Georgia Ad Valorem Tax 2021

Topics covered include the state of georgia transfer tax. This tax is based on the value of the vehicle.

2021 Property Tax Bills Sent Out Cobb County Georgia

A bill to be entitled an act to amend article 1 of chapter 5 of title 48 of the official code of georgia annotated, relating to general provisions regarding ad valorem taxation of property, so as to change certain requirements relating to advertising and notice requirements pertaining to millage rate adoption;

Georgia ad valorem tax 2021. On october 22, 2021, the us treasury reported in its monthly treasury statement (and xlsx) for september that the federal deficit for fy 2021 ending september 30, 2021, was $2,772 billion. To provide for related matters; In 2017 our gas tax (at least in part is used to pay for roads) was $.3102.

To provide for related matters; To revise the time for payment of related ad valorem taxes; 7003), as amended, particularly by an act.

Aviation fuel, $3 per gallon;. Topics covered include property tax exemptions (e.g., basic homestead exemption) and property tax returns. 2021 ga hb352 (summary) ad valorem tax;

Since march 1, 2013 georgia has a new title ad valorem tax (tavt) that applies to all new car purchases and leases — and used car purchases. Taxes must be paid by the last day of your registration period (birthday) to avoid a 10% penalty. Vehicles, purchased on or after march 1, 2013 and titled in georgia, are subject to title ad valorem tax (tavt) and are exempt from sales and use tax and the annual ad valorem tax.

Motor vehicle dealers should collect the state and local title ad valorem tax fee (“tavt”) from customers purchasing vehicles on or after march 1, 2013, that will be titled in georgia. A bill to be entitled an act to amend chapter 5 of title 48 of the official code of georgia annotated, relating to ad valorem taxation of property, so as to grant counties the option of requiring that mobile homes procure and display decals; Signed by governor on may 3, 2021.

Car leasing in georgia has changed and is now a bit different than in most other states. Get the estimated tavt tax based on the value of the vehicle using: Property tax bills shall include the amounts of assessments levied for each of the three immediately preceding tax years;

The two changes that apply to most vehicle transactions are: Transaction taxes are taxes associated with buying and selling real estate and mortgaging or borrowing money against real estate. A bill to be entitled an act to amend an act providing a homestead exemption from city of atlanta independent school district ad valorem taxes for educational purposes in the amount of $15,000.00 of the assessed value of the homestead for residents of that school district, approved may 4, 1992 (ga.

The tax must be paid at the time of sale by georgia residents or within six months of. Here are the numbers, including total receipts, total outlays, and deficit compared with the numbers projected in the fy 2022 federal budget published in february 2021: To revise certain requirements for certification of.

My car gets 30 miles to the gallon so i would have to drive 19,350 a year to have spent that much in gas tax. In the most recent legislative session, the georgia general assembly passed senate bill 65, which made several changes to the title ad valorem tax (tavt) code sections, which apply to vehicles purchased or sold on or after january 1, 2020. Expand an exemption for agricultural equipment and certain farm products

To limit the determination of fair market value to a weighted market and income approach to valuation; The tax is levied on the assessed value of the property which, by law, is established at 40% of the fair market. Independent school district ad valorem tax exemption;

A bill to be entitled an act to amend article 13 of chapter 5 of title 48 of the official code of georgia annotated, relating to ad valorem taxation of qualified timberland property, so as to add a definition; Currently, i average about 1/3 of that and the average driver under 14,000. Payment of the tavt provides an exemption from sales tax on the motor vehicle and the purchaser will also be exempt from the annual ad valorem tax, or.

Tax amounts vary according to the current fair market value of the vehicle and the tax district in which the owner resides. Ad valorem taxes are due each year on all vehicles whether they are operational or not, even if the tag or registration renewal is not being applied for. A bill to be entitled an act to amend chapter 5c of title 48 of the official code of georgia annotated, relating to alternative ad valorem tax on motor vehicles, so as to revise the definition of fair market value of the motor vehicle to exclude certain interest and financing charges for leased motor vehicles;

The ad valorem calculator can also estimate the tax due if you transfer your vehicle to georgia from another state. A bill to be entitled an act to amend chapter 5 of title 48 of the official code of georgia annotated, relating to ad valorem taxation of property, so as to grant counties the option of requiring that mobile homes procure and display decals; $5,000 of assessed value for residents;

To provide an effective date; The basis for ad valorem taxation is the fair market value of the property, which is established january 1st of each year. A bill to be entitled an act to amend article 13 of chapter 5 of title 48 of the official code of georgia annotated, relating to ad valorem taxation of qualified timberland property, so as to add a definition;

To revise certain requirements for certification of. To limit the determination of fair market value to a weighted market and income approach to valuation; Georgia motor vehicle assessment manual for title ad valorem tax.

Not in the case of the ga gas tax (at least not directly). Ad valorem taxes are georgia annual property taxes. 2021 motor vehicle assessment manual for tavt (13.56 mb) 2020 motor vehicle assessment manual for tavt (13.63 mb) 2019 motor vehicle assessment manual for tavt (10.8 mb) 2018 motor vehicle assessment manual for tavt (7.04 mb)

2021 ga hb498 (summary) ad valorem tax; Georgia announces average local tax on motor fuel sales. To change certain provisions relating to acceptance of a tax.

The tavt rate will be lowered to 6.6% of the fair. To provide for related matters; Ad valorem tax, more commonly known as property tax, is a large source of revenue for governments in georgia.

The following average retail sales prices will be in effect july 1, 2021, through dec. Of revenue has announced the average retail sales prices used to calculate the prepaid local tax on motor fuel sales. To revise the time for payment of related ad valorem taxes;

To provide an effective date; Property tax bills shall include the amounts of assessments levied for each of the three immediately preceding tax years;

Tax Rates Gordon County Government

What Are New Georgia Lease Laws Ga Car Dealership Near Me

Property Taxes Milton Ga

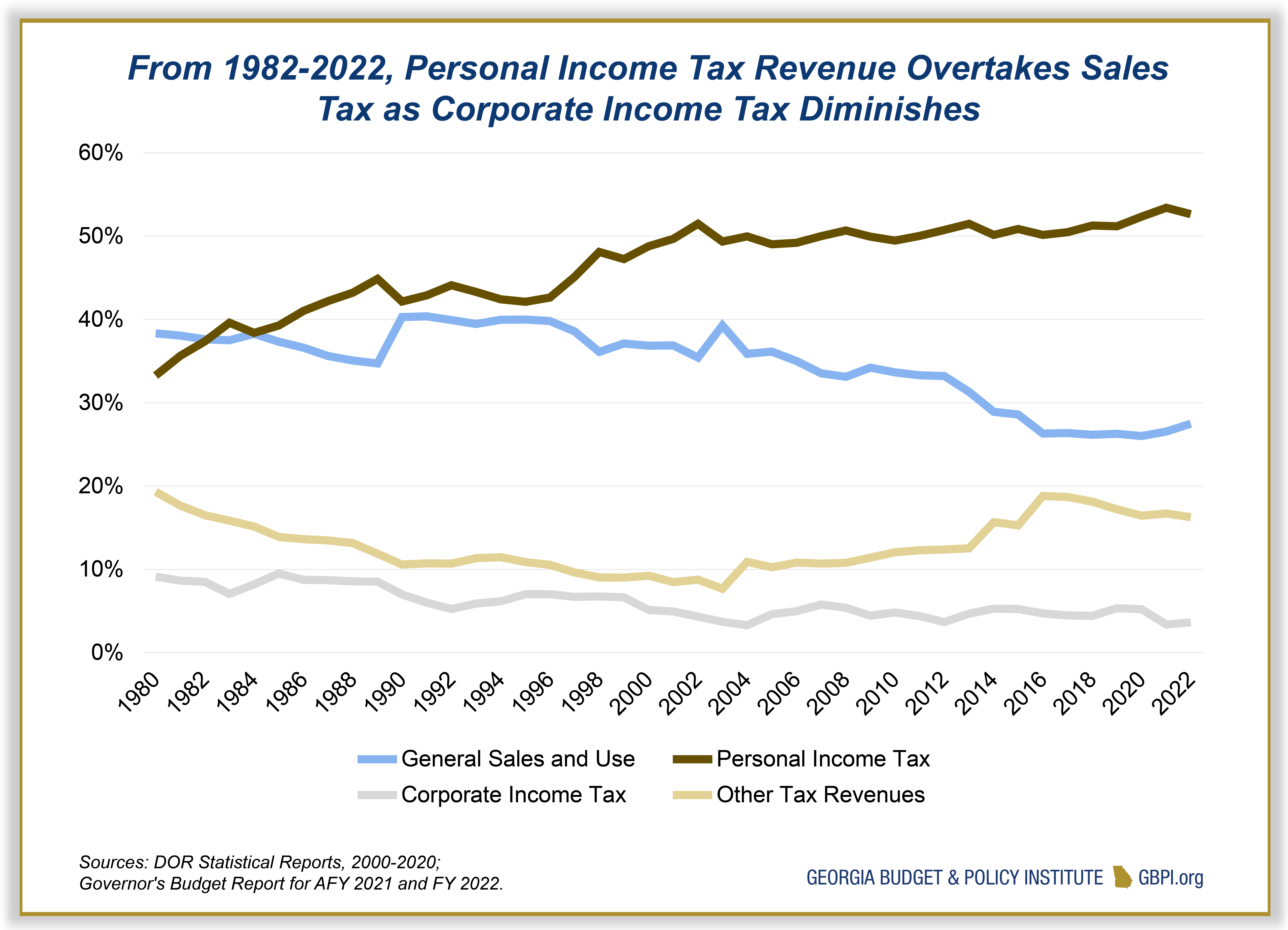

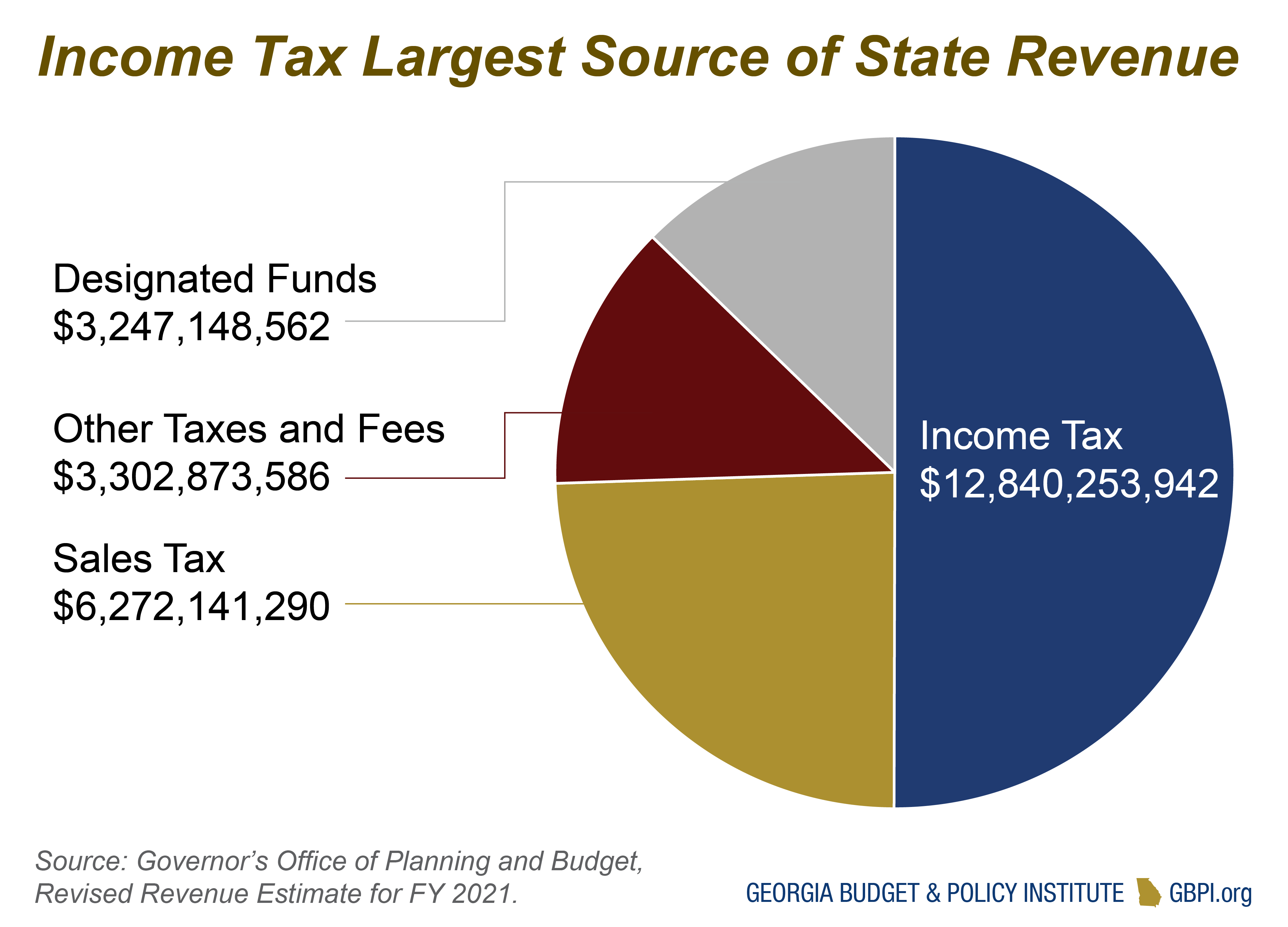

Reimagining Revenue How Georgias Tax Code Contributes To Racial And Economic Inequality - Georgia Budget And Policy Institute

Georgia Used Car Sales Tax Fees

Minimum Auto Insurance Coverage In Colorado In 2021

2019 State Solar Power Rankings - Solar Power Rocks Solar Power Incentive Programs Solar

Reimagining Revenue How Georgias Tax Code Contributes To Racial And Economic Inequality - Georgia Budget And Policy Institute

Reimagining Revenue How Georgias Tax Code Contributes To Racial And Economic Inequality - Georgia Budget And Policy Institute

Chattahooch Hills Ga

7 Steps To Buying A Second Home - Remax Of Ga Remaxga Homebuyer Secondhome Vacationhome Buying First Home Vacation Home Home Buying

Are There Any States With No Property Tax In 2021 Free Investor Guide In 2021 Property Tax Retirement Strategies Retirement Advice

Property Taxes Laurens County Ga

Minimum Auto Insurance Coverage In Colorado In 2021

Reimagining Revenue How Georgias Tax Code Contributes To Racial And Economic Inequality - Georgia Budget And Policy Institute

Georgia Revenue Primer For State Fiscal Year 2021 - Georgia Budget And Policy Institute

Ad Valorem Tax - Overview And Guide Types Of Value-based Taxes

Reimagining Revenue How Georgias Tax Code Contributes To Racial And Economic Inequality - Georgia Budget And Policy Institute

15 Purple Martin Ln Savannah Ga 31419 - Mls 8954814 - Coldwell Banker In 2021 Purple Martin House Styles Savannah Chat