San Antonio Local Sales Tax Rate

Local tax rates in texas range from 0.125% to 2%, making the sales tax range in texas 6.375% to 8.25%. 2020 official tax rates & exemptions name code tax rate / $100 homestead 65 and older disabled freeze year;

2

Avalara license filing, starting at $499 per location:

San antonio local sales tax rate. Each tax year local government officials, such as city council members, school board members, and commissioner's court, examine the taxing units' needs for operating budgets and debt repayment in relation to the total taxable value of properties located in the jurisdiction. San antonio’s sales tax rate is 8.125 percent. Texas sales tax rates vary depending on which county and city you’re in, which can make finding the right sales tax rate a headache.

The property tax rate for the city of san antonio consists of two components: The texas sales tax of 6.25% applies countywide. The base state sales tax rate in texas is 6.25%.

The fiscal year (fy) 2022 m&o tax rate is 34.677 cents per $100 of taxable value. San antonio in texas has a tax rate of 8.25% for 2021, this includes the texas sales tax rate of 6.25% and local sales tax rates in san antonio totaling 2%. The sales tax jurisdiction name is san antonio atd transit, which may refer to a local government division.

For questions regarding your tax statement, contact the bexar county tax. 0.125% dedicated to the city of san antonio ready to work program; Share the top spot on the tax foundation list as each has a sales tax rate of 10 percent.

Box 839950 san antonio, tx 78283. In san antonio, for instance, a business located in the central city collects the general city sales tax, additional city taxes for venues and a municipal development corporation and taxes for two separate transit authorities (exhibit 4). The san antonio sales tax is collected by the merchant on all qualifying sales made within san antonio.

Find your texas combined state and local tax rate. Some cities and local governments in bexar county collect additional local sales taxes, which can be as high as 2%. Find your texas combined state and local tax rate.

The fy 2022 debt service tax rate is. The minimum combined 2021 sales tax rate for san antonio, texas is. The san antonio sales tax is collected by the merchant on all qualifying sales made within san antonio.

The us average is 4.6%. 0.125% dedicated to the city of san antonio ready to work program; The base state sales tax rate in texas is 6.25%.

Texas has recent rate changes (thu jul 01 2021). This is the total of state. Higher maximum sales tax than any other texas counties.

The san antonio sales tax rate is %. The county sales tax rate is %. Let our business license experts prepare your applications for you.

The county sales tax rate is %. The us average is 7.3%. There is no applicable county tax.

The local sales and use tax rate history shows the current and prior sales tax rates imposed by a local jurisdiction, along with the effective date and end date of each tax. The 8.25% sales tax rate in san antonio consists of 6.25% texas state sales tax, 1.25% san antonio tax and 0.75% special tax. The san antonio mta, texas sales tax is 6.75%, consisting of 6.25% texas state sales tax and 0.50% san antonio mta local sales taxes.the local sales tax consists of a 0.50% special district sales tax (used to fund transportation districts, local attractions, etc).

What is the sales tax rate in san antonio, texas? The texas sales tax rate is currently %. Road and flood control fund:

Here's how bexar county's maximum sales tax rate of 8.25% compares to other counties around the united states: Learn license requirements, find applications, and get help submitting them. The sales tax jurisdiction name is san antonio atd transit, which may refer to a local government division.

It's the last major municipality in texas to reach that level. Identify the licenses, permits, and how many you need to start or grow your business in san antonio. Current sales tax rates (txt).

Find your texas combined state and local tax rate. The city of von ormy withdrew from the san antonio mta effective september 30, 2009. Name local code local rate total rate;

Rate histories for cities who have elected to impose an additional tax for property tax relief, economic and industrial development section 4a/4b, sports and community. Maintenance & operations (m&o) and debt service. Some dealerships may charge a documentary fee of 125 dollars.

This is the total of state, county and city sales tax rates.

Which Texas Mega-city Has Adopted The Highest Property Tax Rate

2

Texas Sales Tax Rates By City County 2021

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket

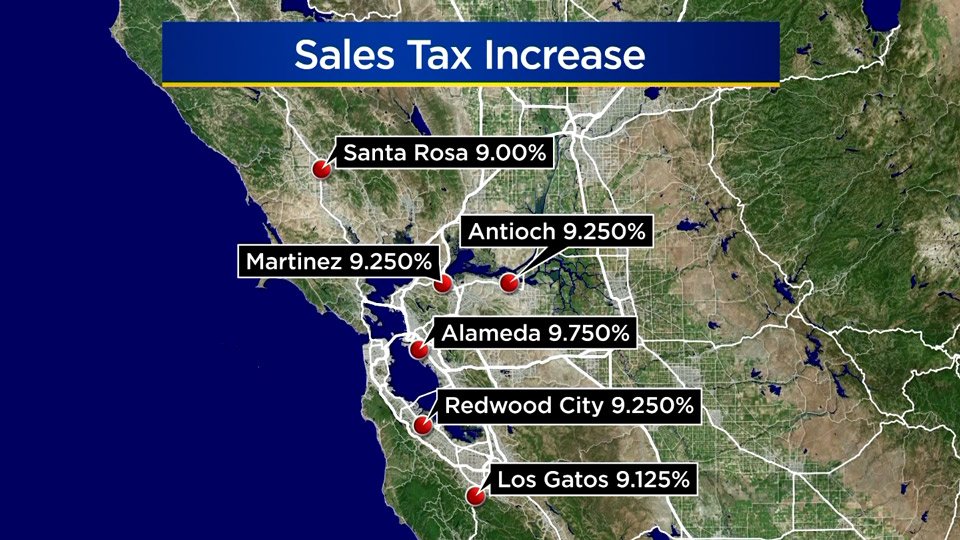

Sales Tax Rates Rise Monday Out-of-state Online Sellers Included Cbs San Francisco

Texas County Challenge Texas County Map Texas County Texas Map

San Antonio Tx Neighborhood Map - Best Worst Neighborhoods Map The Neighbourhood San Antonio

What Is The San Antonio Sales Tax Rate - The Base Rate In Texas Is 625

Austin Property Tax What Can You Expect When Moving Here Bhgre Homecity

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeographycom

Hotel Occupancy Tax San Antonio Hotel Lodging Association

Share This Info-graphic About Buying And Selling At The Same Time With Your Spanish Speaking Clients Real Estate Marketing How To Speak Spanish We Buy Houses

How High Are Cell Phone Taxes In Your State Tax Foundation

Texas Sales Tax - Small Business Guide Truic

How To Calculate Sales Tax - Video Lesson Transcript Studycom

Hotel Occupancy Tax San Antonio Hotel Lodging Association

Which Cities And States Have The Highest Sales Tax Rates - Taxjar

Pin On New Acquisitions

Which Cities And States Have The Highest Sales Tax Rates - Taxjar