Geothermal Tax Credit 2021 Irs

This created a 26% tax credit for costs associated with qualified geothermal equipment “placed in service” through the end of 2021 for all dayton, springfield and sw ohio residents. The incentive will be lowered to 22% for systems that are installed in 2023, so act quickly to save the most.

Top Ten Faqs For Federal Solar Tax Credit 2021 Sunpro Solar

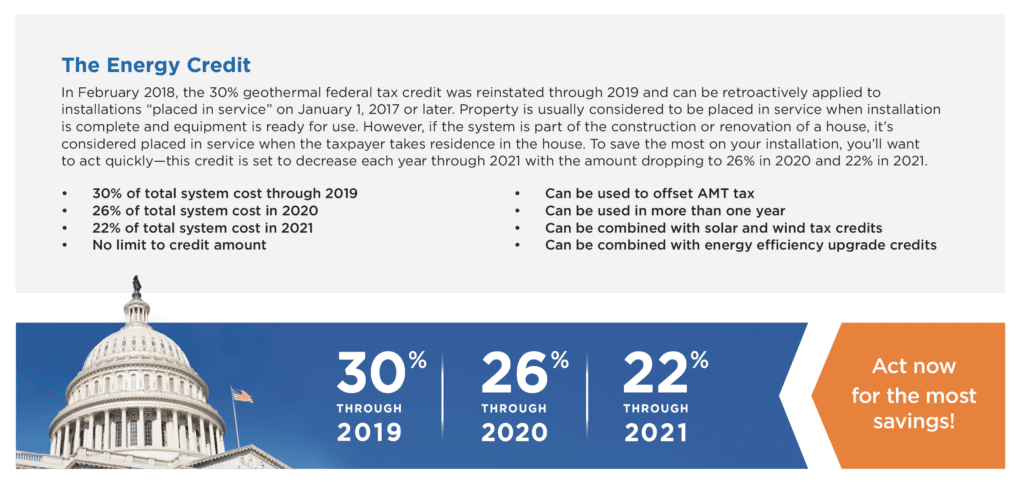

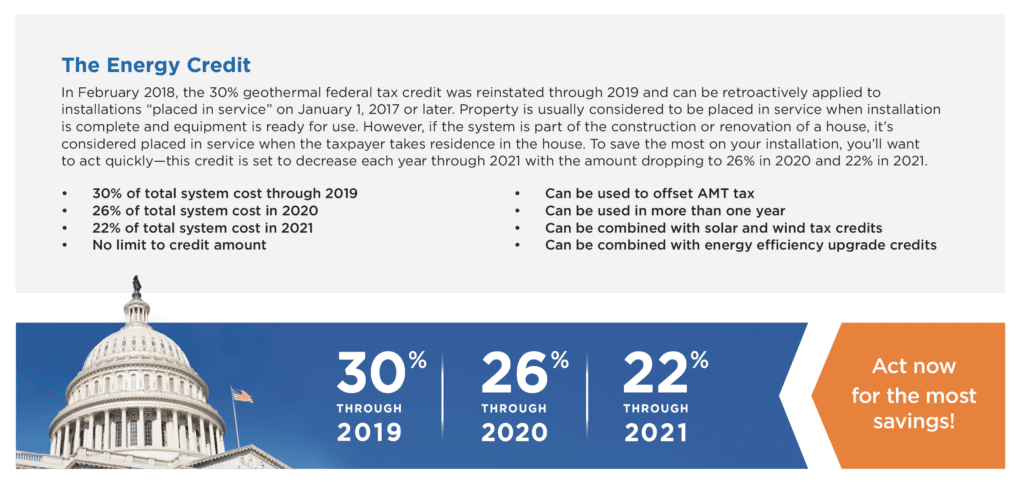

The credit is worth 30% for upgrades made before december 31 st, 2019.

Geothermal tax credit 2021 irs. Like that other credit, the amount you can get back is still 30%, with a decline until the tax credit expires after 2021. Through this legislation geothermal heat pumps were added to the definition of energy property under section 48(a) of the internal revenue code, which provides a 10% investment tax credit for spending on property, the construction of which begins prior to 1/1/2022. The renewable energy tax credit is for solar, geothermal, and wind energy installments and improvements.

The tax credit for builders of energy efficient homes has also been retroactively extended, through december 31, 2021.tax deductions for energy efficient commercial buildings allowed under section 179d of the internal revenue code were made permanent under the consolidated appropriations act of 2021. The consolidated appropriations act, 2021, signed into law on december 27, 2020, extends the federal tax credit for geothermal heat pump installations through 2023. In 2018, 2019, 2020, and 2021, an individual may claim a credit for (1) 10% of the cost of qualified energy efficiency improvements and (2) the amount of the residential energy property expenditures paid or incurred by the taxpayer during the.

It's gone through cycles of expiration and extension over the last 15+ years, most recently expiring at the end of 2016 and undergoing reinstatement in 2018. You will add up your various energy credits on irs form 5965. 30% for systems placed in service by 12/31/2019

This includes the solar energy tax credit. $12,000 x 26% = $3,120 qualified geothermal heat pump property expenditures include replacement units as long as they meet the eligibility requirements. Tax credits for geothermal heating & cooling systems credits good thru 2021.

Residential credits will remain at 26% of the total installation cost through 2022, stepping down to. The energy tax credit can be combined with solar and wind credits as well as energy efficiency upgrade credits. All tax credits on these products are eligible until december 31 st, 2021.

The tax credits for residential renewable energy products are now. You may still carry forward any remaining tax credit until the carryforward period expires. A 26% federal tax credit for residential ground source heat pump installations has been extended through december 31, 2022.

You can even keep doing this as long as the tax credit is active. The credits will expire on january 1, 2024. The consolidated appropriations act, 2021, signed into law on december 27, 2020, extends the federal tax credit for geothermal heat pump installations through 2023.

The taxpayer spends $12,000 to install a new geothermal heat pump property in 2021. The 2021 geothermal tax credit has been around in various forms since 2005. What is the 2021 geothermal tax credit?

You may be able to take a credit of 26% of your costs of qualified solar electric property, solar water heating property, small wind energy property, geothermal heat pump property, and fuel cell property. Geothermal systems do qualify for tax credits. For qualified fuel cell property, see lines 7a and 7b, later.

If your tax burden in 2021 is less than the full amount of your credit, you can carry over the remainder when filing your taxes in 2022. Under the consolidated appropriations act of 2021, the renewable energy tax credits for fuel cells, small wind turbines, and geothermal heat pumps now feature a gradual step down in the credit value, the same as those for solar energy systems. Residential credits will remain at 26% of the total installation cost through 2022, stepping down to 22% in 2023.

The geothermal tax credit can offset regular income taxes and even alternative minimum taxes. This in focus summarizes the current renewable energy itc and reviews its legislative history. If your system was installed before december 31, 2019, the tax credit is 30%, 26% if installed by january 1, 2023, and 22% if installed by january 1, 2024.

Under the consolidated appropriations act of 2021, the renewable energy tax credits for fuel cells, small wind turbines, and geothermal heat pumps now feature a gradual step down in the credit value, the same as those for solar energy systems. The geothermal heat pump is replacing a prior geothermal heat pump installed in 1995. In october 2008, geothermal heat pumps were added to section 25d of the internal revenue code.

You may not claim this credit after tax year 2021.

What Is The 2021 Geothermal Tax Credit - Climatemaster Geothermal Hvac

The Alliance For Green Heat - Federal Tax Incentives For Wood And Pellet Stoves - Sustainable Local And Affordable Heating

Top Ten Faqs For Federal Solar Tax Credit 2021 Sunpro Solar

Questions Answered Federal Tax Credits And Local Incentives For Residential Geothermal Installation

The Federal Geothermal Tax Credit Your Questions Answered

What Is The 2021 Geothermal Tax Credit - Climatemaster Geothermal Hvac

Form 5695 Instructions Claiming The Solar Tax Credit Energysage

What Is Form 5695 Obtain An Energy Loan For Housing Purposes Using Form 5695 Newshunt360

How The 2021 Federal Geothermal Tax Credit Works

What Federal Tax Incentives Are There For Geothermal Heat Pumps

Financial Incentives

Irs Releases 2021 Section 45 Production Tax Credit Amounts Mayer Brown - Tax Equity Times - Jdsupra

The History Of Geothermal Systems

The Federal Geothermal Tax Credit Your Questions Answered

Financial Incentives

Federal Tax Credit For Hvac Systems How Does It Work And How To Claim Step-by-step Instructions

Extended 300 Federal Tax Credits For Air Conditioners And Heat Pumps - Symbiont Air Conditioning

Geothermal Investment Tax Credit Extended Through 2023

Form 5695 For 2021 2022 Energy Tax Credits