Are St Jude Raffle Tickets Tax Deductible

Winner shall be responsible for any and all applicable federal, state, local taxes, and document fees. Jude will select the name of potential winners of.

Spring Sporting Clays Fundraiser Presented By Orange County Ironworks

Furthermore, how do i pay taxes on st jude's dream home?

Are st jude raffle tickets tax deductible. What are the taxes on the house and what do i. When you get a ticket, you're signing up for a chance to win in a raffle. Sowa will conduct the early bird drawings on october 15, 2021 (early bird drawing 1) and november 12, 2021 (early bird drawing 2).

When you get a ticket, you're signing up for a chance to win in a raffle. Identification matching the name on the winning raffle ticket will be required to claim the prize. Jude dream homes benefits st.

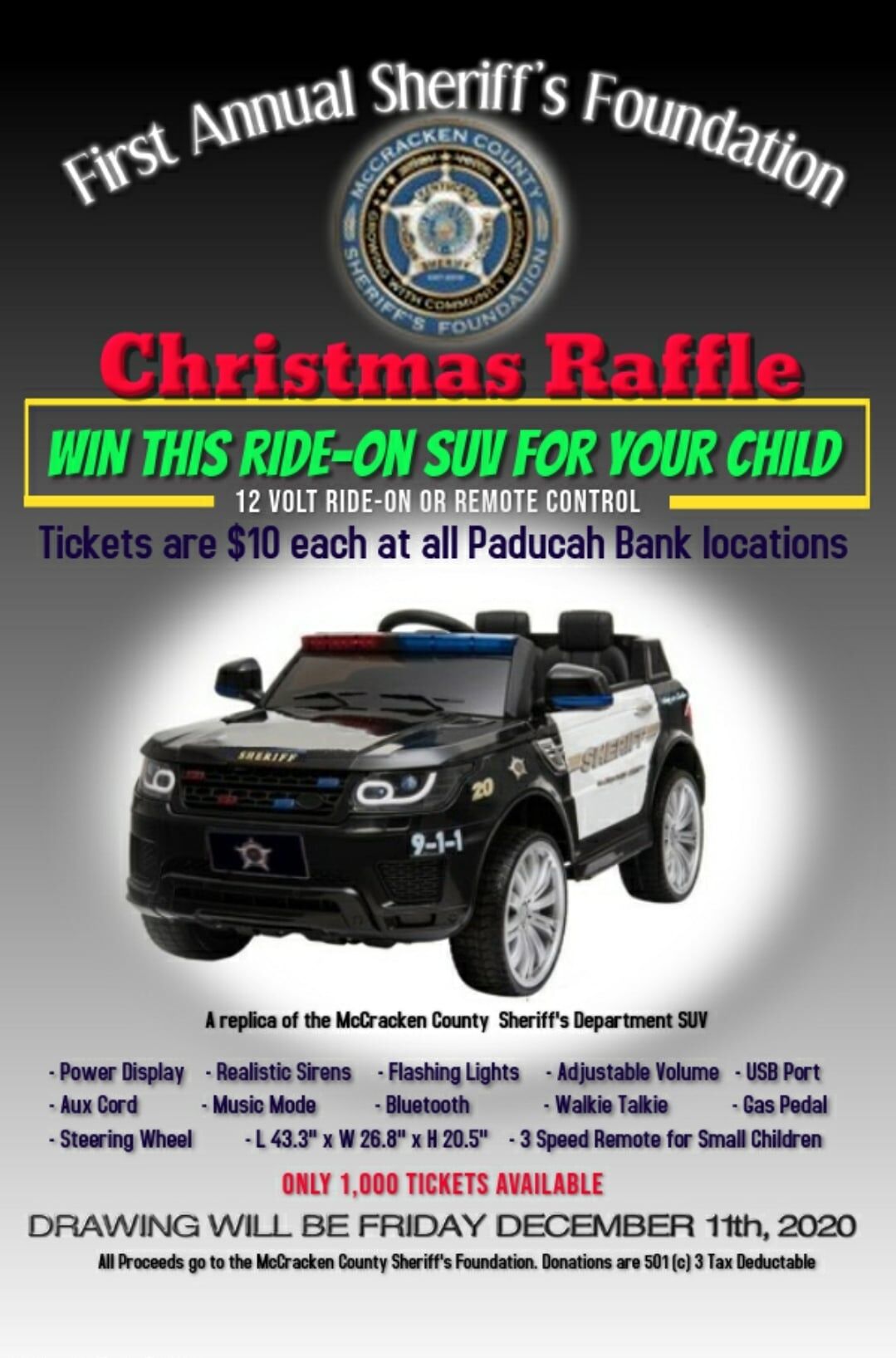

These $10 raffle tickets are only available at paducah bank locations and only 1,000 tickets will be sold. The grill is a $500 value. Patrick’s day drawing wins $1,000.00.

When you get a ticket, you're signing up for a chance to win in a raffle. When you get a ticket, you're signing up for a chance to win in a raffle. Lorem ipsum dolor sit amet, consectetur adipiscing elit.morbi adipiscing gravdio, sit amet suscipit risus ultrices eu.fusce viverra neque at purus laoreet consequa.vivamus vulputate posuere nisl quis consequat.

• the winning ticket for each prize will be selected by a random drawing on the date of the raffle drawing. The cost of a charity raffle ticket is not tax deductible. Winners are encouraged to consult a tax professional.

For example, if you bought $100 worth of raffle tickets that did not win but won $500 on a $5 raffle ticket, you would have to claim $500 in income but could deduct the $100 you spent on. This is your chance to help kids fight cancer to win a beautiful $ 475,000 home in olmsted falls. Jude will select the name of potential winners of the prizes in a random drawing from all

Anne shrine preservation society is happy to announce a high ticket raffle item to benefit the shrine. Ten thousand tickets will be sold. For every $25.00 minimum donation you make, your name will be entered into the drawing.

If you accept the house in lieu of cash, you'll be responsible for ongoing property taxes, which generally run up to 4 percent of the home's value depending on its location. Property taxes for a dream house are exorbitant. This is well worth your $10 tax deductible donation, as often one family wins several times!

The irs has adopted the position that the $100 ticket price is not deductible as a charitable donation for federal income tax purposes. Winners should consult a tax advisor for guidance. The irs has adopted the position that the $100 ticket price is not deductible as a charitable donation for federal income tax purposes.

Sowa will conduct the early bird drawings on october 15, 2021 (early bird drawing 1) and november 12, 2021 (early bird drawing 2). The 100 club of arizona is responsible for the purchase of the motorcycle only. Unfortunately, the purchase of raffle tickets is not tax deductible.

However, a winner may deduct the cost of a winning ticket from the value of the prize awarded in determining the amount to include in taxable gross income with respect to the prize. We have a weber e 310 gas grill that was donated by yale appliance. When you get a ticket, you're signing up for a chance to win in a raffle.

Although you cannot take a tax deduction for buying a raffle ticket, you may be able to deduct the amount spent on losing tickets to the extent you had gambling winnings of at least that amount. • the winning ticket for each prize will be selected by a random drawing on the date of the raffle drawing. The cost of a charity raffle ticket is not tax deductible.

Jude will select the name of potential winners of. Raffle tickets are being sold at the gift shop and are $20 each. The drawing will be held at a time to be announced.

So far, 11,273 tickets have been sold at 6:07 am. • the winning ticket for each prize will be selected by a random drawing on the date of the raffle drawing. We will raffle off $100.00 each day in march, and the st.

According to the irs, you are not making a strict donation to charity as you are receiving something in return for your contribution, a chance to win a home or other prize. The cost of a charity raffle ticket is not tax deductible. To claim a prize, you only need to show your driver’s license to prove your identity.

Silent Auction Donation Form Template Luxury Employment Confirmation Letter Template Doc Samp Donation Letter Silent Auction Donations Donation Letter Template

Charity Challenge Raffle

Dancers Making Waves - Home Facebook

Level Up Challenge - Kids For Kids Foundation

Dancers Making Waves - Home Facebook

A 550000 Home Raffle Ends With An Unfortunate Fortune 13newsnowcom

Raffle Tickets Available For Battery-powered Mccracken County Sheriffs Office Suv News Wpsd Local 6

Fundraising Ideas Httpcoregearusacomshopcoregear-usa-misters-personal-mister-sprayer-mist-40- Fundraising Activities How To Raise Money Pta Fundraising

St Jude Dream Home Giveaway Faq Everything You Need To Know Fox 8 Cleveland Wjw

Ojjkjmtg--juom

A 550000 Home Raffle Ends With An Unfortunate Fortune Wfaacom

Guitar And Banjo Raffle Official Rules

Calameo - St Jude Annual Report 2016 2017

Raffle Tickets Available For Battery-powered Mccracken County Sheriffs Office Suv News Wpsd Local 6

Dream House Raffle Draws Scrutiny No Homes Actually Awarded Cbs San Francisco

Hinckley Festival Association - Home

Pin On Example Cover Letter Writing Template

Raffle Ticket Sales Speed Up For Kiwanis Car Raffle Longboat Key Your Observer

A 550000 Home Raffle Ends With An Unfortunate Fortune Wfaacom