Does Indiana Have Estate Or Inheritance Tax

Indiana's inheritance tax is imposed on certain people who inherit money from someone who was an indiana resident or owned property (real estate or other tangible property) in the state. Below we detail how the estate of indiana will handle your estate.

Form Ih-5 State Form 48834 Download Fillable Pdf Or Fill Online Claim For Refund Of Inheritance And Estate Taxes Indiana Templateroller

But even though indiana may not have an estate tax, you could have an issue at the federal level.

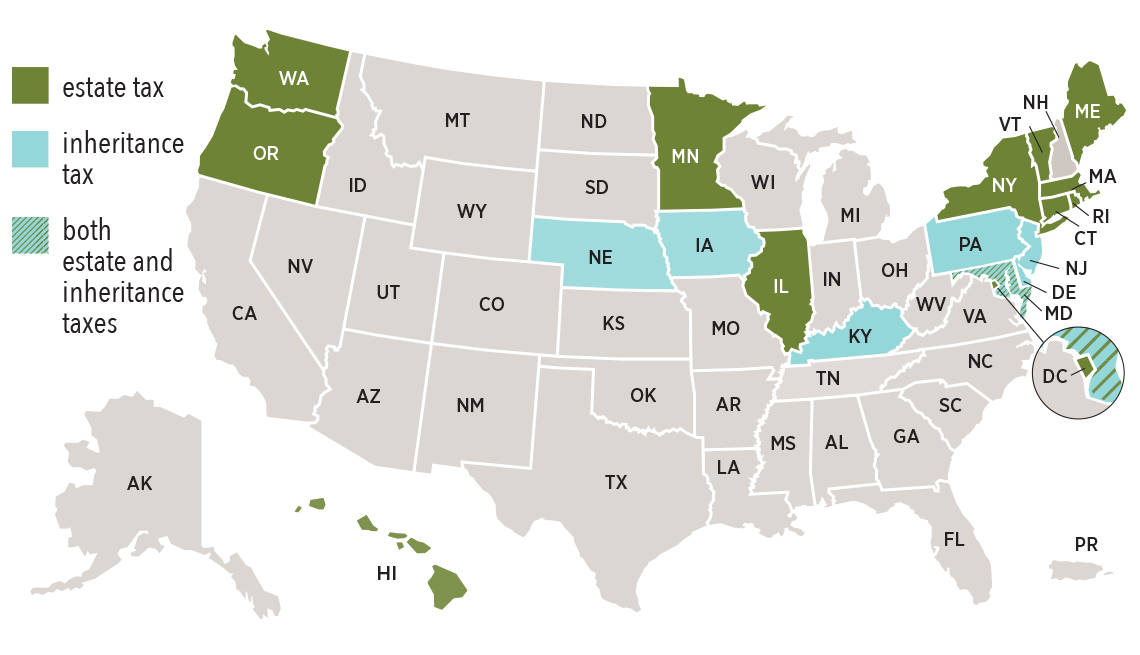

Does indiana have estate or inheritance tax. On the federal level, there is no inheritance tax. However, be sure you remember to file the following: Twelve states and the district of columbia impose estate taxes and six impose inheritance taxes.

The top estate tax rate is 16 percent (exemption threshold: Do you have to pay taxes on inheritance in indiana? While federal estate tax is assessed on a decedent’s total combined asset value, indiana inheritance tax is a transfer tax assessed on each separate transfer.

You do not need to pay inheritance tax if you received items from an indiana resident who died after december 31, 2012. Indiana is one of 38 states in the united states that does not have an estate tax. Inheritance tax applies to assets after they are passed on to a person’s heirs.

Ad an inheritance tax expert will answer you now! Although some indiana residents will have to pay federal estate taxes, indiana does not have its own inheritance or estate taxes. No estate tax or inheritance tax.

Below we detail how the estate of indiana will handle your estate if there’s a valid will as well as who is entitled to your property if you have an invalid will or none at all. There is also a tax called the inheritance tax. Indiana levies no state taxes on the inheritance or estates of residents and nonresidents who own property there.

To the extent that there is any good news about a. Indiana repealed the inheritance tax in 2013. For individuals dying before january 1, 2013.

That tax has now been completely eliminated and in fact, the inheritance tax division of the indiana department of revenue remains open only to enforce collection of tax owed from prior years. No estate tax or inheritance tax. Although some indiana residents will have to pay federal estate taxes, indiana does not have its own inheritance or estate taxes.

Oklahoma and kansas have also repealed their estate taxes. Indiana inheritance tax was eliminated as of january 1, 2013. Hawaii and washington state have the highest estate tax top rates in the nation at 20 percent.

Tennessee followed suit in 2016, and new jersey and delaware eliminated their estate taxes as of 2018. How much is inheritance tax. In fact, the indiana inheritance tax was retroactively repealed as of january 1st of 2013.

Inheritance tax of up to 15 percent People often use the terms “estate tax” and “inheritance tax” interchangeably when, in fact, they are distinct types of taxation. Indiana inheritance and gift tax.

Whereas the estate of the deceased is liable for the estate tax, beneficiaries pay the inheritance tax. Here in indiana we did have an inheritance tax, and this is why some people assume that we are one of these states. Indiana’s inheritance tax still applies.

What is an inheritance tax and does indiana impose one? There's a federal estate tax, although it only applies to estates worth over $11.7 million. Estate tax of 10 percent to 16 percent on estates above $1 million;

There is no inheritance tax in indiana either. Indiana inheritance tax is imposed on the transfer of property from an indiana decedent to a beneficiary. Inheritance tax of up to 18 percent;

Of course, indiana cannot change federal law and there does remain in existence a federal estate tax. As of 2020, 12 states plus the district of columbia impose an estate tax; An inheritance tax is a state tax that you’re required to pay if you receive items like property or money from a deceased person.

No estate tax or inheritance tax Delaware repealed its estate tax at the beginning of 2018. 3 hours ago does indiana have an inheritance tax or estate tax?

The top inheritance tax rate is 15 percent (no exemption threshold) kansas: Maryland is the only state to impose both. Several states have their own estate taxes with lower thresholds, while five have inheritance taxes.

Estate tax of 3.06 percent to 16 percent for estates above $5.9 million; Indiana, ohio, and north carolina had estate taxes, but they were repealed in 2013. Federal estate tax can be complicated and requires a cpa or tax attorney to navigate the issue.

Most states have been moving away from estate or inheritance taxes or have raised their exemption levels, as estate taxes without the federal exemption hurt a state’s competitiveness. However, the state of indiana is not one of them. Ad an inheritance tax expert will answer you now!

However, other states’ inheritance laws may apply to you if. New jersey finished phasing out its estate tax at the same time, and now only imposes an inheritance tax. In general, estates or beneficiaries of.

The tax rate is based on the relationship of the inheritor to the deceased person. As a result, indiana residents will not owe any indiana state tax after this date with respect to transfers of property and assets at death. This is great news if you live in the hoosier state.

Twelve states and the district of columbia collect an estate tax at the state level as of 2019. Eight states and the district of columbia are next with a top rate of 16 percent. Inheritance tax of up to 16 percent;

State Estate And Inheritance Taxes In 2014 Tax Foundation

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Does Your State Have An Estate Or Inheritance Tax

Alternative To Inheritance Tax Cuts Seventh State

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Does Indiana Have An Inheritance Tax Indianapolis Estate Planning Attorneys

In States The Estate Tax Nears Extinction Huffpost Latest News

Does Your State Have An Estate Or Inheritance Tax Tax Foundation

State-by-state Estate And Inheritance Tax Rates Everplans

Ingov

Indiana Does Not Have An Inheritance Tax Anymore Indianapolis Estate Planning Attorneys

Welcome To The State Death Tax Manager Leimberg Leclair Lackner Inc

17 States With Estate Taxes Or Inheritance Taxes

Does Your State Have An Estate Or Inheritance Tax Tax Foundation

/will-you-have-to-pay-taxes-on-your-inheritance-6fc653662f34493991da5e21433cf537.png)

Three Taxes Can Affect Your Inheritance

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

How Do State Estate And Inheritance Taxes Work Tax Policy Center

State Estate And Inheritance Taxes