Montgomery County Al Sales Tax Return

The jefferson county sales tax rate is %. The 2018 united states supreme court decision in south dakota v.

Welcome To Montgomery County Texas

When an automotive vehicle is removed from the state within 72 hours or delivered out of state,

Montgomery county al sales tax return. Motor fuel/gasoline/other fuel tax form. Total amount enclosed make check payable to city of montgomery $ this form combines sales and seller’s/consumer's use tax reporting. Alabama has state sales tax of 4% , and allows local governments to collect a local option sales tax of up to 7%.

Therefore, your first city of hartselle local tax return filed with alabama department of revenue is for the tax period ending july 31, 2017, which is due on or before august 21, 2017. 2018) pj gas tax (updated jan. 2018) gas tax (updated dec.

If applicable, businesses may check with each agency to obtain their automotive, farm equipment and manufacturing rates. Montgomery county commission, tax & audit department p. *mail return with remittance to:

100 south lawrence street, 3075 mobile hwy. Bank routing number, bank account number, select. Combined application for sales/use tax form.

2019) sales tax (updated oct. Alabama has a 4% statewide sales tax rate, but also has 287 local tax jurisdictions (including cities, towns, counties, and special districts) that collect an average local sales tax of 3.996% on top of the state tax. Sales tax is also due on the gross receipts from places of amusement or entertainment.

Eva, priceville, somerville, decatur, hartselle, falkville and trinity). • montgomery county tax & audit department: Toggle navigation sales tax calculator

If you need access to a database of all alabama local sales tax rates, visit the sales tax data page. County sales/use tax c/o sarah g. Return due monthly filers should file each calendar month on or before the 20th of the following month even if no tax is due.

2018) pj sales tax (updated oct. Click any locality for a full breakdown of local property taxes, or visit our alabama sales tax calculatorto lookup local rates by zip code. There are a total of 287 local tax jurisdictions across the.

The alabama state sales tax rate is currently %. The following tax rates are currently in effect: Please remit the city of hartselle’s local tax to:

• all returns with zero tax payment or sebp 7/02 any correspondence should be mailed to: Lowest sales tax (5%) highest sales tax (11.5%) alabama sales tax: Return & tax type code discount allowed;

5% on the 1st $100 of tax due, and 2% of all tax over $100. This means that, depending on your location within alabama, the total tax you pay can be significantly higher than the 4% state sales tax. 334‐832‐1697 please note when you file your local montgomery county alabama sales and use tax return, you will need to enter your bank information on the mat system, i.e.

Sales & use administers, collects and enforces several different taxes, including sales tax and consumers tax, and is responsible for administering, collecting, and enforcing those tax types. Total amount enclosed make check payable to city of montgomery $ this form combines sales and seller’s/consumer's use tax reporting. Return due monthly filers should file each calendar month on or before the 20th of the following month even if no tax is due.

The license and revenue division assists businesses in the city of montgomery in issuing and maintaining appropriate business licenses and sales tax numbers. Has impacted many state nexus laws and sales tax collection requirements. The general sales tax rate in the city of alabaster is 9% (state of alabama= 4%, shelby county= 1%, and city of alabaster= 4%).

Sales/seller's use/consumers use tax form. All tax returns are due to the business revenue office by the 20th day of the following month. Spear, montgomery county revenue commissioner po.

5% on the 1st $100 of tax due, and 2% of all tax over $100. Sales tax with estimated payment (se) yes, if tax is timely paid: Discount cannot exceed $400 per month pursuant to executive order no.

Combined application for sales/use tax form. Sales tax (ss) yes, if tax is timely paid: Average sales tax (with local):

This is the total of state and county sales tax rates. Montgomery county lodgings tax rates for lodgings offered inside the county. The local sales tax rate in montgomery county is 0%, and the maximum rate (including maryland and city sales taxes) is 6% as of november 2021.

Montgomery county commission monthly filers should file each calendar month on or before the 20th of the following month even though no tax is due. If you are a alabama business owner, you can learn more about how to collect and file your alabama sales tax return at the 2021 alabama sales tax handbook.

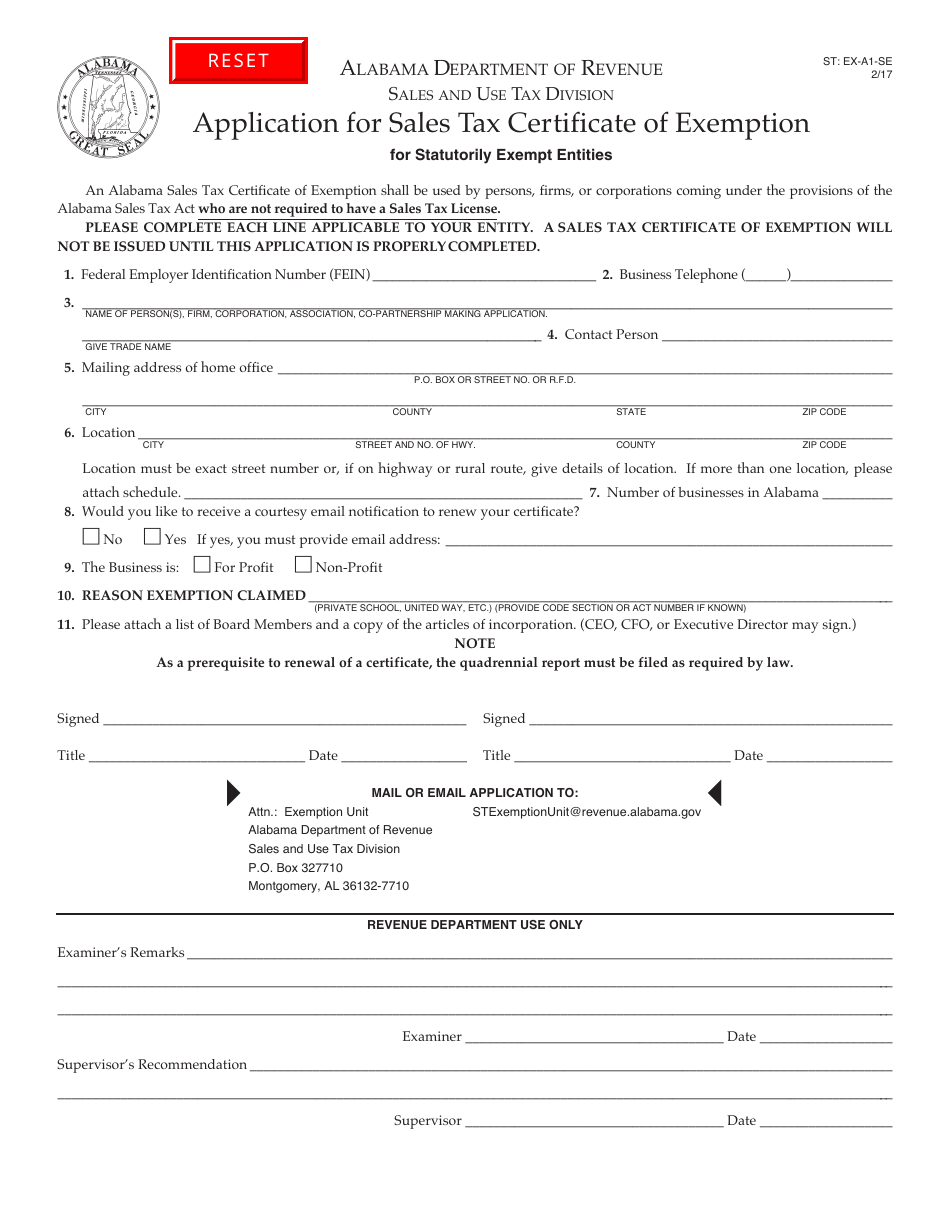

Form St Ex-a1-se Download Fillable Pdf Or Fill Online Application For Sales Tax Certificate Of Exemption For Statutorily Exempt Entities Alabama Templateroller

Listing Presentation Must Dos Real Estate Marketing Plan Real Estate Tips Real Estate Marketing

2

Chicago Now Home To The Nations Highest Sales Tax Sales Tax Chicago National

Pin By Jerri Jensen On Gardening Ideas Bluestone Patio Patio Contemporary Patio

2

Other Alabama Taxpayer Forms Avenu Insights Analytics Taxpayer

County Offices Closed Other Changes In Effect For Monday Holiday In 2021 Martin Luther King Jr County Montgomery County

2

Alabama Retailers Anticipate More Shoppers This Back-to-school Sales Tax Holiday - Alabama Newscenter

Alabama Birth Certificate Signed By Catherine Molchan Donald Birth Certificate Alabama Digital

Sales Tax Audit Montgomery County Al

Pin On Type

2

2

2

2

Alabama Sales Tax - Taxjar

2