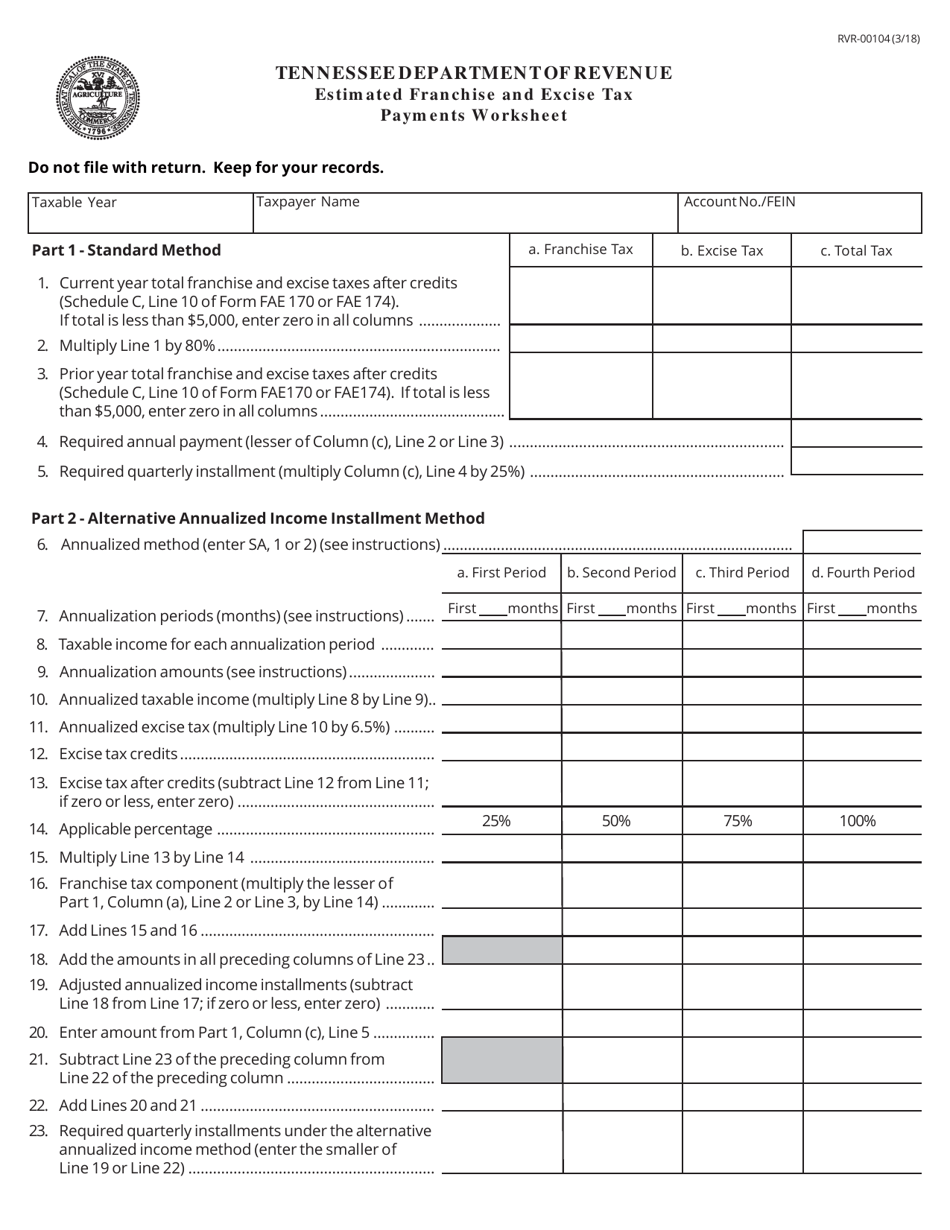

Form Rvr-00104 Download Printable Pdf Or Fill Online Estimated Franchise And Excise Tax Payments Worksheet Tennessee Templateroller

Tennessee Fae 170 Instruction 2019 - 112021

Download Instructions For Form Fae170 Rv-r0011001 Franchise And Excise Tax Return Pdf 2020 Templateroller

Tngov

Fillable Online Tn Franchise And Excise Tax Job Tax Credit Business Plan Franchise And Excise Tax Job Tax Credit Business Plan - Tn Fax Email Print - Pdffiller

Tngov

Fae 170 - Fill Out And Sign Printable Pdf Template Signnow

Tennessee Franchise And Excise Tax Guide - Tngov Franchise And Excise Tax Guide Is Intended As An Franchise And Excise Tax Statutes Or Rules Also Offers A Toll-free Franchise -

Tngov