Workers Comp Settlement Taxes

Disposable wages are usually the amount left after fica taxes are removed. Here's what you need to know:

Are Workers Compensation Settlements Taxable

Most people who receive workers' comp do return to work eventually.

Workers comp settlement taxes. Do you still have to pay taxes? It doesn’t matter if they’re receiving benefits for a slip and fall accident, muscle strain, back injury, tendinitis or carpal tunnel. The federal law determines that up to 25% of your disposable income or anything you earn that passes 30% of the federal minimum wage could be garnished.

You do not need to report this income to the irs. June 4, 2019 7:13 pm. This is true even if you've retired due to an illness or injury that gave rise to a workers' comp claim.

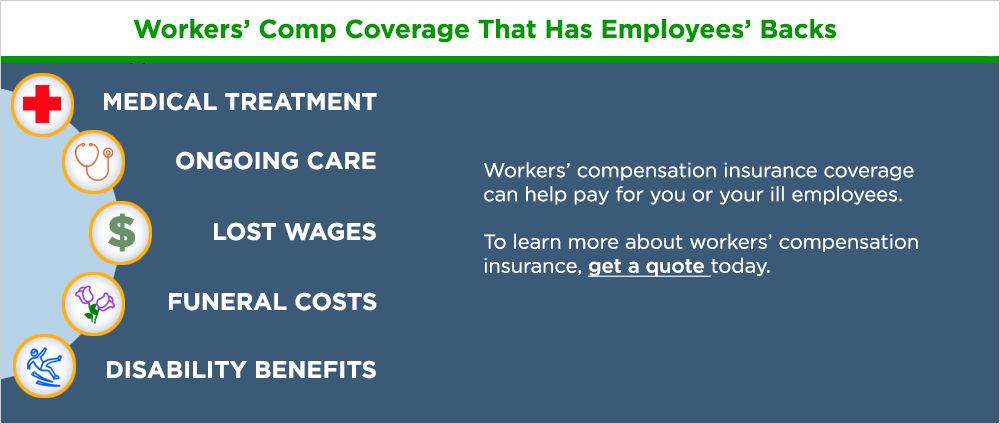

Whether or not you have a permanent or total disability as a. Your weekly ttd is not taxable and neither is ppd or a settlement taxable. If you are also receiving supplemental security income (ssi) or social security disability insurance (ssdi) benefits, a portion of your workers’.

As a general rule, workers’ compensation benefits are not taxable. Although workers' comp benefits generally are not taxable, any retirement benefits you've collected based on your age, years of service, or prior contributions, are not exempt from taxation. The type and severity of your injuries;

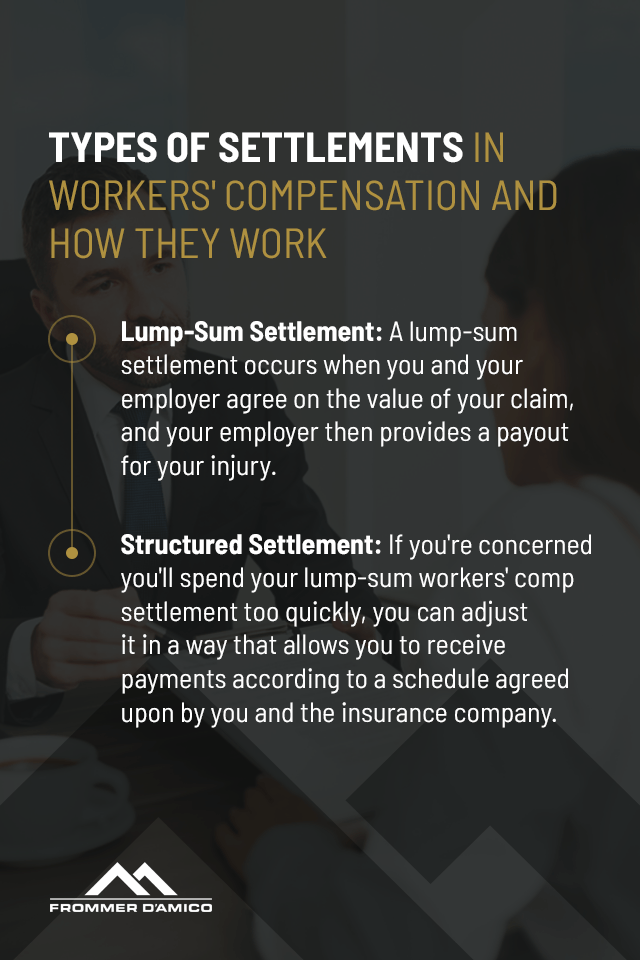

Workers comp benefits are not taxable. However, there is one exception. If you do win a settlement, it can be paid out in one of two ways:

You will not receive a 1099 or a w2. You also shouldn’t have to pay taxes on portions of a settlement that are supposed to pay for things like medical care, repairs to your car or other property, legal fees, loss of quality of life, emotional distress, loss of consortium, or wrongful death. Is a workers’ comp settlement taxable?

In most cases, they won’t pay taxes on workers’ comp benefits. This means you do not have to pay federal or state taxes on them. In most instances, injured workers who receive settlements from workers comp are not taxed and are not obligated to report it on their tax returns.

No, workers’ compensation benefits are not taxable. No, workers' compensation benefits are not taxable income. Thus, workers’ comp settlements are not taxable both at the state and federal level.

You can use the money to pay medical expenses, replace lost income, and support your family and household. Amounts you receive as workers' compensation for an occupational sickness or injury are fully exempt from tax if they are paid under a workers' compensation act or a statute in the nature of a workers' compensation act. According to publication 907, “workers’ compensation for an occupational sickness or injury if paid under a workers’ compensation act or similar law” is exempt.

The amount reduced in your ssdi or ssi payments due to your workers’ comp benefits will be taxable. Is worker comp settlement considered income? The quick answer is that, generally, workers’ compensation benefits are not taxable.

With a structured settlement, you will receive payments, often monthly, over a period of time. The answer to your question is no. As a lump sum or as a structured settlement.

Many, but not all, workers’ comp cases end in a settlement. As workman's compensation is designed to provide for injuries and medical benefits when you are injured on the job, the payments are not taxable income and not reported on your tax return, although there are some exceptions. The disadvantage is that once you agree to structured settlements, it can’t be changed to a lump sum without incurring penalties.

Unlike figuring your workers’ comp pay rates, there is no formula that is used to calculate your workers comp settlement amount.rather, your employer or the insurance company will base their offer on a number of different factors:. In general, the law does not consider workers’ compensation as taxable income. With a lump sum, you will receive the entirety of your award at once.

Workers’ compensation is in the same category of non. A certified tax professional can help you answer specific questions about your tax obligations following a workers’ compensation settlement. In pennsylvania, workers’ compensation benefits are not taxed like regular income, which includes workers’ compensation settlements.

Do i have to report my workers compensation settlement? If you received workers’ compensation benefits for an entire tax year,. There are a lot of answers filled with gibberish here.

Workers’ comp settlement in georgia Workers compensation settlements are not taxed, but if a lump sum is invested, any earnings on that money are taxed. Are workers’ compensation benefits taxable?

However, you may not owe any taxes even when a portion of your workers’ comp benefits is taxable due to the offset. It doesn’t matter whether you’re receiving monthly payments or a lump sum settlement. However, that amount is usually not significant enough for taxation.

Do You Pay Taxes On Workers Comp Checks What You Need To Know

When Will Workers Comp Offer A Settlement Bdt Lawfirm

Workers Comp Back Injury Settlements - Tina Odjaghian Law

Can I Get A Settlement From Workers Compensation If I Go Back To Work John Foy Associates

How A Workers Comp Settlement Is Calculated - Bdt Law Firm

How Long Does It Take To Get A Workers Comp Settlement Check

Michigan Workers Comp Law Protects Employees Hurt On-the-job It Is A Safety Net That Covers Medical Bill In 2021 Employment Workers Comp Insurance Workplace Accident

Is Workers Comp Taxable Gordon Gordon Law Firm

What Happens If You Dont Pay Taxes A Peak Behind The Curtain Concept Workers Comp Insurance Marketing Strategy

Do I Have To Pay Taxes On A Workers Comp Payout Adam S Kutner Accident Injury Attorneys

Do I Have To Pay Taxes On A Workers Comp Payout Bachus Schanker

Is Workers Comp Taxable Income In Michigan What You Need To Know

Do I Have To Pay Taxes On My Workers Comp Benefits

How To Avoid Taxes Like The Rich Top Tax Tips Of The Wealthy Estimated Tax Payments Tax Time Filing Taxes

Getting Hurt On-the-job Can Turn A Persons Life Upside Down This Is Especially True For Those Families Living Paycheck-to-paychec Worker Work Accident Paying

Workers Comp Return To Work Policy Workers Compensation

Are Workers Compensation Benefits Taxable In California Workers Compensation Attorney

Is Workers Comp Taxable

What To Do When Youre Offered A Workers Comp Settlement - Top Legal Advice