Texas Estate Tax Rate

No estate tax or inheritance tax. If a person’s estate value is over the exemption amount, the tax liability will be 40%.

Texas Inheritance And Estate Taxes - Ibekwe Law

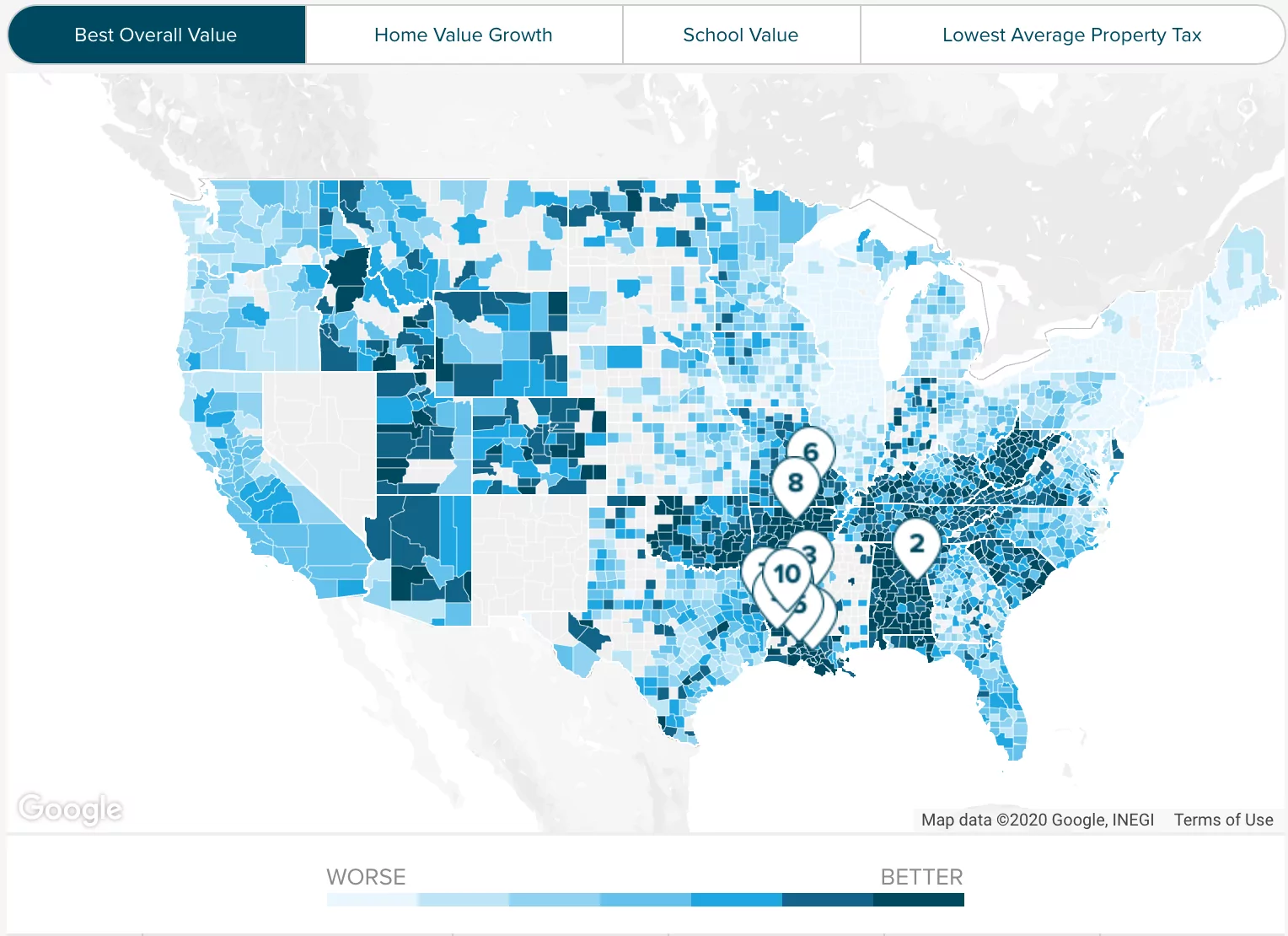

The following table provides 2017 the most common total combined property tax rates for 93 houston area cities and towns.

Texas estate tax rate. The median property tax in texas is $2,275.00 per year for a home worth the median value of $125,800.00. Compare that to the national average, which currently stands at 1.07%. Texas has state sales tax of 6.25% , and allows local governments to collect a local option sales tax of up to 2%.

Estate tax rate ranges from 18% to 40%. 1 of the following year, as required. If an estate exceeds that amount, the top federal tax rate is 40%.

Only the federal income tax applies. The fair market value of these items is used, not necessarily what you paid for them or what their values were when you acquired them. Intestate succession laws affect only assets that are typically covered in a will, specifically assets that you own alone like real estate, stock market investments, businesses and other types of physical possessions.

It consists of an accounting of everything you own or have certain interests in at the date of death (refer to form 706 pdf (pdf)). With local taxes, the total sales tax rate is between 6.250% and 8.250%. No estate tax or inheritance tax.

($1 million x 40% = $400,000). Does texas have an inheritance or estate tax? When is the estate tax due?

There are a total of 815 local tax jurisdictions across the state, collecting an average local tax of 1.377%. Breaking this out in dollars, if your home is valued at $200,000, your personal property taxes at the average rate of 1.80% would be $3,600 for the year. The estate tax is a tax on a person’s assets after death.

Texas has one of the highest average property tax rates in the country, with only thirteen states levying higher property taxes. The first step towards understanding texas’s tax code is knowing the basics. Estate tax rates are typically assessed in brackets after the exemption threshold, like income tax is assessed.

Your effective tax rate for 2021 = general tax rate (gtr) + replenishment tax rate (rtr) + obligation assessment rate (oa) + deficit tax rate (dtr) + employment and training investment assessment (etia) minimum tax rate for 2021 is 0.31 percent. There is a 40 percent federal tax, however, on estates over $5.34 million in value. There are no inheritance or estate taxes in texas.

Each state’s tax code is a multifaceted system with many moving parts, and texas is no exception. Property taxes in texas are calculated based on the county you live in. The tax rate, as of 2019, typically starts at 10% and then increases in steps up to about 16%.

Also called a privilege tax, this type of income tax is based on total business revenues exceeding $1.18 million. How is the estate tax calculated? Texas has recent rate changes (thu jul 01 2021).

No estate tax or inheritance tax. A full chart of federal estate tax rates is below. Ad a tax advisor will answer you now!

The tax rates included are for the year in which the list is prepared and must be listed alphabetically according to the county or counties in which each taxing unit is located, and by the name of each taxing unit. The state sales tax rate in texas is 6.250%. The top estate tax rate is 20 percent (exemption threshold:

The comptroller's property tax assistance division (ptad) publishes this list not later than jan. While texas does not impose a state inheritance or estate tax, if you die without a will, your assets will be distributed through the state’s intestate succession process. The estate tax is a tax on your right to transfer property at your death.

Texas has no individual income tax as of 2021, but it does levy a franchise tax of 0.375% on some wholesalers and retail businesses. No estate tax or inheritance tax. For example, if a person died today with an estate valued at $12.7 million they left to their children, their estate tax liability would be $400,000.

Counties in texas collect an average of 1.81% of a property's assesed fair market value as property tax per year. Select the texas city from the list of popular cities below to see its current sales tax rate. Questions answered every 9 seconds.

Questions answered every 9 seconds. Southside place, which has a combined total rate of 1.94 percent, has the lowest property tax rate in the houston area and galena park, with a combined total rate of 3.02 percent, has the highest rate in the area. Below, we have highlighted a number of tax rates, ranks, and measures detailing texas’s income tax, business tax, sales tax, and property tax systems.

The top estate tax rate is 16 percent (exemption threshold: Ad a tax advisor will answer you now! Texas has no state income tax.

Texas is one of seven states that do not collect a personal income tax. The average property tax rate in texas is 1.80%. In 2020, federal estate tax generally applies to assets over $11.58 million.

Average sales tax (with local):

The Impacts Of Us Tax Reform On Canadas Economy Business Council Of Canada

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Analysis Texas Property Tax Cut Measure Passed With The Long Game In Mind The Texas Tribune

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Sales And Use Tax Rates Houstonorg

Americas Richest 400 Families Pay A Lower Tax Rate Than Average Taxpayer

The States With The Highest Capital Gains Tax Rates The Motley Fool

Texas Sales Tax - Small Business Guide Truic

Do I Have To Pay Taxes When I Inherit Money

States With Highest And Lowest Sales Tax Rates

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Florida Property Tax Hr Block

If Dallas Property Tax Rates Are Going Down Why Are My Payments Going Up - Mansion Global

State Corporate Income Tax Rates And Brackets Tax Foundation

Texas Has The Fifth-highest Property Taxes In The Nation But Do We Get What We Pay For - Candysdirtcom

Talking Taxes Estate Tax - Texas Agriculture Law

Harris County Tx Property Tax Calculator - Smartasset

Texas Income Tax Calculator - Smartasset

Austin Property Tax What Can You Expect When Moving Here Bhgre Homecity