Des Moines New Mexico Sales Tax Rate

Des moines, ia sales tax rate: The december 2020 total local sales tax rate was also 7.000%.

New Mexico Income Tax Calculator - Smartasset

This is the total of state, county and city sales tax rates.

Des moines new mexico sales tax rate. Today, it is 7% in most areas of iowa. Fort dodge, ia sales tax rate: “gains in sales and use tax as well as corporate income tax remain significant,” says jeff robinson of the legislative services agency, “while individual income tax growth for the year has been flat.”

The estimated 2021 sales tax rate for 98198 is. The des moines county, iowa sales tax is 7.00%, consisting of 6.00% iowa state sales tax and 1.00% des moines county local sales taxes.the local sales tax consists of a 1.00% county sales tax. Des moines, ia sales tax rate the current total local sales tax rate in des moines, ia is 7.000%.

The sales tax was 5% at the time. Clive, ia sales tax rate: Instead of the rates shown for the des moines tax region above, the following tax rates apply to these specific areas:

Coralville, ia sales tax rate: The current total local sales tax rate in new hampton, ia is 7.000%. Davenport, ia sales tax rate:

2021 cost of living calculator: The des moines sales tax rate is 7%. The december 2020 total local sales tax rate was also 7.000%.

The des moines sales tax is collected by the merchant on all qualifying sales made within des moines. View 20 photos for 103 folsom hwy, des moines, nm 88418 a 3 bed, 2 bath, 900 sq. Sales tax rates in polk county are determined by sixteen different tax jurisdictions, clive, ankeny, grimes, alleman, altoona, polk county, elkhart, johnston , bondurant, polk, urbandale, des moines, west des moines, mitchellville, pleasant hill and windsor heights.

No longer do i pay much attention to clothing sales, but perhaps penney’s and several other stores have finally offered. Iowa city, ia sales tax rate: Download all new mexico sales tax rates by zip code the des moines, new mexico sales tax is 5.13% , the same as the new mexico state sales tax.

The des moines county sales tax is collected by the merchant on. The new mexico sales tax rate is currently %. About cramer law plc cramer law business tax real estate from cramerlawplc.com here's a crash course on.

While many other states allow counties and other localities to collect a local option sales tax, iowa does not permit local sales taxes to be collected. The actual rate differs according to income and location, but there is a maximum rate of 28%, so you will not pay more than this. Johnston, ia sales tax rate:

Des moines, iowa vs boston, massachusetts. The des moines, washington sales tax is 10.00%, consisting of 6.50% washington state sales tax and 3.50% des moines local sales taxes.the local sales tax consists of a 3.50% city sales tax. Council bluffs, ia sales tax rate:

The des moines sales tax rate is %. Toggle navigation sales tax calculator Has impacted many state nexus laws and sales tax collection requirements.

Here's how you can avoid paying sales tax on clothing, shoes this month hannah rodriguez, des moines register 8/3/2021 explainer: When you make a profit from the sale of precious metals, you must pay this tax. · estimated median household income in 2017:

Just like the rest of the united states, iowa has a federal capital gains tax. Mfd/mobile home built in 1991. The des moines sales tax is collected by the merchant on all qualifying sales made within des moines

The des moines, new mexico sales tax rate of 6.0625% applies in the zip code 88418. The west des moines, iowa sales tax is 6.00% , the same as the iowa state sales tax. The county sales tax rate is %.

While many other states allow counties and other localities to collect a local option sales tax, iowa does not permit local sales taxes to be collected. Des moines — there’s been a nearly six percent increase in state tax receipts in the past five months compared to the same period a year ago. Remember that zip code boundaries don't always match up with political boundaries (like des moines or union county), so you shouldn't always rely on something as imprecise as zip codes to.

There are two additional tax districts that apply to some areas geographically within des moines. The december 2020 total local sales tax rate was also 7.000%. The minimum combined 2021 sales tax rate for des moines, new mexico is.

Indianola, ia sales tax rate: A salary of $64,000 in des moines, iowa should increase to $135,302 in boston, massachusetts (assumptions include homeowner, no child care, and taxes are not considered. Dubuque, ia sales tax rate:

The cost of living in des moines is 21% lower than the national average des moines housing is 63% lower than the national average new mexico general sales tax is 1% higher than the national average The 2018 united states supreme court decision in south dakota v. 128 (0% urban, 100% rural).

The local sales tax rate in des moines county is 1%, and the maximum rate (including puerto rico and city sales taxes) is 7% as of october 2021. Des moines, new mexico · population in 2017: The current total local sales tax rate in west des moines, ia is 7.000%.

The des moines, iowa sales tax is 6.00% , the same as the iowa state sales tax. Polk county, iowa has a maximum sales tax rate of 7% and an approximate population of 365,771.

Ebay Sales Tax Everything You Need To Know Guide - A2x For Amazon And Shopify - Accounting Automated And Reconciled

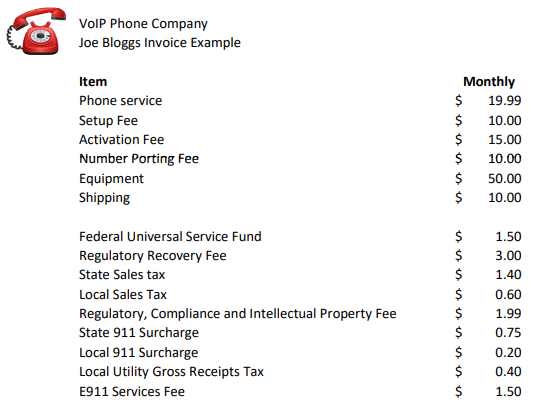

Voip Pricing Taxes And Regulatory Fees Explained

The Louisa County Iowa Local Sales Tax Rate Is A Minimum Of 7

New Mexico Sales Tax Rates By City County 2021

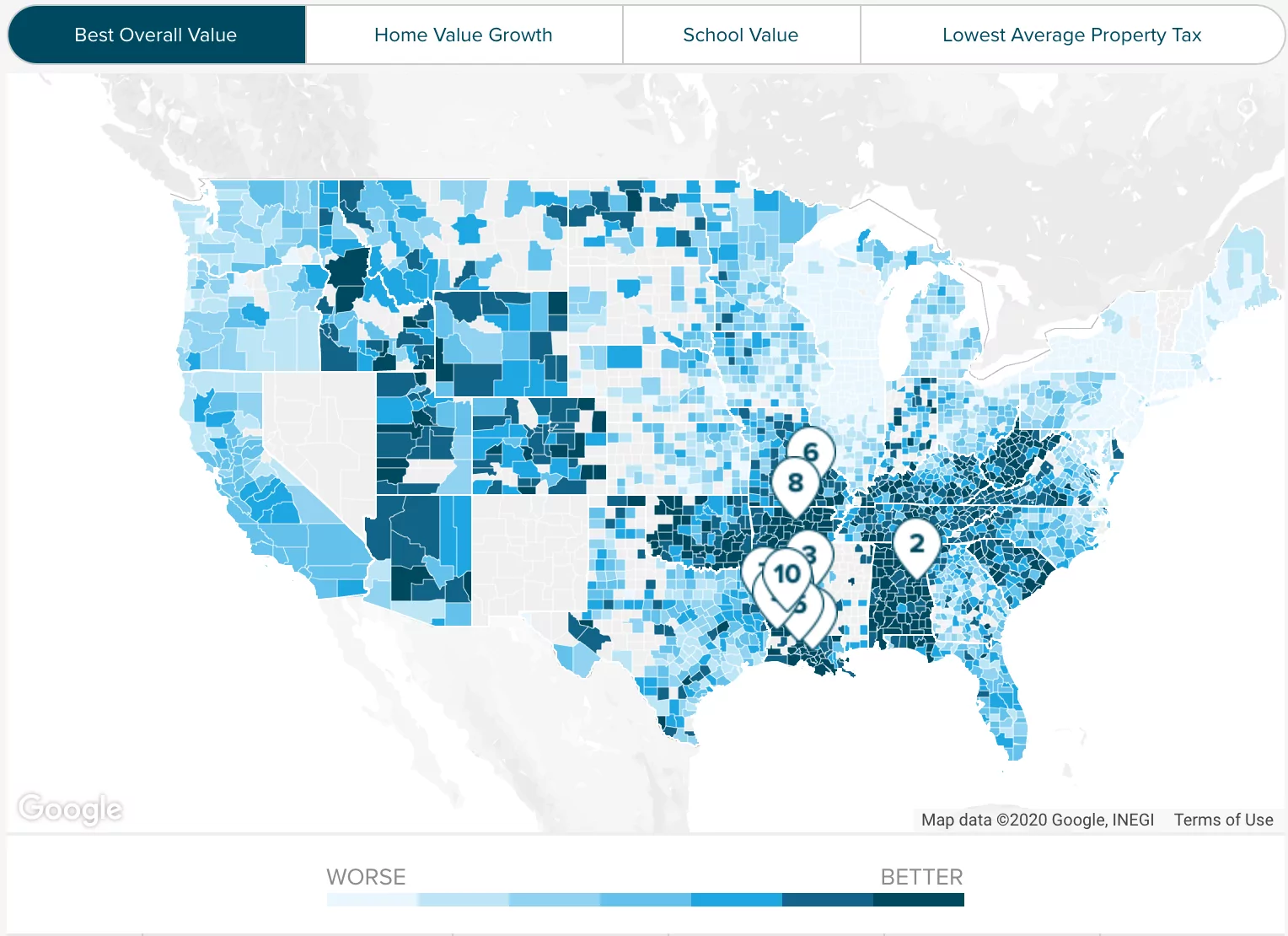

Using The Tax Structure For State Economic Development Urban Institute

Louisiana Sales Tax Rates By City County 2021

Missouri Sales Tax Rates By City County 2021

New Mexico Sales Tax Calculator Reverse Sales Dremployee

New Mexico Income Tax Calculator - Smartasset

Ii Taxes On Commodities A Survey In Tax Harmonization In The European Community

Des Moines New Mexico Nm 88418 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Ii Taxes On Commodities A Survey In Tax Harmonization In The European Community

New Mexico State Tax Return - Etaxcom

Using The Tax Structure For State Economic Development Urban Institute

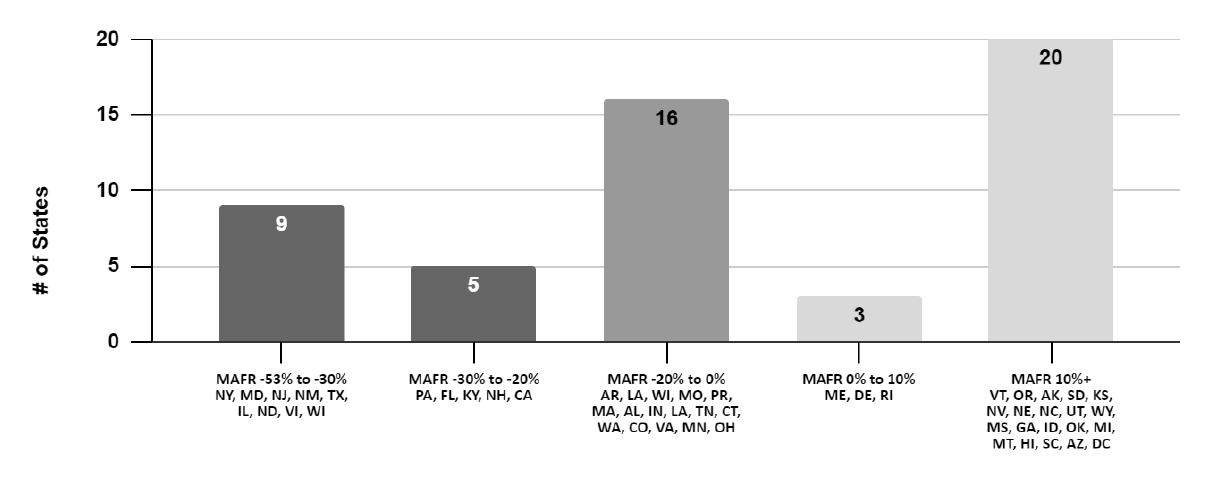

2022 Sui Tax Rates In A Post-covid World Workforce Wise Blog

King County Wa Property Tax Calculator - Smartasset

Sales Tax Rates In Major Cities Tax Data Tax Foundation

North Dakota Sales Tax Rates By City County 2021

The King County Washington Local Sales Tax Rate Is A Minimum Of 65