Estate Income Tax Return Due Date 2021

If the due date falls on a weekend or legal holiday, the return is due the next business day. Extended to (as per circular no.

Income Tax Return Deadline Extension Important Things You Need To Know Before Itr Filing Personal Finance News Zee News

For most taxpayers, the main income tax return deadline for 2020 tax returns is april 15, 2021 — aka irs tax day 2021.

Estate income tax return due date 2021. Please note that maryland estate tax payments are due to the comptroller of maryland on or before the nine (9) month due date of the estate tax return, regardless of whether an extension has been granted. Exempt organization returns were due may 17, 2021, for organizations with a tax year ending on december 31. 9/2021 dated 20.05.2021) further extended (as per circular no.

The due date of filing a report of international transactions or specified. For individual taxpayer the last date is december 31. 31 mar 2021 international tax apply for crs registration.

The decedent and their estate are separate taxable entities. Please note that the irs notice cp 575 bthat assigns an employer id number (tax id number) to the estate will probably say that the form 1041 is due on april 15. Pay the tax you owe:

The returns will generally be processed at that time as a service to the estate. If the estate or trust is the client of an agent, it may have until 31 march 2022 to complete the return. If you deposited the tax for the quarter in full and on time, you have until november 10 to file the return.

On march 17, 2021, the irs officially extended the federal income tax filing deadline from april 15 to may 17. If you are required to make estimated tax payments, your payment for the. Important 2021 tax due dates for individuals.

Have a tax agent 8 income tax return • 7 july 2021 2021 income tax return due for people and organisations who do not have a tax agent or extension of time • 31 march 2022 2021 income tax return due for clients of tax agents (with a valid extension of time 9 quarterly fbt return and payment due 10 annual fbt return and payment due 11 income year fbt return and payment •. Nonresident alien returns were due april 15, 2021. You can file any time from now until april 15.

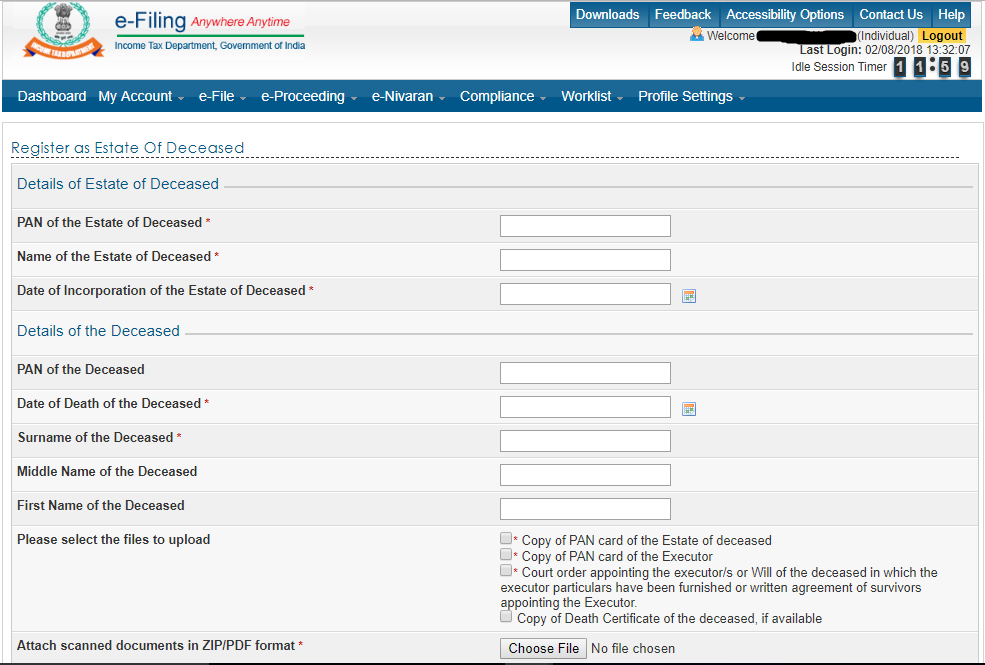

To register the estate you’ll need: 13 rows only about one in twelve estate income tax returns are due on april 15! If a person dies in 2021, the legal representative may choose to file the final return at any time after the date of death.

In these cases, the returns will generally be processed using tax legislation applicable to the 2020 tax year. Where to file a fiduciary return Income tax return for estates and trusts, is required if the estate generates more than $600 in annual gross income.

Fiscal year returns must be filed on or before the 15th day of the fifth month after the close of the fiscal period. Before filing form 1041, you will. Trust, estate, and gift tax returns were due april 15, 2021.

Contact us if you're not sure of the filing date. For example, if you’re sending a return for the 2020 to 2021 tax year (6 april 2020 to 5 april 2021) then you must register by 5 october 2021. Return due date if the estate or trust has a 31 march balance date, you have until 7 july 2021 to send in the return, unless you have been granted an extension of time.

That means taxpayers who owe money don’t need to file a tax return until this date, and if they owe money they don’t need to make payments until then. Due date of the fiduciary return a 2020 calendar year return is due on may 15, 2021.

I-t Dept Launches Jhatpat Processing For Filing Income Tax Returns Check Details - Businesstoday

Did You File Your Income Tax Return In 2021 Income Tax Return Income Tax Filing Taxes

Pin On Tax Tips

Peer-operator Advisory Income Tax Returnfiling Grab Ph

Odisha Daily Wage Labourer Gets I-t Notice For Rs 147 Cr Transaction Income Tax Filing Taxes Income Tax Return

Lodging Your Tax Return Blacktown In 2021 Tax Return Tax Lodges

Pin By The Taxtalk On Income Tax In 2021 Mca Application Android Acting

Mons77 I Will Review Self Prepared Uk Self Assessment Tax Return Or Apply For Utr Number For 55 On Fiverrcom In 2021 Self Assessment Tax Return Assessment

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at9.17.55AM-43bd78fa82bb4fa397892e3e69047cf2.png)

Form 1040 Us Individual Tax Return Definition

Between Due Dates For Extension Requests Ira Or Hsa Contributions And Other Deadlines Theres More To Do By M In 2021 Tax Deadline Estimated Tax Payments Tax Return

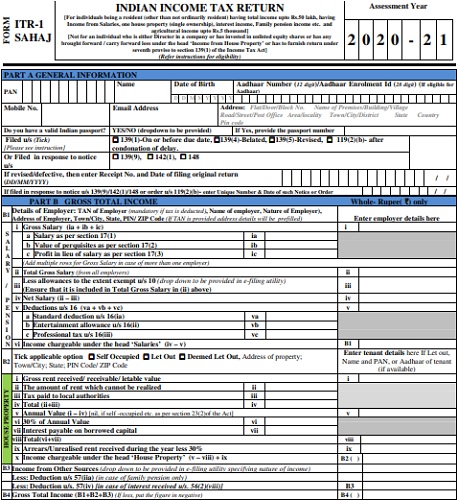

Download Income Tax Return Forms Ay 2020-21 - Itr-1 Sahaj Itr-4 Sugam - Basunivesh

.png?sfvrsn=10a6f687_3)

Iras Tax Season 2021 - All You Need To Know

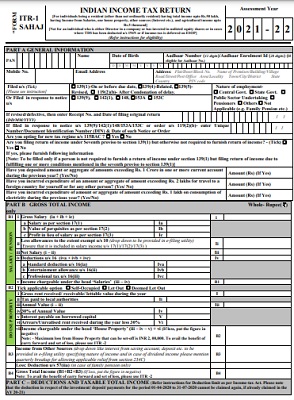

Income Tax Return Forms Ay 2021-22 Fy 2020-21 - Which Forms To Use - Basunivesh

2021 E-calendar Of Income Tax Return Filing Due Dates For Taxpayers In 2021 Tax Saving Investment Income Tax Return Income Tax

File Belated Revised Return For Ay 2020-21 Till 31st May 2021

How To File Income Tax Return For The Deceased By Legal Heir

Income Tax Return Forms Ay 2021-22 Fy 2020-21 - Which Forms To Use - Basunivesh

Fillable Form 1000 2017 In 2021 Fillable Forms Form The Covenant

Havent Filed Income Tax Returns Yet Heres What Will Happen If You Miss Deadline - Businesstoday