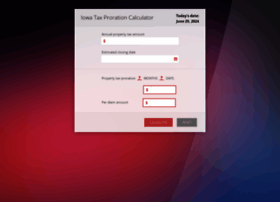

Iowa Tax Proration Calculator

$3,384 2 hours ago iowa property tax calculator smartasset. Tax proration calculator iowa real estate.

Property Tax Abatements

Enter the total amount paid.

Iowa tax proration calculator. Since the closing date is on march 1, the current taxes due are $500, and the prorated taxes for the current fiscal year are calculated from july 1 through march 1, about $663. 2 hours ago iowa real estate tax proration calculator. To use our iowa salary tax calculator, all you have to do is enter the necessary details and click on the calculate button.

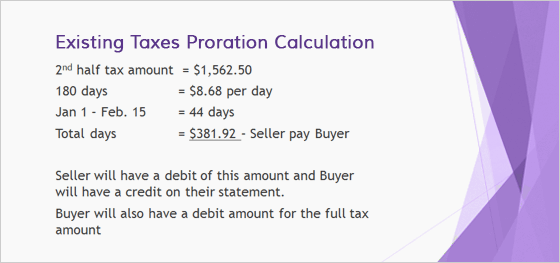

The first half or $500 of the previous year's taxes was paid in september, and the second $500 will assumingly be paid on. Houses (8 days ago) iowa real estate tax proration calculator.homes details: Irs publication 17 tax guide.

The first half or $500 of the previous year's taxes was paid in september, and the second $500 will assumingly be paid on march 31. Iowa real estate transfer tax calculator. Iowa real estate tax proration calculator.

30.5 cents per gallon of regular gasoline, 32.5 cents per gallon of diesel. Iowa tax proration calculator today's date: Since the closing date is on march 1, the current taxes due are $500, and the prorated taxes for the current fiscal year are calculated from july 1 through march 1, about $663.

Since the closing date is on march 1, the current taxes due are $500, and the prorated taxes for the current fiscal year are calculated from july 1 through march 1, about $663. An app that will calculate the tax proration rate using the estimated closing date and annual tax amount of a house. Iowa state tax quick facts.

Since the closing date is on march 1, the current taxes. Iowa property tax proration formula real estate. Iowa property tax proration formula real estate.

This calculation is based on $1.60 per thousand and the first $500.00 is exempt. Houses (2 days ago) tax proration calculator iowa real estate. Iowa tax proration calculator today's date:

187 people used more info ››. Houses (just now) (2 days ago) iowa tax proration calculator real estate. Since the closing date is on march 1, the current taxes due are $500, and the prorated taxes for the current fiscal year are calculated from july 1 through march 1,.

Simply close the closing date with the drop down box. Iowa tax proration calculator today's date: Below are the steps to follow to obtain the tool and load it on the desktop of your computer:

The iowa return proration, federal tax paid & vehicle registration fee calculator tool was created as an aid for obtaining information that may be needed when preparing the iowa state return. The first half or $500 of the previous year's taxes was paid in september, and the second $500 will assumingly be paid on march 31. The county’s average effective property tax rate is 1.97%, which is the highest rate in the state.

The highest property tax rates in the county can be found in des moines. Iowa property taxes are paid in arrears. Taxpayers using filing status 3 (married filing separately on a combined return) or status 4 (married filing separate returns) may be required to prorate (divide) certain entries on the ia 1040, such as reportable social security benefits, federal income tax refunds, estimated federal tax payments, itemized deductions, etc.

Unsurprisingly, the state's $3,384 median annual tax payment falls in the top three of iowa counties. Taxslayer direct debit printing from taxslayer. Then, enter the local, county, and school tax amount and enter the tax period (i.e.

To further complicate matters, you're actually paying the last fiscal year's property taxes. Earlier this decade, iowa enacted one of the largest tax cuts in the state’s history. The property tax estimator assumes that property taxes are paid on september 30th and march 31st.

After a few seconds, you will be provided with a full breakdown of the tax you are paying. The first half or $500 of the previous year's taxes was paid in september, and the second $500 will assumingly be paid on march 31. This breakdown will include how much income tax you are paying, state taxes, federal taxes, and many other costs.

Iowa tax return quality review sheet for taxslayer. 282 people used more info ››. Iowa real estate tax proration calculator.

$3,384 7 hours ago if you are looking for low property tax rates in iowa, polk county may not be your best bet.the county’s average effective property tax rate is 1.97%, which is the highest rate in the state. Property tax proration calculator iowa real estate. 2 hours ago tax proration calculator iowa real estate.

Iowa property tax proration formula real estate.real estate details: That means that when paying property taxes in a given year, you're paying last year's taxes. Iowa real estate tax calculator.

Property tax proration calculator iowa rentals.

Iowataxprocalccom At Wi Simplydesmoines Iowa Taxpro Calculator

Revenue Tax Calculator Iowa - Revneus

Property Tax Prorations - Case Escrow

Iowa Tax Calculator

Property Tax Proration When Selling A Home In Iowa Explained - Youtube

Helpsoftprocorpcom

Tax Calculator Scott County Iowa

How Property Taxes Are Prorated For Residential Sales In Greater Cincinnati - Cincinnati Real Estate - Cincinnati Homes For Sale By Kathy Koops

Iowa Tax Proration Calculator Apps On Google Play

Iowa Paycheck Calculator - Smartasset

Property Tax Abatements

Iowa Tax Proration Calculator Apps On Google Play

Prorating Real Estate Taxes In Michigan

California Property Taxes Viva Escrow 626-584-9999

Bluenoviscom

How To Compute Real Estate Tax Proration And Tax Credits Illinois

Revenue Tax Calculator Iowa - Revneus

Property Tax Proration When Selling A Home In Iowa Explained - Youtube

Your Guide To Tax Proration How Does It Work And Why Does It Matter - A And N Mortgage