Mobile Al Sales Tax Rate 2019

The alabama (al) state sales tax rate is currently 4%. For tax rates in other cities, see alabama sales taxes by city and county.

Top 10 One Pager Startup Templates To Convey The Brilliance Of Your Startup To Vcs And Investors One-pager Start Up Powerpoint Examples

Including city and county vehicle sales taxes, the total sales tax due will be between 3.375% and 4% of the vehicle's purchase price.

Mobile al sales tax rate 2019. The interest rate on tax sale property is 12% annually. November 1, 2021 cu = consumers use | ll = lodgings tax | rt = rental tax | st = salestax | su = sellers use tax municipalities w/county code loc. There is no applicable special tax.

Any tax liens remaining unsold after the auction or sale shall be included in future tax. State administered local tax rate schedule this rate schedule should be read from left to right. The rate of tax against the sales price of such telegraph services or telephone services in the state of alabama is 6% on all gross sales or gross receipts.

3% lower than the maximum sales tax in al. Alabama has state sales tax of 4% , and allows local governments to collect a local option sales tax of up to 7%. You can print a 5.5% sales tax table here.

There is no applicable city tax. For tax rates in other cities, see alabama sales taxes by city and county. As a business owner selling taxable goods or services, you act as an agent of the state of alabama by collecting tax from purchasers and passing it along to the appropriate tax authority.

There is no applicable city tax. Prescription drugs are exempt from the alabama sales tax counties and cities can charge an additional local sales tax of up to 7%, for a maximum possible combined sales tax of 11% Millage rate tax amount ;

Depending on local municipalities, the total tax rate can be as high as 11%. The tax foundation found that alabama has the nation’s fifth highest average combined state and local sales tax rates at 9.14 percent. You can find these fees further down on the page.

Select the illinois city from the list of popular cities below to see its current sales tax rate. The interest rate may not exceed 12%. In addition to taxes, car purchases in alabama may be subject to other fees like registration, title, and plate fees.

These rates are current as of : Oxford 5% sales tax on the retail sale of alcoholic beverages by. The 8% sales tax rate in fairhope consists of 4% alabama state sales tax, 3% baldwin county sales tax and 1% special tax.

You can print a 10% sales tax table here. The utility service use tax is due monthly, with returns and remittances to be filed through the my alabama taxes (mat) filing system on or before the 20th day of the month for the previous month’s sales. Florence, al sales tax rate:

With local taxes, the total sales tax rate is between 6.250% and 11.000%. Hb418 instructs the alabama department of revenue, for ssut purposes, to average out the combined local and county sales tax rates and add that rate onto the state’s 4. The alabama state sales tax rate is 4%, and the average al sales tax after local surtaxes is 8.91%.

There are a total of 287 local tax jurisdictions across the state, collecting an average local tax of 3.982%. The 5.5% sales tax rate in madison consists of 4% alabama state sales tax, 0.5% madison county sales tax and 1% special tax. The 10% sales tax rate in mobile consists of 4% alabama state sales tax, 1% mobile county sales tax and 5% mobile tax.

The current total local sales tax rate in mobile, al is 10.000%. Sales tax is a tax paid to a governing body (state or local) for the sale of certain goods and services. That ranks behind tennessee (9.47 percent), louisiana (9.45 percent), arkansas (9.43 percent), and washington (9.17 percent.) “retail sales taxes are one of the more transparent ways to collect tax revenue,” according to the report.

Average sales tax (with local): After the three year redemption period, the owner of the property is no longer able to redeem his/her property through this office and must communicate with the buyer directly. “sales taxes are easier to.

Higher sales tax than 63% of alabama localities. Illinois has recent rate changes (wed jul 01 2020). 31 rows enterprise, al sales tax rate:

Currently, combined sales tax rates in alabama range from 4 percent to 11 percent, depending on the location of the sale. 24 rows tax type rate type rate; Each subsequent locality will be to the right or below the previous locality.

.png)

States Sales Taxes On Software Tax Foundation

25 Percent Corporate Income Tax Rate Details Analysis

Be A Part Of World Free Tax Zone Register Your Company Today Business Management Business Support Services Business

Amazon Sales Tax A Compliance Guide For Sellers Sellics

Alabama Sales Tax Rates By City County 2021

Michigan Sales Tax - Small Business Guide Truic

Liqour Taxes How High Are Distilled Spirits Taxes In Your State

The Dual Tax Burden Of S Corporations Tax Foundation

Grocery Food

States Without Sales Tax Quickbooks

Pta Elaborates About Taxes On Prepaid Recharge And Other Call Tariffs For Providing Clarity To Mobile Subscribers In 2020 Pta Recharge The Orator

Eqkdqb7mjbevtm

States With Highest And Lowest Sales Tax Rates

States With Highest And Lowest Sales Tax Rates

States Without Sales Tax Quickbooks

How Is Tax Liability Calculated Common Tax Questions Answered

Sales Tax Calculator

State Corporate Income Tax Rates And Brackets Tax Foundation

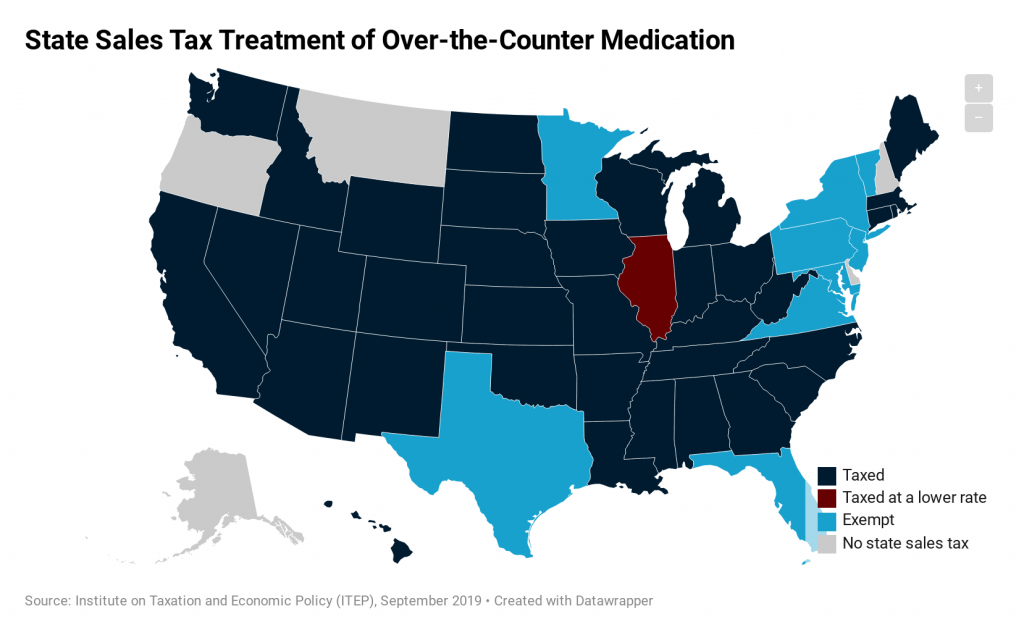

How Do State Tax Sales Of Over-the-counter Medication Itep