Haven't Filed Taxes In 10 Years Canada

Your assessments should be matched to what was filed and reviewed for penalties and interest inclusions. I worked for myself for about 3 years in the last decade (not the most recent years).

What To Do If You Havent Filed Taxes In 10 Years - Debtca

I mean, it’s not something that i would personally want to do, but it’s possible.

Haven't filed taxes in 10 years canada. What happens if you haven't filed taxes in 10 years? Haven't filed taxes in 10 years (canada) i don't know how this happened but i let it all get so overwhelming and the anxiety build up and feed off itself and 10 years have gone by. Waiting 3 more years and cra can't go after you.

The internal revenue service may be looking for you. The cra doesn’t need some elaborate reason. But if you’re due a tax refund in canada, technically you have up to 10 years to file your tax returns.

If you haven’t filed your taxes with the cra in many years, or if you haven’t paid debt that you owe, you should act to resolve the situation. If you haven't filed your taxes in several years, try not to worry too much. While you might be able to avoid the taxman for a few years, eventually the chickens will come home to roost.

If the cra hasn’t been trying to contact you for the years that you haven’t filed taxes, consider that a good sign. Most canadian income tax and benefit returns must be filed no later than april 30, 2018. Individuals who owe taxes for 2017 have to pay by april 30, 2018.

Note that the liability for multiple years is accumulated on the assessment. Filing taxes late in canada. Whether you are late by one year, five years, or even ten years, it is crucial that you file immediately.

People may get behind on their taxes unintentionally. My income is modest and i will likely receive a small refund for 2019 when i file. If you owe taxes and did not file your income tax return on time, the cra will charge you a late filing penalty of 5% of the income tax owing for that year plus 1% of your balance owing for each full.

Gross negligence, false statements or. People fall behind on their taxes all the time for various reasons, and the situation may not be as bad as you think. You are not the only person to have gone years without submitting their taxes.

The cra can also take away your provincial medical plan or your gst cheques/ other benefits if you don’t pay this on time. The irs generally wants to see the last seven years of returns on file. Finalize returns and submit to cra.

Perhaps there was a death in the family, or you suffered a serious illness. Can you skip a year filing taxes? If you only earned for 3 years and it started 10 years ago.

I don’t own a home, i have no investments. But, if you did not qualify or was not required to file an income tax for the last 10 years, you. Filing your tax return late will lead to a late filing penalty of 5% of the balance owing, plus 1% interest of the balance owing for every month you’re late, for up to 12 months.

However, not filing taxes for 10 years or more exposes you to steep penalties and a potential prison term. The irs doesn't pay old refunds. This helps you avoid prosecution for tax evasion, as well as penalties and interest fees for filing your tax returns late.

What you did is tax evasion and it is illegal. According to the cra, a taxpayer has 10 years from the end of a calendar year to file an income tax return. I heard after ten years you can't actually file that years taxes.

Get in contact with an accountant who specializes in taxes, explain the situation, and get your paperwork in. That being said, you should know that the cra statue of limitations to collect past income tax is 10 years. We, as chartered professional accountants (cpa, ca’s) have successfully […]

If you're getting refunds and won't owe taxes, you can focus on the last four years only (as the statute of limitations. How far back can you go to file taxes in canada? You may also face late filing penalties.

Revenue canada is not going to beat down your door, or send out professional thugs for y. Haven’t filed tax returns in years / voluntary disclosure program (vdp) you want to file your income taxes but you haven’t done so for years. Is there a reason, you have not filed an income tax in 10 years?

This is a story we hear all too often. Whatever the reason, once you haven’t filed for several years, it can be tempting to continue letting it go. Just tell them the truth.

I haven’t filed taxes in over 10 years. What if i didn't file 2018 taxes? Whether your late tax filing is 1 year, 5 years or even 10 years past due, it is important to act and get compliant immediately.

The first thing you should do is contact the cra. If the irs filed for you, you'll want to replace the substitute for returns with returns of your own to reduce the balance they assessed. You don’t know where to start and you’re worried about the consequences.

You might think that, if you don’t have the money to pay your taxes, it’s best to not file, but this isn’t the correct strategy to take. Nine tips for filing back tax returns. There can be hefty penalties.

Give yourself credit for getting it done and await receipt of your notice(s) of assessment. That said, you’ll want to contact them as soon as possible to explain the situation of your case. Yes, file your taxes and if you haven’t filed for a year or two—or more—speak with a tax professional who can help you get it resolved.

Confirm that the irs is looking for only six years of returns. The longer you go without filing taxes, the higher the penalties and potential prison term. In this case, you will need an attorney.

If you haven’t filed in years and the cra has not yet contacted you about your late taxes, apply to the voluntary disclosure program as soon as possible.

They Already Have All The Freaking Information Federal Government Announces Plan To File Some Peoples Taxes For Them National Post

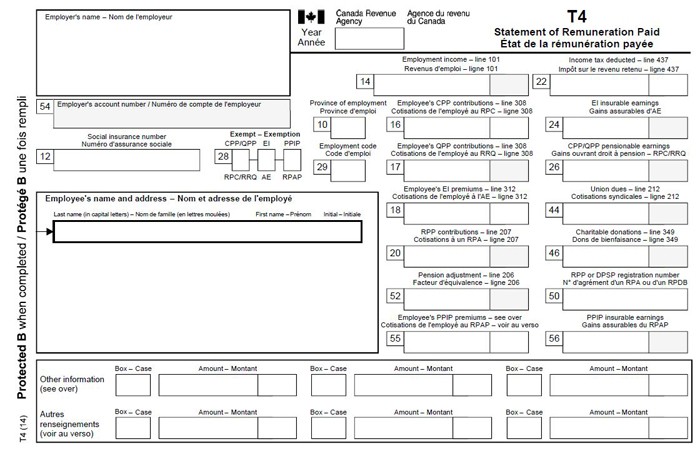

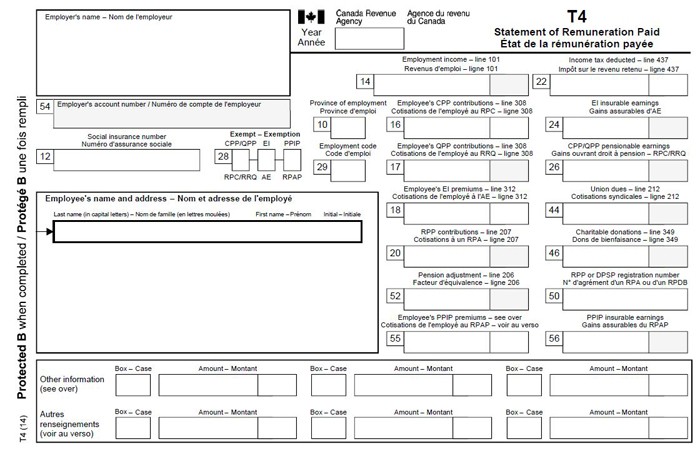

How Do I Get My Prior Years T4 Andor Other Tax Slips Taxwatch Canada Llp

Unfiled Taxes What If You Havent Filed Taxes For Years Kalfa Law

Unfiled Taxes What If You Havent Filed Taxes For Years Kalfa Law

Havent Filed Taxes In Years What You Should Do - Youtube

Unfiled Taxes What If You Havent Filed Taxes For Years Kalfa Law

2 Million Canadians Who Havent Yet Filed Taxes Could Face Benefits Interruption Cra Warns - National Globalnewsca

What Happens If Taxes Are Not Filed Canada 2021 Remolino Associates

Coronavirus Everything You Need To Know About Covid-19 And Your Taxes Explained Ctv News

Unfiled Taxes What If You Havent Filed Taxes For Years Kalfa Law

What To Do If You Havent Filed A Tax Return Cbc News

What Happens If Taxes Are Not Filed Canada 2021 Remolino Associates

Unfiled Taxes What If You Havent Filed Taxes For Years Kalfa Law

Youve Filed Your Tax Return But You Forgot Something Now What

2 Million Canadians Who Havent Yet Filed Taxes Could Face Benefits Interruption Cra Warns - National Globalnewsca

What To Do If You Havent Filed Taxes In Years - Money We Have

Havent Filed Taxes For Years What To Do Filing Taxes

What To Do If You Havent Filed An Income Tax Return - Moneysense

How To File Overdue Taxes - Moneysense