Main Street Small Business Tax Credit 1

By bettywilliams | aug 30, 2021 | cdtfa |. (the 2021 will be available by january 1, 2022.) provide the confirmation number received from cdtfa on the tentative credit reservation.

How To File Previous Year Taxes Online Priortax Filing Taxes Previous Year Tax

Taxpayers can use this new credit against california state income taxes or sales and use taxes.

Main street small business tax credit 1. The tax credit applies to small business meeting the following criteria. Tax credits are used to help reduce the amount of taxes business owners all over the state owe. The california department of tax and fee administration oct.

Upon review by the california department of tax and fee administration, the employer will be notified if a credit has been allocated and the amount of the credit. On september 9, 2020, california governor, gavin newsom, signed the senate bill that established the “main street” small business hiring tax credit. Last week, california’s main street small business tax credit launched, offering some relief for small businesses.

The credit will allow those who qualify to offset their income tax or sales and use tax when filing. Include form ftb 3866, main street small business hiring credit (coming soon), to claim the credit. If not, then does it mean the credit is lost forever if it is not claimed on the original tax return?

August 27, 2021 at 12:18 pm #313261. Provide the confirmation number (received from cdtfa on your tentative credit reservation) when claiming these credits. Businesses must be registered to file their state excise tax electronically.

File your income tax return timely. This allows businesses to be a part of the revitalization of the downtown areas all while saving tax. In late september 2021, governor newsom signed assembly bill (ab) 150 establishing the main street small business tax credit ii.

California cdtfa announces 2021 main street small business tax credit ii available beginning nov. The credit may be applied against sales and use taxes, or income taxes. Does anyone know if credit for ca “main street small business tax credit 1” can be claimed on amended tax return?

28 announced that reservations are available for the 2021 main street small business tax credit ii, beginning nov. The program allows a small business hiring credit against california state income taxes or sales and use taxes to certain qualified small business employers. Qualifying businesses may claim the main street small business tax credit for 2021, equal to $1,000 for each net increase in qualified employees, up to $150,000.

Tentative credit reservation amounts will be reduced by credit amounts reserved or received under the first main street small business tax credit program. Employers that had fewer than 500 employees on december 31, 2020, subject to california withholding laws, would be considered qualified small businesses. We’re currently updating the ftb 3866 for the 2021 tax.

File their income tax return. Main street small business tax credit dental practice owners may benefit the most from the main street small business tax credit. File your income tax return.

Taxpayers that qualified for employee retention credit may also qualify for the main street small business tax credit. This bill provides financial relief to qualified small businesses for the economic disruptions in 2020 and 2021, resulting in unprecedented job losses. California main street small business tax credit ii begins 11/1/21.

On november 1, 2021, the california department of tax and fee administration will begin accepting applications for tentative small business hiring credit reservation amounts through our online reservation system. Credit reservations for qualified small business owners will be available from november 1 st 2021 through. Include your main street small business tax credit (ftb 3866) form, to claim the credit.

This hiring tax credit applies to businesses that (1) had 100 or fewer employees as of dec. The reservation system will be. Include the main street small business tax credit (ftb 3866) form in the tax return.

The 2021 main street small business tax credit ii is set to provide further financial relief to qualified small business employers. You can find more information on the main street small business tax credit special instructions for sales and use tax filers page. On or after january 1, 2020, and before january 1, 2021, a main street small business tax credit is available to a qualified small business employer that received a tentative tax credit reservation from the california department of tax and fee administration (cdtfa).

How to claim the main street small business tax credit. 31, 2019, and (2) suffered a 50% or greater decrease in income tax gross receipts when comparing second quarter 2020 to. 2021 california main street small business tax credit.

Provide the confirmation number (received from cdtfa on your tentative credit reservation) when claiming the credit. When will the credit be available? Beginning on november 1, 2021, and ending november 30, 2021, the california department of tax and fee administration will be accepting applications through their online reservation system for qualified small business employers to reserve.

Use credit code 240 when claiming the credit. Include your main street small business tax credit (ftb 3866) form, to claim the credit. Beginning november 1, 2021, qualified small business employers need to apply for a credit reservation through the california department of tax and fee administration (cdtfa).

Automotive, small business tax briefs. Beginning november 1, 2021, and ending november 30, 2021, the california department of tax and fee administration (cdtfa) will be accepting applications through their online reservation system for qualified small business. 1 for individual income, corporate income, and sales and use tax purposes.

We're currently updating the ftb 3866 for the 2021 tax year and it will be available by january 1, 2022. Visit instructions for ftb 3866 for more information.

/GettyImages-911586914-d4186dafdd8d4c3f94d4b0077f3c5918.jpg)

Explaining The Trump Tax Reform Plan

Turbotax Vs Hr Block Which Online Tax Service Is Best

Tax Id Numbers Why Theyre Importnat And How To Get One Bench Accounting

North Carolina Sales Tax - Small Business Guide Truic

How Fortune 500 Companies Avoid Paying Income Tax

25 Percent Corporate Income Tax Rate Details Analysis

Ho6-o5kszjzl7m

.png)

Maximizing Tax Deductions For The Business Use Of Your Car - Turbotax Tax Tips Videos

How To Start A Real Estate Business Infographic Real Estate Infographic Business Infographic Real Estate Business

Ftz Fueled Mcallens Development - Vbr In 2021 Mcallen Business Leader Rio Grande Valley

Free Client Information Sheet Templates Word Pdf Business Template Business Printables Executive Summary Template

Fillable Form 1003 Loan Application Standard Form Application Form

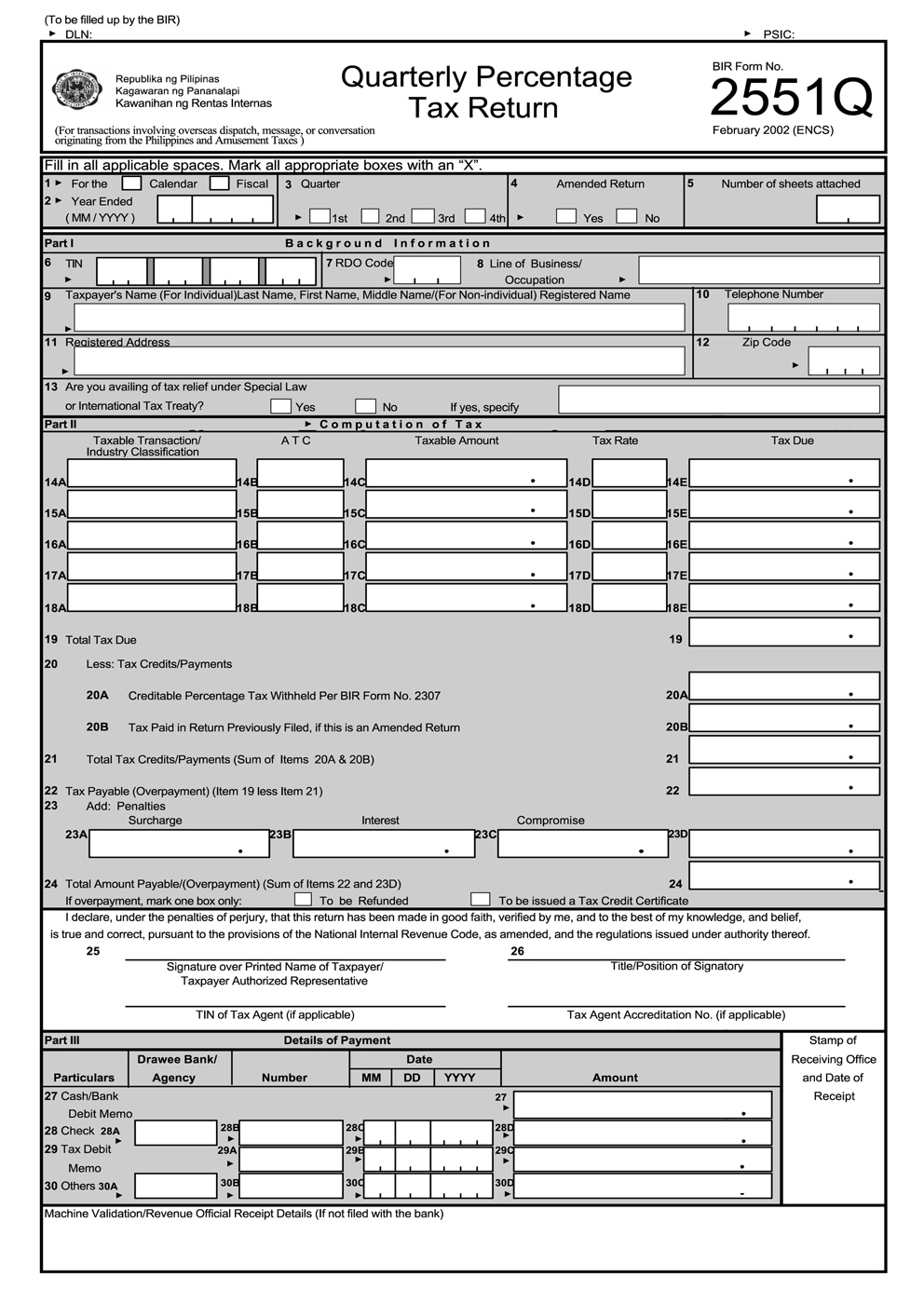

What Are The Taxes A Small Business Needs To Pay Info Plus Forms And Deadlines Ifranchiseph

Basic Income Statement Example And Format Income Statement Profit And Loss Statement Balance Sheet Template

What Is Schedule A Hr Block

California State Controllers Office - Home Facebook

Income Statement Example Income Statement Profit And Loss Statement Statement Template

Understanding The 1065 Form Scalefactor

Can Cellphone Expenses Be Tax Deductible With A Business - Turbotax Tax Tips Videos