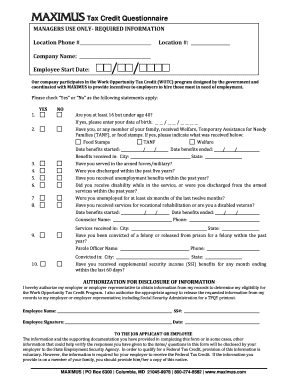

Work Opportunity Tax Credit Questionnaire Social Security Number

You need an ssn to work, collect social security benefits, and receive other government services. I don't feel safe to provide any of those information when i'm just an applicant.' from u.s.

Dmaorg

Employers will earn 25% if the employee works at least 120 hours and 40% if the employee works at least 400 hours.

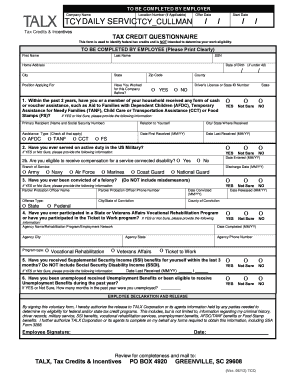

Work opportunity tax credit questionnaire social security number. Have you worked for this employer before? Ewotc allows california employers (or any. Employers must apply for and receive a certification verifying the new hire is a member of a targeted group before they can claim the tax credit.

Find answers to 'do you have to fill out work opportunity tax credit program by adp? It's asking for social security numbers and all. Eligibility for social security benefits.

You don’t need a number to get a driver’s license, register for school, get private health insurance, Work opportunity tax credit (wotc) frequently asked questions. State work opportunity tax credit (wotc) coordinator for the swa must certify the job applicant is a member of a targeted group.

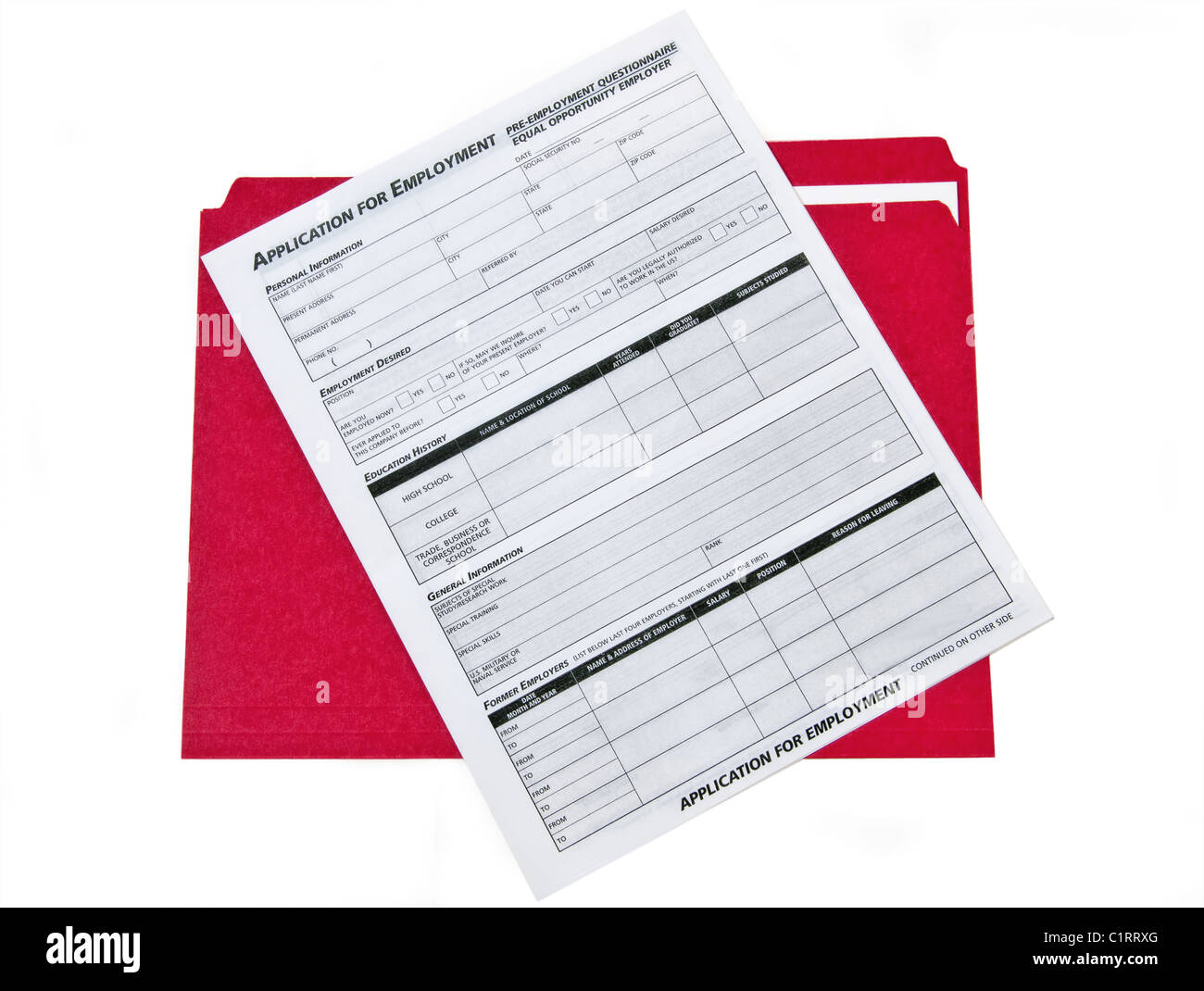

This tax credit is dependent upon the new employee qualifying as a member of one of the specific target groups and working a minimum of 120 hours in their first year. Enter the applicant’s name and social security number as they appear on the applicant’s social security card. Through the work opportunity tax credit (wotc) program, employers have the opportunity to earn a federal tax credit between $1,200 and $9,600 per employee.

Applicant information name (first, mi, last): In this light and even if it might cost applicants the employment opportunity, increasingly job searching counselors recommend that applicants write ssn available upon job offer in that space. I’ve never been asked to fill out a.

After the required certification is secured, taxable employers claim the wotc as a general business credit. The tax credit benefit can range from $2,400 to $9,600 depending upon the employee’s category of eligibility. What ey can do for you

Lawfully admitted noncitizens can get many benefits and services without an ssn. Work opportunity tax credit (wotc) is a program that provides federal tax incentives to employers that hire employees from various targeted groups who consistently face barriers to employment. However, when the worker already has a tin (taxpayer identification number) or social security number, the employer doesn’t need to verify citizenship.

Work opportunity tax credit questionnaire site name/number: Sign in to your talentreef applicant portal to complete the questionnaire. Get answers to your biggest company questions on indeed.

Questions and answers about the work opportunity tax credit program. Generally, an employer elects to take the credit by filing form 5884, work opportunity credit. This entry was posted in wotc questions and tagged tax credits frequently asked questions , work opportunity tax credits , wotc administration' , wotc faq , wotc provider , wotc questions , wotc screening service , wotc vendor.

Employers can verify citizenship through a tax credit survey. About 10 minutes after i submitted my application, the company sent me a work opportunity tax credit form to fill out, and is asking for my ssn. Online application is redirecting me to a questionnaire that's asking for my social security number.

As of 2020, the tax credit can save employers up to $9,600 per employee, with no limit on the number of. Date of birth (if under 40): And people who receive supplemental security income payments.

Employers may meet their business needs and claim a tax credit if they hire an individual who is in a wotc targeted group. California’s electronic wotc (ewotc) application process is a paperless alternative to the original wotc application process which requires employers to mail the irs form 8850 and department of labor (dol) individual characteristics form (icf) 9061 and any supporting documentation to their state workforce agency. Increasingly applicants are objecting to handing over their social security number automatically.

The work opportunity tax credit is a federal tax credit available to employers who hire and retain qualified veterans and other individuals from target groups that historically have faced barriers in securing employment. Questions and answers about the work opportunity tax credit online (ewotc) service. By creating economic opportunities, this program also helps lessen the burden on other government assistance programs.

Recipients of public assistance or food stamps; The wotc encourages the hiring of veterans; There are two sets of frequently asked questions for wotc customers:

In box 8, indicate whether the applicant previously worked for the employer, and if yes, enter the last date or approximate last The social security number will be verified through the social security administration (ssa) master earnings file (mef). My mom won't give me my social security number because she doesn't trust the site.

The work opportunity tax credit congressional research service r43729 · version 8 · updated 2 eligible worker populations this section describes the populations eligible for the wotc under its most recent authorization.6 for most target groups, the maximum wages that are eligible for wotc credit are $6,000. I am trying to apply to panera bread after filling out the application it says i must fill out a questionnaire in order to be considered for the job. I just applied for a job with a well known beauty retailer about an hour ago.

What Is A Tax Credit Screening When Applying For A Job - Welp Magazine

Pdf An Exploratory Study Based On A Questionnaire Concerning Green And Sustainable Finance Corporate Social Responsibility And Performance Evidence From The Romanian Business Environment

Work Opportunity Tax Credit

Oecdorg

Wotc - Advapay Systems Payroll Services

Job Application Form High Resolution Stock Photography And Images - Alamy

P-m-scom

Wotc - Advapay Systems Payroll Services

Work Opportunity Tax Credit

Maximus Tax Credit Questionnaire Form - Fill Online Printable Fillable Blank Pdffiller

Amazoncom Tops 8 12 X 11 Inch Employee Application 50 Sheet Pads 2 Pack 32851 Personnel Forms Office Products

International Students And Taxes Siue

A History And Education About The Ssn A Better Way To Blog Paymaster

Randorg

A History And Education About The Ssn A Better Way To Blog Paymaster

Social Security Instruments - International Labour Organization

With Wotc Timing Is Everything - Wotc Planet

Ncslorg

Wotc Form - Fill Out And Sign Printable Pdf Template Signnow