Ny Paid Family Leave Tax Category

Employees can request voluntary tax withholding After discussions with the internal revenue service and its review of other legal sources, the new york department of taxation and finance issued guidance regarding the tax implications of its new paid family leave program.

Pin En Zakahzakat The 3rd Pillar Of Islam Poors Right

Contribution rates are community rated and are paid entirely by employees.

Ny paid family leave tax category. The paid family leave can be called family leave sdi as long as it is a separate item in box 14. Each year, the department of financial services sets the employee contribution rate to match the cost of coverage. In 2018, 21 states were considering paid family leave laws, and even more are expected to evaluate legislation in the future.

The maximum annual contribution is $385.34. Paying the tax does not mean that you received any benefits. Now, after further review, the new york department of taxation and finance has provided important guidance regarding payroll deduction and pfl taxation.

The maximum contribution in 2022 is $423.71 annually per employee. If your employer participates in new york state’s paid family leave program, you need to know the following: Currently, only california, new jersey, rhode island, new york and the district of columbia have paid family leave laws in effect, but many states are contemplating enacting their own.

The pfl benefits paid by an insurance carrier are reportable on w2s, or on 1099g forms, if pfl benefits are paid by a government agency, such as the ny state insurance fund. New york paid family leave is insurance that may be funded by employees through payroll deductions. Big changes arrived for new yorkers on january 1, 2018, when the new york paid family leave (nypfl) benefit went into effect.

The maximum contribution is $196.72 per employee per year. In 2021, the contribution is 0.511% of an employee’s gross wages each pay period. Taxes will not automatically be withheld from benefits.

Based upon this review and consultation, we offer the following guidance: Tax treatment of family leave contributions and benefits under the new york program. Contribution rate for paid family leave in 2020 is 0.270% of the employee’s weekly wage (capped at new york’s current average annual wage of $72,860.84).

The state of new york communicated paid family leave rates and initial payroll deduction guidance on june 1, 2017. The state begins requiring mandatory withholding beginning with checks dated on or after january 1, 2018. The coverage can be used for wage replacement and job protection to employees who need time off due to:

However, premium for paid family leave is treated as the payment of a new york state tax. The new york department of financial services announced that the 2021 paid family leave (pfl) payroll deduction rate will increase to 0.511% of an employee's gross wages each pay period, up from 0.270% for 2020. New york family leave insurance ( fli ), or paid family leave ( pfl ), is a state mandated coverage for most private employers.

Caring for a family member due to a health condition. Employees can request voluntary tax withholding The coverage is funded by employee payroll contributions.

The maximum 2021 annual contribution will be $385.34, up from $196.72 for 2020. Your employer will not automatically withhold taxes from these benefits; Based upon this review and consultation, we offer the following guidance:

What category description should i choose for this box 14 entry? In 2022, the employee contribution is 0.511% of an employee’s gross wages each pay period. (the state previously said that deductions for the.

Employees wishing to avoid tax liability for receipt of paid family leave benefits can request voluntary tax withholding from such benefits. Any benefits you receive under this program are taxable and included in your federal gross income. New york paid family leave is insurance that is funded by employees through payroll deductions.

The original turbo tax answer (about a year ago) to this question was incorrect, which is why i responded as i did, with the correct info and the nys link stating that nypfl is a state disability insurance tax. The nypfl in box 14 is pfl tax that you paid. Set the appropriate ny rates for family.

State governments do not automatically withhold paid family leave federal tax from an employee’s pfl benefits. You may request voluntary tax withholding. For 2021, the contribution rate for paid family leave will be 0.511% of the employee’s weekly wage (capped at the new york

New york paid family leave premiums will be deducted from each employee’s after tax wages. Confirm the client’s state is ny. Tax treatment of family leave contributions and benefits under the new york program.

If you did not take paid family leave you did not receive any pfl benefits so you do not check the box. You do not withhold taxes on an employee’s pfl benefits because they are not included in your payroll. The pfl benefits will be exempt and may not be, subject to new york state income taxation.

Paid family leave benefits are not treated as disability benefits for any tax purpose. The maximum annual contribution is $423.71. The maximum contribution in 2022 is 0.511% of an employee’s weekly wage, up to but not exceeding the statewide weekly average wage of $1,594.57.

Stories For Kids Stories Bedtime Stories

90s Vintage Stussy Dragon Made In In Usa Men Sweatshirt Medium Etsy In 2021 Sweatshirts Men Sweatshirt Stussy

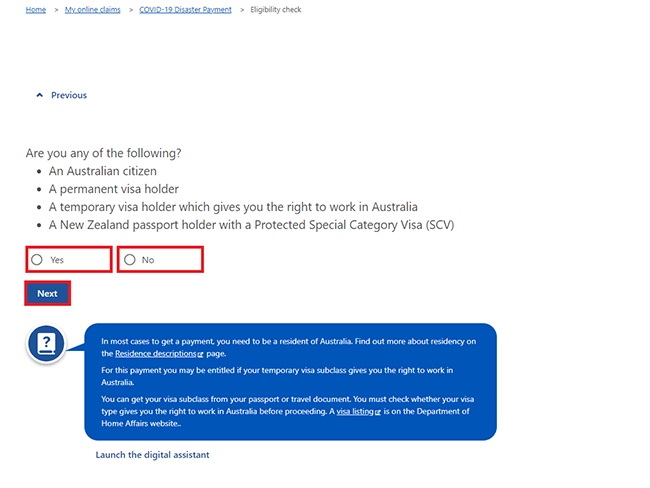

Centrelink Online Account Help - Claim The Covid-19 Disaster Payment If You Dont Get A Centrelink Or Dva Payment - Services Australia

Pin By Alexander Osipov On Chk Live Scan Fingerprinting Fingerprint Cards State Police

Child Benefit Graphic Finland Vs Us Family Medical School Reform Finland

Bustier Fit Flare Tulle Midi Dress - Blush Large In 2021 Tulle Evening Dress Tulle Prom Dress Evening Dresses

Understanding Your Pay Statement Office Of Human Resources

Pin On Coronavirus

What Does Debt Look Like In America Every Generation Is Carrying Some Debt But The Amount And Cause Vary As We Finance Jobs Finance Infographic Finance Goals

On This Years New York State W-2 In Box 14 There Is Nypfl And Nydbl What Category Description Should I Choose For These Box 14 Entries

New National Paid Leave Proposals Explained

Cost And Deductions Paid Family Leave

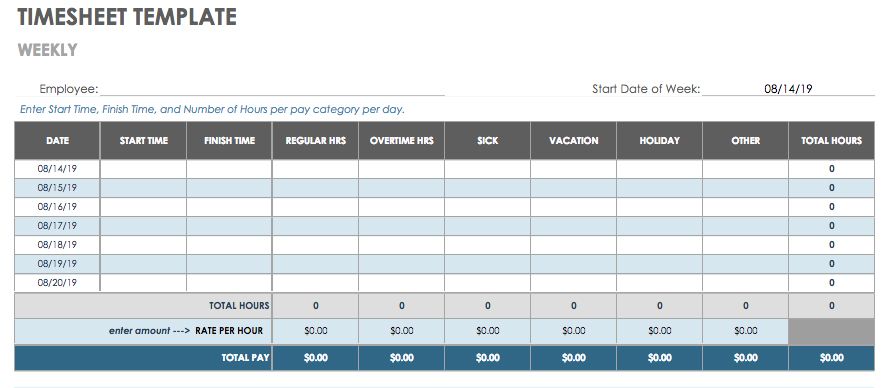

15 Free Payroll Templates Smartsheet

Monthly Budget Plan Template Five Moments That Basically Sum Up Your Monthly Budget Plan Tem Monthly Budget Planning Budgeting Budget Planning

Unseen Passage For Class 10 Factual Cbse With Answers Cbse Sample Papers

How Much Will Artists Be Paid Under The New Wage Certification Program Artist Artistic Space Paradigm

Forms Paid Family Leave

Used Car Dealer Software Carfiles Usa Jacksonville Fl Enter Sale Used Car Dealer Car Dealer Bill Of Sale Template

This Is Why Obama Is So Concerned About The Middle Class Cnn Money Obama Middle Class