Ato Are Raffle Tickets Tax Deductible

The purchase of raffle tickets. The ato views this as an exchange of goods for money, therefore it’s not tax deductible.

Facebook

The ato have confirmed that the ipad will be treated as the equivalent of a laptop.

Ato are raffle tickets tax deductible. For example, buying raffle tickets or paying to attend a fundraising dinner. For example, buying raffle tickets or paying to attend a fundraising dinner. Although you cannot take a tax deduction for buying a raffle ticket, you may be able to deduct the amount spent on losing tickets to the extent you had gambling winnings of at least that amount.

Tax deductions relating to cars, travel, clothing, mobile phone and internet use, and rental properties are among the top claims the ato will be eyeing this tax time. Prefill and prior year info saves you time, then your etax accountant handles the rest. A gift is voluntary and the donor must not receive any material benefit in return, the ato spokesperson says.

With deduction tips & online accountant support. Where the recipient is registered for gst, the sponsor may be able to claim the gst credit on the expense. For example, buying raffle tickets or paying to attend a fundraising dinner.

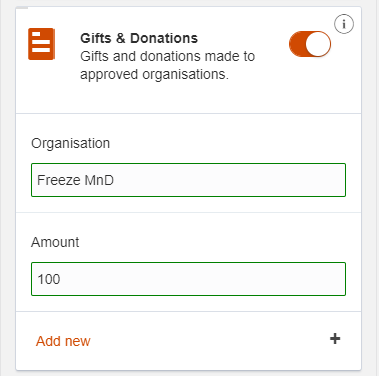

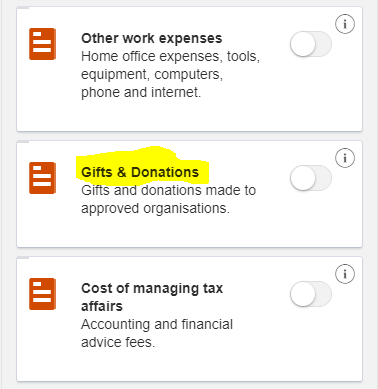

Portion which may be tax deductible. If you receive something small, with no monetary value as a thank you, for example a sticker, that’s. Eligible deductions must be a minimum of $2.00 and a receipt is required.

The ato views this as an exchange of goods for money, therefore it’s not tax deductible. For the purpose of determining your personal federal income tax, the cost of a raffle ticket is not deductible as a charitable contribution. Keeping track of tax deductible donations

Ad do your tax return in minutes! The ato views this as an exchange of goods for money, therefore it’s not tax deductible. Is the cost of a raffle ticket tax deductible?

This is because the purchase of raffle tickets is not a donation, i.e. A tax deductible gift or donation will reduce your taxable income and therefore the amount of tax you need to pay. Ato warns of common tax deduction 2 in 3 get wrong.

If you donate property to be used as the. For specific guidance, see this article from the australian taxation office Section 8.1 of the income tax assessment act 1997 states ‘losses and outgoings to the extent that they are incurred in gaining or producing assessable.

If the value of the prizes to be awarded in a raffle exceeds $10,000 or if the raffle ticket price exceeds $10.00, further regulations apply, including detailed disclosure requirements to be printed on the raffle ticket or in a written notice given to the purchaser prior to the sale. There is the chance of winning a prize. A raffle is a game of chance where the prizes are either goods or cash, or a combination of the two.

It may be deductible as a gambling loss, but only up to the amount of any gambling winnings from that tax year. For example, if you bought $100 worth of raffle tickets that did not win but won $500 on a $5 raffle ticket, you would have to claim $500 in income but could deduct the $100 you spent on tickets that didn't win. Prefill and prior year info saves you time, then your etax accountant handles the rest.

Basically, if you receive something because of your donation, then don’t claim the donation as a tax deduction. Keeping track of tax deductible donations Sponsorship expenses paid by your business may be tax deductible.

If you receive something small, with no monetary value as a thank you, for example a sticker, that’s ok. Ad do your tax return in minutes! First of all, if you receive a raffle ticket, dinner attendance, event entry, chocolates, or anything like that, then your donation can’t be claimed as a deduction.

Some dgr’s have extra tax conditions which affects what they can receive. “thirdly, taxpayers must keep good. If you receive something small, with no monetary value as a thank you, for example a sticker, that’s ok.

When you purchase a book of raffle tickets from a charity, you are receiving something of material value in the exchange. The gift must comply with relevant gift conditions. A spokesperson for the ato says you can only claim tax deduction on gifts.

A donation you make to charity is only tax deductible if the organisation is an ato endorsed deductible gift recipient (dgr). With deduction tips & online accountant support. Ato are raffle tickets tax deductible.

However, raffle tickets are not tax deductible regardless of whether the community or charitable organisation has deductible gift recipient status. “australians are a generous bunch, but not all gifts and donations are tax deductible,” ato assistant commissioner tim loh.

Top 60 Business Mistakes During Tax Audits In 2021 Ads

2

Top 12 Forgotten Ato Real Estate Tax Deductions Propertyme

Atogovau

How To Claim Tax Deductible Donations On Your Tax Return

Tax Deductions For Security Guards - Pdf Free Download

Example Case Study 2 Australian Taxation Office

Claiming Gifts And Donations On The Airtax Tax Return Airtax Help Centre

Ato Warns Of Common Tax Deduction 2 In 3 Get Wrong

Statements And Returns - Secondary

Tax Deductible Donations Get The Most Out Of Giving Back - Ezra Legal

Pdf An Examination Of Tax-deductible Donations Made By Individual Taxpayers In Australia For 199798

Donations And Tax Deductibility

Not For Profits Nfps The Next Solution - Tax Sean Urquhart Partner Nexia Court Sydney 16 November Ppt Download

Claiming Gifts And Donations On The Airtax Tax Return Airtax Help Centre

How To Claim Tax Deductible Donations On Your Tax Return

How To Claim Tax Deductible Donations On Your Tax Return

Example Case Study 2 Australian Taxation Office

Example Case Study 2 Australian Taxation Office