Tax Fraud Lawyer Uk

This could apply if the taxpayer deliberately overstated the level of their expenses or allowances. We are a specialist tax fraud / financial crime law firm and we are recognised as leaders in the field for our work.

Irs Whistleblower Lawyers Report Tax Fraud Kohn Kohn Colapinto

Bright and dedicated lawyers. chambers uk 2021.

Tax fraud lawyer uk. Kuit steinart levy llp undertakes a wide ambit of contentious tax work for clients, including tax scheme investigations, furlough fraud cases, criminal tax investigations and prosecutions. We welcome enquiries by telephone or email. We handle misdemeanor and felony charges.

No two cases are ever the same in what can be a complicated area of the law to navigate. We are aware of the crippling effects and devastating consequences of these investigations and will allocate a team of lawyers to apply defensive measures from the outset. Using the form on the right;

For further information or to speak to our solicitors please telephone us on 020 7387 2032, complete our online enquiry form or contact jeffrey lewis or siobhain egan. Ad our legal team is experienced & aggressive. We handle misdemeanor and felony charges.

If you or your business is found guilty of tax fraud, you could face penalties such as serious fines or. Making a prompt and early admission of fault is a good way to reduce your possible end liability. Contact our tax evasion and tax fraud lawyers in london today selachii is a dynamic litigation and dispute resolution law firm based in kensington, london.

Phone us during office hours on 0333 888 4040; With offices in camden and mayfair, we represent and advise businesses in central london, west london, north london and across the uk. We take pride in our reputation of being one of the leading law firms in england and wales for defending allegations of fraud.

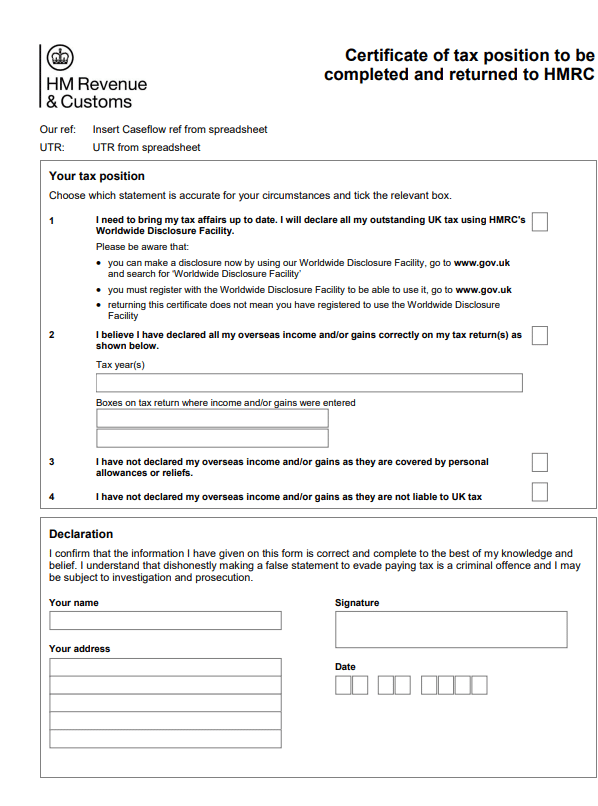

The penalty system for tax fraud includes a mechanism for reducing potential fines in circumstance where the individual or business assists hmrc in uncovering tax fraud. We provide an initial no obligation consultation from our offices in london, birmingham and manchester. Draycott browne are highly experienced in advising and representing clients in tax evasion cases.

Ad our legal team is experienced & aggressive. If hmrc concludes tax liability was deliberately understated, it is regarded as serious tax fraud. Fraud is the act of gaining a dishonest advantage, often financial, over another person.

You should discuss this with your solicitor at the earliest opportunity to give yourself the best. Tax fraud and tax evasion are considered serious crimes and have potentially severe penalties for those who are found guilty. Our offices are based in the city of london, manchester and birmingham and we are able to service our national client base from these 3 major financial centres.

Kangs solicitors is an award winning national law firm. Get professional legal representation today. We have several serious fraud solicitors who are recognised in the legal 500 as being leading national experts in fraud defence.

We can offer you the expert legal guidance you need to navigate the various aspects of uk fraud law. It is now the most commonly experienced crime in england and wales, with an estimated 3.4 million incidents in the year ending march 2017. Our tax fraud solicitors help businesses or individuals accused of committing tax evasion.

Deep bench of experienced lawyers with an approachable style.” legal 500 uk 2021. Our expert fraud solicitors are known for their strategic thinking and knowledge of the law concerning tax evasion cases. Slater and gordon’s specialist white collar crime solicitors have a successful track record in defending charges of fraudulent behaviour and dishonesty.

Call today for a free consultation! Get professional legal representation today. Team head robert levy represents a number of offshore banks in complex tax investigations.

Punishment for not declaring income Call today for a free consultation! Because this is treated as tax fraud, it could result in a tax evasion penalty of up to 70 per cent of the tax owed.

For expert legal advice and representation, call janes solicitors today 020 7930 5100 or complete our online enquiry form and one of our lawyers will be in touch as soon as possible. Criminal defence lawyers for tax fraud and hmrc investigations. At wheldon law, we are experienced in dealing with most types of fraud, and our fraud solicitors are able to provide honest and frank advice and support at every stage of the proceedings.

We are there when you need us. However, the good news is that the tax fraud lawyers at purcell parker can guide you through every aspect of being investigated for tax fraud or tax. We specialise in defending all allegations of dishonesty, from serious fraud office (sfo).

Regarded as one of the best financial crime firms For the best legal advice call our uk lawyers ☎ 02071830529 Call us 24/7 on 0330 041 5869 or contact us and we’ll call you.

Hmrc Issues Nudge Letters On Furlough Fraud Hmrc Tax Disputes Solicitors Barristers

Solicitor Jailed For Stamp Duty Land Tax Fraud - Legal Futures

Hmrc Tax Vat Lawyers - Investigations Rahman Ravelli

Hmrc Tax Disputes Solicitors Barristers London Tax Lawyers

Top Criminal Fraud Defence Solicitors Bark Co Leading Expert Specialist Lawyers London Uk

The Pandora Papers Show The Line Between Tax Avoidance And Tax Evasion Has Become So Blurred We Need To Act Against Both

Tax Avoidance Confessions Of An International Tax Lawyer 2018

Tax Evasion Avoidance Lawyers Richard Nelson Llp

Top Criminal Fraud Defence Solicitors Bark Co Leading Expert Specialist Lawyers London Uk

Hmrc To Hire More Staff In Fresh Tax Clampdown Financial Times

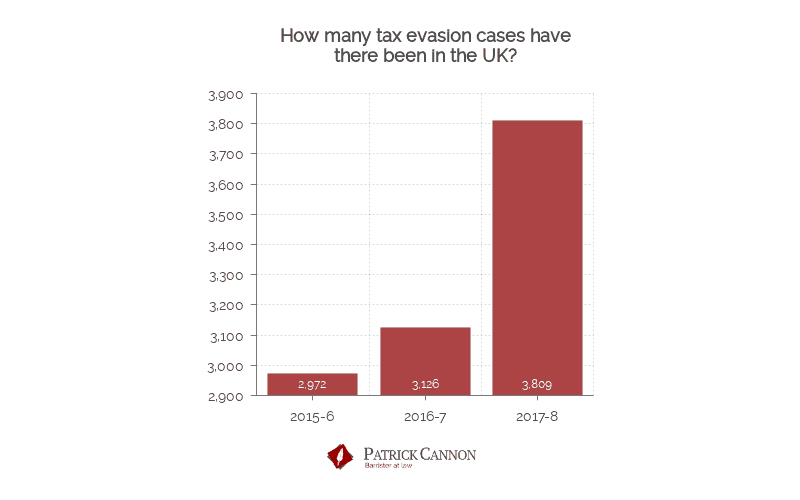

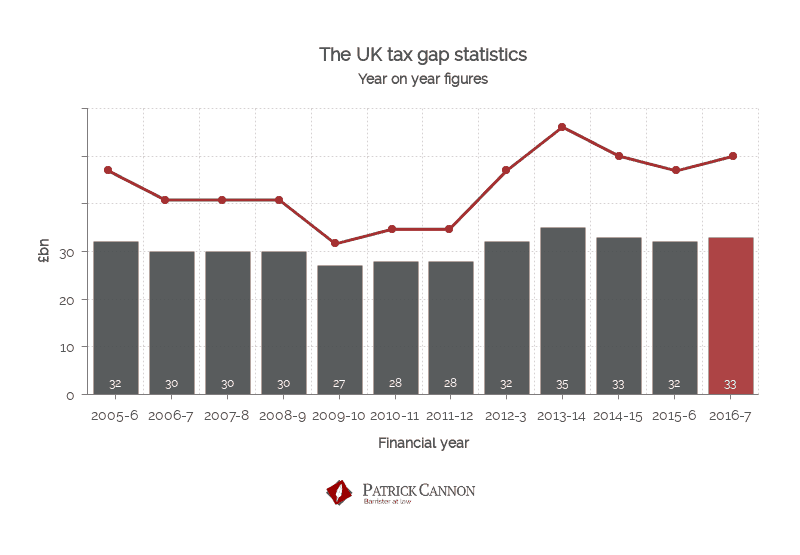

Tax Evasion Statistics 2020 Uk Tax Evasion Facts Patrick Cannon

Tax Time 2015 Why Tax Cheats In Canada Are Rarely Jailed Cbc News

Top Criminal Fraud Defence Solicitors Bark Co Leading Expert Specialist Lawyers London Uk

Hmrc Tax Dispute Lawyers Lexlaw Solicitors Barristers

Tax Investigation Solicitors Services Richard Nelson Llp

Tax Evasion Statistics 2020 Uk Tax Evasion Facts Patrick Cannon

Pdf Aggressive Tax Avoidance By Managers Of Multinational Companies As A Violation Of Their Moral Duty To Obey The Law A Kantian Rationale

Tax Evasion What You Need To Know - The Tax Lawyer

Hmrc Tax Disputes Solicitors Barristers London Tax Lawyers