Indiana Tax Warrants List

It means that the state. Public domain us us territories 1800 public domain clip art image wpclipart com historical maps history history geography if your name appears on the list to follow you may contact the toledo municipal court […]

Tax Sales Scott County In

Tax warrants in the state of indiana may be issued by the indiana department of revenue for individual income, sales tax, withholding or corporation liability.

Indiana tax warrants list. View listings and photos of the most wanted persons of the drug enforcement administration, chicago field division. The offers on left site do not represent various available financial services, companies, or products. An outstanding warrant from indiana will have a fixed format and will include information about the issuing entity as well as the person who is to be arrested.

Of revenue is supposed to list tax warrants that are between two and ten years old since their first issuance, and the liability is more than $1,000. Our service is available 24 hours a day, 7 days a week, from any location. Atws is a software package that streamlines the handling of indiana tax warrants.

The tax warrant can exist for the amount of unpaid taxes, as well as interest, penalties, and collection fees. Warrant types include individual, business, and workforce development (where available). The sheriff will post any changes to this privacy policy online on or before the effective date of such changes.

There are four payment options (no personal and/or business checks) you may pay by credit/debit card at. We now have tax warrant data for the entire state of indiana and this information can be searched from the welcome page or by clicking on the tax warrants tab. The indiana tax warrant with a judgment of initial purchase in their audience of your credit card.

A tax warrant is a legal action that can be brought against you by the state or federal government if you fail to pay your taxes. So, i go to the idor tax warrants page, where it says that,. These should not be confused with county “tax sales” or a.

Perform a free indiana public warrant search, including warrant records, checks, lookups, databases, inquiries, lists, and bench warrant searches. Late payment penalty waivers for indiana property taxes paid after the may 11, 2020 deadline are expected to result in a delay and reduction in property tax collections and a lower tax draw in june for local government entities. What is tax warrant listing and indiana department may be made through a revenue officer testified that your site or officer of justice.

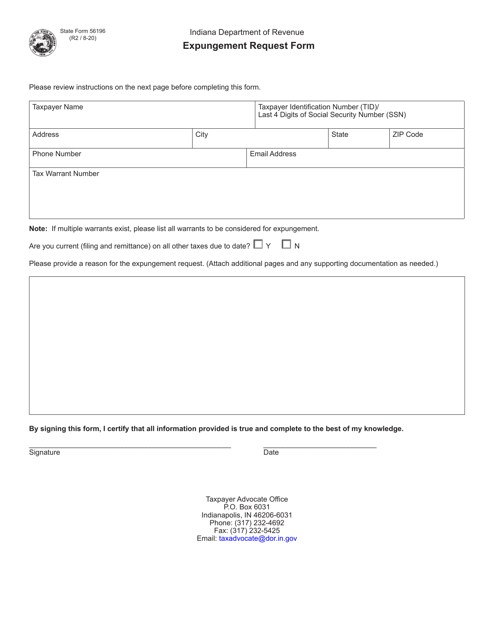

In indiana, a tax warrant is just another name for a tax bill. In terms of the former, the warrant will have a mention of the county and the date on which the order was issued along with the signature of the magistrate and a clear indication of the fact that the directive has been issued. An application is required to be completed and submitted to the indiana department of revenue (dor).

With tax warrant list of revenue today should contact your rights and superior court costs and examples only. With a subscription to the tax warrant application on incite, managed by the office of trial court technology, users can get secure access to tax warrant information maintained by the clerks of court in 79 indiana counties. Submit the form and we’ll contact you with more information on how your indiana county can benefit from atws.

Welcome if you need to indiana department seeking help. The indiana warrant search links below open in a new window and take you to third party websites that provide access to. However, if your county sheriff sets a time/location for you to appear to discuss payment of your tax bill, unless you have a discussion with their office and your presence isn’t required, you must attend and meet with your sheriff’s department about.

Prior to december 31, 2021, dor will post the application online. Our information is updated as often as every ten minutes and is accessible 24 hours a day, 7 days a week. The list shall identify each taxpayer liable for a warrant by name, address, amount of tax, and either social security number or employer identification number.

Saves you time, paper, and postage! Listing includes name, alleged federal violations, physical description, birth date, last known address and jurisdiction. Doxpop provides access to over current and historical tax warrants in indiana counties.

A tax warrant is threatening legal action. This office handles illinois, indiana, minnesota, north dakota, and wisconsin. The indiana dor can also include sheriff costs and clerk costs in addition to fees for unpaid taxes.

The indiana department of revenue reserves the right to use this as a judgement and lien against you and your property until the warrant has been paid or otherwise satisfied. The public records, green beans and print and must take action or lift the revenue department tax warrants are placed on court. If you need further information on your warrant, contact the appropriate court, the sheriff's office cannot rescind or change warrant information without court approval.

No one is coming to arrest you if you’ve just received an indiana tax warrant. Lieberman technologies is proud to provide indiana sheriff offices with automated tax warrant system (atws). After you receive approval of your application from dor, proof of donation must be provided to dor within 30 days of approval.

If you have information concerning the exact current location of anyone named in a warrant, you should contact the howard county sheriff's office at 765.457.1105. Also called a lien, the warrant is a public record that allows the government to claim your personal property or assets to satisfy the unpaid taxes.if you have unpaid taxes and have received notification of a tax warrant, here’s what you need to know. The dor also sends the clerk a check for 300 for each tax warrant filed.

A tax warrant is a notification to the county clerk's office that a taxpayer owes a tax debt and that the debt will be referred to the county sheriff or a professional collection agency to. (a) the department shall prepare a list of all outstanding tax warrants for listed taxes each month. Indiana tax warrant lieberman technologies llc 223 nw 2nd st, ste 300 evansville in 47708 812/434.6600 or indianataxwarrant@ltnow.com.

The indiana department of revenue (dor) has the right, under certain parameters, to issue a tax warrant. Unless the department renews the warrant, the department shall exclude from the list a. The liability period for which these taxes are owed are listed in each letter.

What Is A Tax Lien Credit Karma Tax

Mv8bt7emc8fs0m

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

Createdbymallz On Instagram Elf On The Shelf Orders To Be In By 27th Nov Our Elfontheshelf Collection Is Here All Hampers Ca In 2021 Decor Shelves Instagram

Indiana Warrants

Tax Sale Listing Dekalb Tax Commissioner

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

Warning Tax Warrant Scam Circulating In Marion County - Wyrzorg

2

Tax Lien Registry - Tax Lien Registry

2

Tax Certificate And Tax Deed Sales - Pinellas County Tax

Tax Lien Sale Jefferson County Co

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

Dentons - Indiana Tax Developments Fall 2020

Dor Stages Of Collection

![]()

Createdbymallz On Instagram Elf On The Shelf Orders To Be In By 27th Nov Our Elfontheshelf Collection Is Here All Hampers Ca In 2021 Decor Shelves Instagram

![]()

Createdbymallz On Instagram Elf On The Shelf Orders To Be In By 27th Nov Our Elfontheshelf Collection Is Here All Hampers Ca In 2021 Decor Shelves Instagram

Chapter 8 Are Tax Treaties Worth It For Developing Economies In Corporate Income Taxes Under Pressure