Do You Pay Sales Tax On A Leased Car In Missouri

When you purchase a car, you pay sales tax on the total price of the vehicle. Unlike sales tax, which requires a sale at retail in missouri, use tax is imposed directly upon the person that stores, uses, or consumes tangible personal property in missouri.

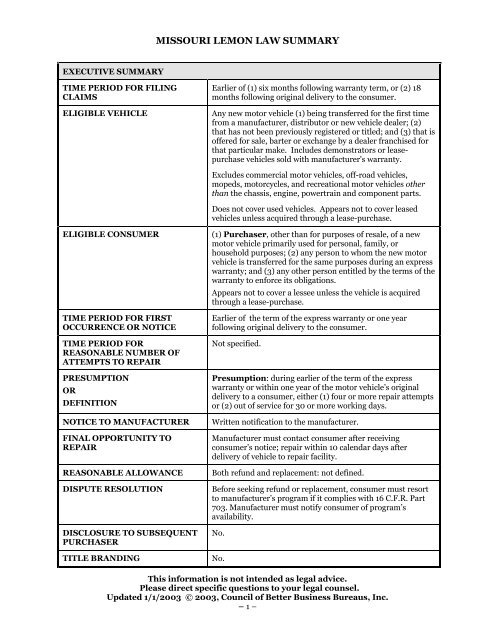

Missouri Lemon Law Summary - Better Business Bureau

The sales tax license must be in the name of the motor vehicle/ marinecraft leasing company.

Do you pay sales tax on a leased car in missouri. Boat and outboard motor titling and. At the very least, you have likely already paid at least some sales tax on the car, so it’s highly unlikely you need to pay taxes on the complete original price of the leased car. Sales of tangible media property are subject to sales tax in missouri.

What kind of taxes do i have to pay if i buy a vehicle in missouri? A sales tax license can be obtained from the missouri department of revenue at the following address: This calculation is only an estimate based on the information you provide.

Missouri charges an auto sales tax of 4.225% of the sales price you paid for your car of truck. The home for all missourians on reddit. And don't put the title in another state, only in the state that you reside in or the company is headquartered in.

Missouri vehicle taxes add up quickly. Motor vehicle titling and registration. Use tax does not apply if the purchase is from a missouri retailer and subject to missouri sales tax.

As of september 2011, oregon, alaska, new hampshire, montana and delaware do not assess a sales tax on consumers, but if you live in one of these states, you may be subject to. For vehicles that are being rented or leased, see see taxation of leases and rentals. State sales tax is 4.225%, and you'll also have to pay a local sales tax (varies depending on county).

A sales tax shall be charged to and paid by a leasing company which does not exercise the option of paying in accordance with section 144.020, on the amount charged for each rental or lease agreement while the motor vehicle, trailer, boat, or outboard motor is domiciled in this state. There is also a local tax of up to 4.5%. Assuming that the sales tax rate is 6%, $3,180 in.

For additional information click on the links below: Missouri vehicle tax is 4.225 percent of the sales price of the car. Upon returning to missouri the vehicle must be safety inspected within 10 days.

Subtract these values, if any, from the sale price of the unit and enter the net price in the calculator. An earlier version of this information guide incorrectly stated that a late payment or penalty charge that is billed to a lessee is not subject to kansas sales tax. In addition to paying for a safety inspection and an emissions inspection, you'll have to pay sales tax.

You don't have sales tax, you will have a use tax which usually the dealer puts in your payment. For example, if you buy a $10,000 car, you can expect to pay $422.50 to the state. This is the place for anything related to the state of missouri.

For most states, car sales tax is calculated before a down payment and is based off the total selling price of the vehicle. A copy of the missouri sales tax license. The maximum tax that can be charged is 725 dollars on the purchase of all vehicles.

Registration (license plate) fees, based on either taxable horsepower or vehicle weight (if. The vehicle must also be emissions inspected within 10 days, if applicable. (this protects people who lease from having a spike in how much they owe if state sales taxes are increased.)

$14.50 for title (includes the $6 processing fee) Any motor vehicle, trailer, boat, or outboard motor which is. Since the lease buyout is a purchase, you must pay your state's sales tax rate on the car.

Missouri collects a 4.225% state sales tax rate on the purchase of all vehicles. Most lessors generally reimburse themselves for the tax they. Add the tax payment to the lease payment.

The lessor is the owner of the vehicle and is liable for tax. You pay the personal property tax every year. This table shows the taxability of various goods and services in missouri.

When lessors lease vehicles for a term longer than one year, they owe use tax up front on the selling price of the vehicle. Part of a customer's charges for a leased vehicle and are subject to sales tax. Although most states only charge sales tax on individual monthly payments (and down payment, if any), some states, such as texas, new york, minnesota, ohio, georgia, and illinois, require the entire sales tax to be paid up front, based either on the sum of all lease payments or on the full sale price of the vehicle, depending on the state.

If you are interested in the sales tax on vehicle sales, see the car sales tax page instead.scroll to view the full table, and click any category for more details. Note that, if you traded in your car or truck, subtract the offered deduction from the sales price to figure out the amount for which you will be taxed.

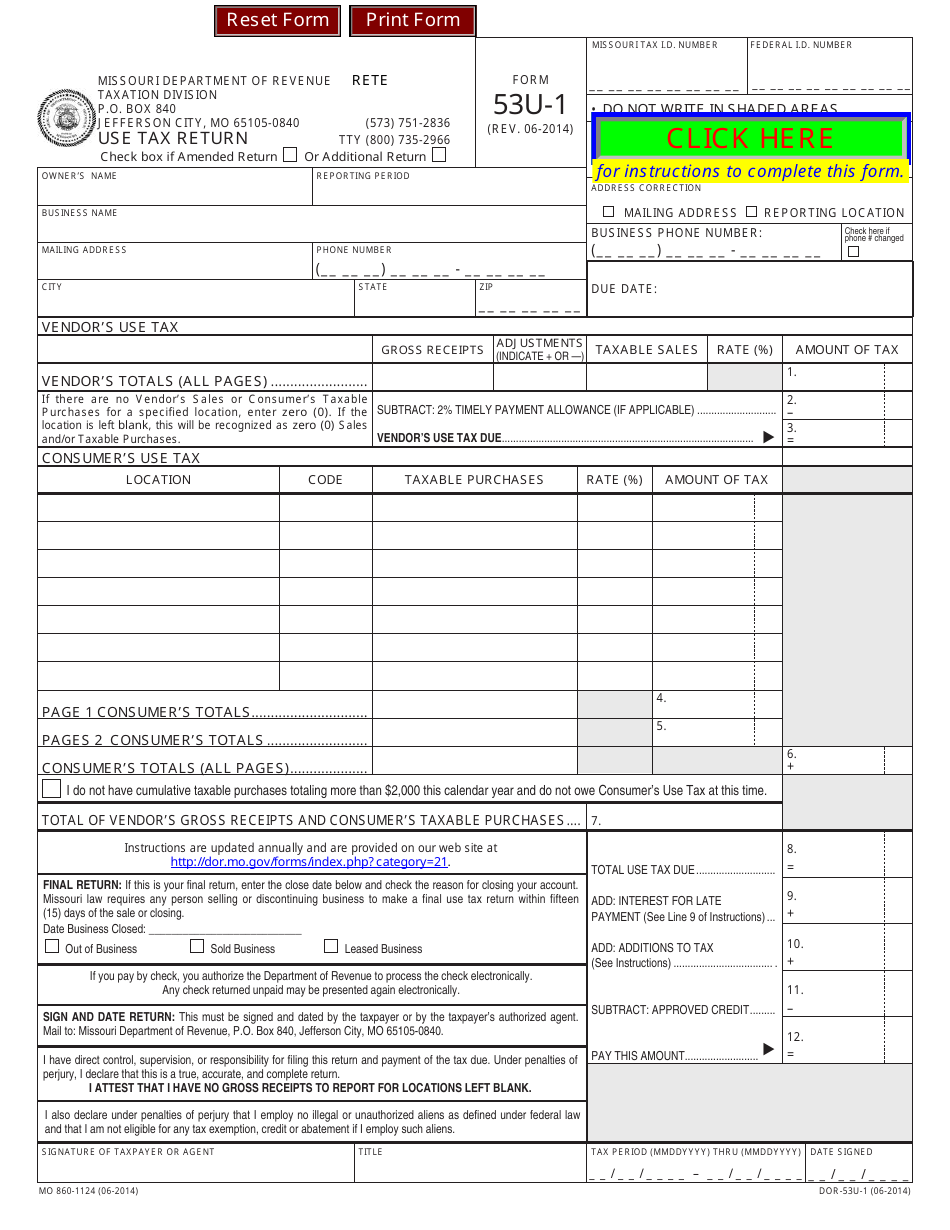

Form 53u-1 Download Fillable Pdf Or Fill Online Use Tax Return Missouri Templateroller

Missouri Sales Tax Guide For Businesses

2

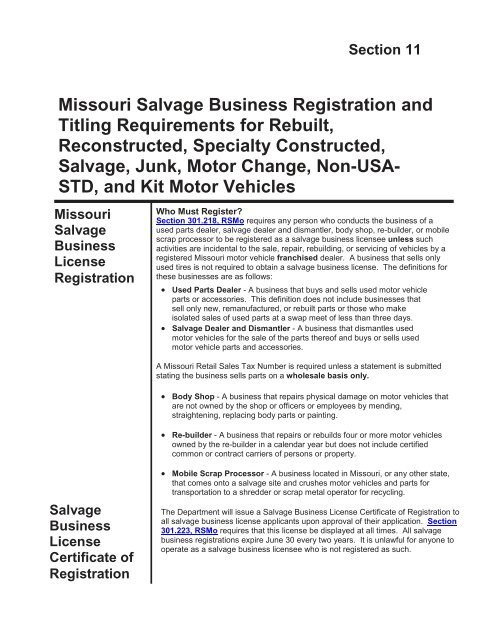

Section 11 Missouri Salvage Business Registration And Titling

Missouri Title Transfer Etags Vehicle Registration Title Services Driven By Technology

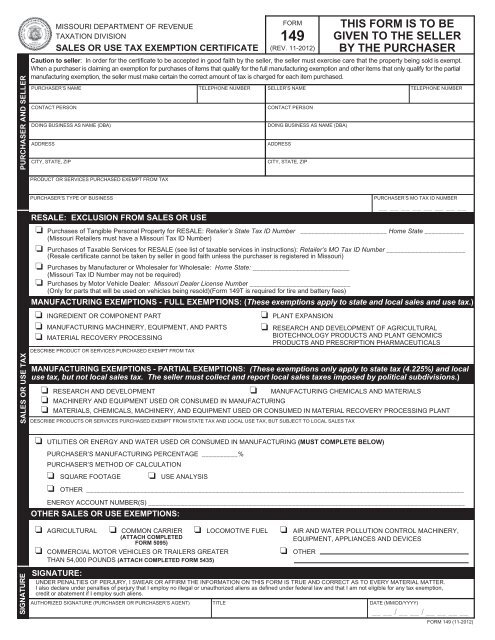

Form 149 Sales And Use Tax Exemption Certificate - Missouri

Monthly Rental Agreement Real Estate Forms Rental Agreement Templates Being A Landlord Real Estate Forms

Subaru Ascent Suv Lease Finance Prices - St Peters Mo

2

How Does A Car Lease Work Gary Crossley Ford Kansas City Mo

Used Honda Cr-v For Sale In Kansas City Mo Edmunds

2

2

Used Volkswagen Atlas For Sale In Saint Louis Mo Carscom

2

2021 Honda Pilot Lease Deal 329mo For 36 Mos Jefferson City Mo

Missouri Car Loan Deficiency Laws Missouri Real Estate Lawyer Missouri Real Estate Lawyer

Subaru Outback Lease Offers Deals - Creve Coeur Mo

Missouri Car Sales Tax Calculator