Us Germany Tax Treaty Withholding Rates

The rates apply as a percentage of the gross payment. You own an investment account in the usa.

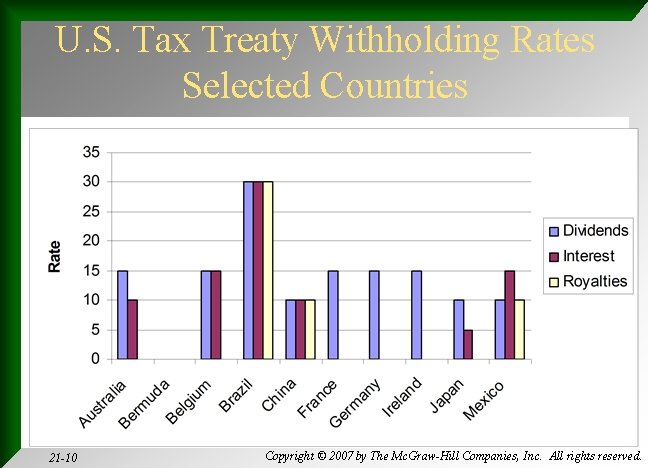

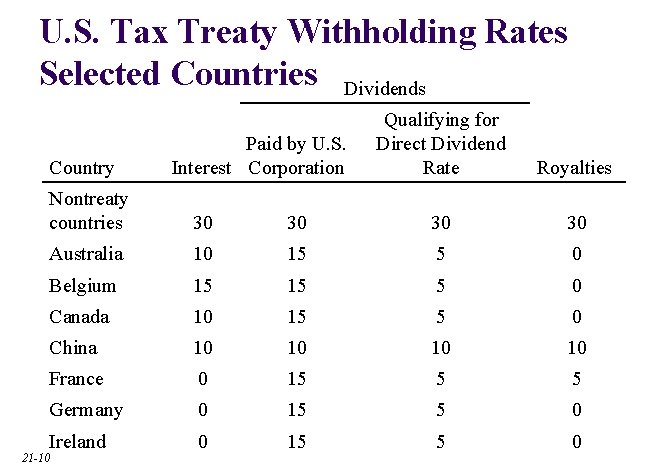

International Financial Management Fourth Edition Eun Resnick 21

And swiss protocol entred into force.

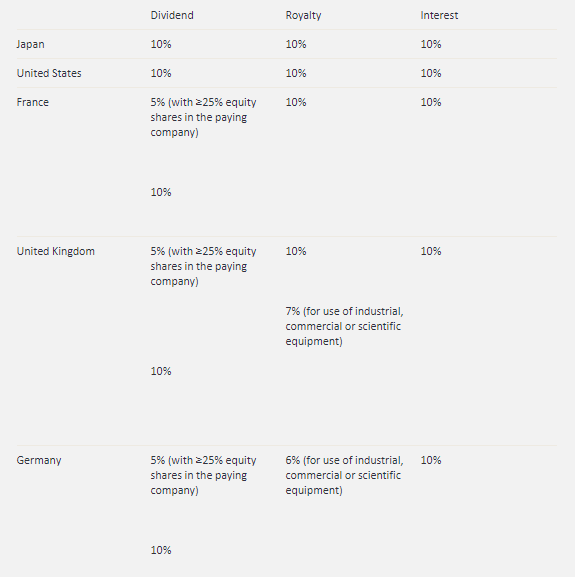

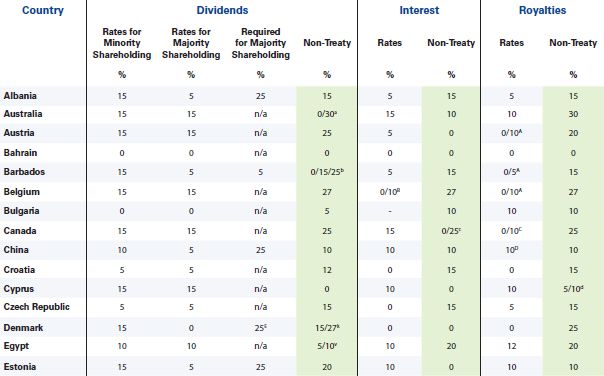

Us germany tax treaty withholding rates. For split rates, please refer to the relevant article in the treaty. Global tax rates 2021 is part of the suite of international tax resources provided by the deloitte international tax source (dits). (m) rate applies to payments to a financial institution by an enterprise engaged in an industrial undertaking.

A treaty may stipulate a higher rate. Certain exceptions modify the tax rates. Tax on loans secured on german property is not imposed by withholding, but by assessment to corporation tax at 15% (plus solidarity surcharge) of the interest income net of attributable expenses.

And chile signed a new treaty on These tables may provide information about the rate of tax that the treaty partner could imposed on u.s. (n) the tax treaty does not deal with interest income.

The withholding tax rate for royalty payments relating to ip registered in germany would be a flat rate of 15.825%, which could potentially be mitigated via double tax treaties or european directives (see potential taxpayer solutions below). In cases where the dtt rate is lower than 15.315% rate, the dtt rate will be applied. Below is a list that shows the tax withholding rates for royalties by country.

Germany's default interest withholding tax rate is 0%. To minimize double taxation, the treaty limits each country’s dividends tax to 5 percent of the gross amount for foreign companies who own at least 10 percent of the corporation’s voting shares; German withholding tax at a rate of 15.825% must be retained, reported and paid to the federal central tax office by the licensee, unless the licensor.

The united states withholding rate on such dividend to german investors will remain at 15 percent. The maximum allowable tax rate is 15%. In some instances, however, the rates applied are not bilateral, and the other country could apply a different rate or impose different.

Provisions of the existing convention permit german resident investors to make portfolio investments in the united states through united states regulated investment companies (rics) and receive an exemption on the income in the federal republic. If the withholding of tax is greater than this, you will need to file a us return to get a refund of the difference (even if you are below the filing threshold). The reduced 5% withholding tax rate would not be available for rics, but the exemption from withholding tax on dividends described above would be available for dividends paid to a pension fund

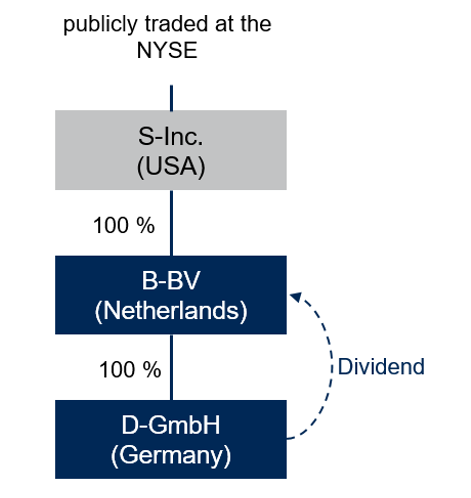

153 rows the parliament has adopted a 15% withholding tax rate on the gross payment on interest,. Residents deriving that category of income from the treaty country. Withholding tax rates 2021 includes information on statutory domestic rates that apply to payments from a source jurisdiction to nonresident companies without a permanent establishment in that source jurisdiction.

(updated to august 1, 2015) country interest The protocol would continue to limit the withholding tax on dividends paid by a u.s. ** includes otc shares and listed investment trusts (etf, reit and nikkei 300).

Income derived by a us resident for artistic or athletic performances in the territory of germany is exempt from german (withholding) tax under article 17 (1) dta usa as long as it does not exceed usd 20,000 (including reimbursed expenses and other receipts) for the calendar year. The us may impose a tax on your dividend and capital gain income from the usa. International tax treaty rates 1 (%) 1 withholding tax rates applied by canada to certain payments to residents of selected countries with which it has signed international tax treaties.

So basically, if you provide us the tax forms with an ein, itin and/or a dob then the withholding rate would drop from 30% to the rate listed below for any income made in the territory of the usa only. Under certain circumstances each country’s dividends withholding tax can even be reduced to zero. The tax authorities can order a wht of 15.825% (including solidarity surcharge) if ultimate collection of the tax due is in doubt.

This table shows the withholding tax rates in the source country (ireland’s treaty partner) for dividend, interest and royalty payments. Therefore, the withholding tax rate of 15% under the income tax act applies. This is for countries that the usa has a tax treaty with.

Otherwise, the tax is capped at 15 percent. Under the protocol, the 0% withholding rate is limited to pensions that do not control the reit paying the dividend.

Host-country Withholding Tax Rates On Cross-border Payments Of Download Table

Witholding Taxes And The Cost Of Public Debt In Imf Working Papers Volume 1994 Issue 018 1994

Pwccom

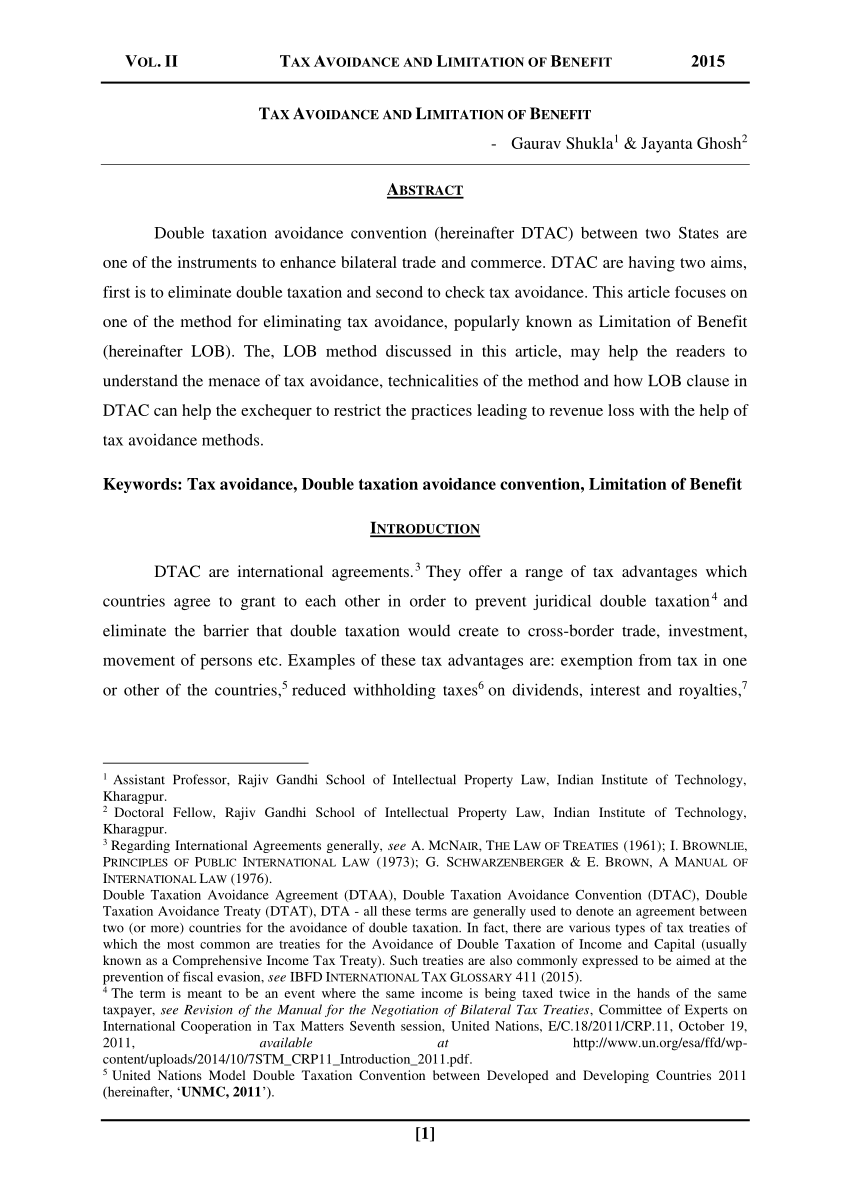

Maltas Double Tax Treaties - January 2016 - Tax - Malta

International Financial Management Fifth Edition Eun Resnick Mc

China Tax Treaties A Quick Guide To Withholding Tax Rates Of Royalty Dividend And Interest - Lexology

Withholding Tax Rates To Non-residents Download Table

International Tax Agreements Indonesian Tax

Tax Treaty Withholding Tables

Tax Treaty Limitation On Benefits Lob Form W8-ben-e - International Tax Blog

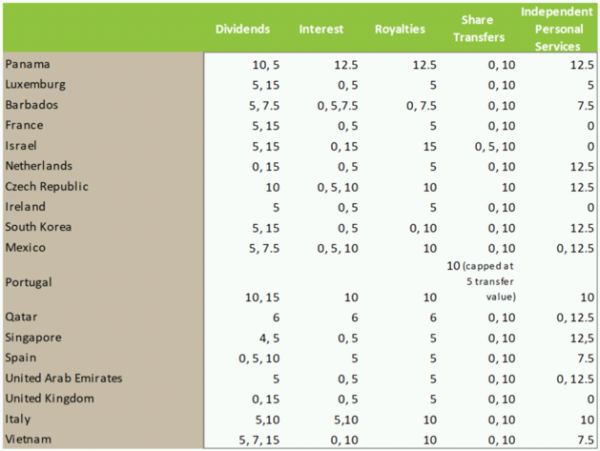

Fin 440 International Finance - Ppt Download

Us Germany Tax Treaty Royalties

Panama Tax Treaties - Tax - Panama

Chapter 8 Are Tax Treaties Worth It For Developing Economies In Corporate Income Taxes Under Pressure

Germany Adopts Substantial Transfer Pricing And Anti-treaty Shopping Rule Changes Mne Tax

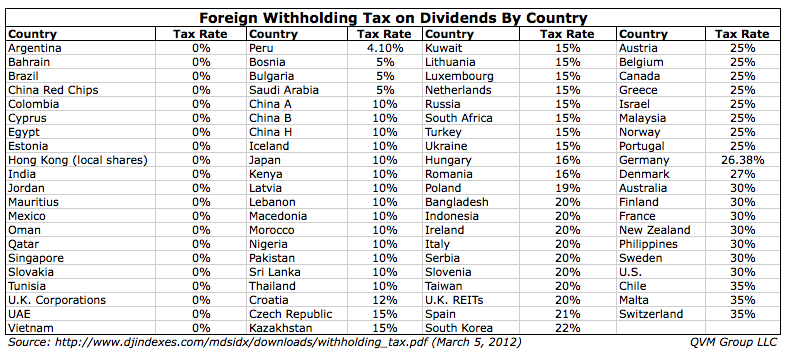

Us Dividend Withholding Tax Rates By Country

Stocks That Avoid Unrecoverable Foreign Dividend Withholding In Tax Deferred Accounts Seeking Alpha

Tax Treaty Withholding Tables

Us Dividend Withholding Tax Rates By Country