Are Funeral Expenses Tax Deductible In Ireland

This relief applies to resident individuals who are subject to unlimited tax liability who incur unavoidable expenses (e.g. A tax incentive aimed at boosting consumer spending in the hospitality sector failed to take off last year, as new figures show the scheme ran aground.

Are Funeral Expenses Deductible The Official Blog Of Taxslayer

Postby exor » tue may 11, 2010 4:12 pm.

Are funeral expenses tax deductible in ireland. In reality, the irs only allows deductions for medical expenses paid to prevent or treat an illness. While the irs allows deductions for medical expenses, funeral costs are not included. In other words, they must satisfy all these conditions:

Actually, publication 463 doesn't mention gifts having to be to a person who is alive. Any payment by you of his estate costs would be deductible from any inheritance and. 30% of the value of agricultural land and buildings.

Funeral costs, medical expenses for special treatments not reimbursed by. Funeral costs as qualifying expenses. You can deduct funeral expenses from the value of the estate, plus a reasonable amount for mourning expenses.

Funeral expenses are included in box 81 of the iht400. Individuals who incur extraordinary expenses can obtain some tax relief. Expenses can include a reasonable amount to cover the cost of:

Although most of us do it, commuting is not tax deductible…but rehab is. Costs associated with marketing and selling the property; You can request a form 12 or a form 12s by calling revenue at (01) 738 3675 and giving your name, your full postal address, your personal public service (pps) number and the number of forms.

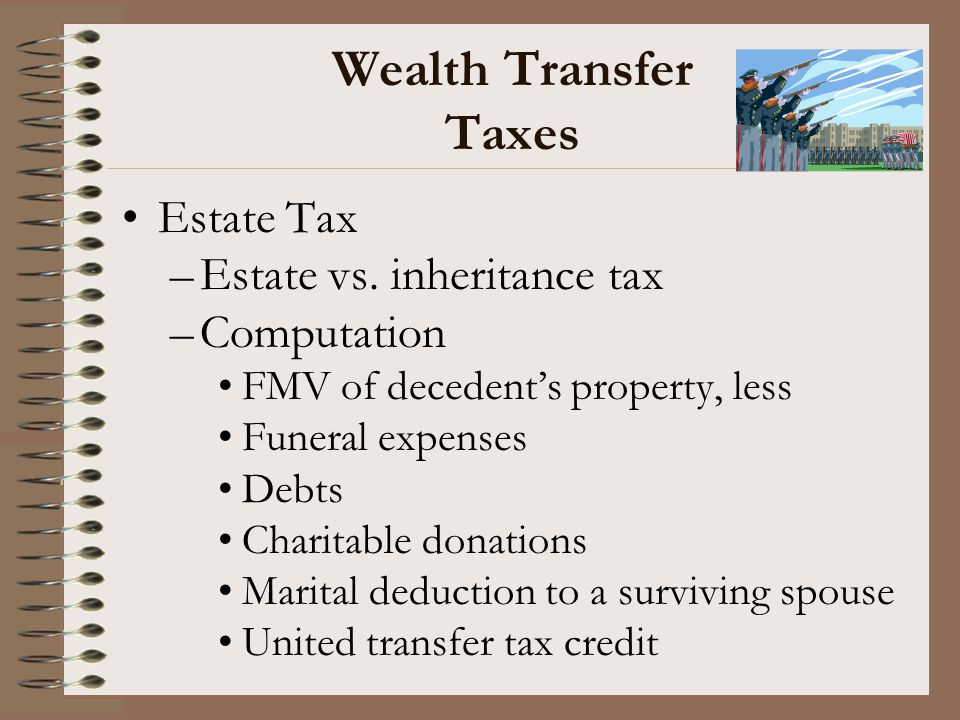

In arriving at the taxable value of the estate, the following deductions from the gross estate are allowable: Each case is decided on its merits by the department of social protection's representative (formerly known as the community welfare officer) at your local office. Has anyone had any experience of success/failure in claiming the above or similar expenses against death iht.

An estate tax deduction is generally allowed for funeral expenses, including the cost of a burial lot and amounts that are. If you can combine a business trip with attending a funeral, you can write off some of your costs, such as air fare overseas. They are in the best position to advise you.

Taxpayers are asked to provide a breakdown of the. This doesn’t include funeral expenses. Even if you pay for your loved one’s funeral yourself, you cannot deduct these expenses.

In the event that there are beneficiaries who are not resident in ireland, irish resident Funeral costs you may be eligible for an exceptional needs payment to help you with the cost of a funeral if your income is low. * necessary expenses paid by the executor or administrator when.

The payment by you is not a tax deduction. There are no inheritance or estate taxes in australia. The gift can go to their estate.

The irs recognizes business travel as a legitimate tax deduction. Beneficiaries must pay their own inheritance tax. The deduction of reasonable funeral expenses is specifically allowed under ihta84/s172.

Individual taxpayers cannot deduct funeral expenses on their tax return. Except where there are not enough assets in the estate to pay all taxes, liabilities and cash legacies, in general, taxes due by the deceased come out of the residue. Check with your accountant on this.

While the irs allows deductions for medical expenses, funeral costs are not included. In this regard reasonable disbursement on foot of funeral meals and grave/headstone expenses will be allowed as a deduction for the purposes of both probate tax and inheritance tax. This would include any costs associated with administering the estate, such as:

The expenses are solely incurred in. When a person dies, the legal personal representative dealing with the deceased person's tax affairs have some important tax and superannuation issues to attend to. Tax relief on dining out expenses a flop.

Many people mistakenly believe that funeral expenses might count under medical expenses. While the irs allows deductions for medical expenses, funeral costs are not included. It also can go to the family of the employee.

It seems that these costs were incurred in the week leading up to the funeral. Qualified disaster relief payments in this case include amounts paid for an individual’s “reasonable and necessary personal, family, medical, living or funeral expenses incurred as a result. You can also claim medical expenses relief offline by completing a paper form 12 (pdf), or a form 12s (pdf) (a simplified version for routine tax returns) and returning it to your revenue office.

These wake costs total around £900. Qualified medical expenses must be used to prevent or treat a medical illness or condition. (income minus deductible expenses) generally, deductible business expenses are those 'wholly and exclusively incurred in the production of income'.

Debts of the deceased due at the date of death and funeral expenses. In addition to the health expenses listed above, certain other expenses are considered to constitute health expenses for the provision of health care for the purposes of tax relief. It almost seems unfair, when such oddities are considered an essential business expense!

Generally speaking, any expenses that are incurred by the personal representative as a result of them properly carrying out their duties should be covered by the estate. Individual taxpayers cannot deduct funeral expenses on their tax return. Are funeral expenses tax deductible in ireland?

Funeral Expenses Tax Deductible Ireland Best Reviews

Tax Deductions In Italy Financial Advice In Rome Italy

Acct 440 Welcome To Taxation Of Business Entities Dr Efrat - Ppt Download

Chapter 3 - Deductions From The Gross Estate Pdf Tax Deduction Estate Tax In The United States

Post Mortem Estate Planning Executors Elections - Advanced American Tax

How Pre-paid Funeral Plans Work Costs Expenses Pros Cons

Refunds Rebates And Shopping Around Here Is How To Save 25000 - Independentie

2021 Breakdown Of Average Funeral Costs

Funeral Expenses Tax Deductible Ireland Best Reviews

Are Funeral Expenses Tax Deductible Claims Write-offs Etc

What Is The Effect Of Death On State Benefits And Credits Low Incomes Tax Reform Group

Are Funeral And Cremation Expenses Tax Deductible National Cremation

Refunds Rebates And Shopping Around Here Is How To Save 25000 - Independentie

Are Funeral Expenses Tax Deductible Claims Write-offs Etc

Claiming Funeral Expenses As Tax Deductions

Funeral Expenses Tax Deductible Irs Best Reviews

Funeral Expenses Tax Deductible Ireland Best Reviews

/red-rose-on-gravestone-in-cemetery-173299137-5bdedb67c9e77c0051f5bc79.jpg)

How Much Can You Claim For Funeral Expense Deductions

Funeral Expenses Tax Deductible Irs Best Reviews