Property Tax Assistance Program Illinois

For a copy of your 2008 second installment property tax bill, contact: Beginning january 1, 2001 legislation will take effect that may significantly increase the

Property Tax Relief How It Works Credit Karma

For the law itself, see illinois's property tax code at 35 ilcs section 200.

Property tax assistance program illinois. Most township websites have specific information about assistance. The chief statewide programs in illinois are summarized here. Any applicant with debt amounts owed to the city of chicago is not eligible for the city of chicago property tax relief program.

Deferred property taxes become a lien against the value of the taxpayer ' s home. Check with your local government on the details, but good examples include homestead exemptions for primary residences, agricultural property tax exemptions, and disabled veteran exemptions. This program allows qualified senior citizens to defer all or part of the property taxes on their personal residence.

Some programs allow the creation of property tax installment plans for property owner(s) who are delinquent in paying taxes as a result of saying being unemployed for the last several months. The county executive’s office declined to comment further. If the homeowner dies, deferred taxes must be paid when the estate is settled.

Welcome to the illinois tax assistance website. Aand information on financial assistance programs for elderly illinois residents is available here. You must have property insurance;

Cook county announces property tax relief for county property owners. We have funds available for delinquent taxes on a first come, first served basis and assistance can only be given to one property per illinois homeowner. The undersigned certifies and requests exemption from property tax obligation for the current year only, because of the inability to contribute fully toward the public charges by.

If so, you may qualify for a state loan of up $5,000 to pay current property tax bills. Townships are the primary governmental resource for assistance; It's a form of a loan with a 6% interest rate, which is to be repaid after the taxpayers death or at the time the property is sold.

Property tax exemptions are exactly what they sound like. Property tax deferral programs allow homeowners to defer payment of property taxes. Recognizing the financial toll of the coronavirus and the pressing need to extend economic relief to area homeowners, cook county board president toni preckwinkle announced wednesday plans to waive late fees on property tax payments.

When the taxpayer sells the home, back taxes plus interest become due. Senior citizens real estate tax deferral program. They alleviate the tax burden on homeowners for a variety of reasons.

Your receipt of a grant may affect your federal or illinois income tax liability. No details have been released about that tax relief or how homeowners can apply for it. Assistance program application & policy and guidelines.

Search $43 million in missing exemptions going. Depending on local tax rates and assessment increases, as well as your own income level, this. Illinois property tax bills are on their way and payment is due in june.

The county’s property tax offices recently announced an extended due date until october 1st. You may qualify for a homeowner exemption if the house in question is your primary residence. While taxes from the 2021 second installment tax bill (which reflect 2020.

Your household income from all sources (for the prior year) must be below $55,000. Any negotiated program will be effective after the local government officials have thoroughly reviewed the owner’s ability to pay and the request from the homeowners. This exemption limits eav increases to a specific annual percentage increase that is based on the total household income of $100,000 or less.

The program will provide $56.0 million in property tax relief and $45.3 million in pharmaceutical assistance to illinois’ senior citizens. View taxing district debt attributed to your property; All real estate benefit programs are processed through your township offices.

Search $72 million in available property tax refunds; Resources to assist seniors with emergency expenses and other costs, including property taxes and social security. The circuit breaker property tax relief program provides rebates to qualified seniors for rent, property taxes or nursing home charges.

31 rows purpose of the property tax relief program: This means that only the owner who lives in the building where the work will occur may apply for assistance (no architects, expeditors, or general contractors). The property must have been your primary residence for at least 3 years;

Disabled Veterans Property Tax Exemptions By State

Cook County Treasurer Maria Pappas Abc7 Chicago Host Black And Latino Homes Matter Phone Bank For Property Taxes Refunds - Abc7 Chicago

Are There Any States With No Property Tax In 2021 Free Investor Guide

Homeowners Property Taxes Grew Faster During Pandemic

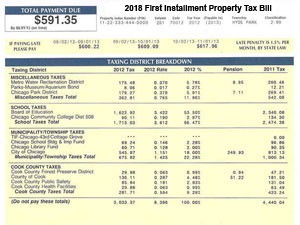

Cook County Property Tax Bill How To Read Kensington Chicago

Dusting Off The Incomeproperty Tax Swap Debate - Cmap

What The Gov Will The Coronavirus Pandemic Affect Your Property Tax Bills Better Government Association

Illinois Property Tax Exemptions Whats Available Credit Karma Tax

Cook County Property Taxes First Installment Coming Due Kensington

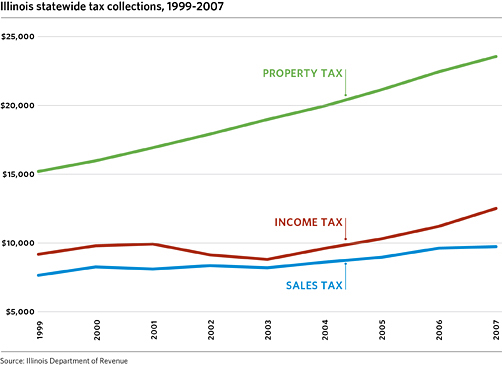

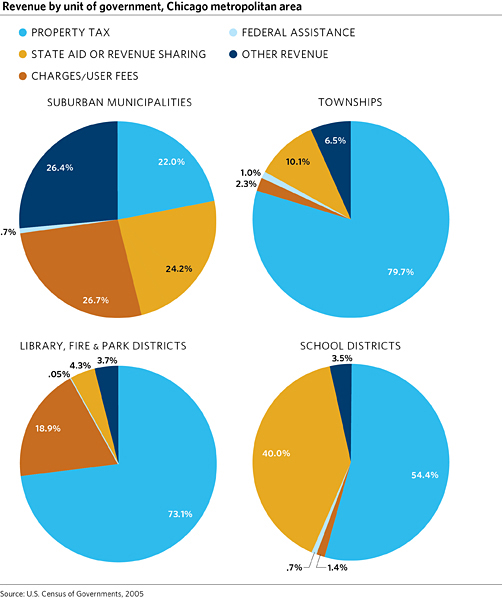

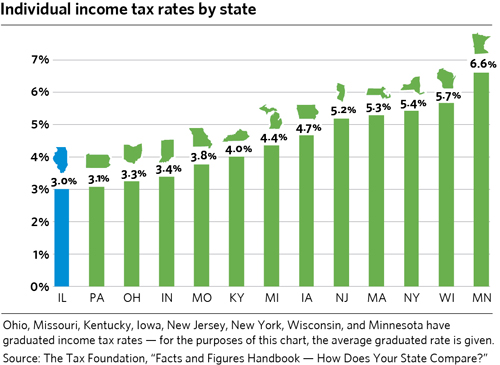

Dusting Off The Incomeproperty Tax Swap Debate - Cmap

How Will Housing Relief From The American Rescue Plan Act Work In Illinois - Mansion Global

2021 Surplus Rebate Application Village Of Crestwood

Covid-19 Faq Cook County Assessors Office

Property Tax Appeal Tips To Reduce Your Property Tax Bill

How To Compute Real Estate Tax Proration And Tax Credits Illinois

Cook County Property Taxes Why Chicago Suburbs Will Shoulder Greater Burden Despite Pandemic Relief Funding - Abc7 Chicago

Dusting Off The Incomeproperty Tax Swap Debate - Cmap

Exemptions

Illinois Taxes - Illinois Economic Policy Institute Illinois Economic Policy Institute