Are Union Dues Tax Deductible In California

The local dues help pay for the costs of representing workers’ interests and collective bargaining. Expenses that exceed 7.5% of your federal agi:

Proposed Tax Deduction For Union Dues In Ca Senate The Sacramento Bee

The chart below details standard dues deductions amounts for 2020 nea/cta/talb dues.

Are union dues tax deductible in california. After computing the annual gross income of a party, the court will then deduct from that figure to arrive at the parent’s annual net disposable income. No, employees can’t take a union dues deduction on their return. Prior to 2018, an employee who paid union dues prior may have been able to deduct them as unreimbursed employee business expenses, if the total of.

Can i deduct union dues now? Job expenses and certain miscellaneous itemized deductions : In 2017, tax law only allowed union dues to be deducted as an unreimbursed business expense.

Can i deduct my union dues in 2020? Ad a tax advisor will answer you now! 5 this meant that (1) only the portion of union dues plus any other unreimbursed business expenses.

Questions answered every 9 seconds. Union dues used for operations are 100% tax deductible. Union dues may be deductible from california income taxes if you qualify to itemize on your california tax return.

To get to the correct location to enter your union dues, in your federal return, type union dues in. Some portion of union assessments are tax deductible your union dues, plus any initiation fees you pay when you join the union, count toward your unreimbursed employee expense deduction on your taxes, just like travel expenses and other employee expenses. If your union dues were incurred in 2017 and before, if you itemized or are eligible to itemize your deductions on schedule a in the tax year you are deducting your dues, and if your dues and other miscellaneous deductions (employee business expenses are/were considered a miscellaneous deduction) were greater than 2% of your adjusted gross income, then you may.

Union fees, subscriptions to associations and bargaining agents fees. For the industry you work in, you can claim a deduction for: Expenses that exceed 7.5% of your federal agi:

Ad a tax advisor will answer you now! Expenses that exceed 2% of your federal agi Workers used to be able to deduct union dues, but they could only do so if they had enough other eligible deductions that it was worthwhile to file an “itemized” tax return ― and even then, the eligible expenses had to amount to more than.

You can claim a tax deduction for these amounts on. Are union dues tax deductible in california 2020? Union dues may be deductible from california income taxes if you qualify to itemize on your california tax return.

Sb 866 gives unions the primary responsibility for processing any changes (e.g., increases) or cancellations to dues deductions by their members, and allows unions, not the employer, to maintain employees’ written authorizations for dues deductions. Union dues may be deductible from california income taxes if you qualify to itemize on your california tax return. The payment of a bargaining agent’s fee to a union for negotiations in relation to a new enterprise agreement award with your existing.

Questions answered every 9 seconds. On home purchases up to $1,000,000: Can you write off union dues?

Where do i place that info? You can only deduct certain types of union dues or professional membership fees from your income tax filings. Ca allowable amount federal allowable amount;

The local union dues are set by a vote of the membership. Mandatory union dues and retirement benefits requires as a condition of employment. Federal and state income taxes ;

On home purchases up to $750,000: The amount of union dues that you can claim is on box 44 of the t4 slip issued by your employer. Employee union dues are no longer deductible in tax years 2018 through 2025 as a result of the tax cuts and jobs act.

Subscriptions to trade, business or professional associations; Prior to the act, they were partially deductible as a miscellaneous deduction under the 2% rule. Not only may unions exclusively decide the amount of the union dues, but they may also exclusively decide.

Union dues in california are deductible on ca tax form, correct. 2577 would have allowed union members in california to deduct their dues on their state personal income tax. The following are deductible from the gross income of a parent:

Union dues may be deductible from california income taxes if you qualify to itemize on your california tax return. The chart below details standard dues deductions amounts for 2020 nea/cta/talb dues.

Claiming A Deduction For Union Or Professional Dues - Virtus Group

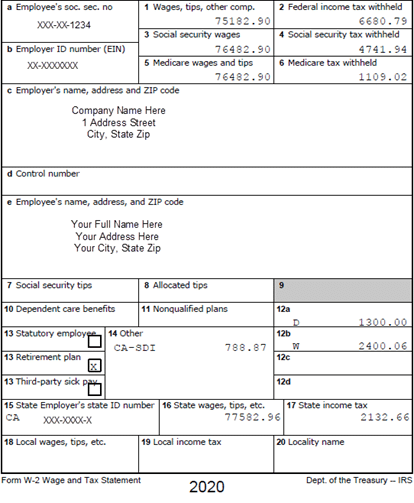

Understanding Your W-2 Controllers Office

Different Types Of Payroll Deductions Gusto

Membership Dues Tax Deduction Info - Teachers Association Of Long Beach

Tax Strategies For Parents Of Kids With Special Needs - The Autism Community In Action Taca

Understanding Your W2 - Innovative Business Solutions

2

Tax Preparers Warn Your Refund May Be Smaller Than Usual This Year Heres Why - Los Angeles Times

2

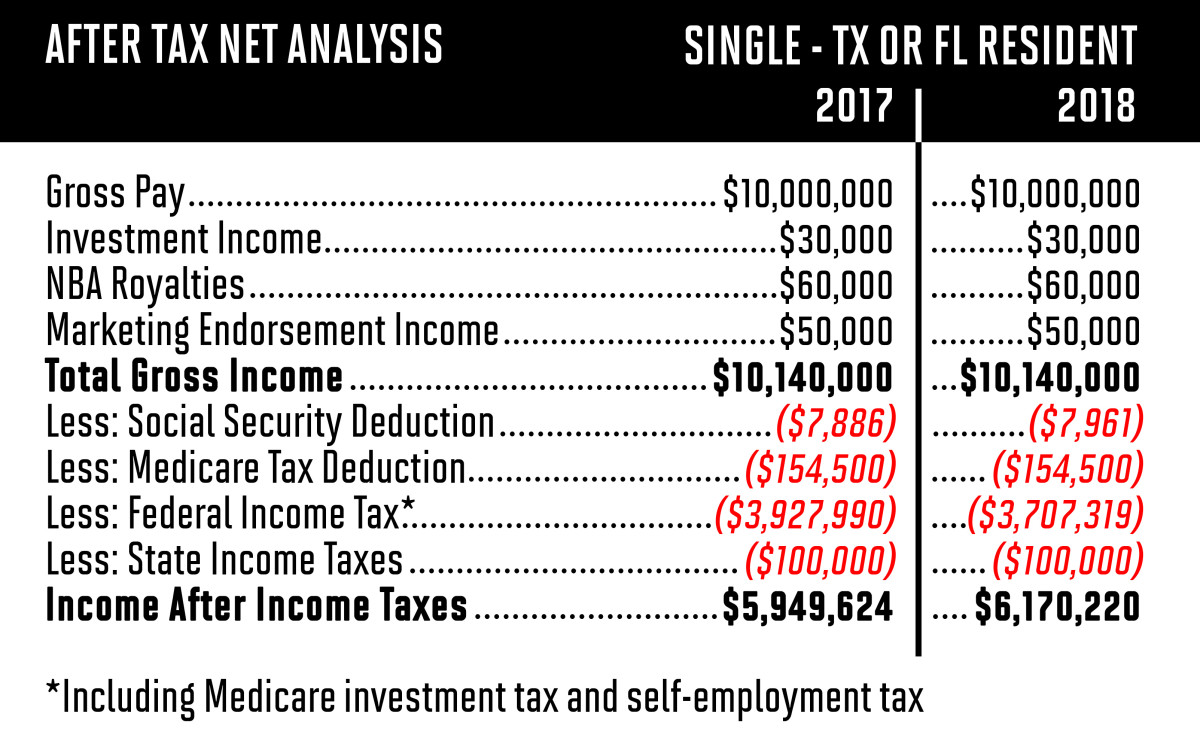

Trumps New Tax Bill The Impact On Star Athletes - Sports Illustrated

Do You Know What Dmv Fees Are Tax Deductible Union City Union City Ca Patch

Deducting Union Dues Drake17 And Prior

Union Dues Are Now Tax Deductible Foa Law

News Of The Week Bill To Deduct Union Dues Stalls In State Senate - National Union Of Healthcare Workers

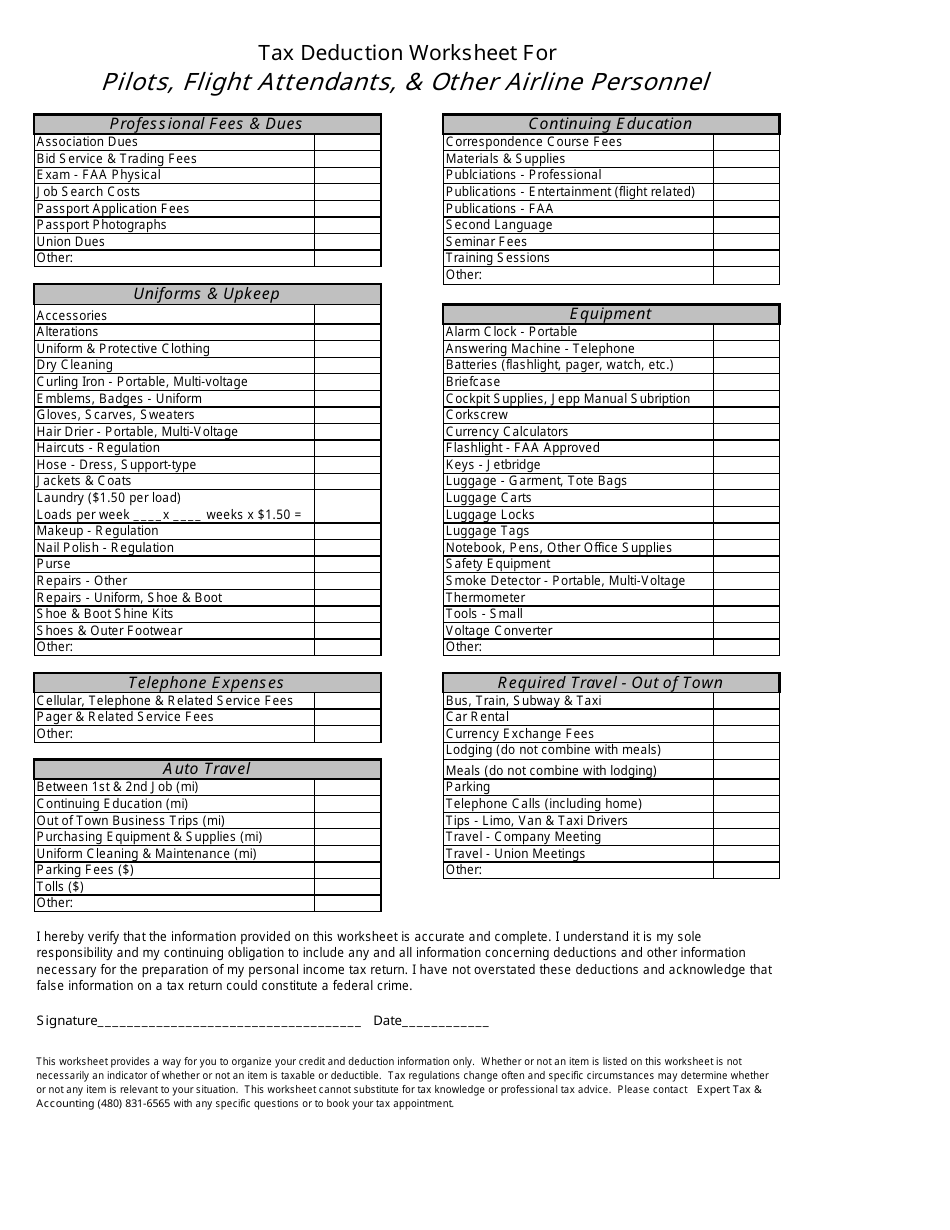

Tax Deduction Worksheet For Pilots Flight Attendants Other Airline Personnel Download Printable Pdf Templateroller

Are Union Dues Deductible

Membership Benefits California State University Employee Union Csusm

Where Do I Enter My Union And Professional Dues Hr Block Canada

Payroll Taxes And Employer Responsibilities