Us Japan Tax Treaty Protocol 2019

Income tax treaties currently in The us tax treaty protocols will enter into force between us and the countries of japan and spain.

Us Releases Details About Tax Treaty Protocols With Japan Spain Tp News

The details for japan and spain are below:

Us japan tax treaty protocol 2019. Entered into force on 30 august 2019. Income tax treaty summary on january 24, 2013, japan and the united states signed a protocol, together with an exchange of notes related thereto, (the “protocol”), amending the income tax treaty signed by the two countries in 2003 (as Although the protocol was signed on 25 january 2013 (japan time) and approved by the japanese diet on 17 june 2013,

Convention between the united states of america and japan for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income, signed at tokyo on march 8,1971. The effective date of specific provisions. The protocol to the 1990 tax treaty between spain and the united states will enter into force on november 27, 2019.

The protocol with japan entered into force on august 30, 2019, and the protocol with spain will enter into force on november 27, 2019. For other taxes, the protocol will apply to taxable years beginning on or after 1. Senate on july 16 and 17 approved resolutions of ratification of protocols signed during the administration of president obama that would amend the u.s.

The protocol was originally signed by japan and the us on january 24, 2013. Protocol to tax treaty between japan and the u.s. The japanese protocol will have effect for withholding taxes (e.g., related to dividends and interest) for amounts paid or credited on or after the first day of the third month following the date on which the protocol enters into force — that is, 1 november 2019.

The government of the united states of america and the government of japan for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income the government of the united states of america and the government of japan, desiring to conclude a new convention for the avoidance of double taxation and the The protocol with japan entered into force on 30 august 2019, and the protocol with spain will enter into force on 27 november 2019. The protocol with spain updates a 1990 tax treaty and is scheduled to enter into force on nov.

Paragraph 4 of article 4 (residence) is replaced, including that where a person. International tax i july 26, 2019 united states tax alert senate approves protocols to tax treaties with japan, luxembourg, and switzerland spain, the u.s. Click here to view the.

On august 30, 2019 the japan protocol entered into force. For effective dates of specific provisions within each of the protocols, taxpayers should refer to the specific agreements. The protocol with japan entered into force on august 30, 2019, provides the following amendments to the 2003 tax treaty:

Protocol signed at washington on january 14, 2013 amending the convention between the government of the united states of america and the government of japan for the avoidance of double taxation and the prevention of fiscal evasion with respect. Summary of provisions in protocols Senate approves protocols with switzerland, luxembourg, japan.

The effective date of specific provisions within the protocols are described in this alert. With respect to withholding taxes, the japan protocol is effective for amounts that are paid or credited on or after november 1, 2019. It will also provide for mandatory binding arbitration to streamline dispute resolutions between the two countries’ tax administrations.

Senate today approved protocol s amending the existing income tax treaties with switzerland, luxembourg, and japan. Japan is a member of the united nations (un), oecd, and g7. The protocol, signed 24 january 2013, provides for the following main changes:

With respect to other taxes, the japan protocol is effective from january 1, 2020. Both protocols were approved by an overwhelming majority in the us senate, the us treasury said, adding that. The protocol entered into force on 30 august 2019, the date japan and the us exchanged instruments of ratification, and applies to withholding taxes on dividends and interest paid or credited on or after 1 november 2019.

The amending protocol to the 2003 income tax treaty between japan and the u.s. “these tax treaty protocols will help to create a level playing field for american businesses and workers, and foster stronger economic growth for both the united states and our trading partners,” said treasury secretary steven t.

Us Tax Treaty With Japan Now In Force Spain To Follow

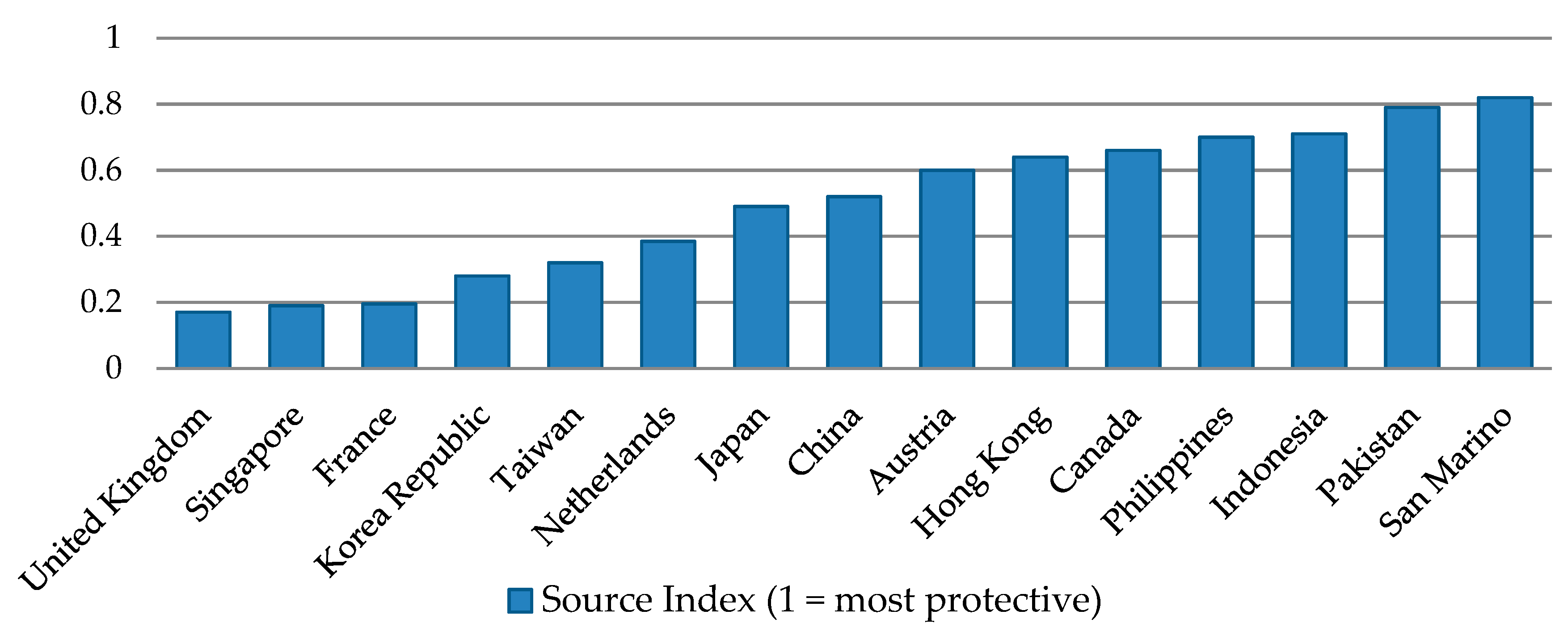

Jrfm Free Full-text Double Taxation Treaties As A Catalyst For Trade Developments A Comparative Study Of Vietnams Relations With Asean And Eu Member States Html

Entry Into Force Of The Protocol Amending Tax Convention Between The Government Of Japan And The Government Of The United States Of America Ministry Of Foreign Affairs Of Japan

2020 Updates Usa Green Light To Amendments To The Tax Treaties With Luxembourg Japan Switzerland And Spain - Auxadi

2

Entry Into Force Of The Protocol Amending Tax Convention Between The Government Of Japan And The Government Of The United States Of America Ministry Of Foreign Affairs Of Japan

Pdf Double Taxation Treaties As A Catalyst For Trade Developments A Comparative Study Of Vietnams Relations With Asean And Eu Member States

Forum A Look At The Amended Japanus Tax Treaty

How To Design A Regional Tax Treaty And Tax Treaty Policy Framework In A Developing Country In Imf How To Notes Volume 2021 Issue 003 2021

Us Expat Taxes For Americans Living In Japan Brighttax

2

2

Us Income Tax Treaties In Force

How To Design A Regional Tax Treaty And Tax Treaty Policy Framework In A Developing Country In Imf How To Notes Volume 2021 Issue 003 2021

Japan-us Tax Treaty 2013 Protocol Entry Into Force Business Tax Deloitte Japan

Us Updates Tax Treaty Protocols With Japan And Spain Accounting Today

Us Senate Approves Tax Treaty Protocols - Us Embassy Consulate In Spain And Andorra

Changes To The Us-japan Tax Treaty International Tax Accountant

How To Design A Regional Tax Treaty And Tax Treaty Policy Framework In A Developing Country In Imf How To Notes Volume 2021 Issue 003 2021