Expanded Child Tax Credit Build Back Better

16, the build back better program only extends the credit through 2022 with the amount per child dropping to just $1,000 per child after 2025. The house of representatives on friday approved president joe biden’s “build back better” plan that would extend the expanded child tax credit established in the coronavirus relief package for one year, create universal and free preschool, subsidize child care for most families, and expand free school meals to millions of children.

Build Back Better Cost Would Double With Extensions Committee For A Responsible Federal Budget

The “build back better” (bbb) framework released oct.

Expanded child tax credit build back better. Of the roughly $1.8 trillion in new programs, four components are specifically aimed at supporting families: The bill would increase the value of the child tax credit (ctc) as authorized under the american rescue plan act (arpa). “the build back better framework will provide monthly payments to the parents of nearly 90 percent of american children for 2022—$300 per month per child under six and $250 per month per child.

The expanded child tax credit is providing more families than ever before a monthly refund to help pay for necessities like food for the fridge, rent, diapers and utilities. Under build back better, families could receive advance child tax credit payments of $300 per child under 6 and $250 per child ages 6. Last year, 44% of adults reported they had skipped at least one “medically necessary” prescription drug due to cost.

Polling on biden's build back better plan 10:28. The house build back better legislation would ensure that families continue to get a significantly expanded child tax credit via monthly payments through 2022; The build back better act extends the expanded child tax credit, as well as the expanded earned income tax credit and the tax credit to help pay for child and dependent care.

The build back better act contains a large number of tax provisions, ranging from an extension of the advance child tax credit, to a wide variety of green energy tax incentives, and a minimum tax on corporations. The build back better bill will likely include a provision to extend the expanded child tax credit, most likely for another year, although negotiations are ongoing. The $1.75 trillion social and climate bill would make the child tax credit fully refundable on a permanent basis.

Build back better extends the expanded child tax credit (ctc) under the american rescue plan act through 2022. — an expanded child tax credit would continue for another year. This latest reiteration of the build back better plan would extend the $3,000 and $3,600 child tax credits for another year.

The expanded child tax credit (ctc) has already had an impact since it began delivering monthly checks in july to families with children ages 17. The build back better bill would extend increased payments in the expanded child tax credit, which was originally passed through the american recovery bill, through the. Extend for one year the current expanded child tax credit for more than 35 million american households, with monthly payments for households earning up to $150,000 per.

The expanded child tax credit, a recently instituted annual payment of up to $3,600 per child that most families now receive if they have kids. Under the american rescue plan, the child tax credit was expanded for the 2021 tax year to a total of $3,600 for children 5 and younger, and $3,000 for those. The build back better plan, also known as the reconciliation bill, is extremely expensive—in its original form, it topped $3.5t.included.

Eligible families (earning up to $150,000 annually) with children receiving $3,000 per child ($3,600 for children under age 6) for the 2021 tax year. According to cnbc as of nov. This week, the washington post.

The president had been pushing to. The build back better act could extend the expanded child tax credit beyond this year, which could cut child poverty by more than 40%. Centrist democrats demand cutting down child tax credit.

Households earning up to $150,000 per year get the credit paid to them on a. And it would permanently make the full credit available to children in families with low or no earnings in a year, locking in substantial expected reductions in child poverty. An extension of the child tax credit:

The house of representatives passed the build back better act on friday. The american rescue plan increased the child tax credit from $2,000 per child to $3,000 per child for children six and over and $3,600 for children under. 28 by the white house offers a vision of what the final product may look like.

Child Tax Credit In Bidens Build Back Better Spending Bill Explained - The Washington Post

Build Back Better Extends 3000 Enhanced Child Tax Credit For A Year

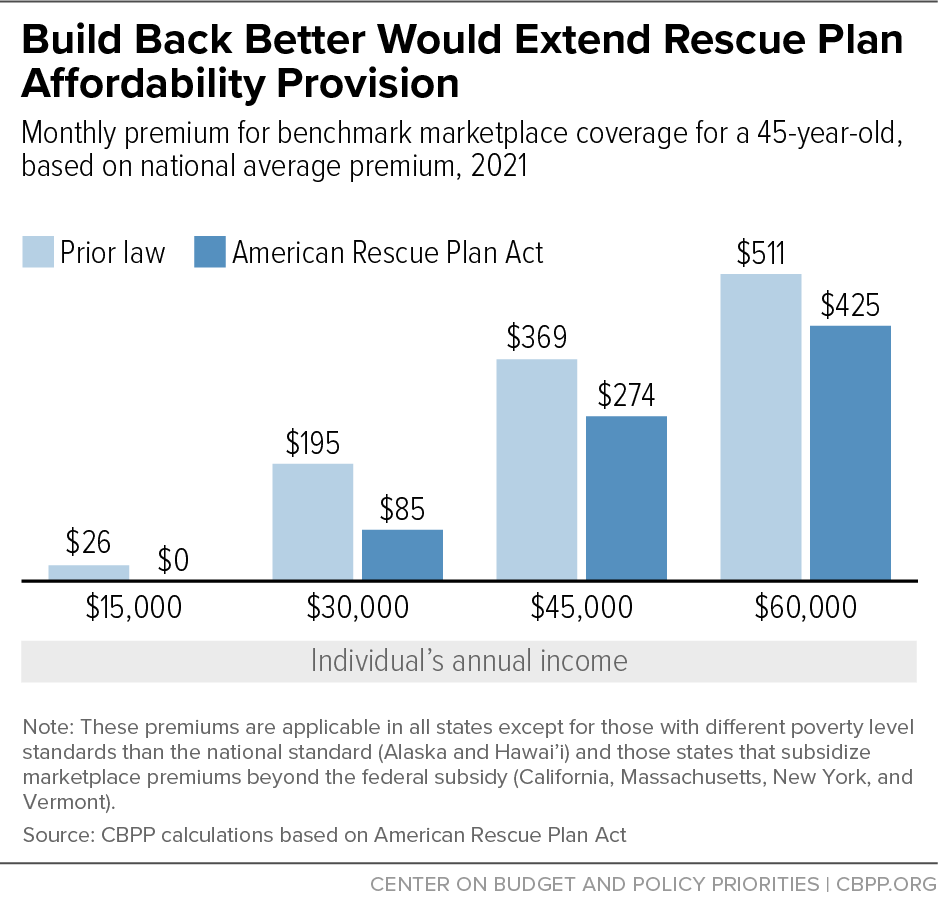

Build Back Better Increases Health Coverage And Makes It More Affordable Center On Budget And Policy Priorities

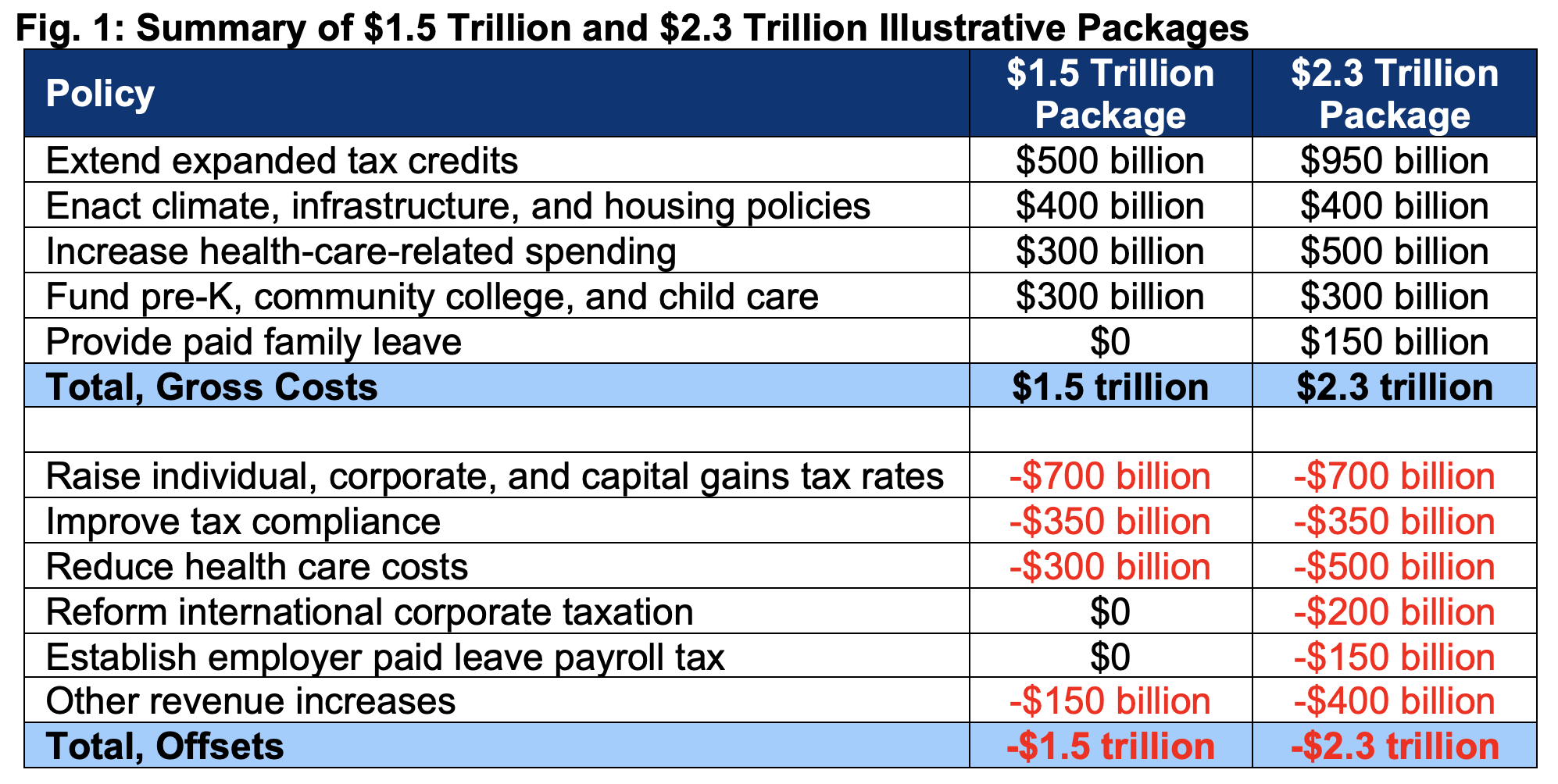

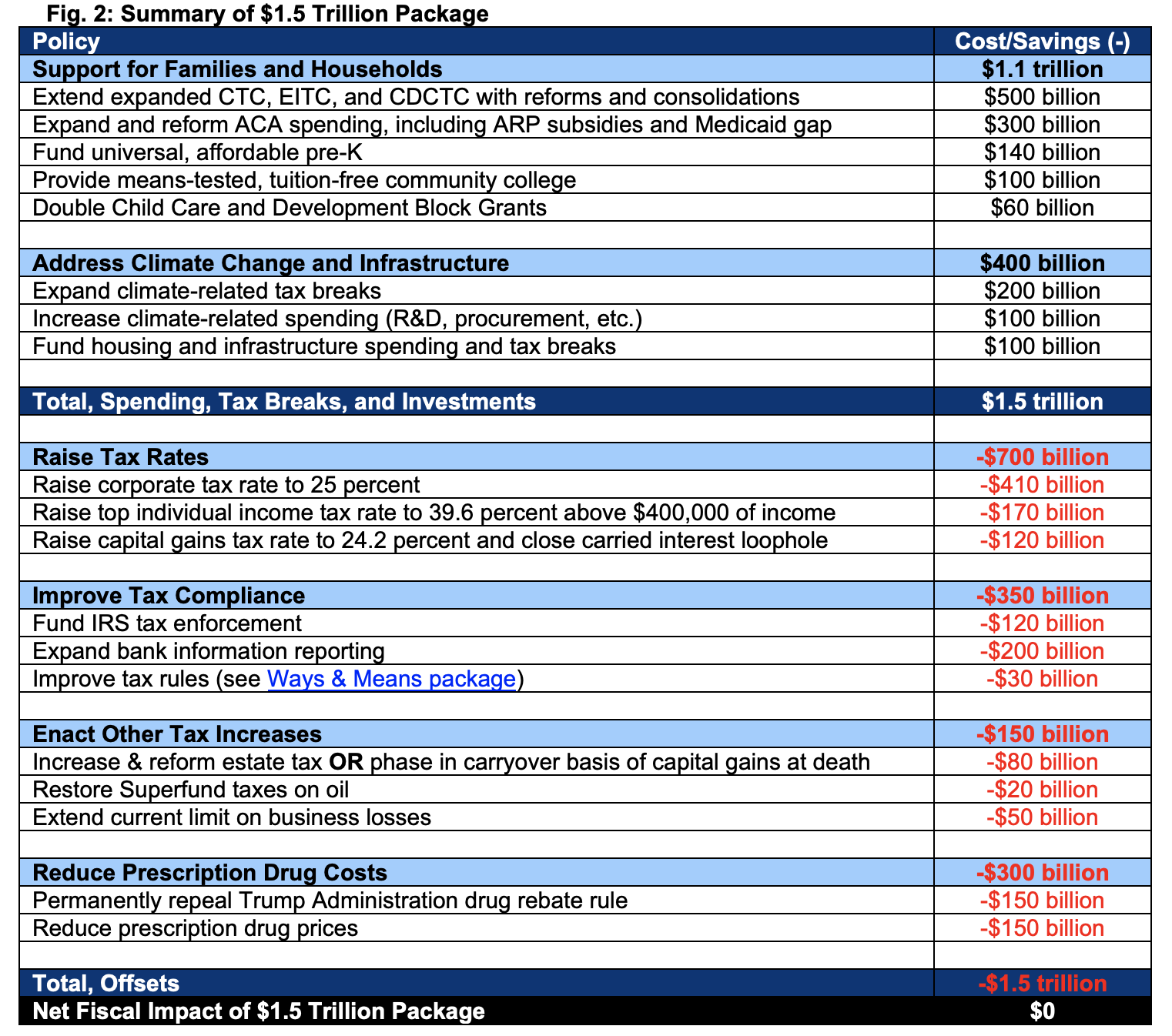

Build Back Better For Less Two Illustrative Packages Committee For A Responsible Federal Budget

Funding For Monthly Child Tax Credit Through 2022 Included In Build Back Better Act

Build Back Better For Less Two Illustrative Packages Committee For A Responsible Federal Budget

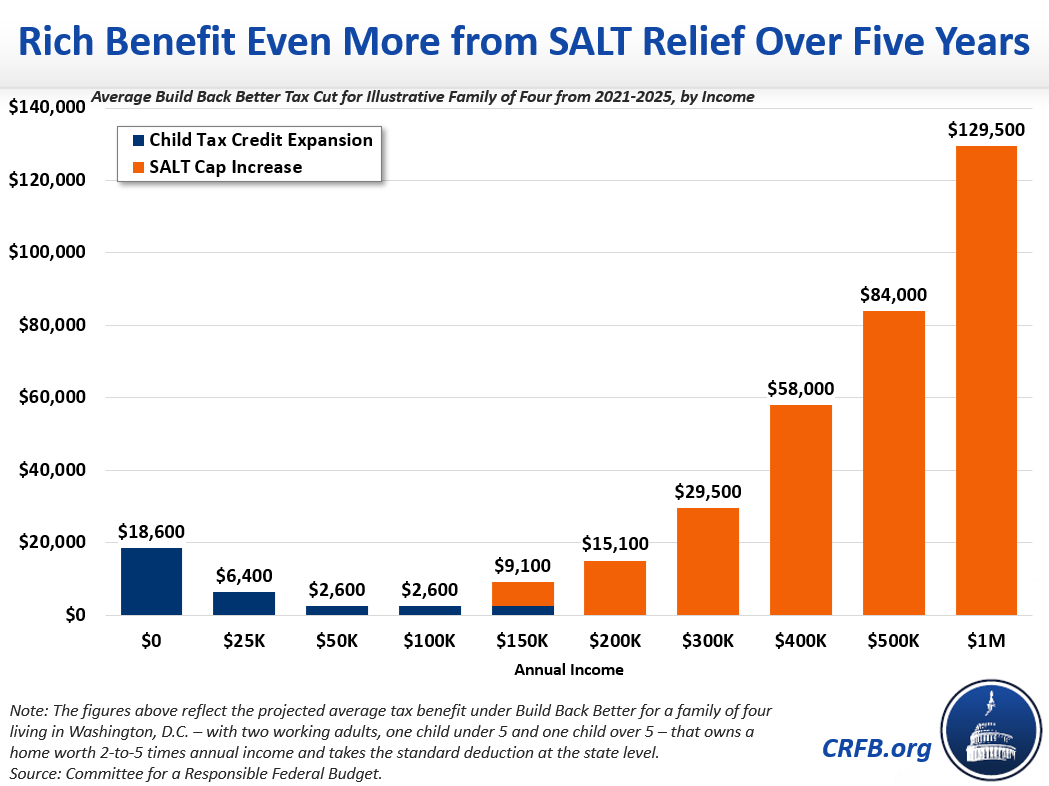

How Build Back Better Act Gives High Earners A One-year Reduction In Taxes

Build Back Better Salt Gains For The Rich Eclipse Child Credit Boost Committee For A Responsible Federal Budget

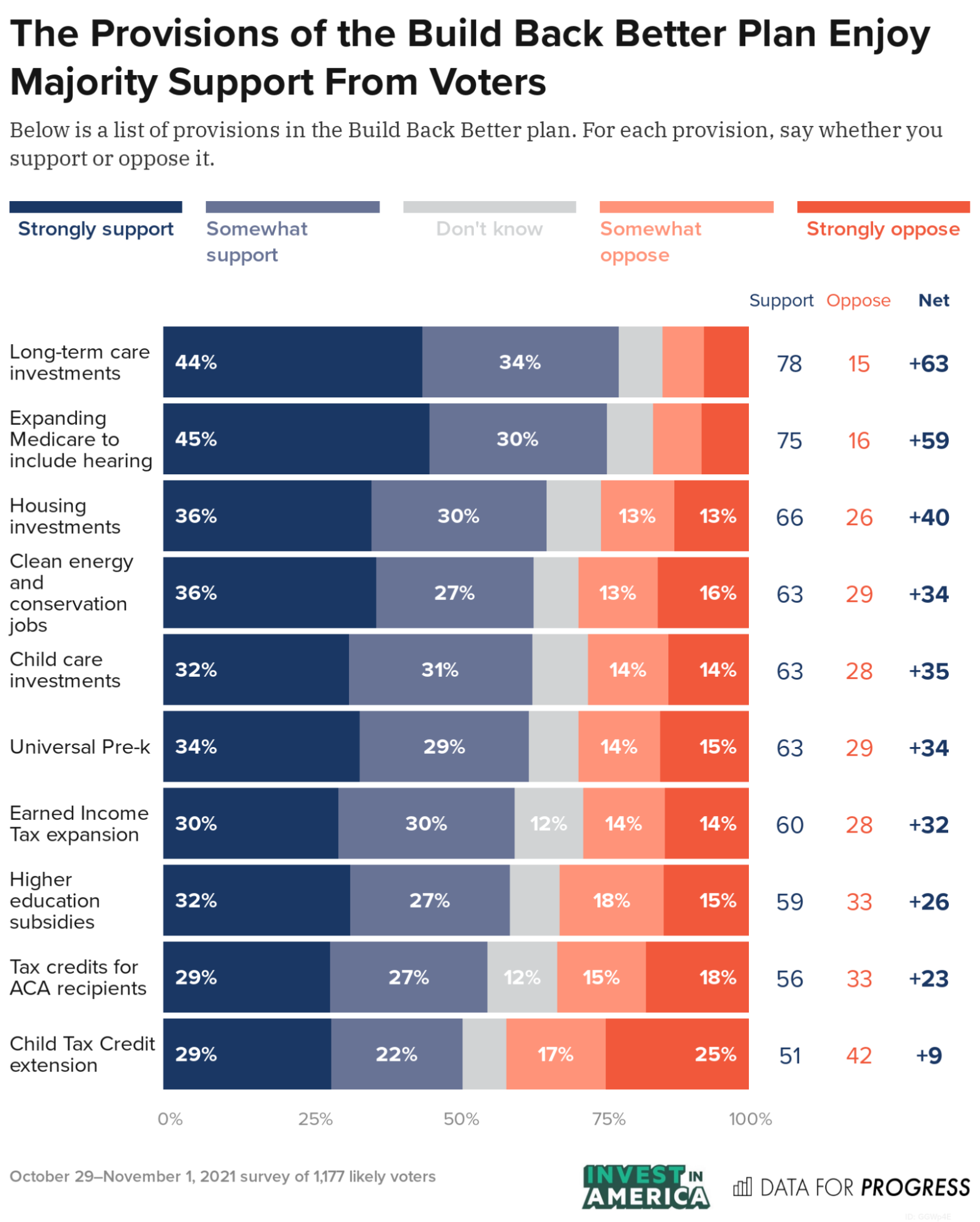

Voters Continue To Support The Build Back Better Agenda

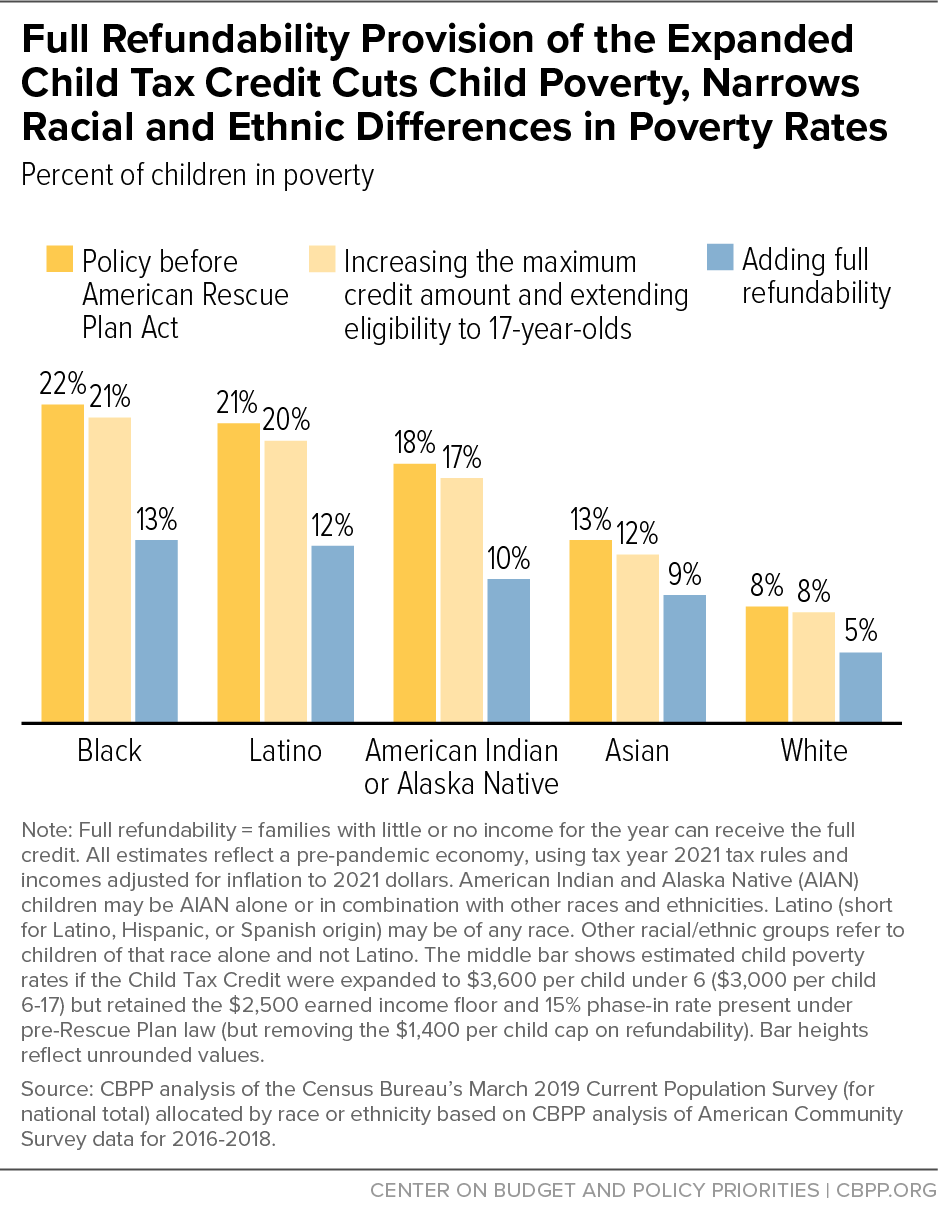

House Build Back Better Legislation Advances Racial Equity Center On Budget And Policy Priorities

Build Back Better 20 Still Raises Taxes For High Income Households And Reduces Them For Others

House Passes The Build Back Better Act Forbes Advisor

Build Back Better Increases Health Coverage And Makes It More Affordable Center On Budget And Policy Priorities

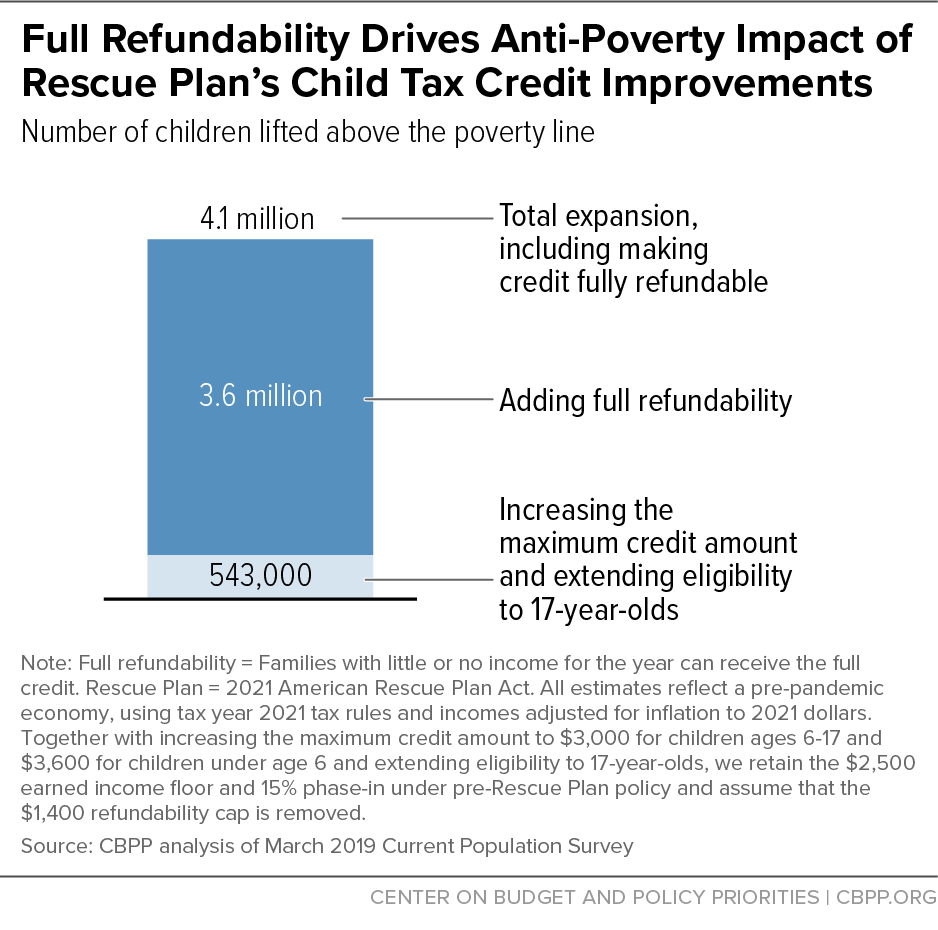

Build Back Betters Child Tax Credit Changes Would Protect Millions From Poverty Permanently Center On Budget And Policy Priorities

Build Back Betters Child Tax Credit Changes Would Protect Millions From Poverty Permanently Center On Budget And Policy Priorities

Build Back Betters Child Tax Credit Changes Would Protect Millions From Poverty Permanently Center On Budget And Policy Priorities

Build Back Betters Child Tax Credit Changes Would Protect Millions From Poverty Permanently Center On Budget And Policy Priorities

Build Back Better Makes Historic Investments To Help Parents

Stimulus Update House Passes Bill Extending Payments Into 2022 Wbff