Child Tax Credit 2022 Income Limit

Prior to upping the child tax credit to $3,000 and $3,600, the income limits were around $200,000 for most taxpayers. Child tax credit family element:

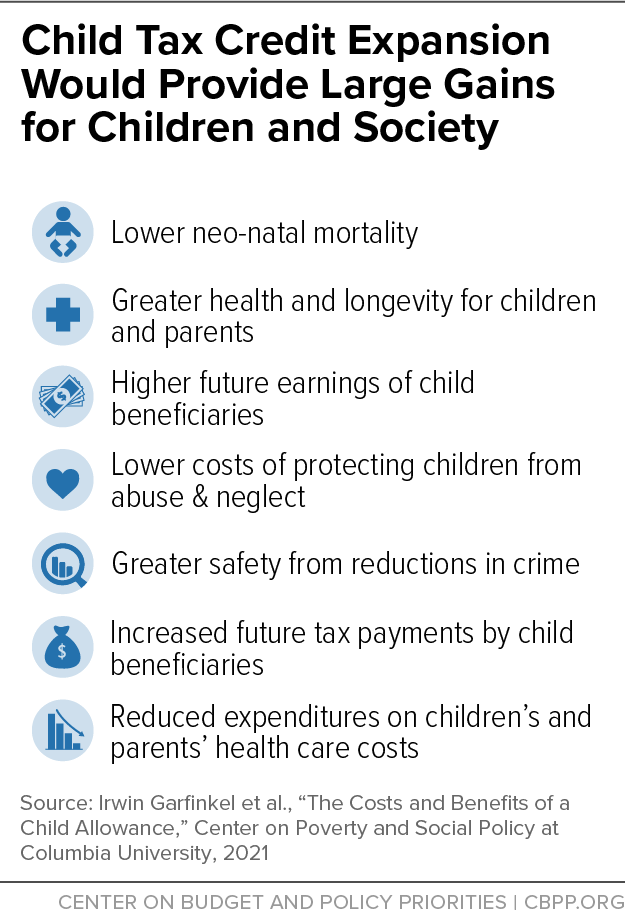

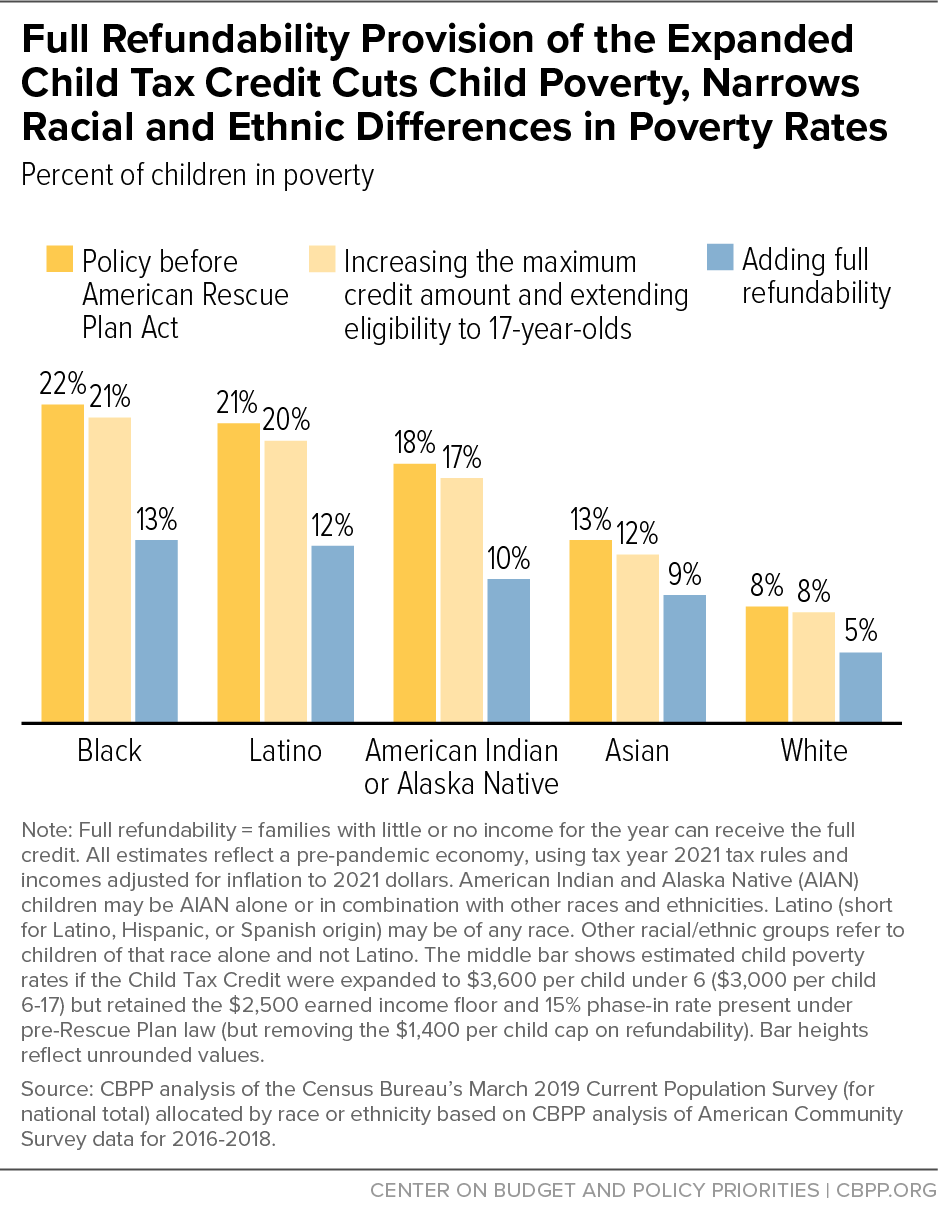

Build Back Betters Child Tax Credit Changes Would Protect Millions From Poverty Permanently Center On Budget And Policy Priorities

For 2022, the maximum amount that this credit is worth ranges from $560 (if you have no qualifying children) to $6,935 (if you have three or more qualifying children).

Child tax credit 2022 income limit. When you file your tax return in 2022, you will get to claim up to $3,600 in child tax credit. The tax year 2022 maximum earned income tax credit amount is $6,935 for qualifying taxpayers who have three or more qualifying children, up from $6,728 for tax year 2021. $112,500 if filing as head of household;

The maximum earned income tax credit is $560 for no children, $3,733 for one child, $6,164 for two children and $6,935 for three or more children. By the end of this year, families will have received. The ctc starts phasing out at an income of $400,000 and is no longer available once your income hits $440,000.

Democrats told huffpost this week that they don’t expect a “work requirement” to be added to the child tax credit as part of the build back better bill they’re hoping to pass in the next few weeks. The child tax credit begins to be reduced to $2,000 per child if your modified agi in 2021 exceeds: Many families are already receiving half their credit in the form of monthly payments.

Like last year, married filers can get a child tax credit of at least $2,000 with income of $400,000 or less. We explain how the child tax credits could affect your taxes in 2022 credit: 2021 to 2022 2020 to 2021 2019 to 2020;

The 2021 credit gives eligible families $3,600 per child under age six, and $3,000 per child ages six to 17. $150,000 if married and filing a joint return or if filing as a qualifying widow or widower; Ages six to 17 is up to $3,000 in total (up to $250 in advance monthly) additionally, a portion of your amount is reduced by $50 for every $1,000 over certain income limits (see the faqs below).

In january 2022, the irs will send families that received child tax credit payments a letter with the total amount of money they got in 2021. Parents paying fees to registered childcare centres are originally allowed to claim of up to rm2,000. $75,000 if you are a single filer or are married and filing a.

Budget summary 2022 these are the key tax measures in the budget statement of 12 october 2021, as made by the minister for finance. In 2020, the credit was worth 2,000 dollars per child aged 16 or younger, according to household income with some variations. Unmarried filers can get a credit of at.

For tax year 2021, the credit was increased from $2,000 per qualifying child to $3,600 for children ages 5 and under and $3,000 for children ages 6 through 17. Earned personal circumstances 2020 € 2021 € single or widowed or According to the irs website, working families will be eligible for the whole child tax credit if;

The child tax credits are worth up to $3,600 per child in 2021, and are automatically issued as monthly advance payments of up to $300. Two more child tax credit checks are on the schedule for this year, with the second half of the payments arriving during tax season in 2022. What are the maximum income limits for the child tax credit 2022?

The revenue procedure contains a table providing maximum eitc amount for. Under budget 2022, it is proposed that this. The maximum credit is $3,733 for one child, $6,164 for two children, and $6,935 for three or more children.

The premium tax credit subsidy caps by percentage of household income for slcsp 2022. Details of the 2022 advance child tax credit. This has been changed to $75,000 for single filers, $150,000 for married couples filing a joint return, and $112,500 for heads of households.

This year, the american rescue plan (arp) increased the ctc from $2,000 per child to as much as $3,000 or $3,600, depending on the age of the child, for many families. The credit amount jumped from $2,000 to $3,000 for children six to 17 years old (notice the additional year added to. For 2021 ( and only 2021 ), the child tax credit was substantially improved.

Balance t exemption limits the exemption limits for persons aged 65 years and over remain unchanged. Income tax tax credits changes are in bold. Although the child tax credit is not available at the moment, there are other tax provisions that may affect your 2020 tax return.

They earn $150,000 or less per year for a married couple. The majority of american families across income thresholds receive financial support from the credit. Higher tax relief limit for payments of nursery and kindergarten fees extended.

Our child tax credit calculator factors in this reduction for you. The maximum earned income tax credit in 2022 for single and joint filers is $560 if the filer has no children (table 5).

Build Back Betters Child Tax Credit Changes Would Protect Millions From Poverty Permanently Center On Budget And Policy Priorities

Budget 2019 - Revised Section 87a Tax Rebate - Tax Liability Calculation Illustration Income Tax Tax Deductions List Tax Deductions

New 2022 Irs Income Tax Brackets And Phaseouts For Education Tax Breaks

Child Tax Credit 2022 Qualifications What Will Be Different Marca

Pin On Twhc

Total Compensation Statement Excel Template Free Smart With Credit Card Statement Temp Personal Financial Statement Statement Template Balance Sheet Template

Build Back Betters Child Tax Credit Changes Would Protect Millions From Poverty Permanently Center On Budget And Policy Priorities

Maximizing Premium Tax Credits For Self-employed Individuals Tax Credits Health Insurance Options Health Savings Account

The Tax Break-down Child Tax Credit Committee For A Responsible Federal Budget

Irs 2019 Tax Tables Tax Table Federal Income Tax Tax Brackets

Build Back Betters Child Tax Credit Changes Would Protect Millions From Poverty Permanently Center On Budget And Policy Priorities

What Are Income Limits That Will Allow You To Qualify For Medi-cal Or Coveredca Health Plans Income Health Plan How To Plan

Us Federal Income Tax Forms 3 Five Things You Probably Didnt Know About Us Federal Income T In 2021 Income Tax Federal Income Tax Tax Forms

Irs Provides Fsa And Hsa Tax Break For 23andme As A Medical Expense Tax Pro Today Httpbacklyu2ewj Medical Estimated Tax Payments Tax Payment Nanny Tax

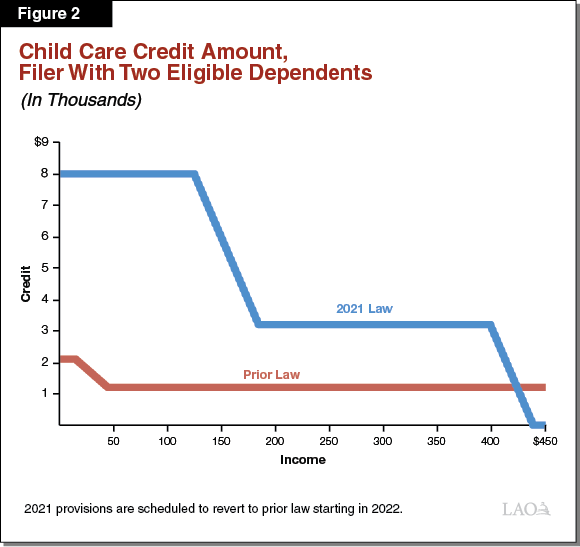

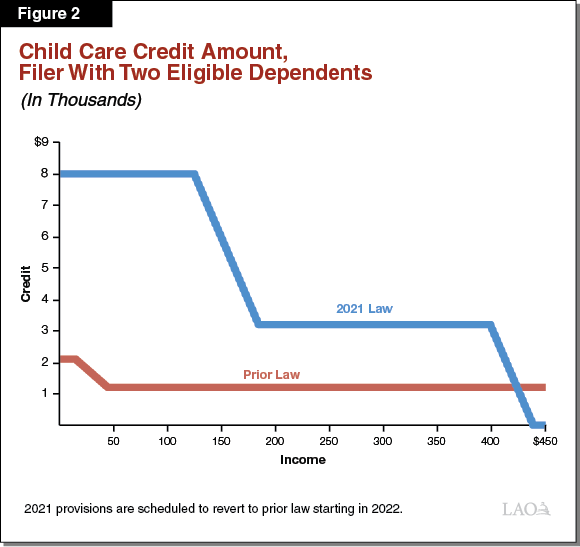

Tax Credit Expansions In The American Rescue Plan

Child Tax Credit What Is The Income Limit For Joint Filers Single Filers And Heads Of Household - Ascom

Tax Credit Expansions In The American Rescue Plan

What Is Taxable Income In 2021 Income Federal Income Tax Filing Taxes

Section 80c 80cc - Deductions Income Tax Deductions Under Chapter Vi For Ay 2021-22 Tax Deductions Income Tax Income Tax Return