Unrealized Capital Gains Tax Warren

27, fool contributors rachel warren, brian withers, and trevor jennewine discuss. It should be noted that the plan to tax unrealized gains is not the same as a “wealth tax” of the kind proposed by senator elizabeth warren.

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

Is expected to lose almost $42 billion in tax revenue.

Unrealized capital gains tax warren. What are unrealized capital gains? The proposal under consideration, in contrast, would focus on unrealized capital gains and. When a “permanent” income tax was introduced after the.

If a large loss remains unrealized, the investor is. What this means is that someone who owns stock or property that increases in value does not pay tax on that. Global asks, democrats are trying to pass a bill to tax unrealized capital gains on a yearly basis.

The proposal under consideration, in contrast,. President biden has upped the ante by talking about taxing unrealized capital gains. It’s clear that americans have figured out the truth about who pays, because politicians are shifting the goalposts.

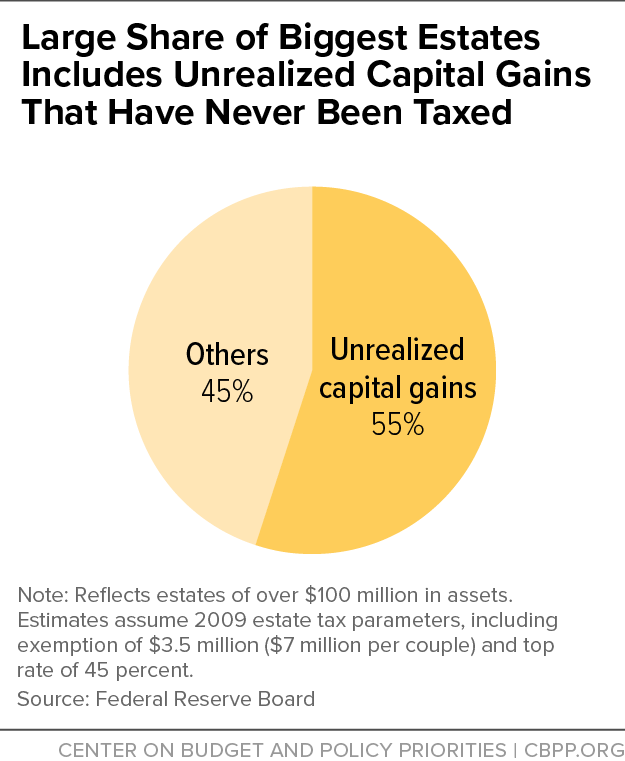

The wall street journal reports that lawmakers are considering a tax on billionaires’ unrealized capital gains to pay for parts of joe biden’s “build back better” agenda. President joe biden has floated proposals to tax wealthy americans’ unrealized capital gains at death,. Elizabeth warren (d., mass.), who has pushed for an annual tax on the wealthiest americans’ assets.

In this segment of backstage pass, recorded on oct. Unrealized gains and losses are also commonly known as “paper” profits or losses. Senator warren’s “nutty idea” to tax unrealized capital gains.

Not surprisingly, congress is not happy about that. Currently, the tax code stipulates that unrealized capital gains aren't taxable income. If it passes, what is the point in investing in the stock market?

It would affect people with $1 billion in assets or those who have reported at. The tax would apply to $1 million of that $2 million gain due to the exclusion. Unrealized capital gains are not income, they are simply increases in value.

Gains or losses are said to be “realized” when a stock (or other investment) that you own is actually sold. Billionaires may be the first target, but a successful deployment could see the net widen. A 15% tax bill on that value increase means the homeowner would have to.

If your home was worth $200,000 last year and $300,000 this year, you have an unrealized capital gain of $100k. If one does not have an extra $40,000, the homeowner will need to borrow the money to pay their tax. That wealth tax that ms.

A tax on an increase in unrealized capital gains is only on the most stretched of interpretations a tax on income. November 7, 2019 by dan mitchell @ international liberty. Billionaires could be taxed on unrealized capital gains on their liquid assets, democratic officials said yesterday.

An unrealized loss occurs when a stock decreases after an investor buys it but has yet to sell it. How would unrealized capital gains tax affect you? An investment with a holding period of forever incurs a capital gains tax of 0%, while all along the holder can be getting wealthy from appreciation.

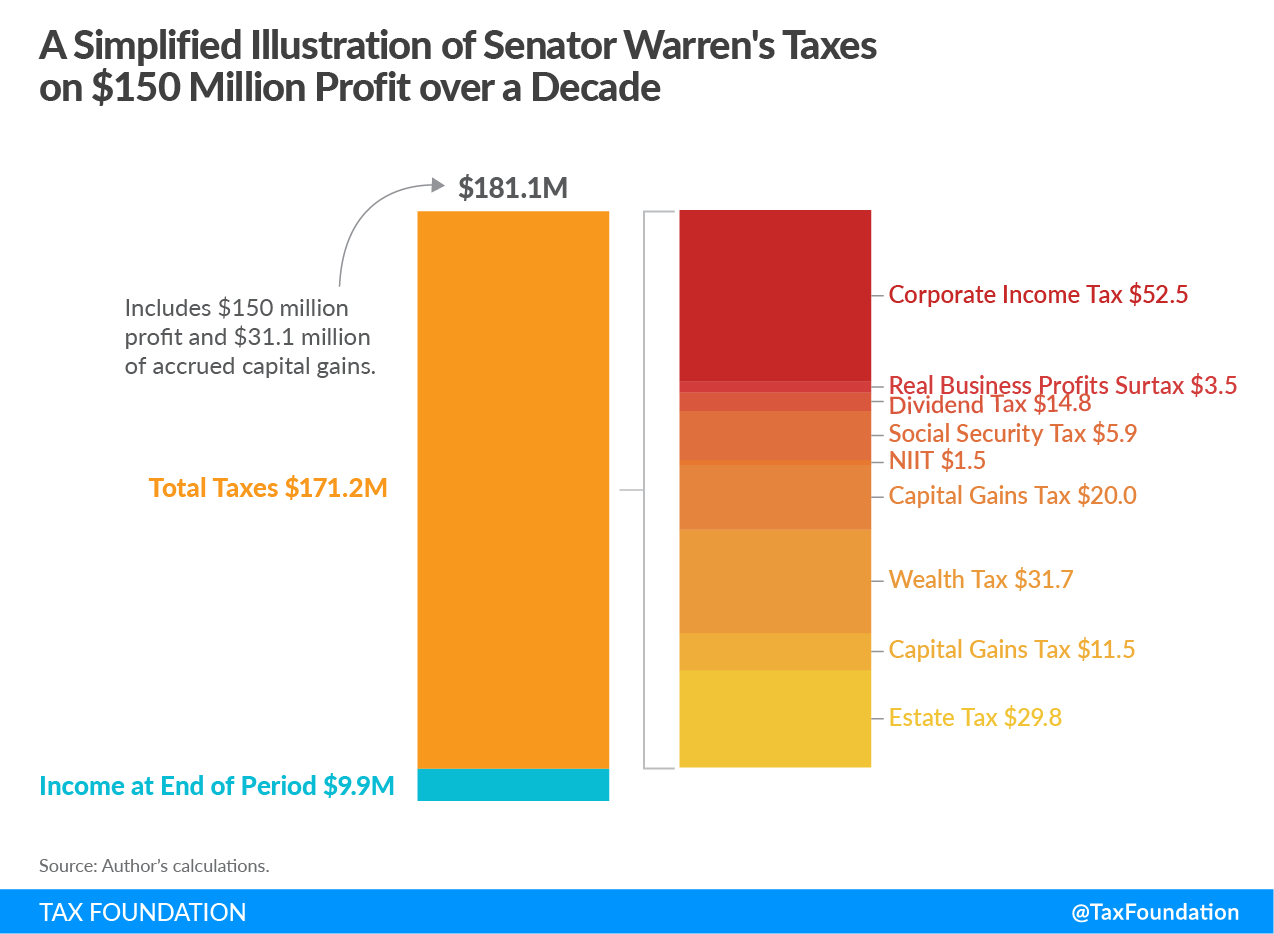

Warren wants to tax unrealized capital gains. As i discussed yesterday on cnbc, she even wants to tax capital gains even if. That wealth tax that ms.

Every other tax that has been challenged on these grounds has been upheld. Elizabeth warren shifted the conversation from what fraction of income the rich paid to what fraction of wealth they paid. The homeowner has two options to remedy their $40,000 tax liability.

Wyden said that under the proposal, about 700 of the country’s richest will be forced to pay unrealized gains from their assets. When it comes down to determining the amount you have to pay tax on these gains, a lot depends on the. Will the unrealized capital gains tax proposal apply to most.

Sinema said friday that she was working with sen. Senator warren’s “nutty idea” to tax unrealized capital gains. Inheritance and estate taxes were upheld in the knowlton case of 1900 not as direct taxes on wealth, but as indirect taxes on the transfer of wealth.

“but it would help get at capital gains, which are an extraordinarily large part of the incomes of the wealthiest individuals, and right now escape taxation, until they're realized, and. Warren talked about during her presidential campaign would have applied to all assets held by the wealthy. Warren talked about during her presidential campaign would have applied to all assets held by the wealthy.

An attempt to tax unrealized capital gains was struck down in the macomber case of 1920.

Warrens 2 Cents Will Prove Costly For All - Wsj

Will The Unrealized Capital Gains Tax Proposal Apply To Most Investors The Motley Fool

Warren Wants To Tax Unrealized Capital Gains - Daniel J Mitchell

Unrealized Capital Gains Tax Stock Bitcoin - Bitcoin Magazine Bitcoin News Articles Charts And Guides

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

Taxing Capital Gains At Ordinary Rates Evidence Says Do Itso Does Buffett Jared Bernstein On The Economy

Unrealized Capital Gains Tax Explained

How Would Unrealized Capital Gains Tax Affect You

What Are Capital Gains Taxes And How Could They Be Reformed

Warrens Tax Plans Could Bring Rates Over 100 Percent On Capital Income

How Would Unrealized Capital Gains Tax Affect You

Elizabeth Warrens Tax Plan Would Bring Rates Over 100 For Some - Wsj

Dems Latest Idea To Fund Their Spendapalooza As Desperate As It Gets

Taxing Unrealized Capital Gains A Bad Idea National Review

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Proposed Tax On Billionaires Raises Question Whats Income - The New York Times

Democrats Weigh A Tax On Billionaires Unrealized Capital Gains - The New York Times

Taxing Unrealized Capital Gains At Death Proposal Tax Foundation

Unrealizedcapitalgains - Twitter Search Twitter