North Dakota Sales Tax Registration

Sign up to receive sales tax emails. Any business that sells goods or taxable services within the state of north dakota to customers located in north dakota is required to collect sales tax from that buyer.

2

New to north dakota online services?

North dakota sales tax registration. File for north_dakota business licenses and north_dakota permits at an affordable price. 99.9 percent of all businesses are required to have a tax id or business tax registration certificate ( both the same). Register once for secure access to state services.

What is taxpayer access point (tap) if you hold a north dakota sales and use tax permit, you may file your sales and use tax. Any business that sells goods or taxable services within the state of north dakota to customers located in north dakota is required to collect sales tax from that buyer. Apply online at the north dakota taxpayer access point (tap).

States assign you a filing frequency when you register for your sales tax permit. How to register for a sales tax permit in north dakota. In north dakota, you will be required to file and remit sales tax either monthly, quarterly, semiannually or annually.

Motor vehicle excise tax (3%) must be remitted when applying for a certificate of title by farmers for their own use. This will include all online businesses. The most common reasons a business in north dakota will need to register for a state business tax numbers include:

Commercial movers must pay motor vehicle excise tax (5%). In most states, how often you file sales tax is based on the amount of sales tax you collect from buyers in the state. Tap additionally provides enhanced features that allow you to access your tax accounts.

Abandoned motor vehicle disposal fee of $1.50 applies upon initial application for north dakota certificate of title. Benefits of north dakota login. Apply for a north dakota sales & use tax permit.

When you select the form preparation service package below, all the license, permit, & tax registration applications required for your specific type and place of business will be filled out. Or file by mail using the north dakota application for income tax withholding and sales and use tax permit. We recommend submitting the application via the online website as it will generally be processed faster and you will receive a confirmation upon submission.

North dakota sales tax application registration. A (n) north dakota business tax registration. Use this link to register to collect and remit applicable sales and use tax in north dakota only.

How do you register for a sales tax permit in north dakota? Learn more about registering for a north dakota. Sales tax taxpayer access point (tap) north dakota sales tax taxpayer access point (tap) is an option offered by the office of state tax commissioner to all sales tax permit holders.

This will include all online businesses. A sales tax permit can be obtained by registering online with the north dakota taxpayer access point (tap) or by mailing in the sales and use tax permit application (form snf 59507). Where to register for a north dakota sales tax permit there are two ways to register for a sales tax permit in north dakota, either by paper application or via the online website.

Sign in with your username and password. After reading the guidelines, complete the electronic application. All refiners, terminal operators, suppliers, distributors, importers, exporters, or retail fuel locations on a native american reservation within the boundaries of north dakota require a license before operating.

If you currently have, or plan to have, employees performing services within north dakota, you should read the income tax withholding guideline. A (n) north dakota dba ( doing business as ) (fictitious / assumed business name or trade. Required registrations for north dakota.

Use the streamline sales tax registration link above if you need to register to collect sales tax in multiple states. North dakota state sales tax online registration. The functionality that was available through the webfile system is also available through tap.

Dealerships may also charge a documentation fee or doc fee, which covers the costs incurred by the dealership preparing and filing the sales contract, sales tax documents, etc. ( business license) also callled an occupational license,or business permit.) 2. Business owners and taxpayers are advised these types of websites are often.

These fees are separate from the taxes. One north dakota login and password to access multiple nd online services.

Resalesales Tax License Agron Llc

North Dakota Charitable Registration Harbor Compliance

Register For A Sales Tax Permit In The State Of Virginia Business Solutions Virginia Sales Tax

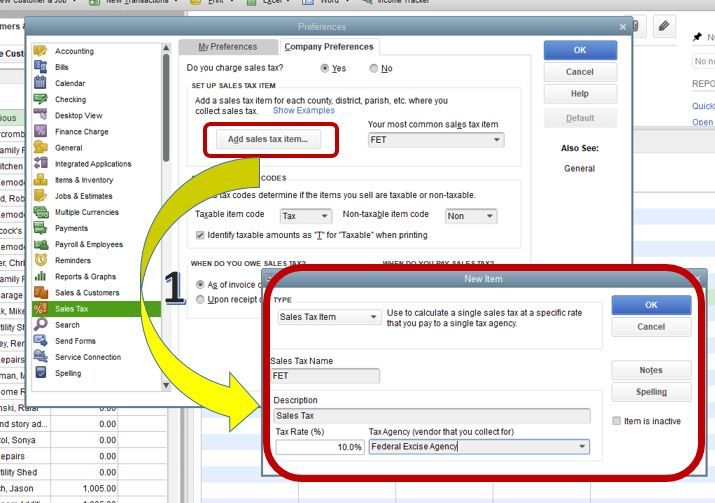

Solved How Do You Add Tax To Estimates And Invoices

Resalesales Tax License Agron Llc

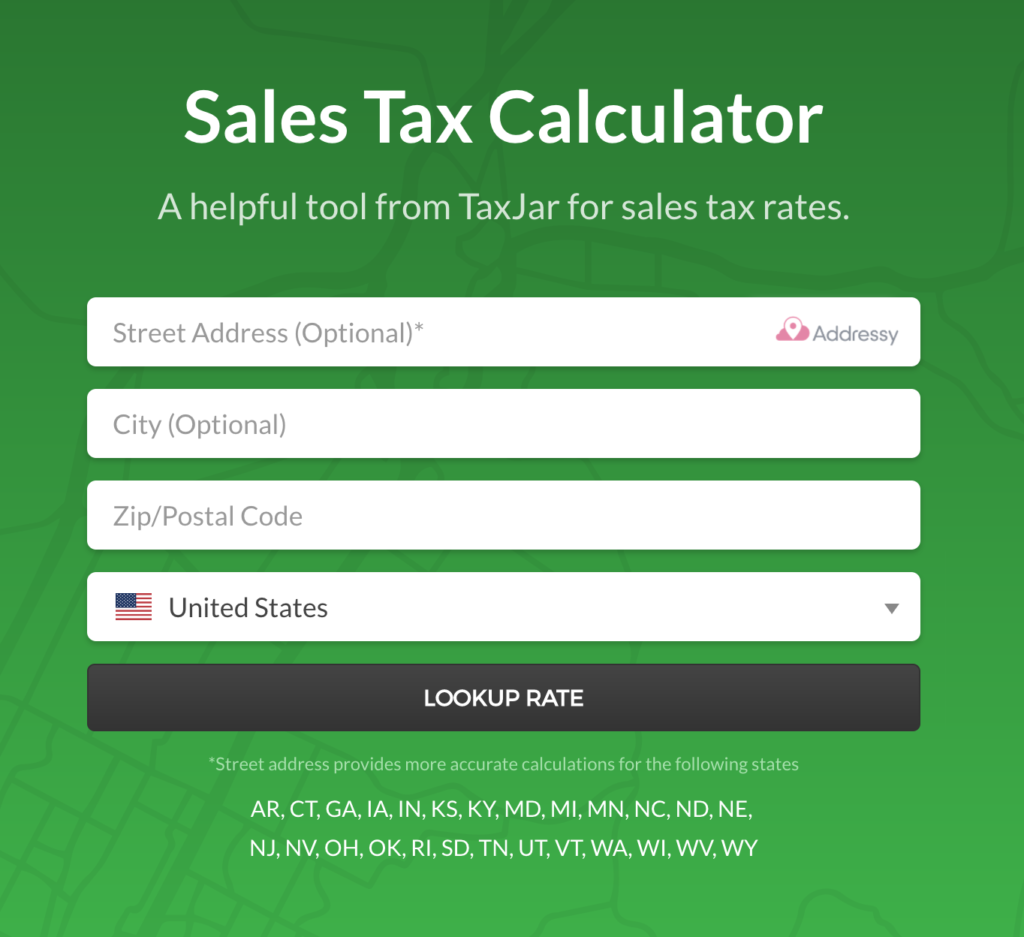

How To Register For A Sales Tax Permit In North Dakota - Taxjar

Resalesales Tax License Agron Llc

Resalesales Tax License Agron Llc

Forms Instructions - Sales North Dakota Office Of State Tax Commissioner

Faq Topics North Dakota Office Of State Tax Commissioner

Do I Have To File State Taxes Hr Block

2

2

Resalesales Tax License Agron Llc

What Is Sales Tax Nexus - Learn All About Nexus

2

Tax Commissioner Ryan Rauschenberger Bio North Dakota Office Of State Tax Commissioner

Sales Use Tax South Dakota Department Of Revenue

Resalesales Tax License Agron Llc