Richmond County Va Business Personal Property Tax

This form pertains to businesses tied to professional or service type businesses. Assessment is the basis upon which taxing authorities tax a property.

Tax Forfeited Land Sales In 2021 St Louis County Pike Lake Land For Sale

For personal property tax payments.

Richmond county va business personal property tax. Failure to receive a tax bill does not relieve. Richmond city council is the governing legislative institution of richmond, virginia and it represents residents in creating and amending local laws, providing government policy and oversight, and establishing the annual richmond government budget. If you fail to find the property you are looking for, please try a less specific search, for example, when searching for a property owned by john doe, try searching by the last name only doe.

For real estate tax payments. All property is taxable based on ownership. You file this return through the richland county auditor’s office.

Personal property located within chesapeake on january 1st and used or available for use in any trade or business, including farm equipment and livestock, must file a return. You can make personal property and real estate tax payments by phone. Personal property must then be registered with the commissioner of the revenue.

Richmond tax records are documents related to property taxes, employment taxes, taxes on goods and services, and a range of other taxes in richmond, virginia. Local tax rates tax year 2018 (pdf) local tax rates tax year 2017 (pdf) local tax rates tax year 2016 (pdf) local tax rates tax year 2015 (pdf) local tax rates tax year 2014 (pdf) local tax rates tax. In richmond county a property's assessed value is calculated by multiplying the market value with an assessment ratio which, currently, according to the state code, is set to 100%.

You have the option to pay by credit card or electronic check.</p> And to serve as a resource for the citizens of richmond county. Personal property taxes on automobiles, trucks, motorcycles, low speed vehicles and motor homes are prorated monthly.

Boats, trailers and airplanes are not prorated. The 10% late payment penalty is applied december 6 th. If available in the property information, you can also search by intrument number and subdivision name.

Business personal property tax return this return is considered public information and will be open for public inspection return completed form to address listed below. Personal property taxes are billed annually with a due date of december 5 th. Personal property statement due for.

There is a $1.50 transaction fee for each payment made online. Click here for council information, members, legislation, meetings, laws, charter, and more! Richmond county collects, on average, 0.45% of a property's assessed fair market value as property tax.

Deadline for filing affidavit of owner of eligible personal property claiming exemption from collection of taxes (for tcv of less than $80k). The median property tax in richmond county, virginia is $673 per year for a home worth the median value of $148,700. The charge to the taxpayer is $25.00.

Richmond county has one of the lowest median property tax rates in the country, with only two thousand nine of the 3143 counties collecting a lower property tax than richmond. To generate an equitable tax digest for the state of georgia, all levying authorities, and the tax commissioner; The daily rental property tax is collected by businesses that derive at least 80 percent of their rental receipts (excluding the rental of vehicles licensed by the state) from rental of personal property for 92 consecutive days or less.

The local tax rates survey is published by the department of taxation as a convenient reference guide to selected local tax rates. Also, for credit card payments there is a 2.5% convenience fee in addition to the total tax and transaction fees charged. These records can include richmond property tax assessments and assessment challenges, appraisals, and income taxes.

The taxpayer must file a return on or before april 30th of each year you own the business. Must be postmarked by this date to be considered timely filed. The tax rate is 1 percent charged to.

The charge to the taxpayers $25.00 for city and 4% of the total refund paid to the state. Interest is assessed as of january 1 st at a rate of 10% per year.

Virginia Department Of Small Business And Supplier Diversity Virginia Department Of Small Business And Supplier Diversity

2

Columbia Pike Streetcar To Get 65m In New State Funding From Commonwealth Of Virginia Laugh Arlington Transportation

Tough Times For Daniel Joseph In Rockingham County Virginia 52 Ancestors 52 Weeks 2 Rockingham County Tough Times Rockingham

Nikita Severinov On Instagram Really Love This New Way Of Business Meetings At Home - Time Saving With Always A Great Environ In 2021 Home Business Meeting Furniture

2

Why Buy Real Estate Home Buying Investing Home Ownership

The Small Business Startup Guide To Virginia Tax Registration Retail Merchants

How To Start A Business In Virginia - A How To Start An Llc Small Business Guide

Pin On Roofing Contract

2

Pay Online Chesterfield County Va

Pin On Dallas Real Estate Market

Home Buying In 6 Steps Infographic Home Buying Real Estate Tips Real Estate Professionals

Bankruptcy Lawyer Richmond Va Tax Attorney Attorneys Intellectual Property Law

Important Tips For Your First Va Loan Mortgage Tool Va Loan Refinance Loans Loan

List Of Auto Insurance Companies General Auto Insurance

Mehangai Ki Maar Essay In 2021 Essay Writing Tips Conference Planning Essay

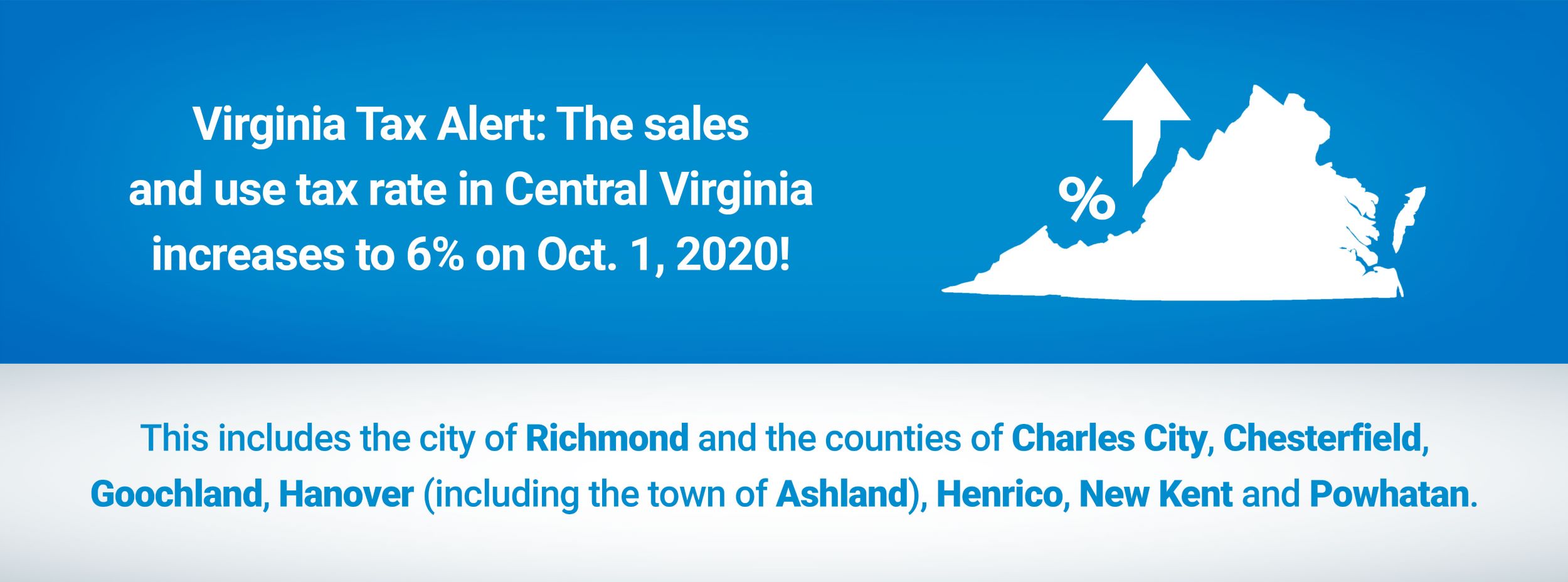

Sales Tax Increase In Central Virginia Region Beginning Oct 1 2020 Virginia Tax