Tax Incentives For Electric Cars Canada

October 1st saw the introduction of the new tax on electric vehicles in saskatchewan, the only such tax in canada. This incentive applies to purchases of both new and used evs.

When Electric Car Incentives Expire A Case Study In Canada

The short period of time for the incentive, she said, would be given for the market to form a base, after which the government could grant incentives to the assembly of electric vehicles.

Tax incentives for electric cars canada. Lawmakers to abandon a proposed electric vehicle purchase incentive — potentially worth up. Consult the canada revenue agency or a financial professional for more details and to learn if the electric vehicle provisions established for cca classes 54 and 55 could support your business. Enhanced capital cost allowances (ccas) enable a higher deduction in the year that an electric vehicle is put on the road (up to 100% of $55,000, prior to 2024).

We continue to oppose this move by the provincial government and encourage them to delay the tax until we have more electric vehicles on our roads. Secretary tatiana clouthier spoke out against a plan by us lawmakers to give tax incentives to electric cars made in that country. As the list of vehicles is constantly changing, please visit transport canada’s page for the most up to date information.

Under the bipartisan infrastructure & jobs act. Vehicle tax credits and rebates. Starting may 1 2019, the government of canada is offering purchase and lease incentives for eligible ev/phevs.

June 29, 2021 ottawa transport canada. Vehicles with 6 or fewer seats, and a starting price under $45,000, with models up to $55,000 (msrp) will be eligible. There are two levels of incentives:

Vehicles with 6 or fewer seats, and a starting price under $45,000, with models up to $55,000 (msrp) will be eligible. The used ev incentive program provides $1,000 toward the purchase of a used fully electric car. Canada has been pushing the biden administration and u.s.

The particulars are a little… well… particular: The government of mexico expressed “strong concern” to us congressmen about its proposal to offer new tax incentives to electric cars manufactured in that country after 2026, considering it “contrary” to what was agreed in the usmca trade agreement. For more information on the izev program,.

In 2019, the federal government launched an incentive program for eligible ev/phevs. Officials view tax incentives of up to $12,500 per vehicle in the new bill as a much needed second step to spur the adoption of electric vehicles. That amount was reduced by almost 50% in 2019.

Zero-emission Vehicles

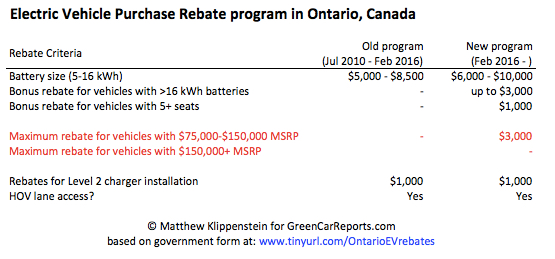

Ontario Canada Boosts Electric-car Purchase Rebate Amounts

2019 Federal Budget New Rebate For Electric Vehicles - The Car Guide

Exclusive Canada Says Proposed Us Ev Tax Credit Could Harm Sector Mulls Possible Challenge Reuters

Canadas Proposed 5000 Ev Incentive Excludes All Tesla Vehicles

Electric Car Incentives In Canada What To Know About The Rebate That Includes Tesla 3 - National Globalnewsca

Federal Incentive For Zero Emission Vehicles Achen Henderson Blog

When Electric Car Incentives Expire A Case Study In Canada

Are The Tax Rebates For Electric And Hybrid Cars Worth It - Loans Canada

Canada Proposes Rebates For Electric Cars Voluntary Sales Mandate Canadas National Observer News Analysis

Ev Incentive Credited For Boosting Canadian Sales By 30 Percent Updated

Trudeau A Little Bit Concerned About Bidens Buy-american Electric Vehicle Tax Credit - National Globalnewsca

Canada Federal Ev Incentives 3 Key Benefits For Fleets

Canada Implements Tax Write-offs Incentives For Ev Purchases - Ngt News

Trudeau A Little Bit Concerned About Bidens Buy-american Electric Vehicle Tax Credit - National Globalnewsca

Canada Announces New 5000 Incentive For Electric Cars Tesla Vehicles Excluded - Electrek

Federal Ev Incentive Could Be Expanded Following Boosted Sales Electric Autonomy Canada

Bcs Electric Car Rebates Ev Charger Rebates Bc Hydro

How To Get Your Electric Car Rebate In 2021