Georgia Personal Property Tax Exemptions

A level one freeport exemption may exempt the following types of tangible personal property: And personal property is everything that can be owned that is not real estate.

Veteran Tax Exemptions By State

Tangible personal property returns must be filed annually with the county tax.

Georgia personal property tax exemptions. Individuals 65 years or older may claim an exemption from all state ad valorem taxes on their primary, legal residence and up to. The home of each resident of georgia that is actually occupied and used as the primary residence by the owner may be granted a $2,000 exemption from state, county and school taxes except for school taxes levied by municipalities and except to pay interest on and to retire bonded indebtedness. Transaction structure an ad valorem property tax abatement can be structured in one of two ways:

Personal exemptionsgeorgia law provides for the following personal exemptions: Filing for homestead exemptions (or the tax assessor in some counties) receiving property tax returns (or the tax assessors in some counties) registration of your motor vehicle; There are several sales and use tax exemptions specific to the manufacturing industry, for those entities that qualify as a “manufacturer”.

Inventory of finished goods manufactured or produced in georgia held by the manufacturer or producer for a period not to exceed 12 months All real property and all personal property are taxable unless the property has been exempted by law. 100% disabled persons of any age can apply for this exemption.

Horticultural, or zoological objects or artifacts and other similar tangible personal property to or for the use by any museum or organization for display or exhibition in a museum in georgia when the museum is open to the public, is tax exempt under section 501(c)(3) of the internal revenue code. $4,000 off county bond taxes. Georgia imposes a tax, albeit subject to certain exemptions, on the retail purchase, retail sale, storage, use, or consumption of tangible personal property, certain enumerated services, and utilities.

All tangible personal property of the taxpayer, except motor vehicles, trailers and mobile homes, shall be exempt from ad valorem taxation if the actual fair market value of the total amount of taxable tangible personal property as determined by the board of tax assessors does not exceed $7,500. (1) (a) except as provided in. Applications filed after that time can receive a.

Property tax proposed and adopted rules. For returning real property and improvements. Georgia’s companies pay no state property tax on inventory or any other real or personal property.

If you're 62 years old or older and living within a school district, and your annual family income is $10,000 or less, then up to $10,000 of your georgia home's value may be exempt from the school tax. Residents over 65 with a household. Domestic animals in an amount not to exceed $300 in actual value.

Application process is through letter application. Authorities in georgia exempt property owned by the authority from ad valorem property taxes,2 all or a portion of the company’s interest in the property will be exempt from taxation,3 as more fully described below. Return of tangible personal property in county where business conducted;

Items of personal property used in the home if not held for sale, rental, or other commercial use. (2) acquisition of the property is reasonable and proporionate. All tools and implements of trade of manual laborers in an amount not to exceed $2,500 in actual value.

Inventory must be reported on the return, but more than 90% of georgia counties have adopted some level of exemption for inventory via the freeport exemption (see below for details). (1) the property is committed to and held in good faith for an exempt use; (a) any person who conducts a business enterprise upon real property, which is not taxable in the county in which the person resides or in which the person's office is located, shall return for taxation the tangible personal property of.

Property tax returns and payment. Georgia exempts a property owner from paying property tax on: There are several homestead exemptions offered by the state of georgia that apply specifically to senior citizens:

Collecting recording intangible tax (in most counties the clerk of superior court collects this tax) Inventory of goods in the process of being manufactured or produced including raw materials and partly finished goods; Voters in the county may elect to exempt commercial and industrial inventory.

$4,000 off school bond taxes. For returning personal property of a business: Senior citizen exemptions from georgia property tax if you are 65 years old or older, and your net income the previous year wa s $10,000 or less, you qualify for a $4,000 property tax exemption.

Application for freeport exemption should be made with the board of tax assessors within the same time period that returns are due in the county. This form is to filed with your county board of tax assessors within 45 days of the date of the notice.

2

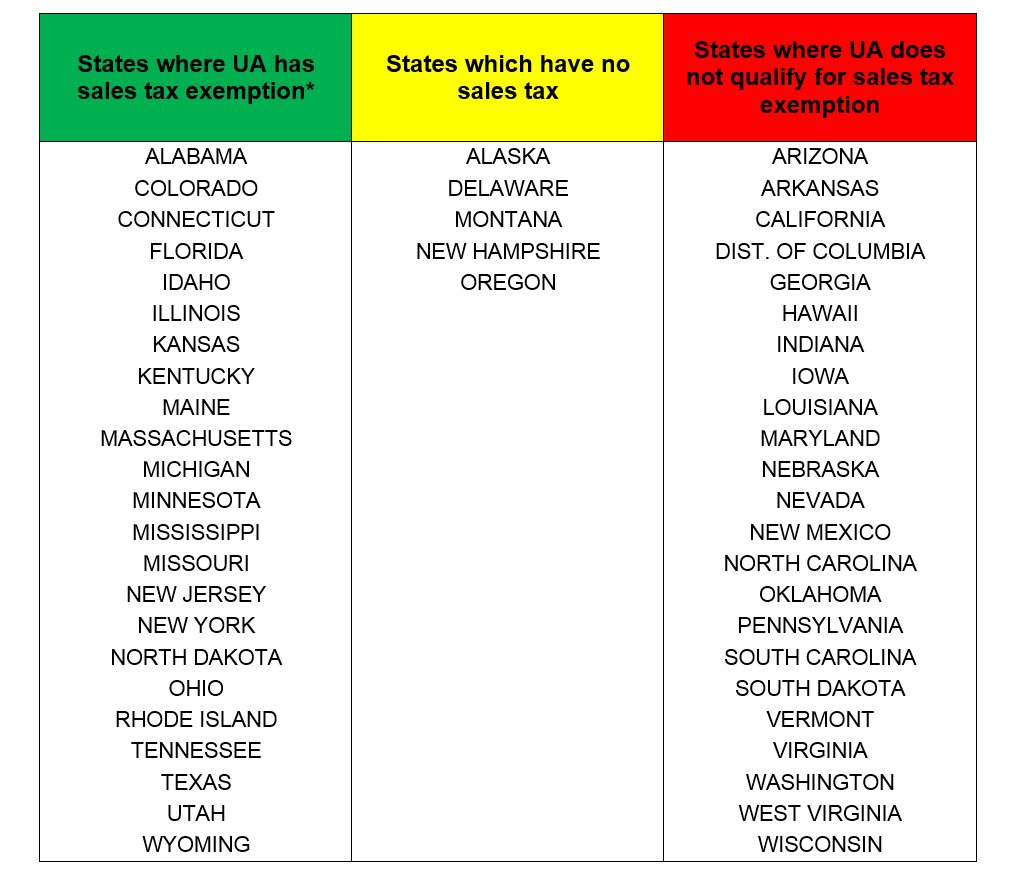

Other States Tax Exemption Tax Office The University Of Alabama

Property Tax Dekalb Tax Commissioner

All The Nassau County Property Tax Exemptions You Should Know About

What Is A Sales Tax Exemption Certificate And How Do I Get One

How To Get A Sales Tax Exemption Certificate In Missouri - Startingyourbusinesscom

Sales Tax Exemption For Building Materials Used In State Construction Projects

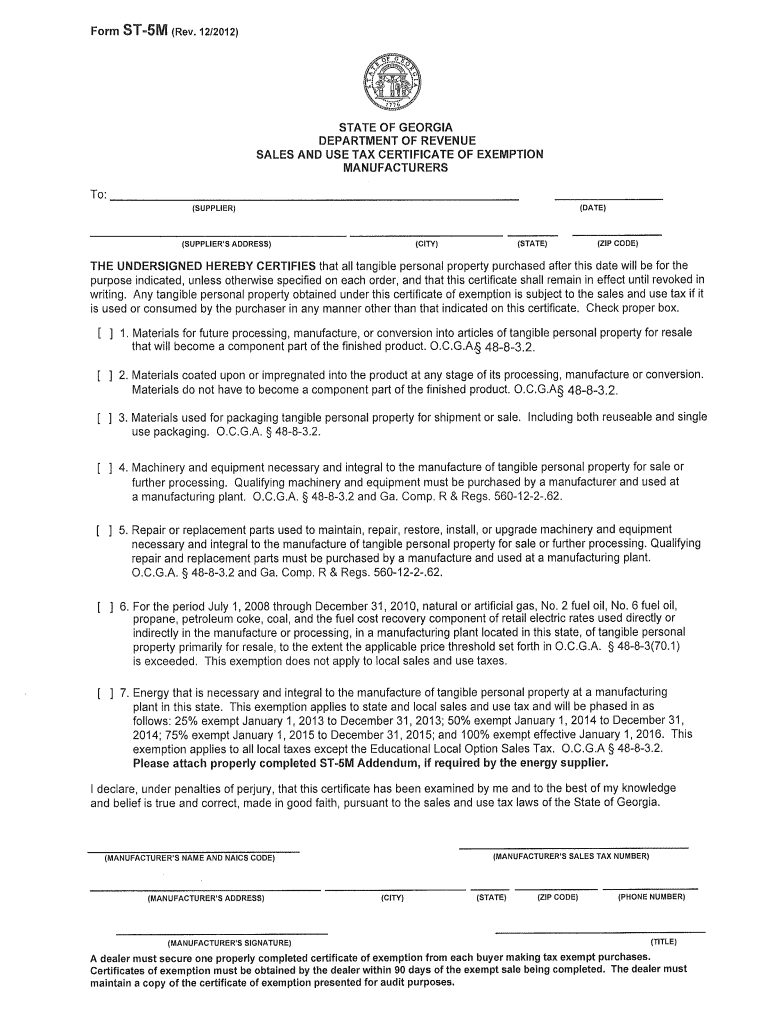

Ga Sales Tax Exemption Form St 5m - Tax Walls

Slc Research - Hospital Property Tax Exemptions In Slc States

2

How To Get A Sales Tax Exemption Certificate In Colorado - Startingyourbusinesscom

Disabled Veterans Property Tax Exemptions By State

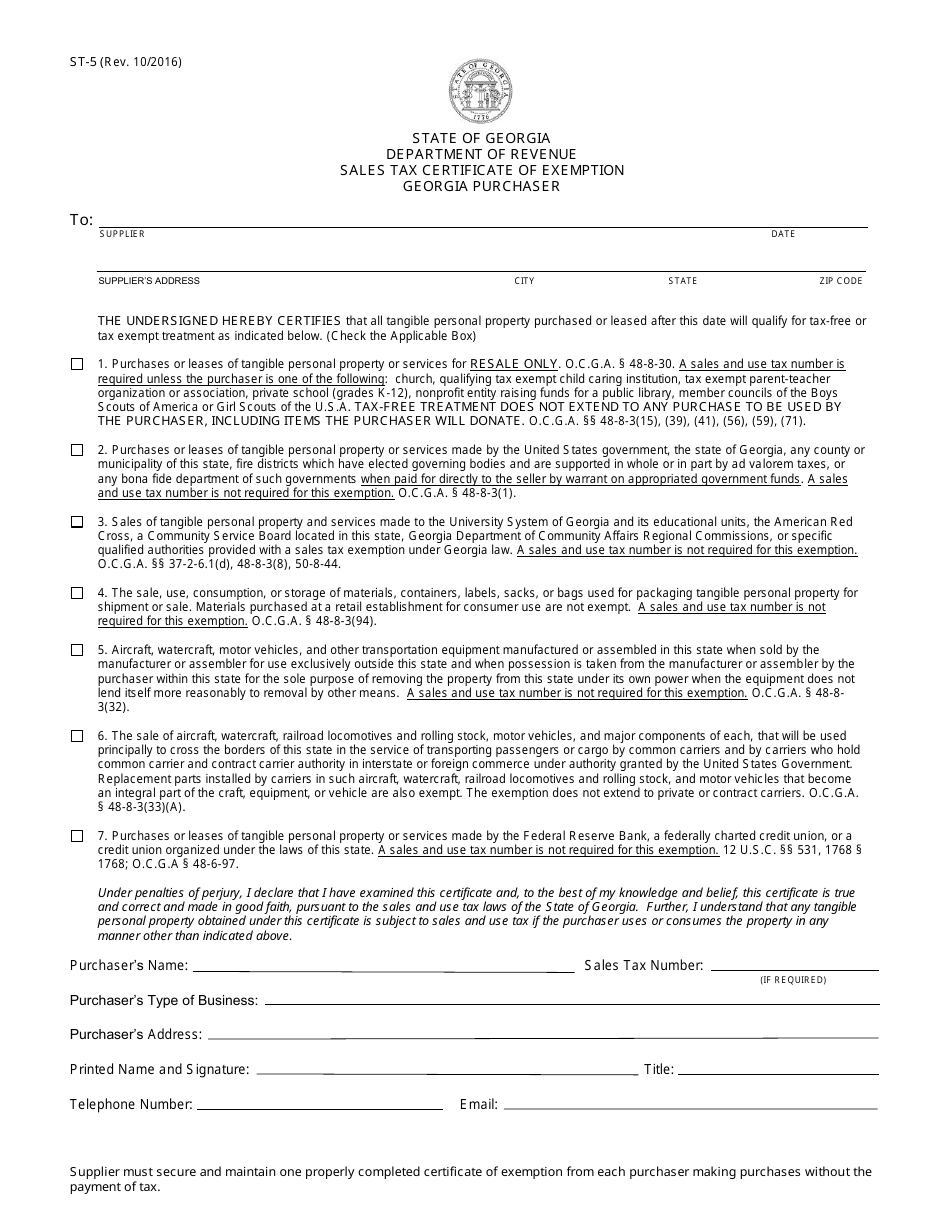

Form St-5 Download Fillable Pdf Or Fill Online Sales Tax Certificate Of Exemption Georgia Purchaser Georgia United States Templateroller

Exemptions

How To Get A Sales Tax Exemption Certificate In Wisconsin - Startingyourbusinesscom

Property Tax Homestead Exemptions Itep

2

How To Get A Sales Tax Exemption Certificate In Arkansas - Startingyourbusinesscom

Exemptions