Nebraska Sales Tax Rate 2020

There is no applicable county tax, city tax or special tax. Tax bracket (gross taxable income) tax rate (%) $0+.

How High Are Cell Phone Taxes In Your State Tax Foundation

The minimum combined 2021 sales tax rate for lincoln, nebraska is.

Nebraska sales tax rate 2020. Groceries are exempt from the nebraska sales tax; The nebraska state sales and use tax rate is 5.5% (.055). 0.5% lower than the maximum sales tax in ne.

The lincoln, nebraska sales tax rate of 7.25% applies to the following 21 zip codes: The county sales tax rate is %. The 5.5% sales tax rate in newcastle consists of 5.5% nebraska state sales tax.

The sales tax jurisdiction name is dixon, which may refer to a local government division. The omaha sales tax rate is %. , notification to permitholders of changes in local sales and use tax rates effective april 1, 2022 updated 12/02/2021 effective nebraska sales and use tax | nebraska department of revenue

Counties and cities can charge an additional local sales tax of up to 2%, for a maximum possible combined sales tax of 7.5% For tax rates in other cities, see nebraska sales taxes by city and county. The higher rate is for all corporate income greater than $50,000.

Waverly, ne sales tax rate. The primary policy issue for nebraska, and other states, is how the income of a multistate enterprise is allocated to nebraska. Nebraska collects a state corporate income tax at a maximum marginal tax rate of 7.810%, spread across two tax brackets.

For tax rates in other cities, see nebraska sales taxes by city and county. The december 2020 total local sales tax rate was also 7.000%. The state sales tax in nebraska is 5.50%.

Average sales tax (with local): There is no applicable county tax or special tax. There is no applicable city tax or special tax.

The nebraska sales tax rate is currently %. Utilize leading marketing tools to boost your business and get found online. The lincoln sales tax rate is %.

For tax rates in other cities, see nebraska sales taxes by city and county. The nebraska income tax has four tax brackets, with a maximum marginal income tax of 6.84% as of 2021. The nebraska state sales tax rate is 5.5%, and the average ne sales tax after local surtaxes is 6.8%.

The december 2020 total local sales tax rate was 6.500%. The table below shows the total state and city sales tax rates for the largest cities in nebraska. The current total local sales tax rate in omaha, ne is 7.000%.

Ad start your dropshipping storefront. See the county sales and use tax rates section at the end of this listing for information on how these counties are treated differently. This is the total of state, county and city sales tax rates.

Utilize leading marketing tools to boost your business and get found online. Ad start your dropshipping storefront. The county sales tax rate is %.

31 rows rates include state, county and city taxes. You can print a 6% sales tax table here. There are a total of eighteen states with higher marginal corporate income tax rates then nebraska.

The 6% sales tax rate in homer consists of 5.5% nebraska state sales tax and 0.5% dakota county sales tax. Detailed nebraska state income tax rates and brackets are available on this page. Nebraska has state sales tax of 5.5%.

The current total local sales tax rate in waverly, ne is 7.000%. Local sales and use tax rates effective january 1, 2020 • dakota county and gage county each impose a tax rate of 0.5%. 68501, 68502, 68503, 68504, 68505, 68506, 68507, 68508, 68510, 68512, 68516, 68520, 68521, 68522, 68524, 68526, 68528, 68529, 68542, 68583 and 68588.

The 7% sales tax rate in waverly consists of 5.5% nebraska state sales tax and 1.5% waverly tax. The nebraska sales tax rate is currently %. The minimum combined 2021 sales tax rate for omaha, nebraska is.

For the last 15 years, nebraska has apportioned multistate income based only on sales. The nebraska state sales and use tax rate is 5.5% (.055). The total rate column has an * for those municipalities

You can print a 7% sales tax table here. 2020 rates included for use. You can print a 5.5% sales tax table here.

, ne sales tax rate. In addition to that, many cities collect their own sales taxes with rates up to 2.50%. This is the total of state, county and city sales tax rates.

There are only two rates of corporate income tax, 5.58% and 7.81%.

Nebraskas Sales Tax

Nebraskas Sales Tax

Sales Tax On Grocery Items - Taxjar

The States Where People Are Burdened With The Highest Taxes Zippia

Nebraskas Sales Tax

2020 Nebraska Property Tax Issues Agricultural Economics

Nebraskas Sales Tax

Iowa Sales Tax - Small Business Guide Truic

Nebraska Sales Tax Rates By City County 2021

Nebraska Tax Forms And Instructions For 2020 Form 1040n

Nebraskas Sales Tax

How Much Does Your State Collect In Sales Taxes Per Capita

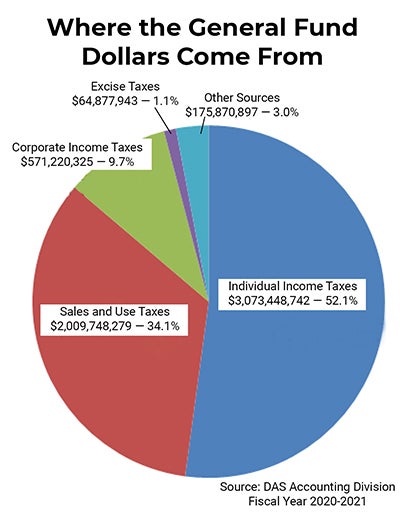

General Fund Receipts Nebraska Department Of Revenue

State Corporate Income Tax Rates And Brackets Tax Foundation

Compared To Rivals Nebraska Takes More From Taxpayers

General Fund Receipts Nebraska Department Of Revenue

Ebay Sales Tax Everything You Need To Know Guide - A2x For Amazon And Shopify - Accounting Automated And Reconciled

States With Highest And Lowest Sales Tax Rates

Us Sales Taxes By State 2020 Us Tax Vatglobal