Option To Tax Togc

The purchaser must also notify hmrc that it has opted to tax. The purchaser’s option to tax is in place by the relevant date;

Changes To Notifying An Option To Tax Crowe Uk

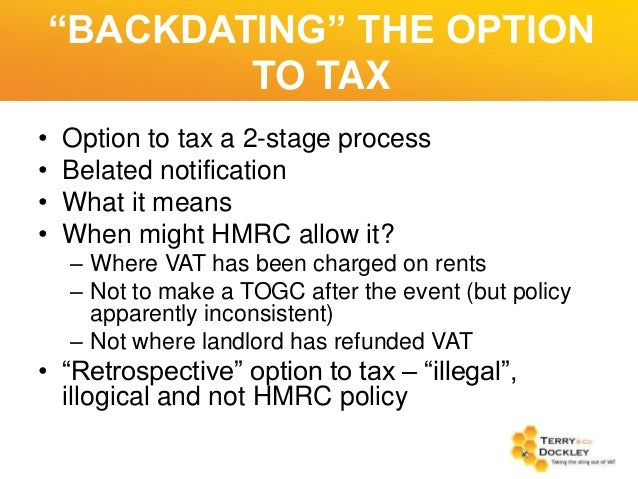

For example, an option to tax one day late will invalidate togc treatment.

Option to tax togc. Details of tax points here A local vat case highlights the importance of taking advice. The option to tax by the purchaser must be notified to hmrc in writing no.

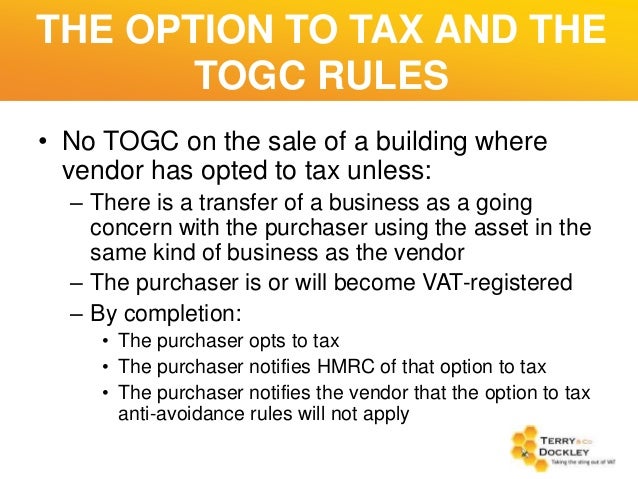

There can also be challenges when assessing whether tenanted property will be classed as a togc (ie whether the transfer is of a property rental business). In most cases it will be the sole proprietor, one or more partners (or trustees), a director or an authorised administrator. If the seller has opted to tax in respect of the property or the property in question is standard rated then the purchaser must also opt to tax and notify hmrc in writing of that option to tax prior to the date of supply.

Say the buyer didn't, in fact, ott the property. If the vendor has opted to tax a property, then in order to acquire the property as a togc, the purchaser must also opt to tax the property with effect from the ‘relevant date’. The vendor's solicitor is claiming that as the rental income is under £25000 they do not need to formally opt to tax.

If you have appointed a third party to notify an option to tax on your behalf, hmrc requires written confirmation that the third party is authorised to do so.” some specific situations: Another example of a property togc is where a property under construction is sold (a development business). If the vendor has exercised the option to tax then in order to obtain togc status on the property, as well as the other assets, the purchaser has to opt to tax the property and notify hm customs & excise on or before the date of the transfer.

Last updated on september 12th, 2016 at 03:42 pm. If this (amongst other criteria) is not met, the transaction will not qualify as a togc. Where property is concerned they must be satisfied that:

A common problem area surrounds the timing of when an option to tax is made. This letter authorises (the named person) to act as our agent in all matters relating to the notification and submission of an option to tax on our behalf and in all matters covered in part 1, schedule 10 of the vat act 1994 unless otherwise specified in writing. A new owner needs to opt to tax in order to get the tax benefits, rather than inherit the option to tax from the vendor.

For the purposes of the togc provisions the freehold disposal by d is a taxable supply (it cannot be a togc as b is unable to notify d that his option to tax is not disapplied). Suggested form of words for an authorisation letter. What purpose do the togc rules serve?

The advantages of opting for sellers of commercial buildings and land are. That the purchaser’s option will not disapply. So, my understanding is that for rental property to be sold vat free as a togc an ott must be in place before the deposit/contract date.

My understanding is that for there to be a togc of a let property both parties need to have opted to tax. As may be seen, timing with a property togc is of utmost importance. A buyer needs to opt to tax and notify hmrc of this option if the sale would, absent a togc, be taxable as result of it being a freehold new building or under the seller’s option to tax.

This might include land and buildings over which an option to tax has been exercised by the seller and ‘new’ commercial property (within 3 years of the date it was completed). If there is no option in place at that time hmrc do not regard it as “the same kind of business” and togc treatment does not apply. Togc allows the sale to be treated as neither a supply of goods nor a supply of services.

If the purchaser opts to tax, but, say, one day after the relevant date, there can be no togc. Postby kitty kat » mon apr 04, 2011 4:30 pm. The relevant date in these circumstances is the tax point.

Failure to do this will mean that the transaction is not a togc, and that vat is therefore chargeable. Option to tax can be overridden or disapplied: The togc rules allow a business to be transferred without vat being charged.

This is often overlooked by the vendor and it can land them with an assessment from hm customs & excise. Mon oct 04, 2010 11:18 am. A guide to land and property.

In order for a property sale to qualify as a togc, it is important that the buyer makes their option and notifies the seller before the sale takes place. The case involved the transfer of a property business and so combined the complex areas of both option to tax and “transfer of going concern” (togc) rules of vat. Note that the vendor is ultimately responsible for applying the correct vat treatment.

Vat Why Timing Is Essential For A Successful Togc Accountingweb

Vat On Property Transactions - Ppt Download

Vat What Is A Togc Why Is It Important - Marcus Ward Consultancy Ltd

Application Of The Transfer Of A Going Concern Rules Taxation

Another Horror Story Taxation

Vat Case Studies For Commercial Property Lawyers

Revoking Vat Option To Tax Elections Taxation

Are You Selling A Business Tax Adviser

Looking Closely Tax Adviser

Vat Latest From The Courts - Option To Tax Togc And Deposits - Marcus Ward Consultancy Ltd

Trustedtaxadvisercouk

Finance Services Vat To Basics Roger Bennett Tax

Vat Case Studies For Commercial Property Lawyers

Vat Property The Option To Tax - Marcus Ward Consultancy Ltd

A Grey Area Of Vat Tax Adviser

Option To Tax Notifications Laytons Etl

Transfer Of Going Concern Togc And Option To Tax

Option To Tax And Transfer Of A Going Concern Why Seek Advice

Managing Mergers The Vat Issues To Do List