Marin County Property Tax Rate

County of marin redevelopment successor agency; Penalties apply if the installments are not paid by december 10 or april 10, respectively.

Editorial Confusing New Law Puts Generational Family Wealth At Stake Marin Independent Journal

The median property tax paid by homeowners in the bay area’s contra costa county is $4,941 per year.

Marin county property tax rate. The indebtedness tax rates of permanent road divisions apply to land only (no. Marin county collects the highest property tax in california, levying an average of $5,500.00 (0.63% of median home value) yearly in property taxes, while modoc county has the lowest property tax in the state, collecting an average tax of $953.00 (0.6% of. The marin county tax assessor is the local official who is responsible for assessing the taxable value of all properties within marin county, and may establish the amount of tax due on that property based on the fair market value appraisal.

Property 60 works for you if you sell your home and buy another home in marin or in one of these counties: Marin countywide successor agency oversight board; Your property taxes would remain at $3,500 instead of the new rate of about $12,500 per year (for a $1m house).

$5,500.00 3 hours ago the median property tax (also known as real estate tax) in marin county is $5,500.00 per year, based on a median home value of $868,000.00 and a median effective property tax rate of 0.63% of property value. Marin county, california property tax rates. The indebtedness tax rates of the north marin and stinson beach county water districts apply to land, improvements, and personal property (no exemptions, except homeowners).

The median property tax (also known as real estate tax) in marin county is $5,500.00 per year, based on a median home value of $868,000.00 and a median effective property tax rate of 0.63% of property value. At that rate, the total property tax on a home worth $200,000 would be $1,620. Marin county collects very high property taxes, and is among the top 25% of counties in the united.

Pay by mail postmarked by friday, april 10, 2020. See marin county, ca tax rates, tax exemptions for any property, the tax assessment history for the past years, and more. On friday, april 10, 2020.

Property tax in marin county. The county of marin department of finance makes every effort to share all pertinent parcel tax exemption information with the public. Where your property tax dollars go;

Marin county has one of the higher property tax rates in the state, at around 1.108%. This table shows the total sales tax rates for all cities and towns in marin county. The voters approved this parcel tax in march 2020, by approximately 71%, for a period of ten years starting with the 2020/21 fiscal year.

The marin wildfire prevention authority measure c is a special tax charged to all parcels of real property located in marin county within the defined boundary of the “member taxing entities.”. The total sales tax rate in any given location can be broken down into state, county, city, and special district rates. That is nearly double the national median property tax payment.

Marin county has one of the highest median property taxes in the united states, and is ranked 26th of the 3143 counties in order of median property taxes. Marin county assessor's office services. Real property information about all types of taxable residential property, from real estate to boats and aircraft.

Quickly identify tax rates in your area and see how much your neighbors are paying in property taxes. Marin county collects, on average, 0.63% of a property's assessed fair market value as property tax. Transfer tax can be assessed as a percentage of the property’s final sale price or simply a flat fee.

Secured property tax bills are mailed only once in october. California has a 6% sales tax and marin county collects an additional 0.25%, so the minimum sales tax rate in marin county is 6.25% (not including any city or special district taxes). To calculate the amount of transfer tax you owe, simply use the following formula:

The tax division includes the property tax and tax collector sectors within the. 36 out of 58 counties have lower property tax rates. Marin county has one of the higher property tax rates in the state, at around 1.108%.

36 out of 58 counties have lower property tax rates. Pay online or by phone by 11:59 p.m. The county’s average effective property tax rate is 0.81%.

Box 4220, san rafael ca 94913. County of marin property tax rate book reports. In order to determine the tax bill, your local tax assessor’s office takes into account the property’s assessed value, the current assessment rate, as well as any tax exemptions or abatements for that property.

It's also home to the state capital of california. The basic and voter approved portions of the tax are levied against the net assessed valuation of your property. Secured property taxes are payable in two (2) installments which are due november 1 and february 1.

20 counties have higher tax rates. The median property tax on a $868,000.00 house is $5,468.40 in marin county. 20 counties have higher tax rates.

Property tax in marin county. Send the correct installment payment stub (1st or 2nd) when paying your bill. City of san rafael redevelopment successor agency;

Note that 1.108% is an effective tax rate estimate. Note that 1.108% is an effective tax rate estimate. The median property tax on a $868,000.00 house is $9,114.00 in the united states.

The median property tax on a $868,000.00 house is $6,423.20 in california.

Home Affordability Declines For Average Workers In Q2 2021 Attom

Sonoma County Property Owners Rush To Transfer Inheritance Ahead Of New Prop19 Rules Higher Taxes

Sonoma County Property Owners Rush To Transfer Inheritance Ahead Of New Prop19 Rules Higher Taxes

Santa-barbara-county Property Tax Records - Santa-barbara-county Property Taxes Ca

Restrictive Covenant Project - County Of Marin

Orange-county Property Tax Records - Orange-county Property Taxes Ca

The Property Tax Inheritance Exclusion

Six Ways To Minimize Your Capital Gains Taxes When Selling Your Home - Marin County Real Estate Capital Gains Tax Capital Gain Financial Literacy

Property Tax Assessments - Mello-roos Explained - Cordon Real Estate

2

Marin County Allocates 1m To Cover New Prop 19 Duties

Santa-barbara-county Property Tax Records - Santa-barbara-county Property Taxes Ca

Marin County California Fha Va And Usda Loan Information

Santa-barbara-county Property Tax Records - Santa-barbara-county Property Taxes Ca

Marin To Ease Covid Mask Rules Next Week

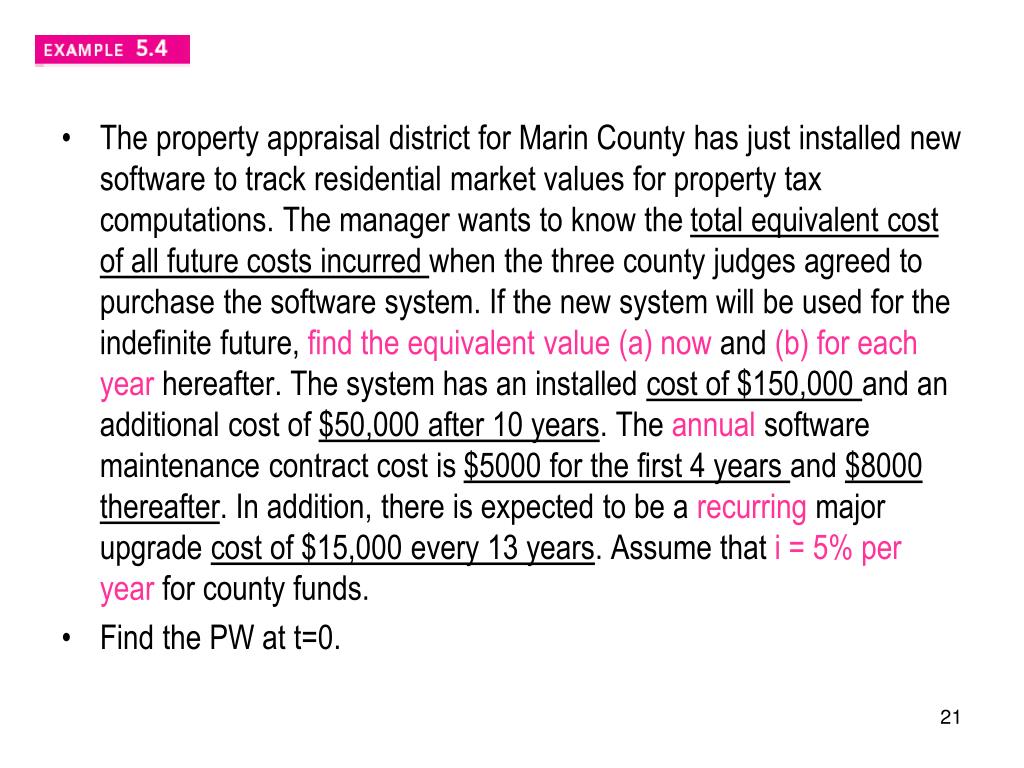

Ppt - In This Chapter Powerpoint Presentation Free Download - Id5170630

2

Santa-barbara-county Property Tax Records - Santa-barbara-county Property Taxes Ca

Sonoma County Property Owners Rush To Transfer Inheritance Ahead Of New Prop19 Rules Higher Taxes