Dallas Texas Sales Tax Rate 2020

Garland, tx sales tax rate: The texas sales tax rate is currently %.

States With Highest And Lowest Sales Tax Rates

For tax rates in other cities, see texas sales taxes by city and county.

Dallas texas sales tax rate 2020. Create your own online store and start selling today. For tax rates in other cities, see texas sales taxes by city and county. Fort worth, tx sales tax rate:

Counties and cities in texas (as well as other jurisdictions such as transit authorities) are allowed to charge an additional local sales tax on top of the texas state sales tax. The december 2020 total local sales tax rate was also 8.250%. Carrollton, tx sales tax rate:

1568 rows combined with the state sales tax, the highest sales tax rate in texas is 8.25% in. The 8.25% sales tax rate in lancaster consists of 6.25% texas state sales tax and 2% lancaster tax. See local sales tax rate information report for a list of jurisdictions who have changed rates in the preceding 14 months.

This is the total of state, county and city sales tax rates. Brownsville, tx sales tax rate: El paso, tx sales tax rate:

Some jurisdictions may have changed tax rates, thus affecting the comparison. Download and further analyze current and historic data using the texas open data center. The dallas sales tax rate is %.

Name local code local rate totalrate name local code local rate totalrate. You can print a 8.25% sales tax table here. Texas has a 6.25% sales tax and dallas county collects an additional n/a, so the minimum sales tax rate in dallas county is 6.25% (not including any city or special district taxes).this table shows the total sales tax rates for all cities and towns in dallas county,.

The sales tax rate in dallas is 8.25 percent of taxable goods or services sold within c ity limits. Denton, tx sales tax rate: In texas, the combined area city sales tax is collected in addition to state tax and any other local taxes (transit, county, special purpose district) when applicable.

The texas state sales tax rate is 6.25%, and the average tx sales tax after local surtaxes is 8.05%. Name local code local rate total rate; Create your own online store and start selling today.

Winnie(chambers co).081250 wylie(collin co) 2043116.020000.082500 chambersco health serv 5036507.005000 wylie(dallas co) 2043116.020000.082500 winnie‐stowellhosp dist 5036525.007500 wylie(rockwall co) 2043116.020000. The tax is collected by the retailer at the point of sale and forwarded to the texas comptroller on a monthly or quarterly basis. What is the sales tax rate in dallas, texas?

There is no applicable county tax. The total sales tax rate in any given location can be broken down into state, county, city, and special district rates. The december 2020 total local sales tax rate was also 8.250%.

2 spd sales and use tax in part of the county. Dallas collects the maximum legal local sales tax. The 8.25% sales tax rate in dallas consists of 6.25% texas state sales tax, 1% dallas tax and 1% special tax.

Dallas, tx sales tax rate: Corpus christi, tx sales tax rate: Frisco, tx sales tax rate:

Try it now & grow your business! The total local sales tax rate in any one particular location — that is, the sum of the rates levied by all local taxing authorities — can never exceed 2 percent. You can print a 8.25% sales tax table here.

The county sales tax rate is %. There is no applicable county tax or special tax. U/c = unable to compute percentage change

Try it now & grow your business! * 1.5% county tax rate; The minimum combined 2021 sales tax rate for dallas, texas is.

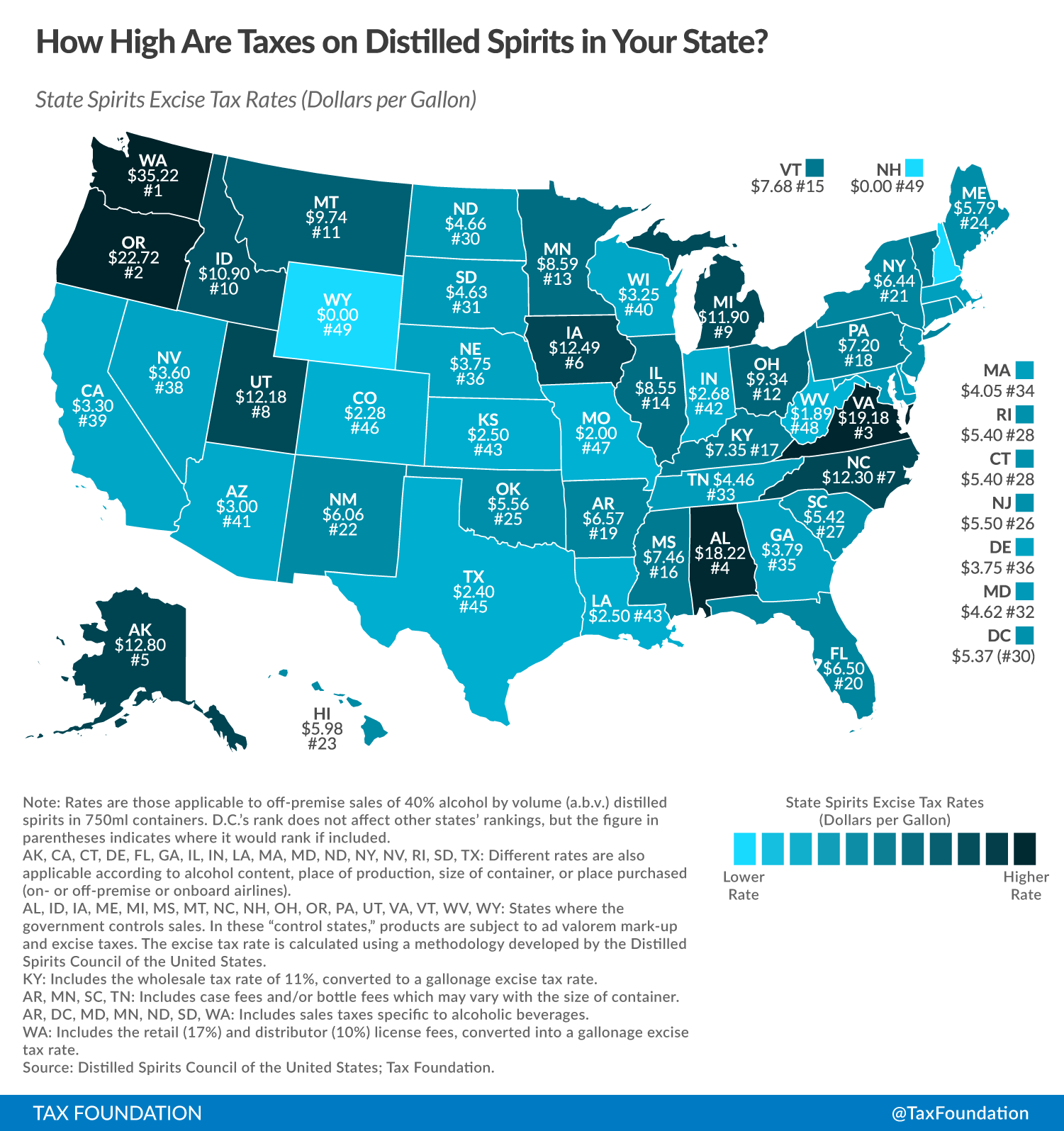

Part 2 How High Are Distilled Spirits Excise Taxes In Your State Infographic - Distillery Trail

How To Get Tax Refund In Usa As Tourist For Shopping 2021

/cloudfront-us-east-1.images.arcpublishing.com/dmn/AOELJWW3DVGNNKZEY5IZ3HZ26Q.jpg)

Arlington Voters Approved A Sales Tax Increase Heres How The City Will Spend That Money

Budget And Tax Facts City Of Lewisville Tx

Budget And Tax Facts City Of Lewisville Tx

How To Charge Your Customers The Correct Sales Tax Rates

2021 - 2022 Tax Information Euless Tx

Compare Sales Income And Property Taxes By State Us Map 2011 My Money Blog

How To Charge Your Customers The Correct Sales Tax Rates

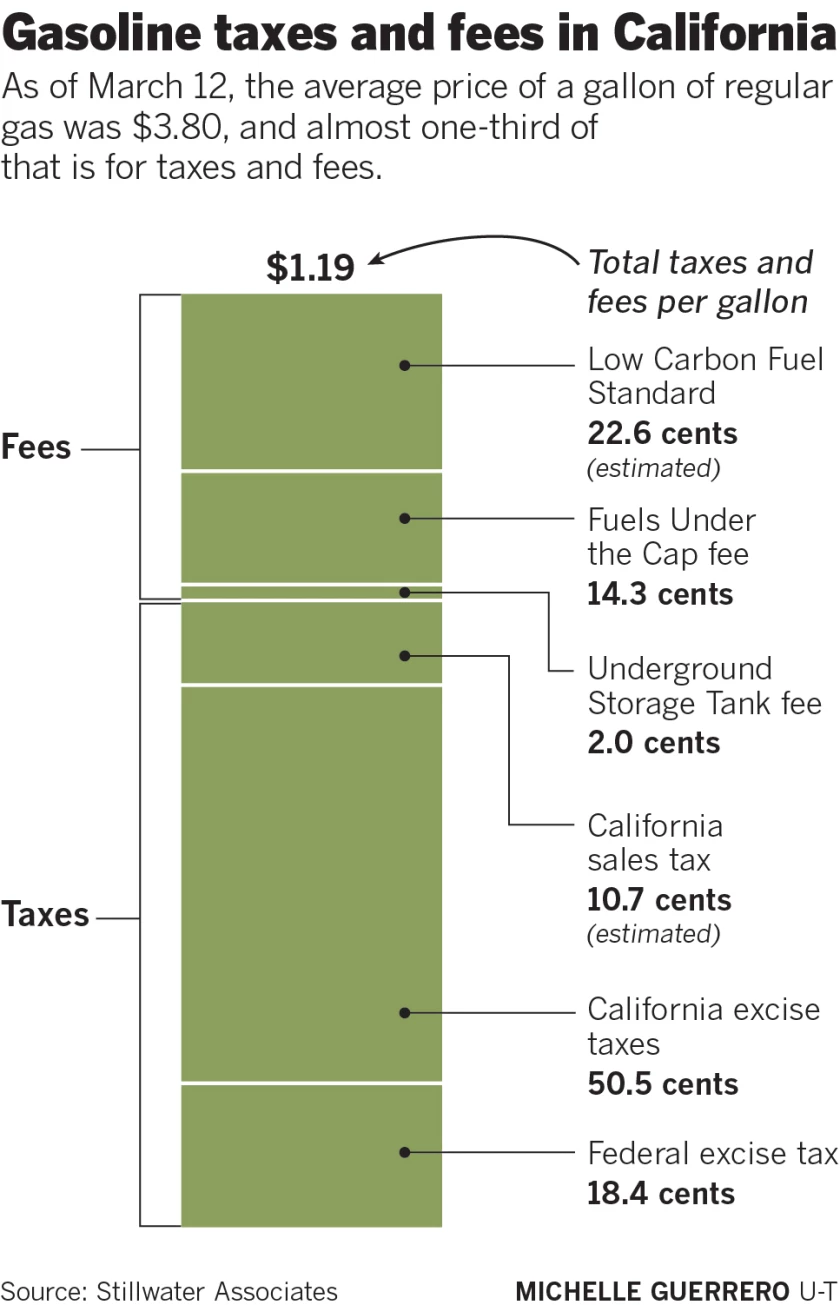

How Much Are You Paying In Taxes And Fees For Gasoline In California - The San Diego Union-tribune

How To Calculate Sales Tax - Video Lesson Transcript Studycom

Texas Sales Tax Rates By City County 2021

Texas Sales Tax - Taxjar

Which Texas Mega-city Has Adopted The Highest Property Tax Rate

Us States With Highest Gas Tax 2021 Statista

How To Charge Your Customers The Correct Sales Tax Rates

States With Highest And Lowest Sales Tax Rates

Taxes Dont Have To Be Scary I Can Sell Your House And Save You Money At The Same Time Send Me A Message To G Tax Deductions Selling House Selling Your

Average Corporate Income Tax Rates In Europe And Surrounding Countries 4592x3196 Oc Rmapporn