Gilti High Tax Exception Canada

The irc 965 blocker issue This option allows cfc shareholders to defer the recognition of undistributed gilti income (and subpart f income) as earnings and profits (“e&p”).

Form 8992 Gilti Calculation Pitfall - Latest To Know For 2020

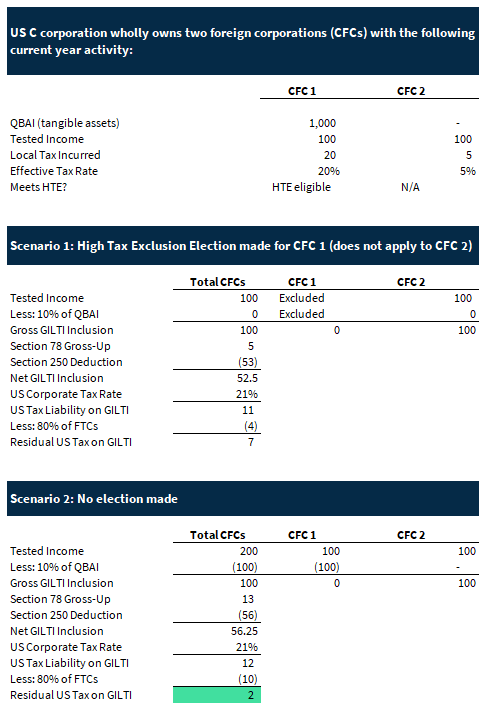

Without effective tax planning, combined u.s.

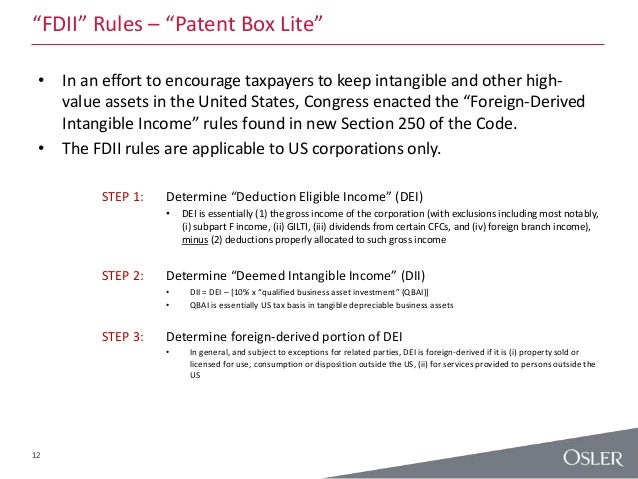

Gilti high tax exception canada. The high tax exception can be a very effective tax planning tool. Corporation where over 50% of the combined voting power or value of shares is owned by u.s. (this option is also available to corporate cfc shareholders).this exception applies to the extent that the net tested income from a cfc exceeds 90 percent of the u.s.

In addition, we will discuss the gilti guidance on a pwc webcast: Federal corporate income tax rate. On june 14, the internal revenue service and the treasury department issued final and proposed regulations (the “final regulations” and the “new proposed regulations,” respectively) addressing the exclusion of income subject to high foreign taxes from the “global intangible low taxed income” (“gilti”) tax introduced by the 2017 tax reform.

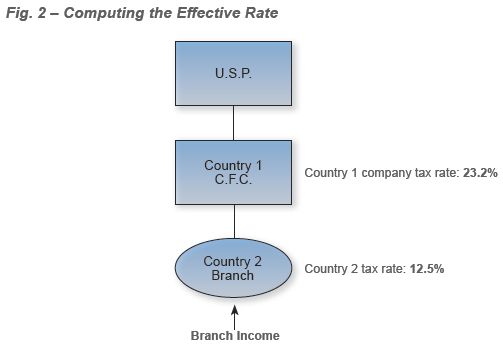

Thus, if the effective foreign tax rate exceeds 18.9 percent, a cfc shareholder can elect to make a high tax exemption. Gilti was presented as part of the 2017 u.s. Therefore, in canada, it is the shareholders of small business corporations who may bear most of the gilti tax as their corporate tax rate in canada may.

Currently, this rate is 21%. Recent proposed regulations (which have been finalized by the irs and department of treasury) allows a cfc shareholder to make a high tax exception to gilti inclusions. In conclusion, gilti is a major thorn in the side of us shareholders who are resident in canada.

Tax reform and its intent was to discourage u.s. Those prior proposed regulations have now been issued in final. Shareholder of a canadian corporation can now claim a high foreign tax exception if the canadian corporation is subject to an effective tax rate that exceeds 90% of the u.s.

In conclusion, gilti is a major thorn in the side of us shareholders who are resident in canada. Following the enactment of the gilti hte measure, a u.s. Hte election is available for the corporation’s tax year beginning after july 23, 2020.

And canadian tax rates approaching 85% could occur as early as 2018.

Irs Finalizes High-tax Exception To Gilti - Tax - Canada

Understanding Gilti - For Us Expats In Canada - Maroof Hs Cpa Professional Corporation Toronto

Us Cross-border Tax Reform And The Cautionary Tale Of Gilti

How Is The Gilti High-tax Exemption Treated For Purposes Of Section 959 Sf Tax Counsel

Gilti High-tax Exclusion How Us Shareholders Can Avoid The Negative Impact Sch Group

The Tax Times Final Regs Provide That Gilti High-tax Exception Is Retroactive

Guidance For Gilti High-tax Exception Bkd Llp

Us Tax Reform For Canadians

Lwcom

Final Gilti High-tax Regulations And The Tested Unit Would A Rose By Any Other Name Smell As Sweet - Tax - United States

Lwcom

5 Things To Know About The Gilti High-tax Exclusion Crowe Llp

Assetskpmg

Us Cross-border Tax Reform And The Cautionary Tale Of Gilti

Who Is More Gilti Biden Or Trump Baker Tilly Canada Chartered Professional Accountants

Recently Released Gilti Regulations May Create Tax Nightmares For Many Us Shareholders Residing In Canada - Moodys Private Client

Lwcom

Final Gilti Hte Regs Provide Flexibility Grant Thornton

Us Cross-border Tax Reform And The Cautionary Tale Of Gilti