Salt Tax Repeal March 2021

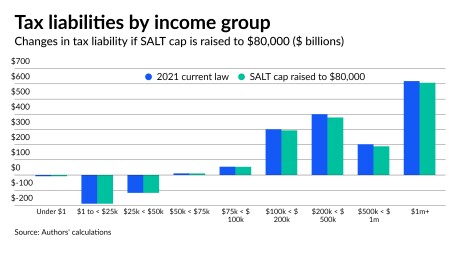

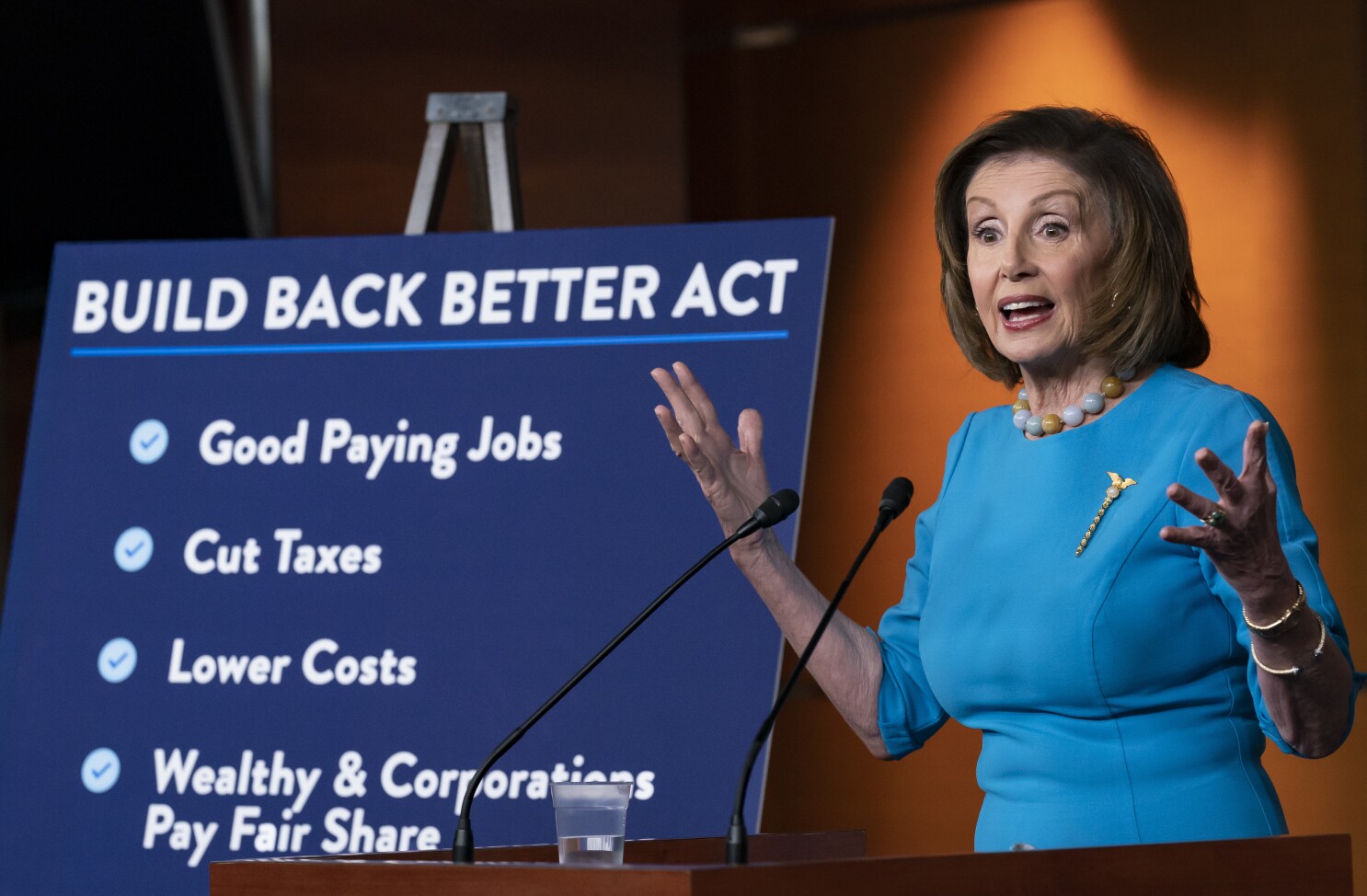

But for many democrats from high property tax states like new york, repealing or altering the federal cap on deductions for state and local taxes (salt) is just as big a priority. Raising the salt cap to $80,000 would reduce federal income tax liability by $55.9 billion in 2021, making it $35.3 billion less expensive than full cap repeal.

Sanders Rips Pelosi Schumer For Backing Repeal Of Salt Cap

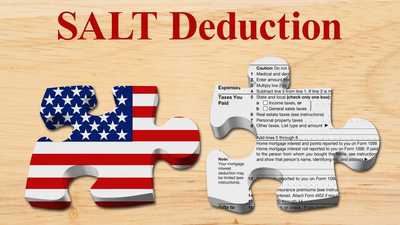

House speaker nancy pelosi is fighting to repeal the cap.

Salt tax repeal march 2021. The state franchise tax board reported that in 2018, the salt cap cost californians $12 billion. I stand by my call that i will not support any change in the tax code unless there is a restoration of the salt deduction. Earlier this week, the house appeared ready to fully repeal the salt cap, cutting taxes for the top 0.1 percent by an average of $150,000 per year.

Biden did not propose a repeal of the $10,000 salt deduction cap, which limits the amount of state and local taxes that can be deducted before paying federal taxes, as part of his social spending. One would allow unlimited state and local tax deductions for people earning up to $400,000 with a. House democrats have proposed to raise the $10,000 cap on state and local tax (salt) deductions to $80,000 and extend that higher limit through.

According to the nonpartisan tax policy center, the top 20% of taxpayers may receive more than 96% of the benefit of a salt cap repeal and the top 1% would see about 54% of the benefit. The $10,000 cap would, in theory, resume in 2024 and 2025. If line 5e of your 2020 schedule a shows $10,000 even, you ran up against the salt cap.

November 5, 2021 at 1:29 p.m. Repealing the salt cap in 2021 would reduce federal income tax liability by approximately $91 billion, or 7.2 percent. In fact, the repeal of the cap would lower the taxes of new yorkers by upwards of $12 billion a year.

According to press reports, the senate is considering repealing the $10,000 cap on the state and local tax (salt) deduction for those making $500,000 per year or less. House democrats on friday passed their $1.75 trillion spending package with a temporary increase for the limit on the federal deduction for state and local taxes, known as salt. The democrats are poised to pass a giant, regressive tax giveaway to the wealthy by raising the salt cap deduction.

The existing $10,000 limit on salt is scheduled to expire at the end of 2025, along with many of the other individual tax changes from trump’s 2017 tax law. The senate approach would likely replace the salt measure in the house version of the bill that calls for lifting the cap to $80,000 from $10,000. Various proposals are under discussion in congress this week to repeal the salt cap.

The plan reportedly would repeal the salt cap for 2022 and 2023 only. The franchise tax board estimated in 2018 that the salt deduction limit cost californians an additional $12 billion a year in federal taxes. Nov 19, 2021 | taxes.

This would be in place of the house plan to lift the cap to $80,000 through 2030 and reinstate it. November 16, 2021, 1:13 pm est updated on november 16, 2021, 1:46 pm est sanders said wealthiest could maintain $10,000 deduction menendez. That’s because only about 10 percent of all tax filers itemize their deductions.

The salt limit deduction brought in $77.4 billion during its first year, according to the joint committee on taxation, and a full repeal for 2021 may cost up to $88.7 billion, and more going forward. Bernie sanders is trying to stop them. Bernie sanders holds a news conference about state and local tax (salt) deductions as part of the build back better reconciliation legislation at the us capitol on november 3, 2021, in washington, dc.

/cdn.vox-cdn.com/uploads/chorus_asset/file/22438807/SALT_Benefits_CBPP.png)

Salt Tax Repeal Democrats Weigh Restoring The State And Local Tax Deduction - Vox

Liberal Democrats Push To Repeal Salt Tax Cap Will Only Benefit Wealthy - Washington Times

Marc Elrich Says Not So Fast On Salt Tax Cap Repeal

Salt Deduction Bond Buyer

Democrats Pressure Biden To Repeal Salt Deduction Cap

Salt Deduction Cap Testimony Impact Of Limiting The Salt Deduction

Salt Deduction Disliked On Both Sides May Live Another Day As Congress Debates 175 Trillion Social-spending Bill - Marketwatch

Salt Break Would Erase Most Of Houses Tax Hikes For Top 1 - Bloomberg

Making Salt Relief Pay For Itself Among Democrats Options - Roll Call

The Retired Investor Will Salt Be Repealed Iberkshirescom - The Berkshires Online Guide To Events News And Berkshire County Community Information

Dems Want To Repeal Salt Cap So They Can Hike State Taxes

Congressman Mike Garcia Introduces Bill To Repeal State Local Tax Deduction Cap

Salt-cap Foes Threaten Biden Tax Plan As Repeal Bid Gains Steam - Bloomberg

/cdn.vox-cdn.com/uploads/chorus_asset/file/22439062/1256311254.jpg)

Salt Tax Repeal Democrats Weigh Restoring The State And Local Tax Deduction - Vox

Calls To End Salt Deduction Cap Threaten Passage Of Bidens Tax Plan

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/22441883/SALT_tax_deduction_poll_Data_for_Progress.png)

Salt Tax Repeal Democrats Weigh Restoring The State And Local Tax Deduction - Vox

Whats The Deal With The State And Local Tax Deduction - Publications - National Taxpayers Union

O5ay_hcl6dyi8m

1 Friendly Salt Cap Repeal Is Part Of The Discussion On Bidens 22t Spending Bill Psaki Says Fox Business