California Mileage Tax Rate

Instead, it would be calculated on a per mile basis. 58 cents per mile for business miles driven, up 3.5 cents from 2018.

/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

Checking demaio’s statements about the high cost of living in california, california does have the highest income tax rate in the nation, at 13.3%, followed by hawaii (11%), new jersey (10.75%.

California mileage tax rate. Service vehicles will charge based on mileage from their office to your location. The mileage tax seems like a good. Rates in cents per mile.

Few people volunteered for the programs initially because of privacy and equity concerns, but. California state tax rates are 1%, 2%, 4%, 6%, 8%, 9.3%, 10.3%, 11.3% and 12.3%. The vehicle mileage tax is typically based on how many miles you drive in a particular time frame, like a year or quarter.

Mileage tax is a type of tax that is paid by the driver based on miles driven. For instance, a sedan may have to pay less mileage tax as compared to a pickup truck. Gavin newsom, a democrat, signed legislation friday expanding a pilot program that charges drivers a fee based on the number of miles they drive instead of a gasoline tax.

Diesel fuel is taxed at 24.3 cents per gallon at the federal level and at a combined (all state and local taxes) rate of 37.5 cents at the state level. The federal tax for gasoline has been 18.4 cents per gallon since 1993. Keep in mind, states can also impose other fees and taxes at the pump.

A recent article in the new american reported that thanks to a gas tax increase that just went into effect on november 1, california residents are now paying 12 cents more per gallon of gas and 20. The california road charge pilot program is billed as a way for the state to move from its longstanding pump tax to a system where drivers pay based on their mileage. A mileage tax would not be calculated on a per gallon basis.

In california, aviation fuel is subject to a state excise tax of $0.18 per gallon. Some drivers in california will soon pay taxes based on how many miles they travel, instead of how many gallons of gas they buy, the associated press reports. Instead of paying at the pump when purchasing.

Mileage reimbursement rates do not necessarily. The average state excise tax rate in 2020 is 25.6 cents, but gasoline is taxed at an average rate of 36.4 cents per gallon when other taxes are included. 56 cents per mile (was 57.5 cents in 2020) medical / moving :

But as cars get more fuel efficient or use other energy sources, the gas tax will no longer fund the infrastructure california needs. When business raise prices on goods to cover the cost of a mileage tax the state collects more sales tax revenue. This is why gas prices in say, san francisco, california are different than in a place like atlanta, georgia.

Oregon and utah launched similar pilot programs in 2015 and 2020, respectively, that yielded mixed results. Employees will receive 57.5 cents per mile driven for business use. 14 cents per mile driven in service of charitable organizations.

Since 2015, the program allows the state to study a road user charge based on vehicle miles traveled as an alternative to fuel taxes. The tax is imposed on the removal of motor vehicle fuel in california from a terminal if the motor vehicle fuel is removed from the rack. If you are a throughputter, terminal operator, blender, enterer, refiner, position holder vessel/pipeline operator, industrial user, or train operator you will need to register with the cdtfa.

The mileage may vary depending upon the weight of the vehicle. California is researching a potential gas tax replacement that’s both sustainable and equitable: The motor vehicle fuel tax is imposed upon each gallon of fuel entered, or removed from a refinery or terminal rack in this state.

If it’s delivered, transported, whatever the cost goes up. California relies on gas tax and other fuel tax revenues to fund its roadway maintenance and repairs. California law extends vehicle miles traveled pilot program.

2021 personal vehicle mileage reimbursement rates 16 cents per mile (was 17 cents in 2020) The gas tax rate is based on changes effective july 1, 2021.

Gavin newsom has signed into law a bill to extend the state’s mileage tax pilot program. Rates are hypothetical and would be set by the california legislature. *unless otherwise stated in the applicable mou, the personal aircraft mileage reimbursement rate is $1.27 per statute mile.

The standard mileage rates for 2021 are as follows: Here's a breakdown of the current irs mileage reimbursement rates for california as of january 2020. A 1% mental health services tax applies to income exceeding $1.

20 cents per mile driven for medical or moving purposes, up 2 cents from 2018; Hence, all vehicles will have to pay the same amount as mileage tax regardless of their fuel type or fuel efficiency.

California Mileage Reimbursement - Dychter Law Offices Apc

Californias Road Usage Charge Pilot Program Stirs Controversy - The Coast News Group

What Are The Mileage Deduction Rules Hr Block

2021 Irs Business Mileage Rate Of 56 Cents Calculated Using Motus Data

Your Guide To California Mileage Reimbursement Laws 2020

Heres How Bidens Tax Plan Would Affect Each Us State

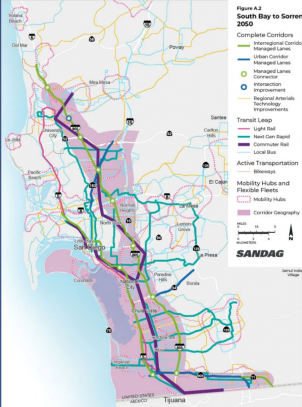

Sandag Approves Mileage Tax Over Objections Of Unfairness To East County East County Magazine

Sandags Proposed Road Charge Would Piggyback On Californias Plans For A Per-mile Driver Fee - The San Diego Union-tribune

/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

2

Sandag Approves Mileage Tax Over Objections Of Unfairness To East County East County Magazine

2021 Everything You Need To Know About Car Allowances

Orange County Ca Property Tax Rates By City Lowest And Highest Taxes

California Law On Employee Vehicle Mileage Reimbursement Williams

2019 Irs Standard Mileage Reimbursement Rate Deduction

Mileage Reimbursement In California - Timesheetscom

2021 Mileage Reimbursement Calculator

Vehicle Mileage Tax Could Be On The Table In Infrastructure Talks Buttigieg Says

Heres What You Should Do If You Forgot To Track Your Mileage Expressmileage