Tennessee Inheritance Tax Laws

No estate tax or inheritance tax The tennessee inheritance tax exemption is steadily increasing to $2 million in 2014 to $5 million in 2015, and in 2016 there’ll be no inheritance tax.

The Pmo Whats The Right Level Of Authority Sculpture Lessons Powerpoint Clip Art Software Development

Inheritance tax is imposed on the value of the decedent’s estate that exceeds the exemption amount applicable to the decedent’s year of death.

Tennessee inheritance tax laws. The legislature set forth an exemption schedule for the tax with incremental increases for the exemptions until it is completely eliminated in 2016. The repeal does not help individuals who died in 2015. Tennessee’s tax exemption schedule is as.

They are still subject to the tax. For tennessee residents, an estate may be subject to the tennessee inheritance tax if the total gross estate exceeds $1,250,000. (a) locally collected privilege taxes.

Also, estates of nonresidents holding property in tennessee must file an inheritance tax return (inh 301). The top estate tax rate is 16 percent (exemption threshold: Tennessee law provides for other relatives to inherit the decedent's property if he had no surviving spouse or descendants, giving priority to family members who are more closely related to the decedent.

There is no inheritance tax in tennessee, this would be tax that falls on the heirs and beneficiaries, not on the estate of the person who died. The net estate is the fair market value of all assets, less any allowable deductions such as property passing to a surviving spouse, debts, and. Assets in excess of the federal exemption are taxed at 40%.

No estate tax or inheritance tax. Every estate has a $1 million exemption. Also, according to tennessee law, children are entitled to inherit the same percentage, whether they are children of the decedent and surviving spouse, or children of the deceased and a prior spouse.

However, if the estate is undergoing probate, a short form inheritance tax return (inh 302) is required. Those who handle your estate following your death, though, do have some other tax returns to take care of, such as: Posted on sep 15 2013 9:57pm by attorney, jason a.

In 2012, the tennessee general assembly chose to phase out the state’s inheritance tax over a period of several years. What is the effect of the repeal? If the value of the gross estate is below the exemption allowed for the year of death, an inheritance tax return is not required.

If there is no will or the will is invalidated, the following relatives of the decedent stand to inherit in order: In making the proration, allowances shall be made for any exemptions granted by the tennessee law imposing the tax and for any deductions allowed by that tennessee law for the purpose of arriving at the value of the net estate. Tennessee inheritance and gift tax.

Taxes and licenses (refs & annos) chapter 8. No estate tax or inheritance tax. No estate tax or inheritance tax.

What tennessee called an inheritance tax was really a state estate tax—that is, a tax imposed only when the total value of an estate exceeds a certain value. It only helps families of decedents who die this year or later. The inheritance tax is due to the tennessee department of revenue nine months after the death of an individual who owes the tax.

The inheritance tax is different from the estate tax. Effective january 1, 2016, the tennessee inheritance tax has been repealed, based on a law that was enacted in 2012. No estate tax or inheritance tax.

For nonresidents of tennessee, an estate may be subject to the tennessee inheritance tax if it includes real estate and/or tangible personal property having a situs within the state of tennessee and the gross estate exceeds $1,250,000. Under tennessee law, the tax kicked in if your estate (all the property you own at your death) had a total value of more than $5 million. The maximum tennessee estate tax rate was 9.5%, which is significantly lower than the federal maximum rate of 40%).

As mentioned previously, the probate process in tennessee typically takes anywhere from eight months to three years to finalize. The federal estate tax exemption is $5,450,000 for 2016 and is indexed for inflation. Federal law also allows the unused estate tax exemption of the first spouse to die to carry over to the second spouse.

Until this estate tax is phased out, the minimum tax rate for estates larger than the exemption amount is 5.5% and the maximum remains 9.5%. Estates in excess of $1 million are taxed on a graduated basis, with the tax on the first $440,000. As of january 1, 2016, tennessee’s inheritance tax is fully repealed.

The inheritance tax applies to money and assets after distribution to a person’s heirs. Limitation on assessment and collection of taxes. Children of a prior spouse do not receive a lesser inheritance, if there is a surviving spouse alive to inherit.

There is a chance, though, that another state’s inheritance tax will apply if you inherit something from someone who lives in that state. The inheritance tax is levied on an estate when a person passes away. Tennessee does not have an inheritance tax either.

Wooden Hammer Law Books Background Good Lawyers Legal Services Injury Lawyer

The Executors Guide Settling A Loved Ones Estate Or Trust By Mary Randolph Jd First Love Management Books Estate Planning

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

Venezuela Supplies 100000 Barrels Of Petroleum To Cuba Each Day On Preferential Terms Cuba Has Paid For This By Sending Cuban Perso Cuban Economy Crude

Download Pdf The Everything Wills And Estate Planning Book Professional Advice To Safeguard Your Assets And Provid Estate Planning Professional Advice Advice

How To Plan A Trip To New Zealand With Kids Revocable Trust Estate Planning New Zealand Travel

Pin On Indiana Law

Why You Need To Begin Estate Planning Now In 2021 Estate Planning How To Plan Estate Planning Attorney

Your Guide To Prorated Taxes In A Real Estate Transaction

/estate_taxes_who_pays_what_and_how_much-5bfc342146e0fb00265d85b5.jpg)

Estate Taxes Who Pays And How Much

Free Form Inh 301 State Inheritance Tax Return Long Form - Free Legal Forms - Lawscom

Pin On 2nd Amendment Rites Stop The Madness

![]()

Venezuela Supplies 100000 Barrels Of Petroleum To Cuba Each Day On Preferential Terms Cuba Has Paid For This By Sending Cuban Perso Cuban Economy Crude

California Is Facing An Extremely Serious Threat To Criminal Justice Reform This Prison Tax And Expansion Proposal Mislead Prison Criminal Justice The Expanse

What Is Tennessee Property Tax Hr Block

How Bill Gates And Warren Buffett Estates Will Pay Zero Estate Tax Httpsyoutubeeuj0ncxvmpq Estate Tax Estate Planning Checklist Warren Buffett

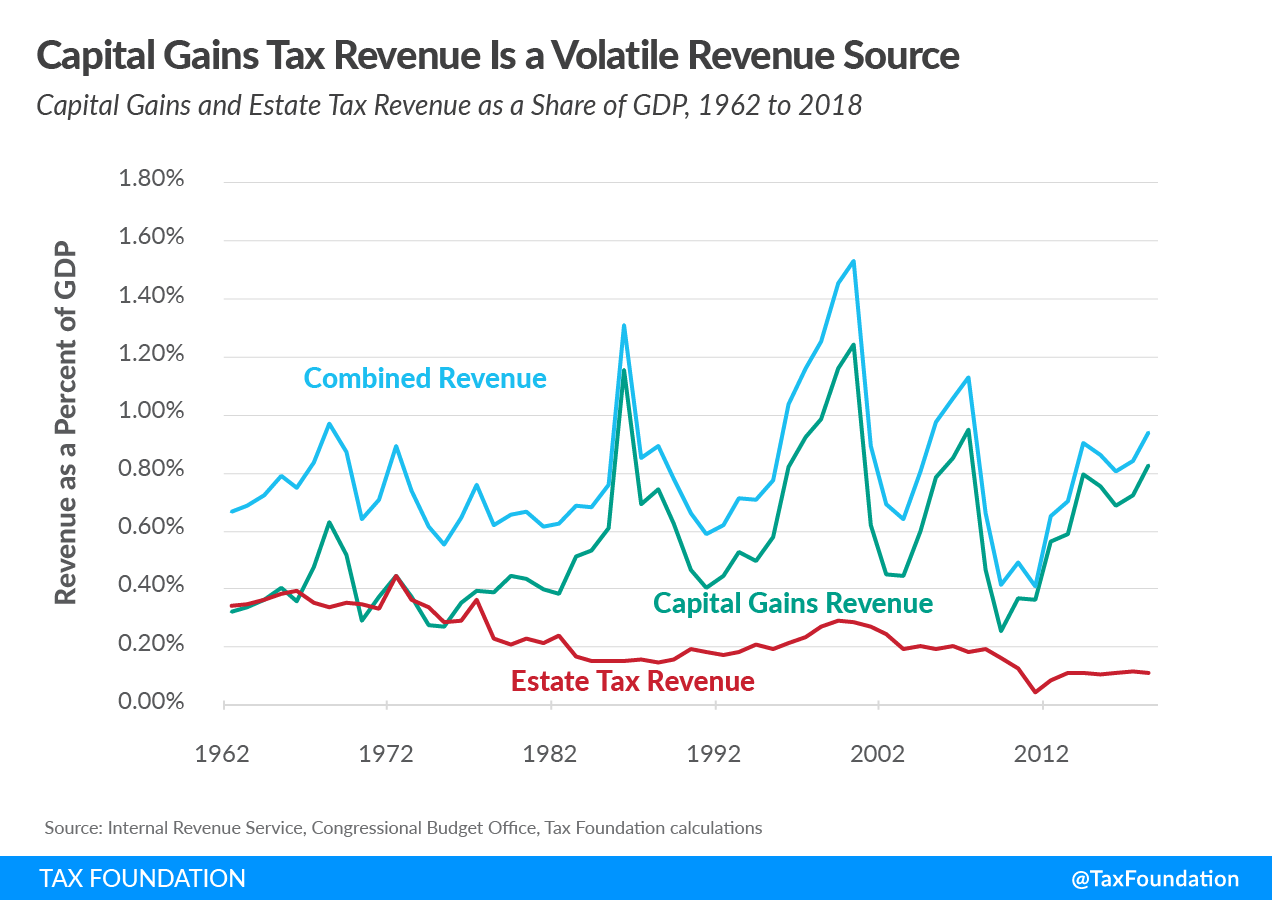

Taxing Unrealized Capital Gains At Death Proposal Tax Foundation

Pin On Adventures In Anderson County

Pin On 2nd Amendment Rites Stop The Madness