Are Electric Cars Tax Deductible Uk

For the example above, purchasing the bmw i3 at £33,340, would save corporation tax of £6,335. This means the full cost would be an allowable deduction against your business’ profits, so it reduces your company’s tax bill.

The Ev Wedge How Electric Vehicle Fuel Savings Vary By Country And Car Shrinkthatfootprintcom

Opt for a low emission vehicle.

Are electric cars tax deductible uk. A change being driven by the rapid rise in electric and hybrid vehicles. It brings your income tax rate to effectively 60%. It all depends on how much business use your vehicle gets.

Capital allowances allow businesses to deduct the cost of an eligible expense from its annual tax bill. Road tax for zero emissions car is free too. Pure battery electric vehicles (bevs) are exempt from ved.

From april 2021, this will no longer be the case as only zero. Road tax, insurance, breakdown cover Electric and ultra low emission vehicles (ulevs) are great for more than just the environment, as road tax and company car tax on electric cars is much lower.

That is because with every £2 that you earn over £100,000 you lose £1 of your personal allowance. Charge for battery electric cars. The tax rules for ultra low emission company cars are set to change from 6 april 2020 making the purchase of an.

100% first year allowance (fya) first year allowance is claimable for up to 100% of the cost of qualifying low emission and electric cars. Any vehicle (excluding bevs) with a list price of £40,000 or above will incur an additional premium rate for 5 years (starting from the second time the vehicle is taxed). Where the business installs, new and unused, charging points for electric vehicles up to 31st march 2023, it can claim a 100% fya for those costs.

Ten easy ways to cut your tax bill. You may think that the main savings made by buying a company car are the fuel savings. As with car tax and company car tax, the rate at which a company can 'write down' the value of company vehicles is based on its co2 emissions.

Business owners who buy and use a car for work purposes can take advantage of. Because of the tax benefits of electric and hybrid cars this means tom and the company can potentially save tax and national insurance of £10,103 overall. Summary of electric car tax benefits.

Car leases can be attractive By choosing a tesla car, your business can claim a 100% year one deduction for the cost of the vehicle. The rates for all 100% electric vehicles are now £0 and this will apply until at least 2025.

Cars with lower emissions benefit from reduced benefit in kind , at 0% for the 2020 tax year, increasing to just 1% for 2021/22, then 2% for 2022/23. Add up all your costs, then deduct the costs of private use. If their employer does not reimburse them, they are entitled to a deduction under s337/s338 itepa 2003 for the.

Are electric cars tax deductible? From 6th april 2018, where the company allows employees to charge their own electric vehicles at the workplace, there is no taxable benefit for the provision of that free electricity. There is an exception to this rule though.

From 1 april 2021 the enhanced ecas only apply to fully electric vehicles (evs). Therefore cars with any co2 emissions will go back to only getting the tax relief at 8% per year. There are reduced ved rates for.

However, for an electric car, the entire £30k can be used as a tax deductible cost, thereby reducing your corporation tax bill by £5,700 in year 1.

Government Electric Car Grants - Save On Your Ev Leasing Options

How To Spread Norways Success With Electric Cars

How To Get More Electric Vehicles On The Road

The Tax Benefits Of Electric Vehicles Taxassist Accountants

Leqbkq_x_vbk4m

Electric Car Incentives In Norway Uk France Germany Netherlands Belgium Cleantechnica Electricity Electric Car Incentive

Carpartscom Launches First Electric Vehicle Hybrid Focused Shopping Hub Business Wire

Road Tax Company Tax Benefits On Electric Cars Edf

Electric Cars Rise To Record 54 Market Share In Norway Electric Hybrid And Low-emission Cars The Guardian

Road Tax Company Tax Benefits On Electric Cars Edf

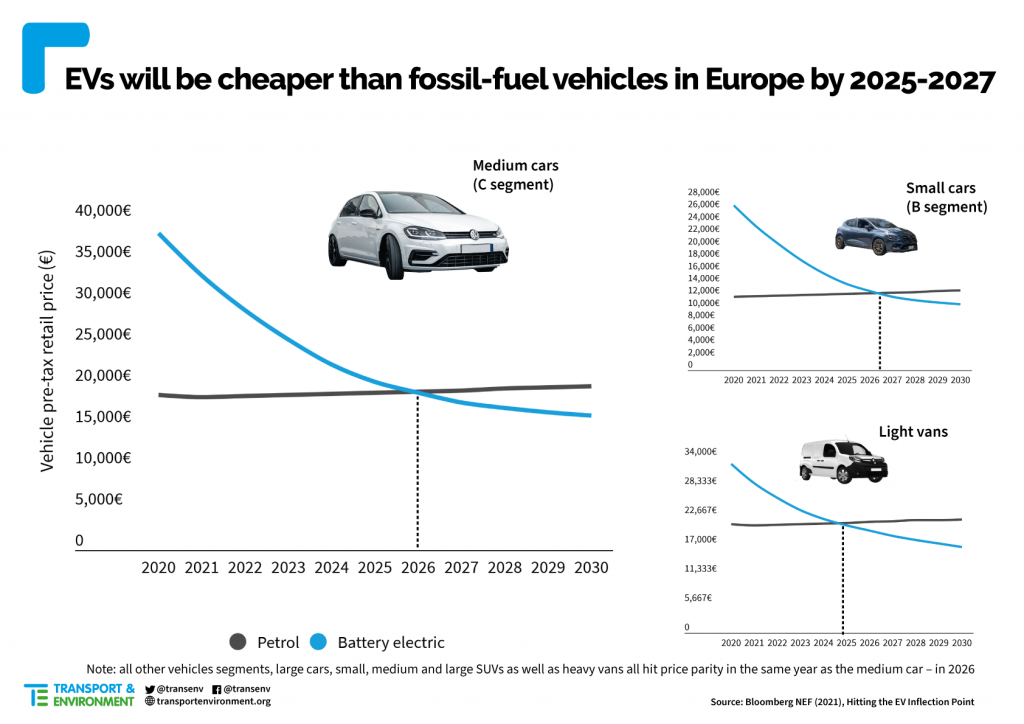

Evs Will Be Cheaper Than Petrol Cars In All Segments By 2027

Road Tax Company Tax Benefits On Electric Cars Edf

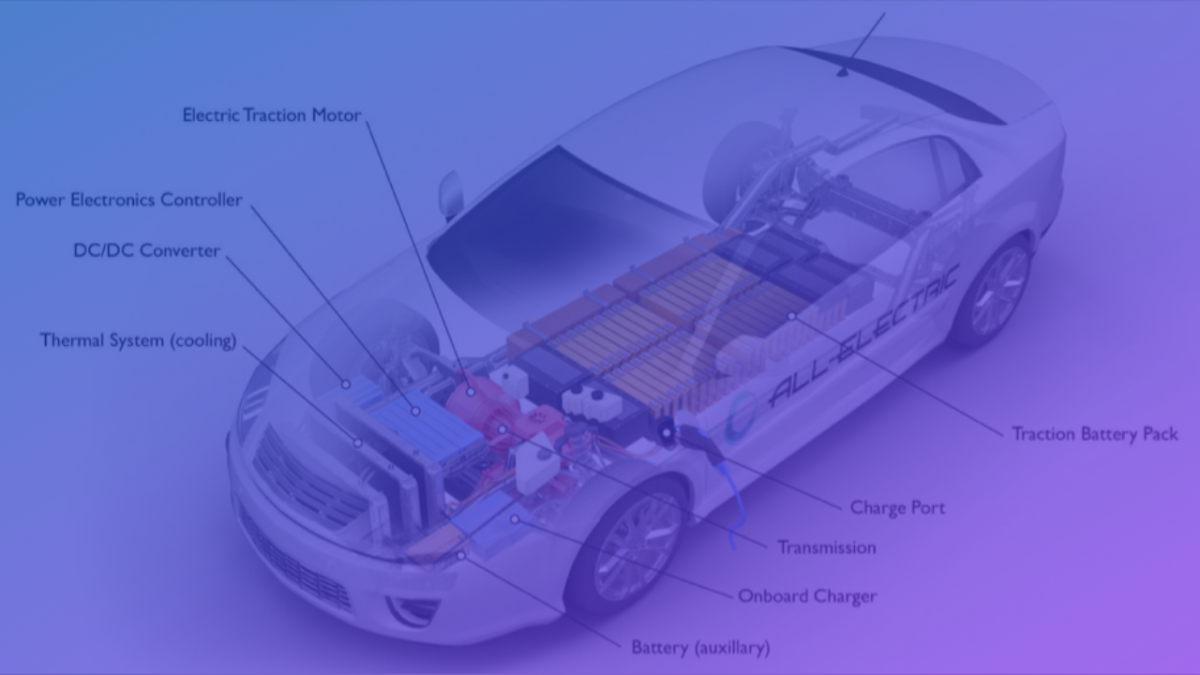

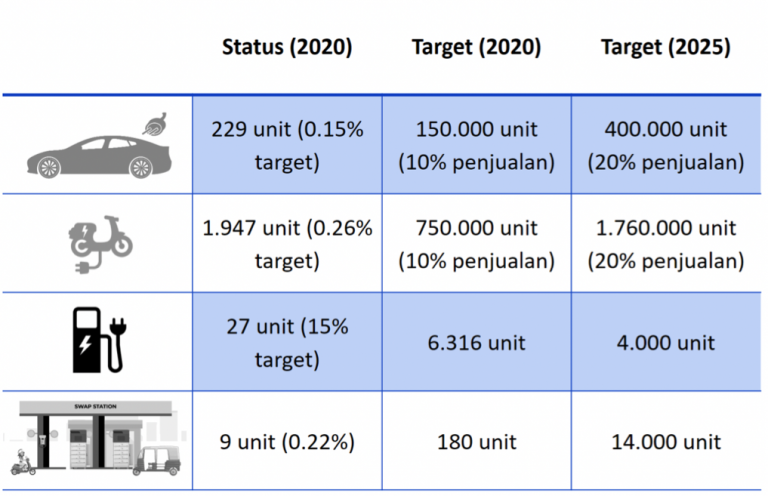

Corporate Strategy To Optimize The Development Of Battery Electric Vehicle In Indonesia Sbm Itb

The Ev Tax Credit Can Save You Thousands -- If Youre Rich Enough Grist

Electric Car Tax Benefits - Green Car Guide

Uk Chancellor Announces 390 Million In New Funding To Support Ev Industry Adoption Electric Vehicle Charging Electric Vehicle Charging Station Electric Cars

Electric Vehicles Face Lingering Challenges How Are Startups Helping Early Metrics

Government Grants For Electric Cars Uk Edf

Corporate Strategy To Optimize The Development Of Battery Electric Vehicle In Indonesia Sbm Itb