Tax Benefits Of Retiring In Nevada

Additionally, social security income is not taxed, as well as withdrawals from retirement accounts. The state ranked 28th highest for property tax collections in 2020.

7 Pros And Cons Of Retiring In Nevada 202 - Aging Greatly

Nevada offers an abundance of tax advantages for relocating home and business owners alike, including:

Tax benefits of retiring in nevada. No tax on issuance of corporate shares. Nevada has no income tax. Benefits of living in henderson, nv.

However, prescription medications and consumable grocery items are exempt. You can’t just fly in every now and then for dinner and drinks or a business conference to be considered for residency even if you own property in nevada. Nevada sales tax is less than in california

Nevada has no state income tax or inheritance tax, making it the ideal state for someone who has a high income in retirement or a substantial 401(k) or ira that they will be forced to distribute at 70.5. At 8.3% total tax burden in nevada is 43rd highest in the u.s. Nevada offers one of the lowest overall tax burdens to its residents in the united states thanks to the revenues which come through because of the tourism industry.

Extremely high temperatures during the summer months. Nevada has no inheritance or estate tax; Pros and cons of retiring in nevada.

A corporation organized and domiciled in nevada can also significantly reduce its state tax burden by shifting its corporate level of activity to the state of nevada. Considering the national average is 100, retirement here is going to cost more than some other states. This is enough to get them a little over one extra year of income.

Cost of living according to sperling's best places, the cost of living index in nevada is 102. Low taxes & cost of living; This often means more money in your pocket throughout.

Individual who are “domiciled” in nevada and become nevada residents will generally escape state taxation of their income, except for income arising from sources within another state. People who live in nevada typically pay more for groceries, healthcare, and transportation than the average consumer. As a percent of value, property tax paid is.84%.

There are also other advantages to nevada’s tax laws being that nevada also has a very low corporate tax rate which makes it a good idea to pack up, move yourself to one of the many desirable. Social security and retirement exemptions. State sales tax is 6.85%, but localities can increase that to 8.1%.

Individuals who are considered domiciled in nevada generally escape taxation. Cons of living in henderson. Low taxes residents of nevada are not assessed a state income tax.

The states that don't tax pension plans extend those same benefits to retirees with 401(k) plans. You will usually pay less in taxes in nevada compared to other states. Higher than average cost of living.

No requirements of shareholders & directors to live in nevada. Even taxpayers who may continue to have a requirement to “source” one or more items of their income to a taxable state may still enjoy a significant reduction in their overall state tax burden. This includes income from both social security and retirement accounts.

Owning real estate in the state of nevada is key factor when considering such tax advantages. Nevada does not tax retirees’ accounts or pensions; Since nevada does not have a state income tax, any income you receive during retirement will not be taxed at the state level.

Additionally, the average effective property tax rate in nevada is just 0.53%. Your 401(k) withdrawals won't be taxed in alaska, florida, illinois, mississippi, nevada, new hampshire, pennsylvania, south dakota, tennessee, texas, washington, and. Stunning outdoor spaces, including parks, golf courses, and areas of natural beauty.

Nevada state taxes hold a massive advantage over tax rates in california for several reasons: Both arizona and nevada have a meager cost of living compared with national averages. The current state sales tax is 6.85 percent with an additional 1.25 percent assessed by counties;

By simulating a move to nevada from california, we find that bob and jane save over $156,000 in taxes throughout their retirement! Nevada does not have a state income tax; Close proximity to the las vegas strip.

Hotel Pools In Las Vegas In 2021 Las Vegas Hotel Pool Daylight Savings Time

Best States To Live In Retirement

Retire To Florida 10 Reasons To Do So

Retiring In Las Vegas Pros And Cons For Sin City Seniors

The Best States To Retire In The Us In 2022 Personal Capital

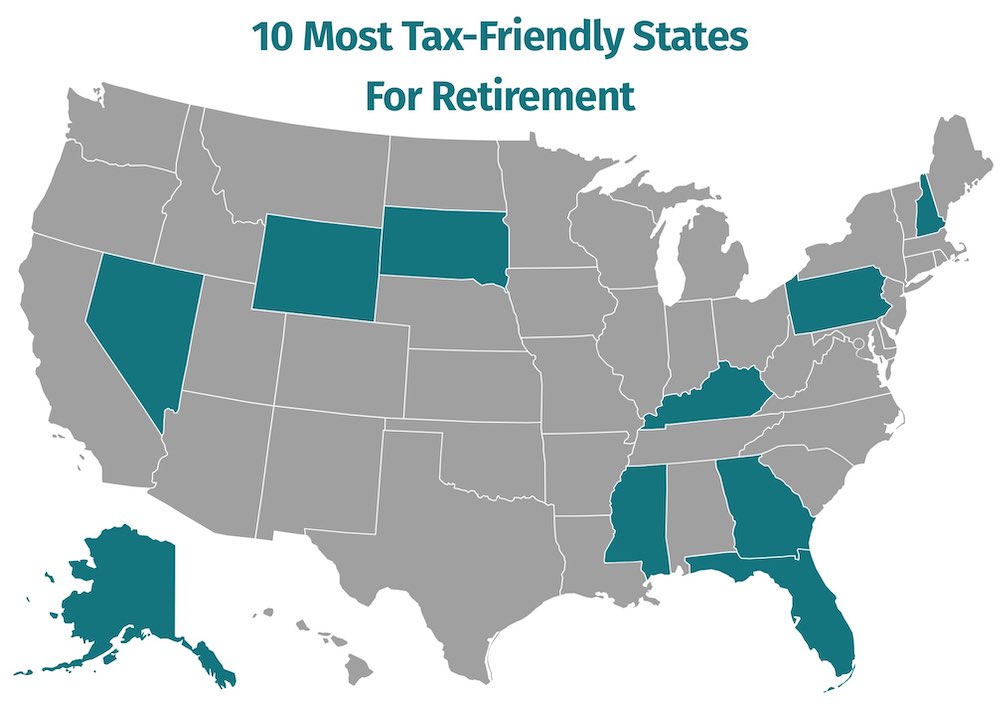

Top 10 Most Tax-friendly States For Retirement 2021

How To Escape The American Tax Man When You Retire Abroad Retire Abroad Abroad Retirement

Top 10 Best Places To Retire In Oregon Visit Oregon

The Best Place To Retire Isnt Florida Best Places To Retire Retirement Locations Retirement

Nevada Tax Advantages And Benefits - Retirebetternowcom

The Most Tax-friendly States For Retirees Vision Retirement

Arizona Vs Nevada Wheres Better To Retire

What State Offers The Most Tax Incentives To Retirees

Choosing A Retirement Destination Tax Considerations - Lvbw

37 States That Dont Tax Social Security Benefits The Motley Fool

Top 5 Reasons To Retire In Las Vegas Nevada

37 States That Dont Tax Social Security Benefits The Motley Fool

Want To Retire In Florida Heres What You Need To Know Vision Retirement

10 Most Tax-friendly States For Retirees Retirement Locations Retirement Advice Retirement Planning