Pay Past Due Excise Tax Chicopee Massachusetts

The city or town where the vehicle is principally garaged levies the excise and the revenues become part of the general funds of the municipality. Vehicle has been sold, traded, or donated;

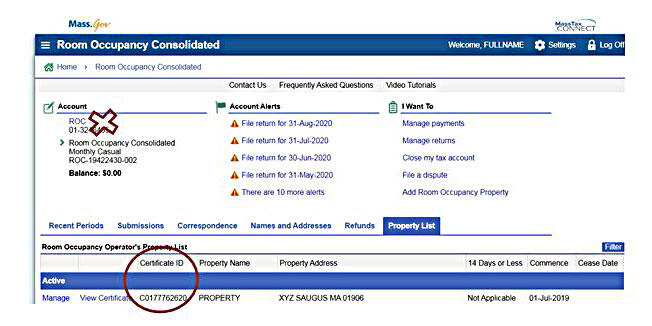

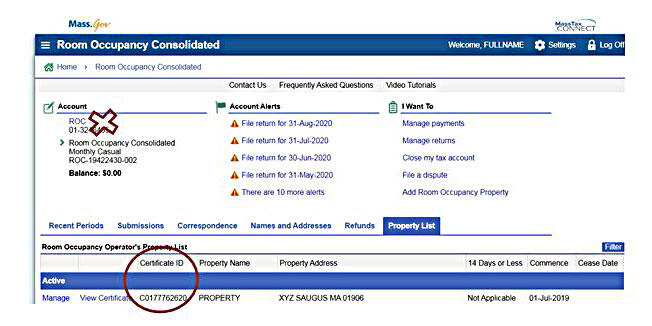

Room Occupancy Excise Tax Massgov

When is the excise payment due?

Pay past due excise tax chicopee massachusetts. Other ways to make a payment. If payment in full (including the demand charge) is not received within 14 days of the demand date issued, a warrant with additional charges will be issued. Early january 90 days after fall tax bill:

Owner has moved within massachusetts prior to january 1st of the tax year If your bill is not past the due date for payment, you have the following options: Past due real estate or personal property tax payments can be made by mail or in person directly to the tax collector's office, or in payment drop box.

Pay your outstanding obligations online by clicking on the green area on the home page. The excise rate, as set by statute, is $25 per thousand dollars of valuation. You need to enter your last name and license plate number to find your bill.

Excise tax demand bills are due 14 days from the date of issue. There are several ways you can make payment on your outstanding bills. Applications are due for residential exemption and elderly, veterans and other statutory exemptions.

For excise tax bills that have gone to warrant you will need to contact and pay to our deputy tax collector. Billing (new online payment system through cityhallsystems) Chicopee collector's office 274 front street chicopee, ma 01013 online payments we accept online payments for:

For your convenience payment can be made online through their website www.kelleyryan.com. All information provided on an excise tax bill comes directly from the registry of motor vehicles. The excise is based on information furnished on the application for registration of the motor.

It appears that your browser does not support javascript, or you have it disabled. Pay bills and taxes gardner ma. All vehicles in the state of massachusetts are subject to an annual motor vehicle excise tax.

What if i mail in my excise tax payment late? Go to our online system You may reach the deputy of.

If javascript is disabled in your browser, please. More information, including how to pay past due bills online can be found here. Call for payoff figure through a specific date as interest accrues daily.

Applications for abatement must be received by the board of assessors within three (3) years after the excise was due, or one year after the excise was paid, whichever is later. You will not be cleared out of the rmv for non renewal until all past due taxes are paid on all outstanding plates. 1 year after the excise was paid;

You may mail your payment coupon and a check in the envelope provided. This information will lead you to the state attorney generals website concerning the tax. Deputy collector, pks associates, inc.

Even if you did not timely file an application, assessors can still grant you an exemption, but only if. 3 years after the date the excise was due, or; Motor vehicle excise tax bills are due and payable within thirty days from the date of issue.

If an excise is not paid within 30 days from the issue date, the account will be assessed a $10.00 demand charge plus interest. Once an excise tax bill has gone passed the initial due date on the first mailing, payment must be made either by mail or at our office. Filing an application does not mean that collecting the excise has stopped.

There is a fee for credit card payments. Chicopee city hall 17 springfield street chicopee, ma 01013 phone: Bills are assessed on a calendar basis.

Online payments for excise tax are accepted only within the 30 days from the date of issue on the original tax mailed. All massachusetts residents who own and register a motor vehicle must pay the motor vehicle excise annually. What if i don't receive my excise bill?

Payment of the motor vehicle excise is due 30 days from the date the excise bill is issued. 30 days after tax bill: Excise tax (current bills only) in person:

Please note all online payments will have a 4.5% processing fee added to your total due. Jones & associates 98 cottage street p o box 808 easthampton, ma 01027 ph: According to massachusetts general law chapter 60a, section 2, failure to receive notice shall not affect the validity of the excise.

If you have any past due. Please have your bill number and checkbook or credit card ready before proceeding. For immediate clearance of marked bills, payments in cash can be made at the deputy collector’s office in brockton city hall monday through friday from 8:30am to 4:30pm.

Cash, check or credit card, pay at the tax collector’s office, gardner city hall, or the kelly and ryan office at the massrmv; For excise tax warrants, final notices, & marked registrations, please see below. You can pay your excise tax through our online payment system.

Chicopeemagov

Chicopee Mayor Vieau - City Of Chicopee - Mayors Office Facebook

Chicopeemagov

Chicopee Gives Preliminary Approvals To New 15 Million Cannabis Cultivation Business - Masslivecom

Excise Tax What It Is How Its Calculated

Mass-cannabis-controlcom

City Of Chicopee Comes Together In The Wake Of Two Mass Shootings News Westernmassnewscom

Chicopeemagov

Prospectusbondtraderprocom

Opposition To United States Involvement In The Vietnam War - Wikipedia

Chicopeemagov

Revenue Stamp Duties Abstract Of The U S Excise Tax Laws Prepared For The Use Of Merchants Bankers Lawyers And The Public Generally Revenue Stamps Of Every Description Constantly For Sale In

Chicopee Gives Preliminary Approvals To New 15 Million Cannabis Cultivation Business - Masslivecom

Options For Payment Of Taxes Town Of Orange Ma

News Flash Chicopee Ma Civicengage

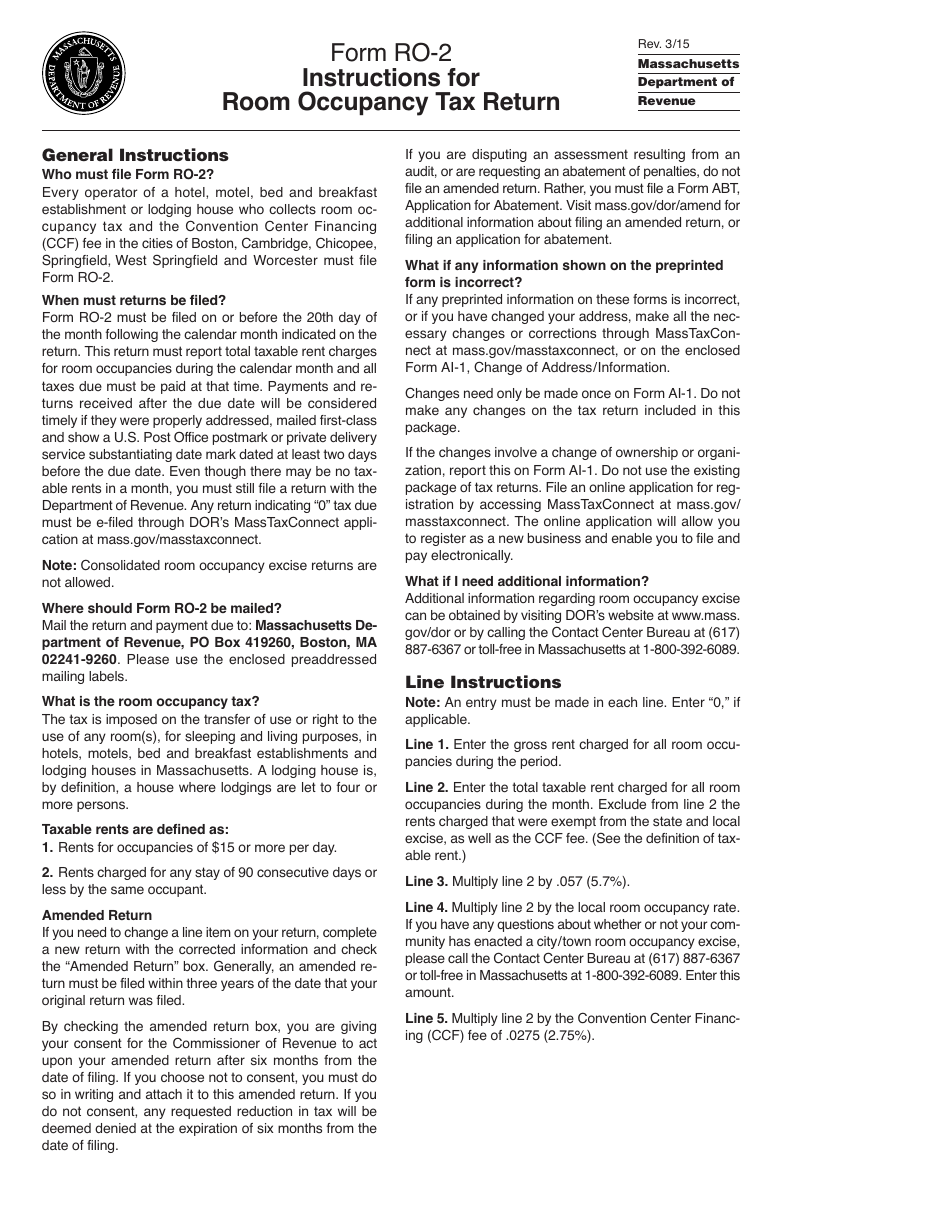

Download Instructions For Form Ro-2 Room Occupancy Tax Return Pdf Templateroller

Massgov

Coronavirus Worries Prompt Chicopee To Give Residents 1-month Grace Period On Tax Bills - Masslivecom

Chicopee Residents See Late Fees After Allegedly Not Receiving Excise Tax Bills